What Would My Mortgage Interest Rate Be

So, you're dreaming of a new place. Maybe a cozy cottage? A sprawling mansion? Whatever your dream home, there's one big question lurking: what's my mortgage interest rate gonna be? Sounds serious, right? But honestly, it's kind of a fun mystery. Like a financial scavenger hunt!

Think of your interest rate as the secret handshake of homeownership. It's the extra dough you pay for the privilege of borrowing a bajillion dollars. And boy, does it make a difference. A tiny little percentage point can save you thousands. Or cost you thousands. It's a big deal, but also, kinda like a game of chance.

The Mystery Ingredient: You!

First things first, your interest rate isn't some random number pulled from a hat. It's all about YOU. Your financial life story, basically. Lenders want to know if you're a reliable borrower. Someone who'll actually, you know, pay them back.

So, what are the big factors they look at? Let's spill the beans.

Your Credit Score: The All-Star Player

This is the MVP, folks. Your credit score is like your financial report card. It tells lenders how you've handled money in the past. Did you pay bills on time? Did you max out those credit cards like confetti at a party? High score? Awesome! Low score? Time to do some financial soul-searching.

Think of it like this: a great credit score is like walking into a fancy restaurant with a VIP pass. You get the best table, the best service, and maybe even a free appetizer. A low score? You're stuck waiting at the bar, hoping for leftovers.

A score of 740 and above is generally considered "excellent." This is where you start seeing the really good rates. Below 670? You might be looking at higher costs. It's not the end of the world, but it definitely makes the hunt harder.

Down Payment: The "I'm Serious" Signal

How much cash are you throwing down upfront? This is your down payment. The bigger it is, the less you need to borrow. And lenders love that. It means less risk for them.

Putting down 20% used to be the golden ticket. It gets you out of Private Mortgage Insurance (PMI), which is like a penalty for not putting down enough. But now, lenders are getting more creative. Some loans let you get in with as little as 3% down!

Imagine you're buying a car. If you put down a huge chunk, the dealer is way more willing to give you a sweet deal on the loan. Same goes for houses. Your down payment is your financial power move.

Debt-to-Income Ratio: The Balancing Act

This is a fancy way of saying: how much debt do you have compared to how much money you make? Lenders want to see that you can handle your existing bills and a new mortgage payment. It's all about balance.

If your DTI is too high, it means you're already juggling a lot of payments. Adding another big one might be a recipe for financial disaster. Lenders usually like to see a DTI below 43%.

Think of it like a seesaw. You want your income to be heavier than your debt. If it's too wobbly, lenders get nervous.

Loan Type: The Choose-Your-Own-Adventure

Not all mortgages are created equal! You've got your fixed-rate mortgages, where your interest rate stays the same for the entire loan. Predictable, like a comfy old sweater. Then you have your adjustable-rate (ARM) mortgages, where the rate can change over time. It might start lower, but then it could climb. Like a roller coaster!

Then there are government-backed loans like FHA or VA loans. These are often for people with lower credit scores or who are veterans. They can have more flexible requirements, but sometimes come with different fees.

And let's not forget about jumbo loans for those super-luxe properties! They have their own set of rules.

The Quirky Stuff That Matters

Beyond the big three (credit, down payment, DTI), there are other little things that can nudge your rate. It's like the secret sauce!

Your Job Stability: The Steady Eddy

Are you in a stable job? Do you hop jobs like a kangaroo on a sugar rush? Lenders like to see a history of consistent employment. It shows you're reliable. If you've been at the same company for years, that’s a big plus.

Imagine applying for a loan to rent a fancy yacht. If you can show them your steady income stream from your pirate captain gig, they'll be more likely to say yes than if you just found a treasure map last week.

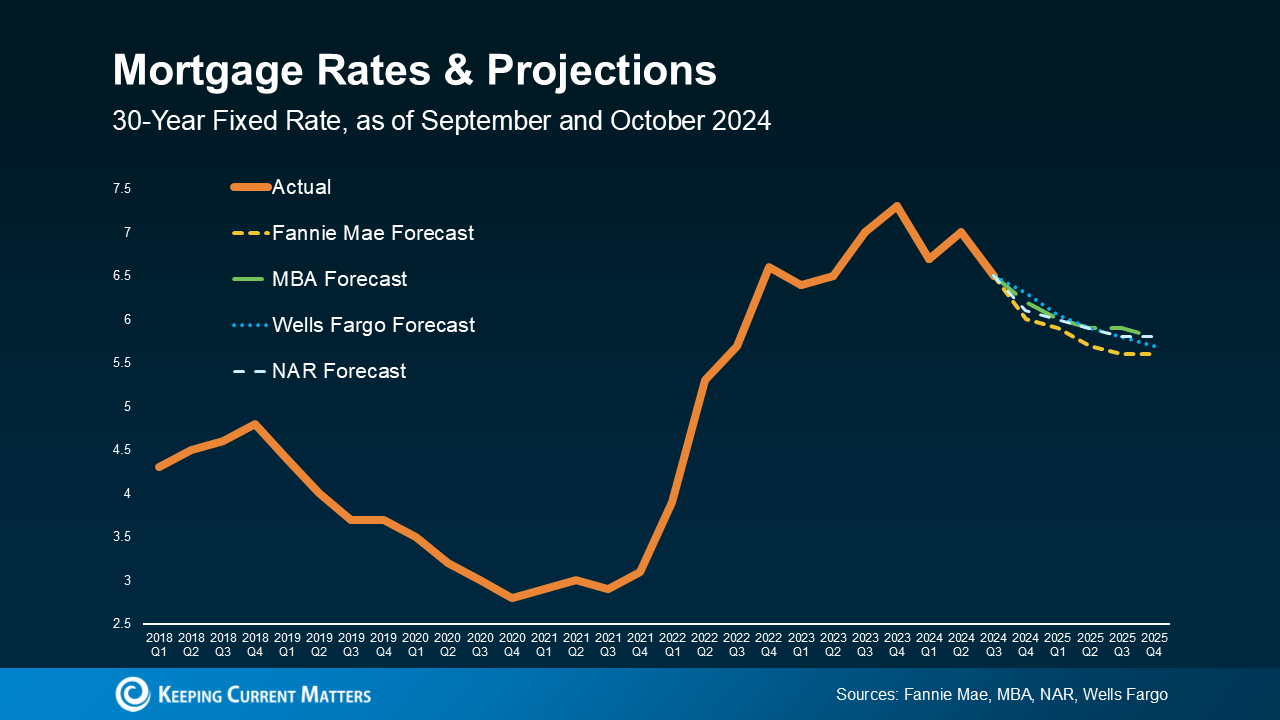

The Market Conditions: The Ever-Shifting Sands

This is where things get a bit out of your control. Interest rates are influenced by the economy. When the economy is booming, rates might go up. When things are slow, rates might go down to encourage borrowing.

It's like the weather. You can't control it, but you can definitely dress for it. You can’t control the market, but you can be prepared to act when the rates are in your favor.

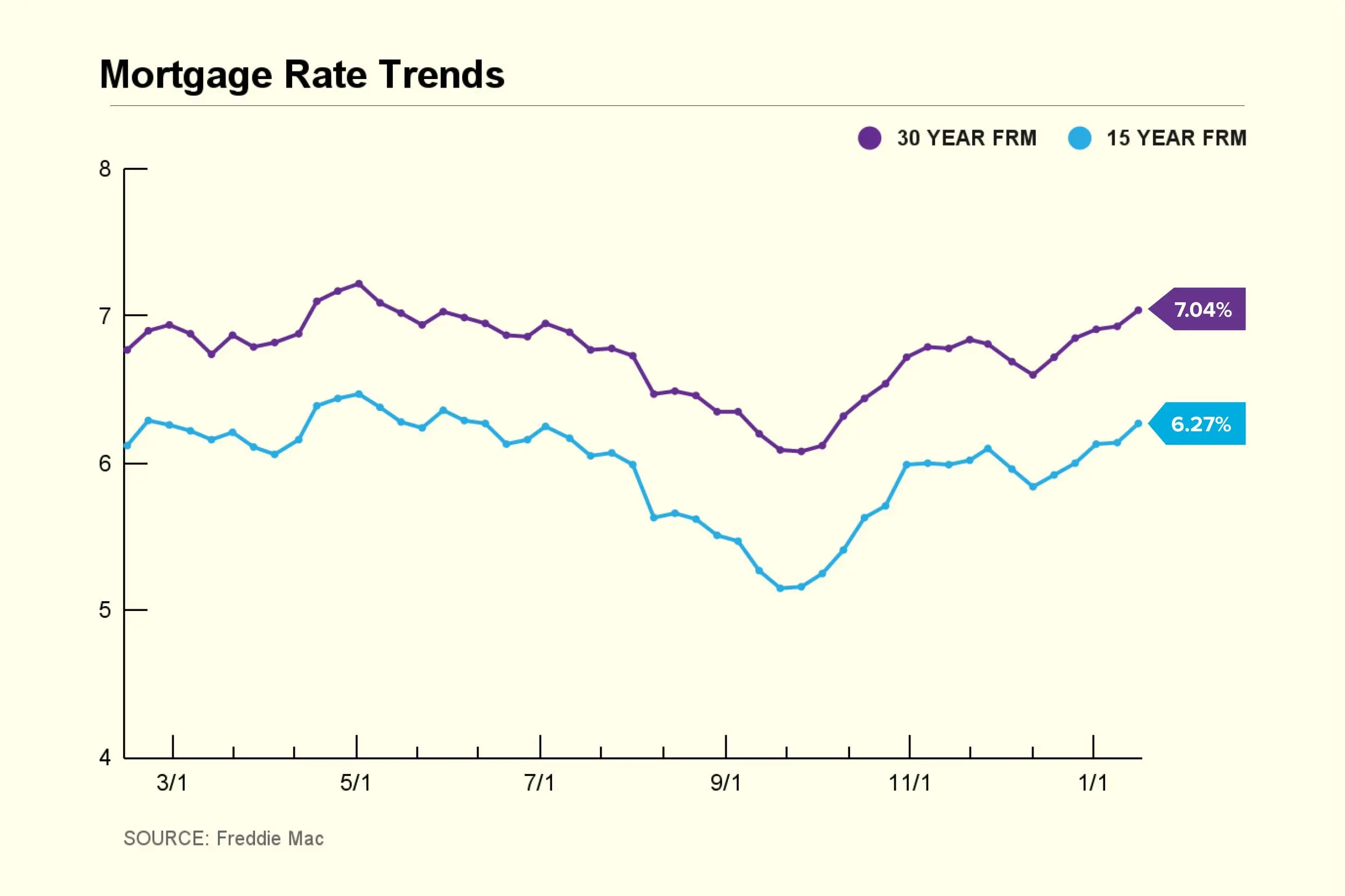

Your Loan Term: The Marathon vs. The Sprint

Are you going for a 30-year mortgage, the marathon of home loans? Or a 15-year sprint? Shorter loan terms usually come with lower interest rates. Makes sense, right? Less time for things to go sideways for the lender.

But a shorter term means bigger monthly payments. It's a trade-off! Think about what fits your budget and your long-term goals.

The Fun Part: Shopping Around!

This is where the "fun" in this whole process really kicks in. You wouldn't buy the first car you see, would you? Same with a mortgage. You gotta shop around!

Talk to different lenders. Banks, credit unions, online mortgage companies. Each one might offer a slightly different rate. It's like comparing prices at different stores for that perfect gadget.

And don't be afraid to negotiate! If you've got a great credit score and a solid financial picture, you have some leverage. It never hurts to ask, "Can you do better?"

Pre-approval is your secret weapon here. Getting pre-approved for a mortgage tells you how much you can borrow and gives you an estimate of your interest rate. This makes you a serious buyer in the eyes of sellers and helps you narrow down your options.

A Little Known Fact: Lender Fees!

Besides the interest rate, lenders also charge fees. These are called "points" or "origination fees." You can sometimes pay "points" upfront to lower your interest rate. It's like paying a little extra now to save a lot later. This is a whole other layer of negotiation!

Sometimes, a slightly higher interest rate with fewer fees can be a better deal than a lower rate with a ton of upfront costs. Do the math! It's a puzzle, and solving it saves you money.

So, What's the Verdict?

The truth is, there's no magic formula to tell you exactly what your interest rate will be without going through the actual application process. But understanding these factors gives you a huge advantage. It empowers you!

It's about being informed, being prepared, and being a smart shopper. The mortgage interest rate is a big piece of the homeownership puzzle, but it’s a puzzle you can totally solve. Now go forth and conquer your home-buying dreams! And remember, a little bit of playful curiosity can go a long way.