Why Is Green Thumb Industries Stock Falling

So, you've been peeking at your Green Thumb Industries stock. And maybe, just maybe, your eyebrows have done a little dance. The numbers are looking a bit… green, but not in the way you'd hope. It's like your favorite plant suddenly decided to droop right before your eyes.

Let's talk about Green Thumb Industries. You might know them as GTI. They're one of the big players in the cannabis game. Think of them as the folks trying to grow a really, really big garden. A garden that's still finding its footing in the world.

The stock price, as you've probably noticed, has been taking a bit of a dip. It’s not exactly doing a celebratory samba. More like a slow, wistful waltz. What's going on with our leafy friend's stock?

One of the biggest whispers in the wind is about regulations. Ah, regulations. They’re like the strict gardening rules. Sometimes they help things grow, and sometimes they just make it really, really complicated. The cannabis industry is still figuring out all these rules.

Think of it this way: imagine trying to bake a cake, but the oven temperature keeps changing, and the recipe keeps getting new, weird ingredients added. It’s a recipe for… well, maybe not a perfect cake. And that uncertainty can make investors a little jumpy.

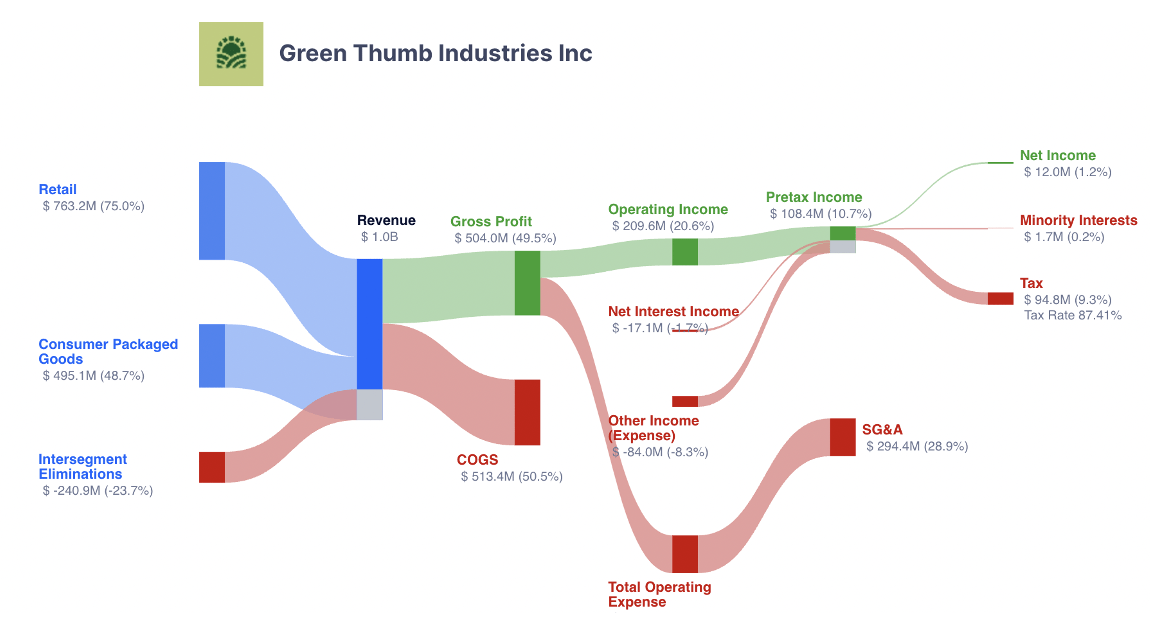

Then there's the whole money situation. Growing big businesses costs a lot of dough. GTI is investing in new stores, new products, and expanding their reach. That’s generally a good thing, right? It’s like planting a lot of seeds.

But all that planting requires a lot of watering and sunlight. And sometimes, those seeds take longer than expected to sprout. So, while they're spending, the immediate profits might not be as dazzling. It’s a long-term game, this gardening of a major corporation.

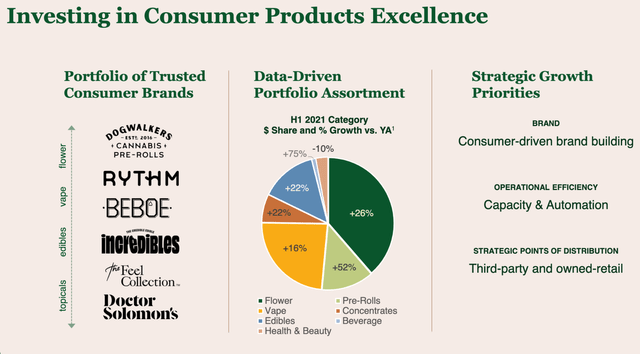

Let’s not forget about the competition. The cannabis market is getting crowded. It’s like your neighborhood is suddenly full of new bakeries, all trying to sell the best cupcakes. Everyone’s vying for the attention of the sweet-toothed customer.

GTI is trying to stand out. They have their Rise dispensaries and their Drift edibles. You might have seen them around. They're working hard to make their brand the one everyone wants. But when there are so many options, it can be tough to capture everyone’s fancy.

And speaking of customers, consumer demand can be a fickle friend. Sometimes people are buying up all the products, and sometimes they’re just browsing. It’s like predicting how many people will want ice cream on any given day. So many factors!

Economic conditions play a role too. When people are feeling a bit tight on cash, they might cut back on… well, things that aren’t strictly essential. Cannabis is still a bit of a luxury for many. It's not like buying bread or milk, sadly.

This can lead to a slowdown in sales. And when sales slow down, the stock price can start to sag a little. It's a chain reaction. Like dominoes, but with fewer clatters and more worried sighs.

Another factor that can spook investors is the federal legalization question. In many places, cannabis is legal at the state level. But federally? It's still a bit of a grey area. This creates a cloud of uncertainty.

Imagine you're building a treehouse, and you're not sure if the tree is on your property or your neighbor's. You might hesitate to put in the really expensive slide, right? That’s a bit like how some investors feel about the big picture for cannabis companies.

The lack of consistent federal laws makes things tricky for companies like GTI. It affects banking, interstate commerce, and a whole bunch of other things that help businesses thrive. It’s like trying to drive a car with one wheel on the road and the other in the ditch.

Now, here’s where my little theory, my maybe-unpopular opinion, comes in. What if the stock is just… tired? Think about it. This industry has been through a lot of hype. It's been through the “will it or won’t it” dance for years.

Perhaps investors are a bit weary. They’ve seen the potential, they’ve seen the promises, and maybe they’re just waiting for a more stable, predictable path. It’s like a relationship that’s had a lot of ups and downs. You want it to work, but you also want some peace and quiet.

And let’s be honest, the stock market can be a bit of a popularity contest. When the shiny new thing comes along, sometimes the older, established players get overlooked. It’s like when a new video game comes out, and everyone forgets about the classics.

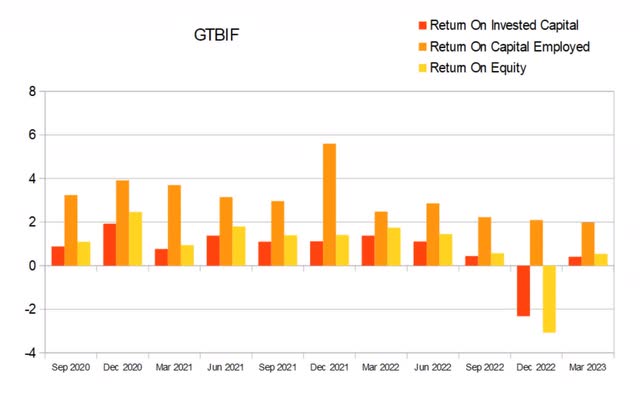

GTI is not a new fad. They’re a solid company with established operations. But in the fast-paced world of stocks, sometimes “solid” doesn’t get the same cheers as “explosive growth potential.” It's a subtle, yet powerful, difference.

Also, let's not forget the global economic climate. Things are a bit… wobbly out there. Inflation, interest rates, all these grown-up financial terms. When the general economy is a bit shaky, investors tend to get more cautious. They might pull their money out of riskier ventures.

And while the cannabis industry has matured, it's still seen as having a bit more risk than, say, investing in a utility company. It’s like choosing between a thrilling roller coaster and a gentle carousel. Some days you want the thrill, and some days you just want to feel safe.

So, when you see Green Thumb Industries stock taking a tumble, it's likely a mix of things. It’s the regulatory maze, the significant investments they're making, the fierce competition, and the overall economic mood. It's a whole bouquet of factors, not just one wilting petal.

Perhaps, just perhaps, this is a good time for the patient investor. The one who sees the long-term potential in this growing industry. The one who understands that gardens don't bloom overnight. They require care, patience, and sometimes, a little bit of faith.

Maybe the stock is just taking a deep breath. Getting ready for its next growth spurt. It’s like a plant that’s putting down strong roots before it reaches for the sky. You can’t always see the growth happening underground, can you?

It’s easy to get caught up in the day-to-day stock movements. But sometimes, stepping back and looking at the bigger picture is what’s needed. GTI is a significant player. They're not going anywhere. They're just navigating the sometimes bumpy, always interesting, road to success.

So, next time you check your Green Thumb Industries stock, try a little smile. It's a story unfolding. A complex, sometimes confusing, but always fascinating story. And who knows? Maybe the next chapter will be a real page-turner. Or, in this case, a real seed-sprouter.