Who Has The Best High Yield Savings Account

Alright, let's talk about money. Not the exciting kind where you win the lottery and buy a private island shaped like a giant croissant. We're talking about the other kind of money, the kind that sits around, doing its thing, slowly (and I mean slowly) growing. We're diving into the world of high-yield savings accounts, and honestly, it’s less about adrenaline rushes and more about the quiet satisfaction of watching your pennies turn into… well, slightly more pennies. It’s the financial equivalent of watching paint dry, but with the bonus that the paint is actually, like, worth something.

Think of it this way: you’ve got that emergency fund, right? The one you meticulously built after that one time your washing machine decided to become a water feature and flood half your basement. Or maybe it's the "treat yourself, you deserve it" fund, which currently contains enough for a really fancy coffee and a donut. Whatever it is, it's money you don't want to be touched, like that last slice of pizza nobody else saw. And just like that pizza, you want it to be safe, but you also wouldn't mind if it somehow magically multiplied while you weren't looking. Enter the hero of our story: the high-yield savings account.

Now, before you picture some stuffy banker in a suit whispering secrets about interest rates, let’s demystify this. It’s basically a savings account that pays you a bit more for keeping your money with them. It’s like a thank-you note from the bank, only instead of a Hallmark card, it’s a tiny bit of extra cash. And who doesn’t love free money, even if it’s just a little? It’s like finding a forgotten twenty-dollar bill in your old jeans – a delightful little surprise!

So, Who’s Got the Golden Ticket?

Ah, the million-dollar question. Or, more accurately, the “how-many-extra-coffees-can-I-get-this-month” question. The truth is, the “best” high-yield savings account is a bit like trying to find the perfect pair of socks. It depends on what you’re looking for, and what works for one person might feel like a slightly-too-tight sock for another. There’s no single, universally crowned champion, no Beyoncé of the savings world. It's more of a vibrant, ever-shifting ecosystem.

The landscape is dotted with players, some big and established, others online-only and surprisingly zippy. You’ve got your traditional banks dipping their toes in, and then you have the digital-first outfits that seem to be built on caffeine and pure innovation. It’s a bit like choosing between your reliable old neighborhood store and that trendy new boutique that just opened up – both have their merits!

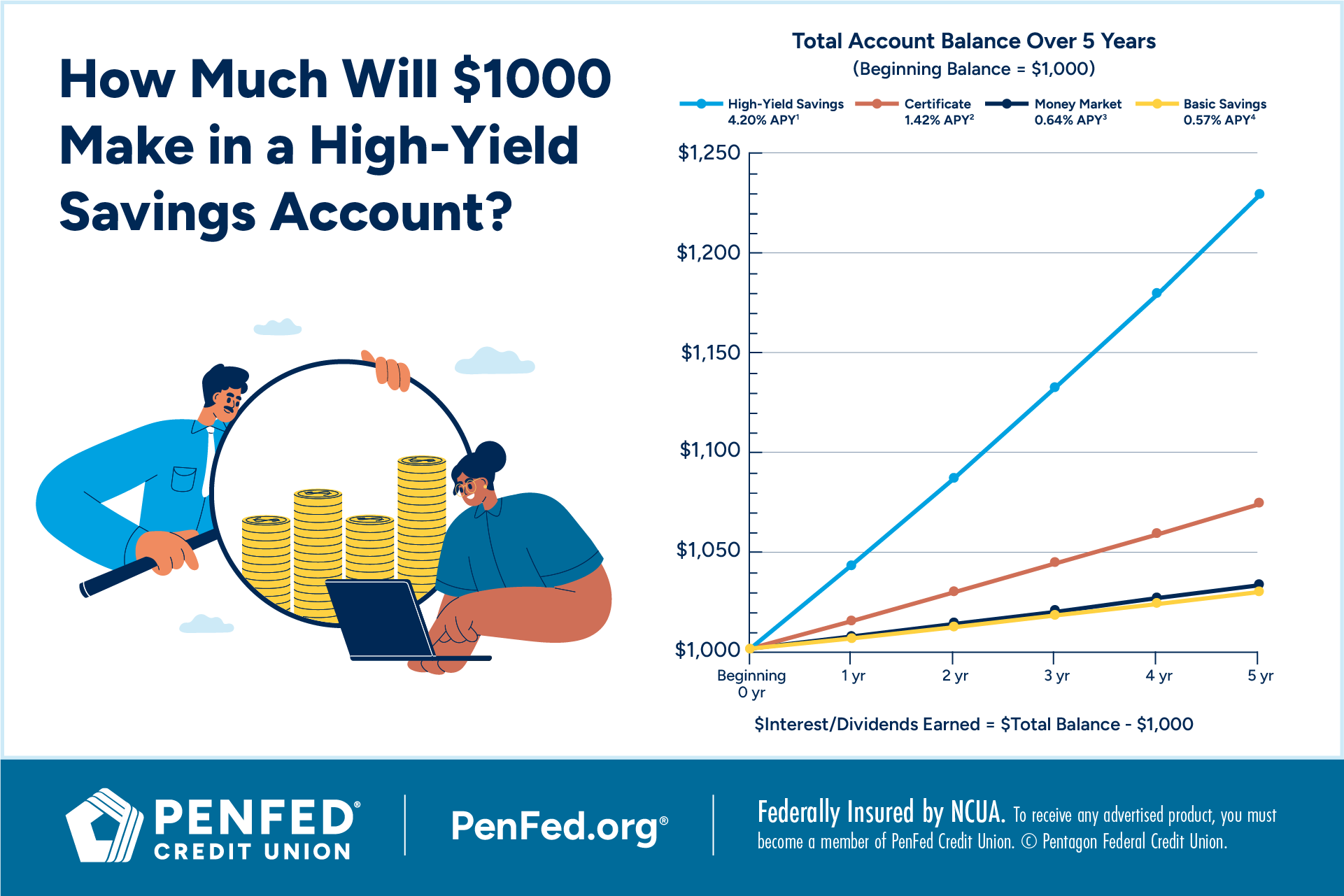

The main game-changer here is the Annual Percentage Yield (APY). This is your fancy way of saying "how much money you'll actually earn." Think of APY as the speed of your money’s growth. A higher APY means your money is jogging, or maybe even doing a light sprint. A lower APY means it’s… well, let’s just say it’s enjoying a leisurely stroll, perhaps stopping to admire the scenery.

And here’s the kicker: these rates are constantly changing. It’s like the stock market, but instead of heart-stopping drops, you get gentle nudges up or down. One day, Bank A is offering the highest APY, and the next, Bank B has decided to sweeten the deal. It can feel a bit like trying to catch a greased pig at a county fair – a bit slippery and requires quick reflexes!

The Usual Suspects (and Why They’re Worth a Look)

When you’re hunting for that perfect high-yield savings account, a few names tend to pop up more often than your weird uncle at family gatherings. These are the reliable workhorses, the ones that consistently offer competitive rates and generally don’t make you want to pull your hair out with complicated processes.

You'll often see online banks like Ally Bank and Discover Bank mentioned. These guys are the digital natives of the banking world. They don’t have fancy brick-and-mortar branches where you can go and stare at potted plants while waiting in line. Instead, they focus on giving you a great online experience and, crucially, a decent APY. Their customer service is usually pretty solid too, often available 24/7, which is handy for those late-night “did I lock the front door?” money worries.

Then there are the newer players, like Marcus by Goldman Sachs. Yes, that Goldman Sachs. They’ve branched out into the world of everyday banking, and they’re surprisingly good at it. They tend to offer very competitive rates, and their interface is usually quite sleek. It’s like your favorite tech gadget suddenly deciding to offer financial services – efficient and, dare I say, a little bit cool?

And let’s not forget the banks that might already be in your life. Your existing bank, the one where you have your checking account and have been for years, might also offer a high-yield savings option. Sometimes, these are competitive enough, especially if you value the convenience of having everything under one roof. It’s like staying with the same pizza place you’ve always loved – familiar, reliable, and you know what you’re getting.

The trick is to do a little digging. Think of it as a treasure hunt, but instead of a dusty map, you have a search engine. A quick online search for "best high yield savings accounts" will unleash a torrent of options. Websites that compare financial products are your best friends here. They’ll lay out the APYs, any fees (though most high-yield accounts are blissfully fee-free these days – a true unicorn!), and minimum balance requirements.

What to Look for (Besides Just a Fat APY)

While the APY is definitely the shiny object that catches our eye, it’s not the only thing that matters. Imagine buying a car based solely on its top speed; you might forget about things like gas mileage, reliability, or whether it has enough cup holders for your travel mug collection. The same applies here.

Fees: This is a biggie. You want an account with as few fees as possible. Ideally, you’re looking for something with no monthly maintenance fees. Some accounts might have fees for things like excessive transactions or wire transfers, but for a standard savings account, these should be minimal. Fees are like tiny little vampires, slowly draining your hard-earned cash.

Minimum Balance Requirements: Some accounts will boast a super-high APY, but then whisper in the fine print that you need to keep a king’s ransom in there to get it. Thankfully, many of the best high-yield accounts have no minimum balance requirement, or a very low one. This is great for those just starting out or for smaller emergency funds. You don't want to feel like you need to sell a kidney to qualify for decent interest!

Accessibility and Online Tools: How easy is it to get your money if you really need it? Most online accounts offer a smooth mobile app and website for transfers. Check out their app reviews – are people happy with the user experience, or are they complaining about glitches that make them want to throw their phone against the wall? You want to be able to move your money without a whole song and dance, like trying to get a refund for a slightly-too-expensive artisanal cheese.

FDIC Insurance: This is non-negotiable. Make sure the bank is FDIC-insured. This means your deposits are insured by the government up to $250,000 per depositor, per insured bank, for each account ownership category. It’s like a safety net for your money. Even if the bank does a swan dive, your cash is safe. It’s the financial equivalent of a guardian angel in a beige uniform.

Customer Service: While you hope you won't need it often, good customer service is a lifesaver when you do. Are they easy to reach? Are they helpful? A quick peek at online reviews can give you a good idea of their reputation. You don't want to be stuck on hold for hours, listening to elevator music that’s slowly driving you insane, just to ask a simple question.

The Ever-Shifting Sands of Interest Rates

This is the part that keeps things interesting, and sometimes, a little bit frustrating. Interest rates are influenced by the Federal Reserve and a bunch of other economic factors that are way above my pay grade. Basically, when the Fed raises interest rates, banks generally follow suit, and so do their APYs. When the Fed lowers rates, those APYs tend to do a little dip.

So, the account that’s offering the best rate today might not be the top dog next month. This is why it’s a good idea to revisit your high-yield savings account choice periodically. Think of it as an annual financial check-up, like taking your car in for an oil change. You’re not necessarily expecting anything to be wrong, but it’s good to be proactive.

Some people are super diligent and switch accounts every few months to chase the highest APY. This is like being a professional coupon clipper, but for savings accounts. It can be effective, but it also requires a bit of effort and attention. For most of us, finding a solid account with a consistently competitive rate and sticking with it is more than enough. We’re not aiming to win a Nobel Prize in Finance, just to have our money work a little harder for us.

It’s also worth noting that some of these online banks are really good at marketing. They’ll send you emails telling you about their latest rate increases, so you'll be kept in the loop. It’s like getting a friendly nudge from your bank, reminding you that your money is doing a little happy dance.

The Verdict: It’s a Marathon, Not a Sprint

So, who has the best high-yield savings account? The honest answer is: it depends. The "best" is the one that meets your needs, offers a competitive APY, has minimal fees, and makes you feel comfortable and secure. It's the one that allows your money to grow without causing you unnecessary stress.

My advice? Start by doing a bit of research. Check out a few of the big online players like Ally, Discover, and Marcus. See what your current bank offers. Compare their APYs, read the fine print for any fees or requirements, and then pick one that feels right for you. Don’t overthink it too much. It’s not a life-altering decision, but it’s a smart one.

Remember, the goal here isn't to become a banking guru. It's simply to get a little bit more bang for your buck. It’s about making your savings work a little bit harder, so you can get closer to that fancy coffee, that emergency fund buffer, or whatever financial goal you're aiming for. So, go forth, explore, and may your APY be ever in your favor!