When Planned Investment Exceeds Saving In A Private Closed Economy

Alright, settle in, grab your latte, and let's talk about something that sounds super serious, but is actually kind of like a wild party where the invitations got mixed up. We're diving into a world where planned investment boogies way past planned saving in a private closed economy. Think of it as a potluck where everyone brings a seven-layer dip, but nobody remembered the chips. Total chaos, right? Well, sort of!

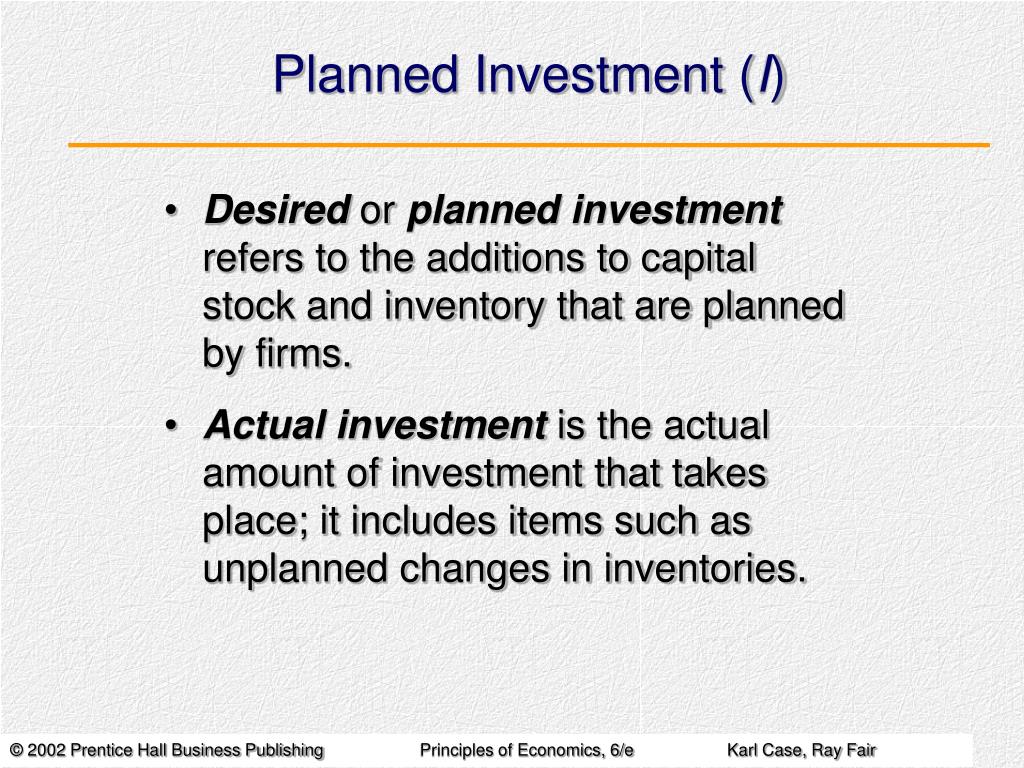

So, what in the name of all that is fiscally responsible are we even talking about? Imagine a country that's all by itself. No international trade, no borrowing from Uncle Sam's global buddies. It's just… us. And in this little economic bubble, businesses have grand plans. They want to build new factories, buy fancy new machines, maybe even invest in a giant robot army (hey, a guy can dream!). This is our "planned investment." It's the collective daydream of entrepreneurs wanting to make more stuff.

On the flip side, we have "planned saving." This is what all the folks in our closed economy decide they aren't going to spend on immediate goodies. They're socking it away, perhaps for a rainy day, a new unicorn petting zoo, or just because they're feeling particularly thrifty. It's the national impulse to put some cash under the mattress, metaphorically speaking.

Now, here's where the plot thickens, like a poorly stirred gravy. What happens when the investment plans are way bigger than the saving plans? It's like saying, "I want to build a spaceship that can travel to Mars and back, but I've only got enough pocket change for a bus ticket to the next town over." Big discrepancy, my friends.

The Investment Juggernaut Rolls In!

When planned investment screams, "I'm going to buy all the shiny new tools!" and planned saving whispers, "I might buy a new pair of socks," we've got a problem. Businesses are ready to spend big. They want to hire people, order materials, and generally grease the economic wheels. But where's all the money coming from if people aren't saving enough to fund these ambitious projects?

This is where the magic (or mild panic) happens. Businesses, eager to get their hands on those machines, start looking around for money. They'll try to borrow from banks, maybe issue some stock if they're feeling fancy. The demand for loanable funds goes through the roof. It's like Black Friday for loans!

Meanwhile, the rest of us are still mostly consuming. We're buying groceries, going to the movies, and maybe occasionally splurging on that extra scoop of ice cream. Our saving rate is just… not keeping up. We're like a turtle trying to outrun a cheetah. The race is already lost!

The Unexpected Consequences: A Full-Blown Shopping Spree (Almost!)

So, what's the immediate effect of this investment-saving mismatch? Well, businesses are still going to try and invest. They'll find the money, one way or another. But here's the kicker: they're going to be competing for the same pool of actual savings. This competition can drive up interest rates. Think of it as a bidding war for cash. "I'll give you 5% for that dollar!" "Nah, I'll give you 7%!" Suddenly, borrowing becomes more expensive.

But here's the really fun part, the part that makes economists get a little giddy. Businesses, bless their ambitious hearts, have already decided to invest. They've made their plans. They think they have the resources. When they don't, they start looking at what consumers are actually doing. And if consumers aren't saving enough, it means they're spending a lot!

This is where the economy can actually get a temporary shot in the arm. Businesses see demand for their products (because people are spending their income instead of saving it). They might ramp up production a bit, hire a few more folks to keep up with the unexpected surge in sales. It's like a surprise bonus for the economy! For a little while, at least.

The Catch-22: Unintended Inventory Buildup

However, this party can't last forever. Remember those shiny new machines businesses wanted to buy? They still want them. They've committed to them. And if they can't secure enough actual savings to finance them, they might have to cut back somewhere else. Or, here’s the truly bizarre twist: they might end up with more stuff than they can sell.

See, businesses are producing based on their investment plans. If they're building factories and making a ton of widgets for those factories, but consumers aren't saving enough to buy all the widgets, guess what happens? Unsold widgets! Piles and piles of them. The warehouses start looking like a scene from a poorly managed Amazon distribution center.

This is called an unintended inventory buildup. It's like baking 500 cookies for a party of 10. You've got a lot of cookies, and a lot of disappointed guests who can't eat them all. Businesses suddenly have a lot of unsold goods, and that's not a good look for their bottom line. It’s the economic equivalent of realizing you’ve accidentally ordered 100 pizzas for yourself.

The Inevitable Correction: A Slowdown is Coming

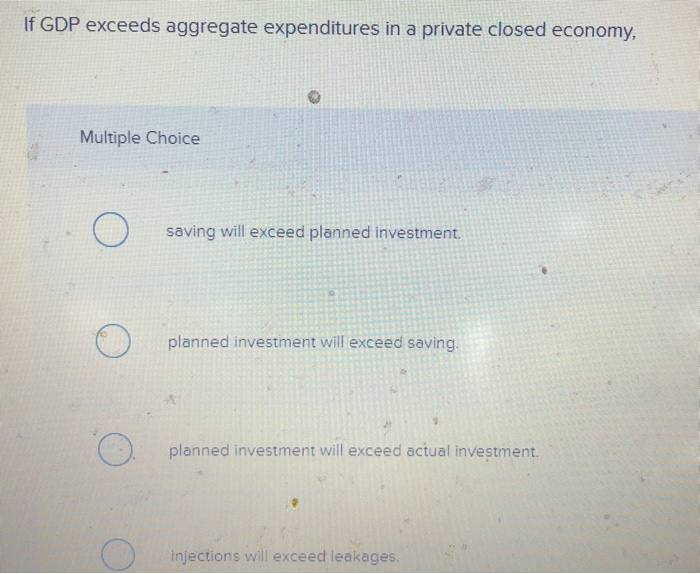

So, when planned investment is running wilder than a toddler in a candy store and planned saving is playing shy, the economy is in a bit of a pickle. Businesses are pumped to spend, but there isn't enough "future spending power" (savings) to go around. They might try to borrow more, driving up interest rates. Or, they might find themselves with a mountain of unsold goods.

Eventually, this disconnect has to be resolved. Businesses that built up too much inventory will have to slow down production. They'll have to re-evaluate their investment plans. Maybe that giant robot army is a bad idea after all if nobody can afford to buy the robots’ output. The temporary boost from increased consumption might fade as businesses cut back.

It’s like a financial game of musical chairs. When the music stops, some businesses might find themselves without a seat (i.e., with unsold products and a need to cut back). The initial burst of activity can be misleading. The real story is the strain on resources and the eventual need for adjustment.

The Takeaway: Balance is Key!

The fundamental lesson here is that in a closed economy, what you plan to invest needs to be financed by what you plan to save. If there's a gap, something has to give. It's not always immediate, and there can be some interesting short-term effects, but eventually, reality bites.

Think of it as a budgeting exercise for the entire nation. If you dream of buying a yacht but only have enough for a kiddie pool, you've got a planning problem. The economy faces the same challenge. A healthy economy thrives on a reasonable balance between the desire to invest for the future and the willingness to set aside resources (savings) to make those investments a reality. Too much of one without the other leads to… well, let's just say it’s not the most stable of party scenes.

So, next time you hear about planned investment and planned saving, remember the potluck analogy. And maybe, just maybe, keep a few extra chips handy. You never know when the dips might get a little too ambitious!