Why Berkshire Hathaway Stock Is So Expensive

Ever found yourself staring at the stock market ticker, utterly bewildered by those eye-watering numbers next to certain company names? You know, the ones that make your wallet feel a little lighter just by looking at them? Well, today, we're diving headfirst into one of the biggest, baddest, and most famously expensive players on the board: Berkshire Hathaway. And no, we're not here to bore you with dry financial jargon. We're here to have some fun and figure out why this particular stock costs an arm and a leg, and more importantly, why that's actually pretty darn cool!

So, imagine this: you're at a fancy buffet, right? Everything looks delicious, but there's one particular dish that’s sitting pretty at the very front, gleaming under the lights, and with a price tag that makes you do a double-take. That's kind of like Berkshire Hathaway stock. It’s not just a stock; it’s the stock that people whisper about, the one that’s been on a wild, wonderful ride for decades. But why so pricey? Let's break it down, shall we?

It's All About the Masterminds!

First things first, you can't talk about Berkshire Hathaway without talking about the legends behind the curtain. We're talking about Warren Buffett and his trusty sidekick, Charlie Munger. These guys aren't just your average CEOs; they're practically financial superheroes! They've been at the helm for ages, building this company brick by incredibly smart brick. Think of them as the Gandalf and Dumbledore of the investing world, guiding their company with wisdom, patience, and a serious knack for picking winners.

When you buy a share of Berkshire Hathaway, you're not just buying a piece of a company. You're buying a piece of a philosophy. It’s a philosophy built on long-term thinking, good old-fashioned value investing, and a deep understanding of what makes businesses truly tick. It’s like buying a vintage wine – it's expensive because it’s been aged to perfection and the vintners are absolute masters of their craft.

A Business Empire Under One Roof

Now, here’s where it gets really interesting. Berkshire Hathaway isn't just one company; it’s a gigantic, sprawling conglomerate. Imagine a magical umbrella that covers a dizzying array of businesses. We're talking insurance giants like GEICO (you know, the gecko!), massive energy companies, railroads, manufacturers of all sorts of things, and even a famous ice cream maker (hello, Dairy Queen!). Seriously, the list goes on and on.

This diversification is key. While one part of the business might be facing a bit of a chill, another is likely basking in the sunshine. This stability and breadth of operations make Berkshire Hathaway a very resilient and reliable investment. It’s like owning a well-diversified portfolio all wrapped up in a single stock. Pretty neat, huh?

The "No Dividend" Charm

Now, you might be thinking, "But wait, why isn't it even more expensive if it's so good? What about dividends?" Ah, this is where things get a little counter-intuitive, and honestly, quite brilliant. Berkshire Hathaway historically doesn't pay out dividends. Instead, Warren and Charlie are famous for reinvesting all the profits back into the business. They’re constantly looking for smart new investments, buying up other fantastic companies, and growing the pie even bigger.

Think of it this way: instead of getting a small cash payout now, you’re trusting them to use that money to make your share worth a whole lot more down the line. It’s like a really generous friend who keeps buying and improving the house you all live in, knowing it will be worth a fortune when you finally decide to sell. This strategy has a proven track record of creating incredible long-term wealth for shareholders.

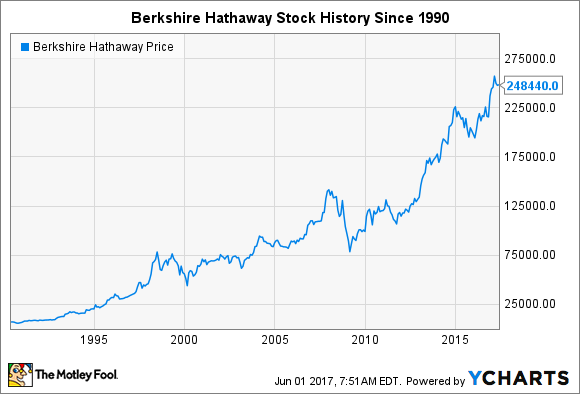

The "Classy" Stock Split Story

Okay, so the sheer price of a single Berkshire Hathaway 'A' share (yes, there are two types of shares, we'll get to that!) is a bit daunting. We're talking hundreds of thousands of dollars! This is largely due to the fact that they have never split their 'A' shares. Never! This is a deliberate choice, and it adds to their almost mythical status. It signifies a commitment to long-term holders and a belief that the value of the business will continue to grow organically.

However, for us mere mortals who might not have a small nation’s GDP to invest in one share, they also have 'B' shares. These were introduced later and are a fraction of the 'A' shares. They represent ownership in the same incredible business but at a much more accessible price point. So, you can still get a piece of the Berkshire pie without needing to sell a kidney!

It's About Trust, Not Just Numbers

At its core, the high price of Berkshire Hathaway stock is a testament to trust. Investors trust Warren Buffett and Charlie Munger to make wise decisions. They trust the business model. They trust the enduring power of the companies within the conglomerate. It’s a stock that has weathered economic storms and emerged stronger, time and time again.

And this, my friends, is where the fun comes in! Learning about Berkshire Hathaway is like diving into a fascinating case study of smart business, ethical leadership, and patient wealth creation. It's a story that can inspire you to think differently about money, about investing, and about the power of long-term vision. It’s not just about buying a stock; it’s about understanding a legacy.

The Inspiring Takeaway

So, why is Berkshire Hathaway stock so expensive? It’s a combination of brilliant leadership, a diverse and stable business empire, a unique reinvestment strategy, and decades of consistent, smart growth. It’s a symbol of enduring value and unwavering trust.

And the most inspiring part? You don't need a million dollars to learn from this incredible story. You can start by reading about Warren Buffett's letters to shareholders, exploring the history of the companies they own, or even just following their financial news. Understanding how Berkshire Hathaway became what it is today can spark a newfound curiosity about the world of finance and investing. It’s a reminder that with smarts, patience, and a long-term perspective, incredible things are possible. So, go on, get inspired, and let your financial curiosity run wild!