Why Is It Best To Have A Prime Credit Score

Alright, settle in, grab your latte (or whatever your poison is), because we need to talk about something that sounds drier than a week-old baguette but is actually, I kid you not, the secret sauce to a smoother, less anxiety-inducing adult life: your credit score. Specifically, the magical land of the prime credit score. Think of it as your financial VIP pass, the golden ticket that gets you the good stuff without the side-eye.

Now, before you glaze over thinking about numbers and spreadsheets, let me paint a picture. Imagine your credit score as your financial reputation. It's what banks and lenders whisper about you behind their mahogany desks. A bad score? They picture you juggling ramen packets and hiding from the mailman. A prime score? They see you as a financial rockstar, someone who’s got their ducks in a row, probably wearing a tiny monocle and sipping champagne. Okay, maybe not the monocle, but you get the idea.

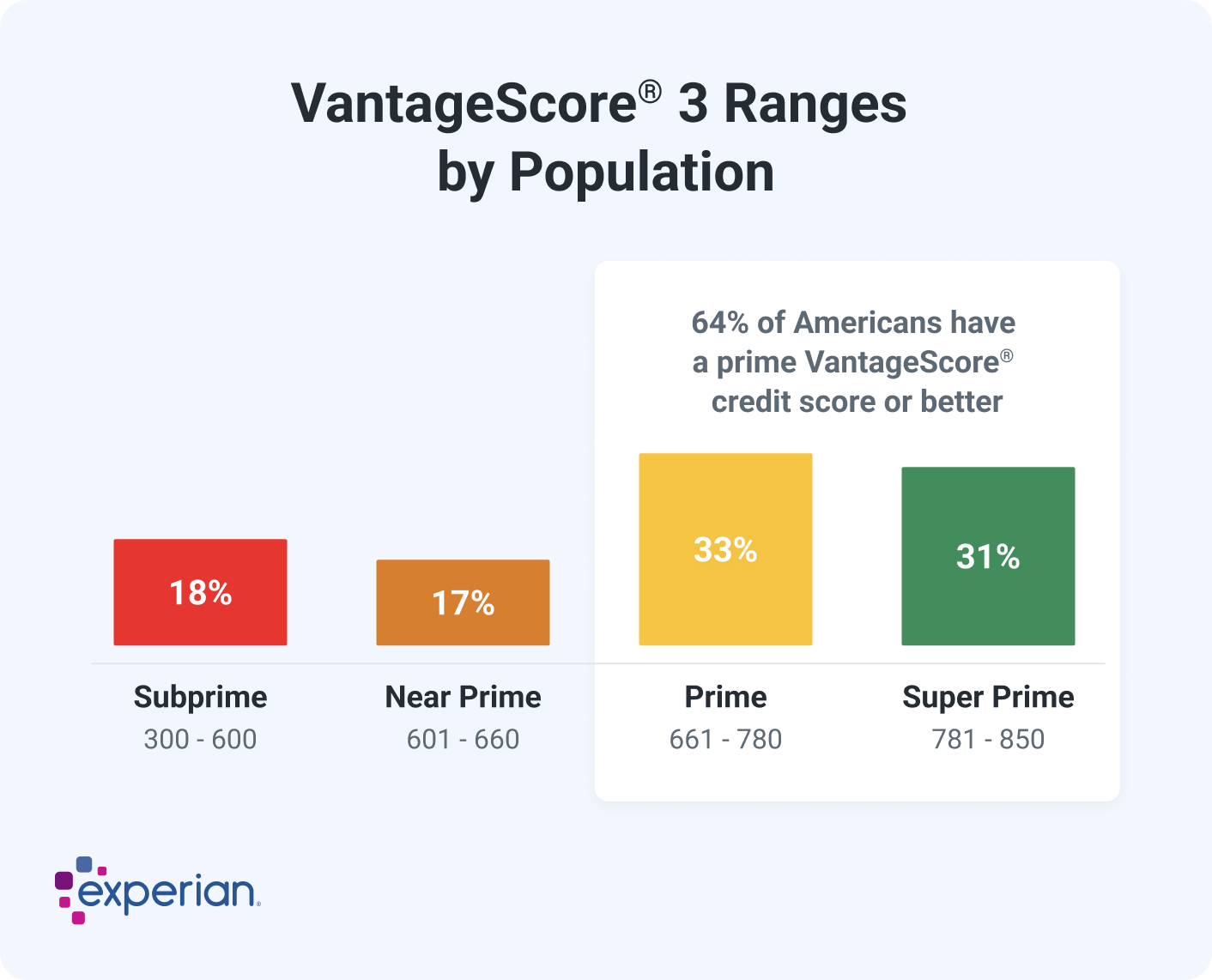

So, what exactly is this mythical "prime" score? It’s generally considered to be anything in the 700s and above. Think of it as graduating from "just scraping by" to "effortlessly acing life." It’s the difference between getting a loan with a grimace and a nod, and getting one with a wink and a cheerful "Here you go, superstar!"

Why is this so important, you ask? Well, let's dive into the glorious perks, shall we? It’s like getting backstage passes to the concert of adulting.

The Bank's Best Friend (And Yours)

First off, lower interest rates. This is the big kahuna, folks. When you have a prime credit score, lenders practically throw money at you because they know you’re a safe bet. It’s like they’re saying, "You? You're so responsible, we'll lend you our prized vintage car for a weekend. And we'll barely charge you for the tiny scratch you might accidentally make."

Let’s do some pretend math. Imagine you're buying a car. A not-so-stellar credit score might land you an interest rate of, say, 10%. A prime score? You could be looking at a sweet 4% or even less. Over the life of a typical car loan, that’s thousands, potentially tens of thousands, of dollars saved. That’s like finding a winning lottery ticket in your old jeans. It’s pure, unadulterated financial bliss.

This also applies to mortgages. That dream house you’ve been pinning on Pinterest? A prime credit score makes that dream a whole lot cheaper. The difference in monthly payments can be the difference between a cramped studio and a sprawling mansion (okay, maybe not a mansion, but definitely a nicer place). It’s the difference between eating beans and rice every night and, you know, actual vegetables.

The Perks Go Beyond Just Loans

But it’s not just about borrowing money. Oh no, my friends, the magic of prime credit extends further than you might think. Need a new apartment? Landlords often check your credit score. A prime score means they’ll be practically rolling out the red carpet, eager to have a tenant as reliable as the sunrise. A low score? They might envision you painting the walls with ketchup and hosting underground ferret races. Not ideal.

Think about getting a new phone plan. Sometimes, companies will waive that hefty security deposit if your credit is tip-top. That’s money in your pocket that you can spend on, well, anything! Maybe a fancy coffee, a new book, or even, dare I say it, a down payment on that slightly less vintage car.

And get this: some utility companies (electricity, gas, water) might even waive their setup fees for customers with excellent credit. Seriously. They trust you with their precious electrons and H2O flow. It’s like they’re handing you the keys to the city’s plumbing system, but, you know, in a good way.

The "Oh Crap!" Moments Become Less Frequent

Having a prime credit score is like having a superhero cape for your finances. When life throws you a curveball – a sudden job loss, an unexpected medical bill, or your cat decides to redecorate your couch with its claws – your credit score can be your safety net.

Need a short-term loan to tide you over? With a prime score, you’re far more likely to get approved, and at a much better rate. It’s like having a financial parachute ready to deploy. Without it, you might be scrambling, paying exorbitant fees, and generally feeling like you’re drowning in a sea of bills.

It also means you have more options. If you need to finance a major purchase or deal with an emergency, you’re not limited to the sketchy payday loan places that charge more interest than a dragon hoarding gold. You can shop around, compare offers, and pick the one that actually makes sense for your wallet.

It's Easier Than You Think (Mostly)

Now, I’m not saying you have to be a financial wizard. Building and maintaining a prime credit score is pretty straightforward, actually. It boils down to a few key principles:

- Pay your bills on time, every time. This is like brushing your teeth. Do it consistently, and you avoid bigger problems later. Late payments are the broccoli of credit scores – nobody likes them, and they can really mess things up.

- Keep your credit utilization low. This means not maxing out your credit cards. Think of your credit limit as a pie. You don't want to eat the whole thing in one sitting. About 30% of your limit is a good target.

- Don't open too many credit accounts at once. It can make you look desperate, like you’re speed-dating credit cards.

- Check your credit report regularly. It’s like a yearly physical for your financial health. You can catch any errors or suspicious activity before they become major issues.

It's really about showing lenders that you're responsible and trustworthy. It’s about demonstrating that you can handle credit, not be overwhelmed by it. It’s like being a good tipper at a restaurant – you get better service, and the waiter (or lender) is happy to see you again.

The Surprising Truth: It’s About More Than Just Money

Here’s a fun, slightly surprising fact: your credit score can even influence things like your car insurance rates. In many states, insurance companies use credit-based insurance scores to determine premiums. Why? Because statistically, people with better credit tend to be less risky drivers. It’s a weird correlation, I know, but it’s true! So, a prime credit score can literally save you money on your car insurance. Mind. Blown.

In conclusion, having a prime credit score isn't just about impressing your future self or making lenders happy. It's about unlocking opportunities, saving money, and generally making your life as an adult just a smidge less stressful. It's the silent partner that helps you navigate the world of finance with a little more grace and a lot less panic. So, if you're not already on the prime score train, hop aboard! The view is much, much better from up here.