When Can I Retire Born In 1961: Complete Guide & Key Details

Hey there, fellow 1961 babies! Feeling that itch for freedom? That whisper of "Is it time yet?" when you’re stuck in traffic or staring at a particularly dull spreadsheet? You’re not alone! For us born in the groovy year of 1961, the golden question of "When can I retire?" is buzzing louder than ever.

Think of it like a perfectly aged wine or a classic rock album – we're getting better with time, and retirement is the ultimate concert encore. But unlike just showing up to the show, there are a few backstage passes we need to know about.

The "Official" Countdown: Social Security Magic!

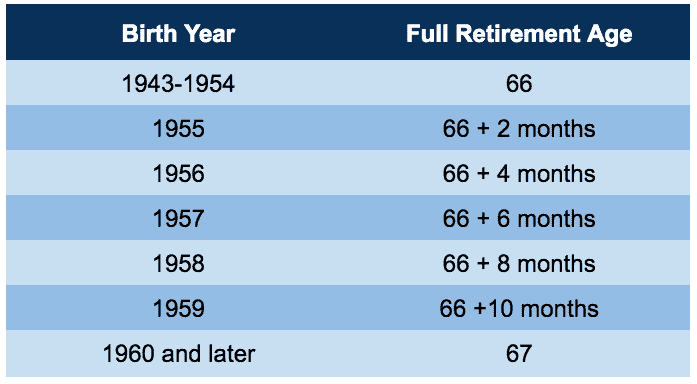

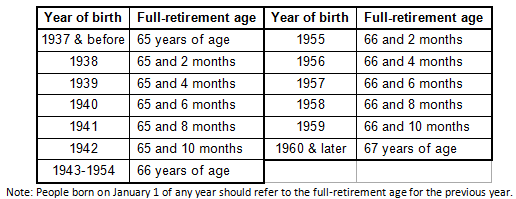

Okay, let's talk about the big cheese: Social Security. This is probably the first thing that pops into your head when retirement whispers your name. For those of us born in 1961, the magic number for your full retirement age is 67. Yep, a whole 67 years of rocking this planet!

This means you can start collecting your full Social Security benefits without any haircut. Imagine walking into that Social Security office, not with dread, but with a spring in your step. That’s the goal!

"Full retirement age is that sweet spot where you get 100% of the benefit you’ve earned."

Now, before you start practicing your victory dance, remember that 67 is the full retirement age. This is crucial. It’s like reaching the summit of Mount Retirement – the view is spectacular, and you don't have to pay extra for the oxygen mask!

The "Early Bird Gets the Worm... and Less Worm" Option

But what if 67 feels like a million years away? What if you’re picturing yourself on a beach, margarita in hand, right now? Well, you have options, my friends. You can choose to claim Social Security benefits as early as age 62.

This is the "early bird" special. It's exciting, it’s tempting, and it means you get to start your retirement party sooner. Think of it as getting your appetizer course a little earlier. Delicious!

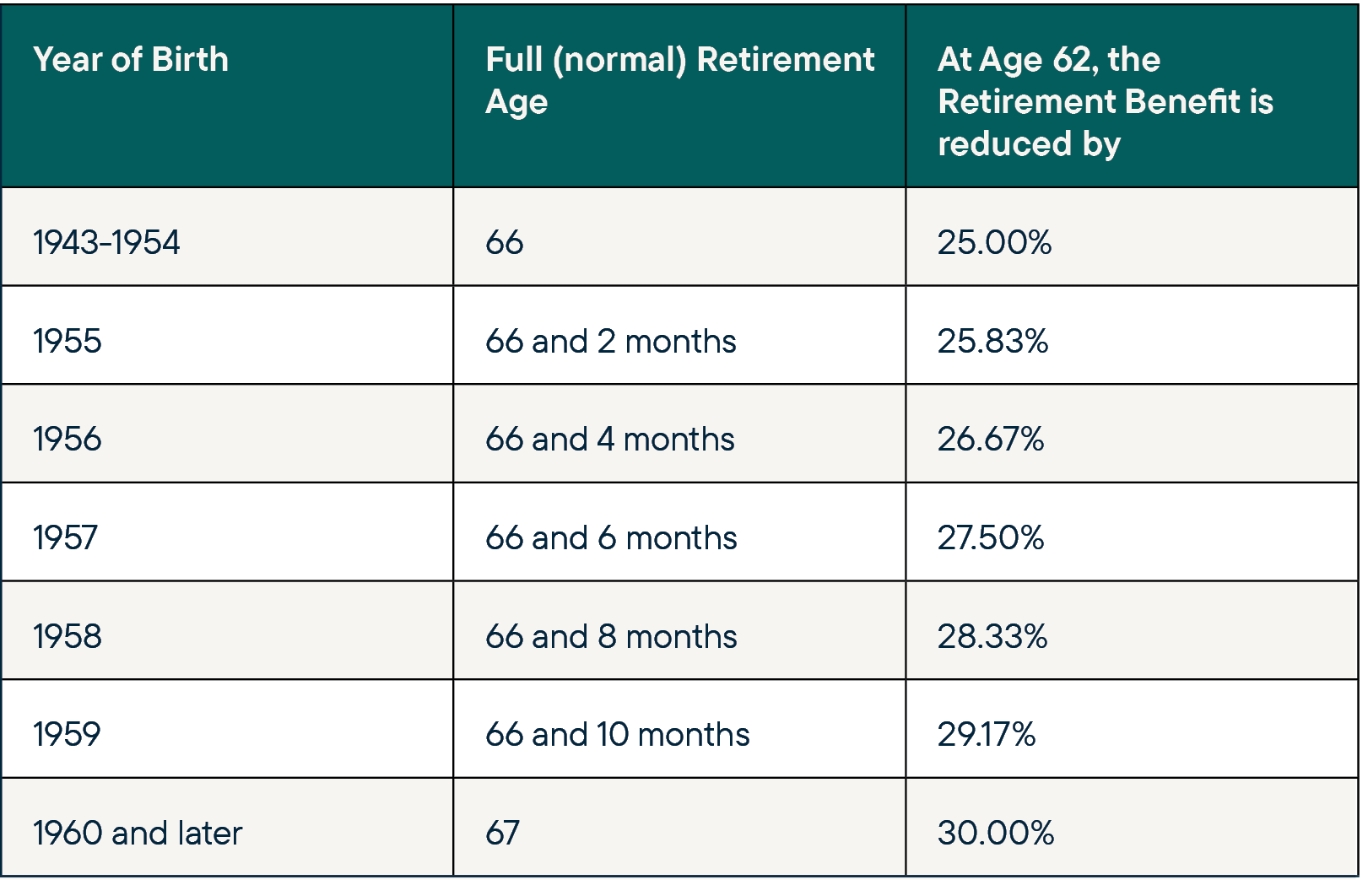

However, there’s a little catch, a tiny footnote in the retirement fairy tale. If you start claiming benefits early, your monthly payment will be permanently reduced. It’s like getting a slightly smaller slice of that retirement cake. Still cake, but a bit less of it, every single month, for the rest of your life.

So, for someone born in 1961, claiming at 62 would mean receiving about 70% of your full benefit. That’s a significant chunk, so it’s worth pondering if that early freedom is worth the trade-off.

The "Procrastinator's Delight": Waiting for More Dough!

On the flip side, what if you’re feeling financially fit and want to squeeze every last drop out of your Social Security? You can delay claiming your benefits even past your full retirement age of 67. This is where things get really interesting.

For every year you delay past 67, your benefit amount increases. This is called Delayed Retirement Credits. It’s like a loyalty program for patiently waiting your turn. Pretty neat, huh?

You can actually delay all the way up to age 70! And by the time you hit 70, your monthly Social Security check will be a whopping 124% of your full retirement age benefit. That's a serious power-up for your retirement fund!

"Waiting a few extra years can mean a significantly larger income stream in retirement. It’s like planting a money tree!"

Imagine the possibilities with that extra cash! More travel, more hobbies, maybe even a second, more luxurious retirement home. The world is your oyster, and with a fatter Social Security check, you can afford a lot more oysters.

Beyond Social Security: The 401(k) and Other Fun Stuff!

Now, Social Security is a fantastic foundation, but it’s usually not the whole retirement house. Most of us have been diligently saving in 401(k)s, IRAs, or other investment accounts. These are your personal retirement piggy banks, filled with your hard-earned cash.

Generally, you can start withdrawing from these accounts penalty-free at age 59 ½. So, if you're 1961 and you're already there, you could technically start tapping into those funds without the IRS breathing down your neck.

This is a game-changer! It means that even if you’re not quite at your full Social Security retirement age, you might have access to some of your own money to supplement your income or enjoy early retirement perks.

Think of your 401(k) as your personal retirement emergency fund, or your "fun money" fund. Need to fix that leaky faucet or take that spontaneous trip to see the grandkids? Your 401(k) can be your superhero.

The Roth IRA Revelation: Tax-Free Fun!

If you’ve been savvy enough to contribute to a Roth IRA, you're in for another treat. While the general rule of 59 ½ applies for penalty-free withdrawals of earnings, you can always withdraw your contributions tax-free and penalty-free at any age. It’s like a magic money drawer!

So, if you've been putting money into a Roth IRA, and you're in your 50s or 60s, you have direct access to that money without any tax implications. This can be a fantastic way to bridge the gap between being able to work and being able to collect full Social Security benefits.

It's like having a secret stash of cash that the government doesn't even get a cut of. How’s that for a retirement bonus?

Pensions: The (Sometimes) Mysterious Unicorns

Some of us might have pensions from our long-standing careers. These are like a personal annuity, often providing a steady income stream in retirement. The rules for pensions can vary wildly, so it’s important to check with your former employer.

Some pensions allow you to start collecting benefits as early as age 55, while others might have specific age and service requirements. It's like finding a treasure map – you need to follow the instructions carefully to get to the gold.

If you’re one of the lucky ones with a pension, dive into those paperwork details. It could be a significant piece of your retirement puzzle.

The "What Ifs" and the "What Nows": Planning Your Grand Exit

So, as a 1961-born individual, you have a spectrum of retirement ages to consider:

- Age 62: Early bird Social Security, but with a permanent reduction.

- Age 67: Full retirement age for Social Security – the full pension!

- Age 70: Max out your Social Security benefits with Delayed Retirement Credits.

- Age 59 ½: Access to most retirement accounts without penalties.

The "best" time to retire is a deeply personal decision. It depends on your financial situation, your health, your lifestyle dreams, and your willingness to keep working. Are you dreaming of endless golf or finally learning to paint that masterpiece?

It’s a journey, not a destination. Think of it as planning the ultimate vacation. You need to pack the right things, know your itinerary, and have enough money for souvenirs!

The Heartwarming Part: Freedom!

Ultimately, the most exciting thing about retirement is the freedom it represents. The freedom to wake up without an alarm clock, the freedom to pursue passions you’ve put on hold, and the freedom to spend your time exactly how you want.

For us born in 1961, we've navigated different eras and experienced so much. Retirement is our chance to enjoy the fruits of our labor, to savor the moments, and to write the next chapter of our lives with gusto.

So, when can you retire? The answer is a delightful "it depends," and that's the beauty of it! Start exploring your options, crunch your numbers, and most importantly, start dreaming about that fabulous retirement you deserve.