Which Statements Describe How The Fed Responds To High Inflation

You know, I was at the grocery store the other day, doing the usual ritual of squinting at price tags and muttering to myself. I reached for a carton of my favorite fancy oat milk – the one that tastes suspiciously like dessert – and the price had jumped. Again. It wasn't a small jump, either. It felt like the oat milk had suddenly decided it was a artisanal craft beer. My wallet, bless its heart, did a little sigh. I’m pretty sure I heard it whisper, “We’re going to need to have a serious talk about… discretionary spending, aren’t we?”

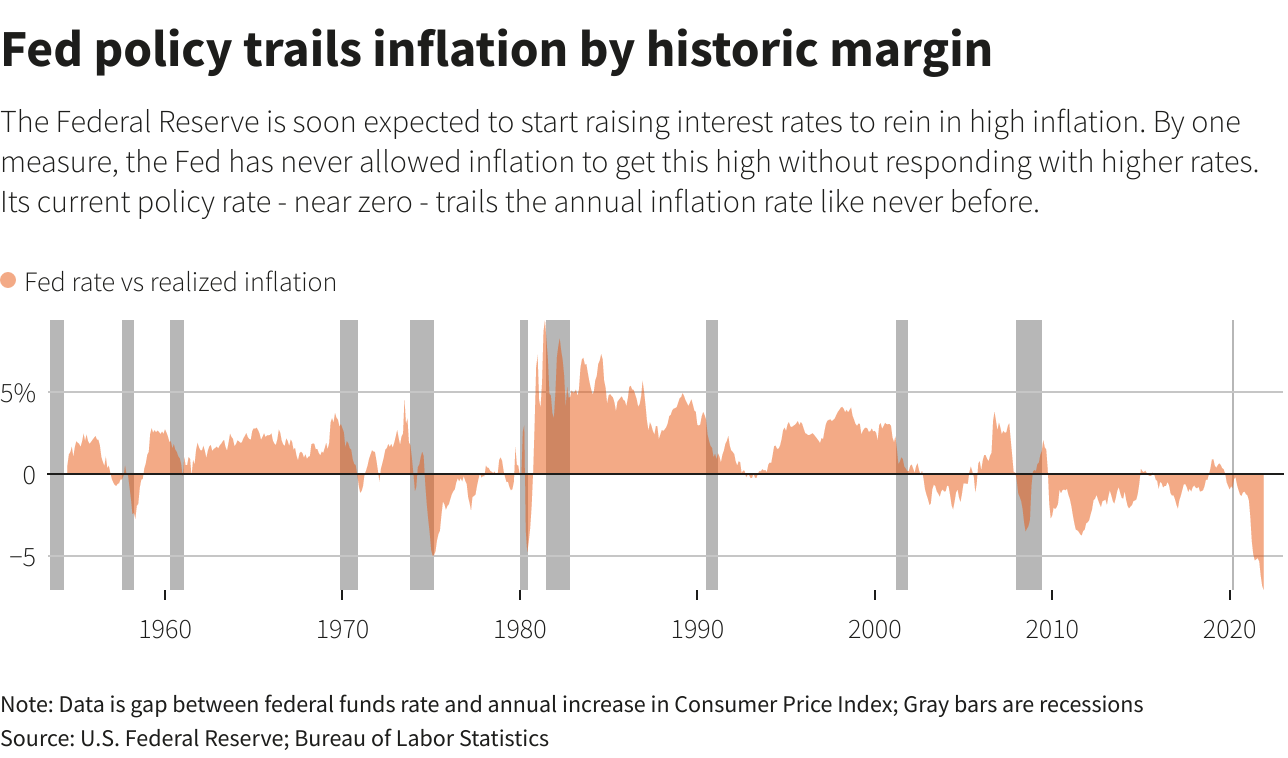

And that, my friends, is where our friendly neighborhood central bank, the Federal Reserve (or the "Fed" as we all affectionately call it), steps in. When prices, like my beloved oat milk, decide to go on a joyride upwards, that’s what economists wag their fingers and call “high inflation.” It’s like the whole economy is having one giant, expensive party, and nobody’s quite sure who's footing the bill.

So, How Does the Fed Deal with This Pricey Predicament?

Think of the Fed as the ultimate party planner for the economy. When things get too wild – and by "wild," I mean prices are spiraling out of control – they have to step in and try to calm things down. It’s not about telling your Uncle Barry he’s had too much to drink, but it’s definitely about adjusting the overall vibe of the economic soirée.

The main tool in their toolbox, the one that gets the most headlines, is playing with interest rates. This might sound a bit dry, but trust me, it has a ripple effect that touches everything from your mortgage to that oat milk.

Raising Interest Rates: The Fed's "Chill Out" Button

When inflation is running hot, the Fed's go-to move is to raise interest rates. This sounds simple, but what does it actually mean? Well, when the Fed raises its target for the federal funds rate (which is basically the rate banks charge each other for overnight loans), it makes it more expensive for banks to borrow money.

And guess what? Banks don't just absorb that cost. They pass it on! So, suddenly, loans become more expensive. Think about it:

- Mortgages get pricier: That dream home might feel a little further away when your monthly payments are suddenly higher.

- Car loans cost more: Buying that new set of wheels? Get ready to pay more in interest.

- Credit card interest rates go up: That outstanding balance you’ve been meaning to tackle? It’s now costing you more.

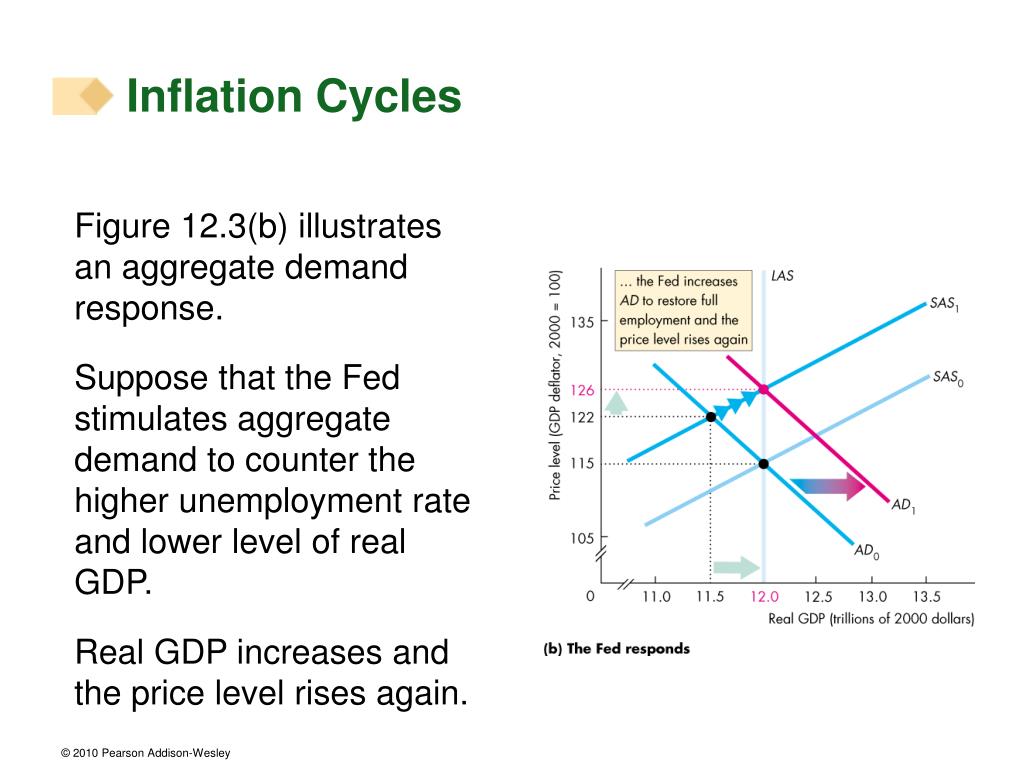

This is intentional, believe it or not! The idea is to discourage borrowing and spending. If it costs more to borrow money, people and businesses are less likely to take out loans to buy big-ticket items or expand their operations. When people spend less, the demand for goods and services decreases. And when demand goes down, prices should, in theory, stop climbing so rapidly, or even start to fall.

It’s like the Fed is saying, “Okay, everyone, let’s take a deep breath. Maybe we don't need that third latte this morning. Let’s save a little, borrow a little less, and let things cool down.” It’s a delicate balancing act, though. They don’t want to slam on the brakes so hard that the economy stalls completely.

Quantitative Tightening (QT): The Fed's "De-cluttering" Effort

Beyond just nudging interest rates, the Fed also has another, somewhat more complex, tool up its sleeve: quantitative tightening (QT). Now, this sounds super technical, and honestly, it can be. But let's break it down in a way that makes sense.

Remember back in the day, after the 2008 financial crisis and during the pandemic, when the Fed was doing something called quantitative easing (QE)? That's when they were buying up a ton of government bonds and other securities. The goal was to pump money into the financial system, lower long-term interest rates, and encourage lending and investment. Think of it as the Fed handing out free samples at the economic buffet, trying to get everyone to try a little bit of everything.

Well, QT is the opposite of QE. Instead of buying assets, the Fed starts to let those assets mature without reinvesting the money, or even actively sells them off. This has the effect of reducing the amount of money that’s circulating in the financial system. It’s like the Fed is now going through its pantry and tossing out items that are past their prime, making the whole system a little leaner.

When the Fed shrinks its balance sheet through QT, it essentially drains liquidity from the markets. This can lead to higher borrowing costs (even beyond the direct interest rate hikes) and can make it harder for companies to raise capital. Again, the goal is to reduce the overall demand in the economy, which in turn should help to curb inflation.

It’s a bit like when you're trying to tidy up your house. QE was like bringing in more stuff to make things look fuller and more vibrant. QT is like Marie Kondo-ing your financial bookshelf, keeping only what’s essential and letting go of what’s not. It's a way to take excess money – and remember, too much money chasing too few goods is a classic recipe for inflation – out of the system.

Communication is Key: The Fed's "Guidance"

Now, here’s something that often gets overlooked but is incredibly important: the Fed’s communication. The folks at the Fed don't just make decisions in a vacuum. They spend a lot of time talking about what they’re doing and what they plan to do. This is called forward guidance.

When the Fed signals that it’s serious about fighting inflation – by, say, hinting at future interest rate hikes or explaining its QT plans – it can influence the expectations of businesses and consumers. If everyone believes that inflation is going to come down, they might adjust their own behavior accordingly.

For example, if a business expects inflation to cool, they might be less inclined to hike their prices aggressively right now. If consumers expect inflation to ease, they might be less likely to rush out and buy things they don't immediately need, fearing they’ll pay even more later. It's like a psychological nudge.

This communication is a powerful tool because it can shape market sentiment and economic behavior without the Fed actually having to do anything concrete yet. It’s the economic equivalent of a stern but reassuring look from your parents. You know they mean business, and that knowledge itself can influence your actions.

Think about it: if the Fed chair stands up and says, "We are unwavering in our commitment to bringing inflation down," that sends a strong signal. It can calm nerves, anchor expectations, and even encourage a more cautious approach to spending and investing. It’s less about the specific action at that moment and more about the promise of future actions and the commitment to a goal.

Other, Less Frequent Tools: The Fed's "Emergency Kit"

While raising interest rates and QT are the mainstays, the Fed does have other tools, though they are usually reserved for more extreme situations or specific circumstances. These are less about broad economic adjustment and more about targeted interventions.

For instance, they have reserve requirements. This is the amount of money that banks are required to keep in reserve, either in their vaults or on deposit at the Fed. If the Fed were to raise reserve requirements, it would mean banks have less money available to lend out. This would, in turn, tighten credit and potentially slow down spending.

However, this tool is used very infrequently now because it can be quite disruptive to bank operations. It's kind of like your mom telling you to put all your toys away right now – it gets the job done, but it can cause a bit of chaos.

Another tool, though even more rarely used in a direct inflation-fighting context for developed economies like the US, is open market operations beyond just QT. This is the fundamental mechanism by which the Fed buys and sells government securities to influence the money supply. While QT is a form of this, the Fed can also conduct more direct purchases or sales to fine-tune liquidity in the banking system.

These are generally considered more blunt instruments compared to the nuanced approach of interest rate adjustments and forward guidance. The Fed prefers to use the tools that offer the most flexibility and the least potential for unintended consequences.

The Balancing Act: Avoiding Recession is Key!

Now, here's the million-dollar question (or perhaps the multi-trillion-dollar question, considering the economy): how does the Fed do all this without sending the economy into a nosedive – a recession?

This is where the art of central banking truly shines (or, you know, where it gets really stressful). The Fed is constantly analyzing reams of data: employment numbers, consumer spending, business investment, inflation figures, global economic trends, you name it. They're trying to gauge the temperature of the economy in real-time.

If they tighten monetary policy too aggressively, they risk triggering a recession. This means job losses, reduced economic output, and general economic gloom. Nobody wants that. On the other hand, if they don't act decisively enough, inflation can become entrenched, making it even harder and more painful to bring down later.

It’s a bit like walking a tightrope over a very deep chasm. They have to move deliberately, carefully, and with a constant awareness of the potential consequences of every step.

The goal is to achieve a "soft landing," where inflation is brought under control without causing a significant economic downturn. It’s the economic equivalent of a perfectly executed gymnastics routine – graceful, controlled, and sticking the landing.

So, when you see those headlines about the Fed raising interest rates, or hear about QT, remember it’s all part of a deliberate strategy to cool down an overheating economy. They're not trying to make your oat milk more expensive for fun; they're trying to make sure that all prices, and the overall economy, are on a more stable and sustainable path.

And who knows, maybe if they're successful, that fancy oat milk will eventually come down in price. A person can dream, right? In the meantime, I guess I'll be eyeing the store-brand version. It’s all about adapting to the economic climate, one slightly less fancy beverage at a time.