What The Difference Between Epo Ppo And Hmo

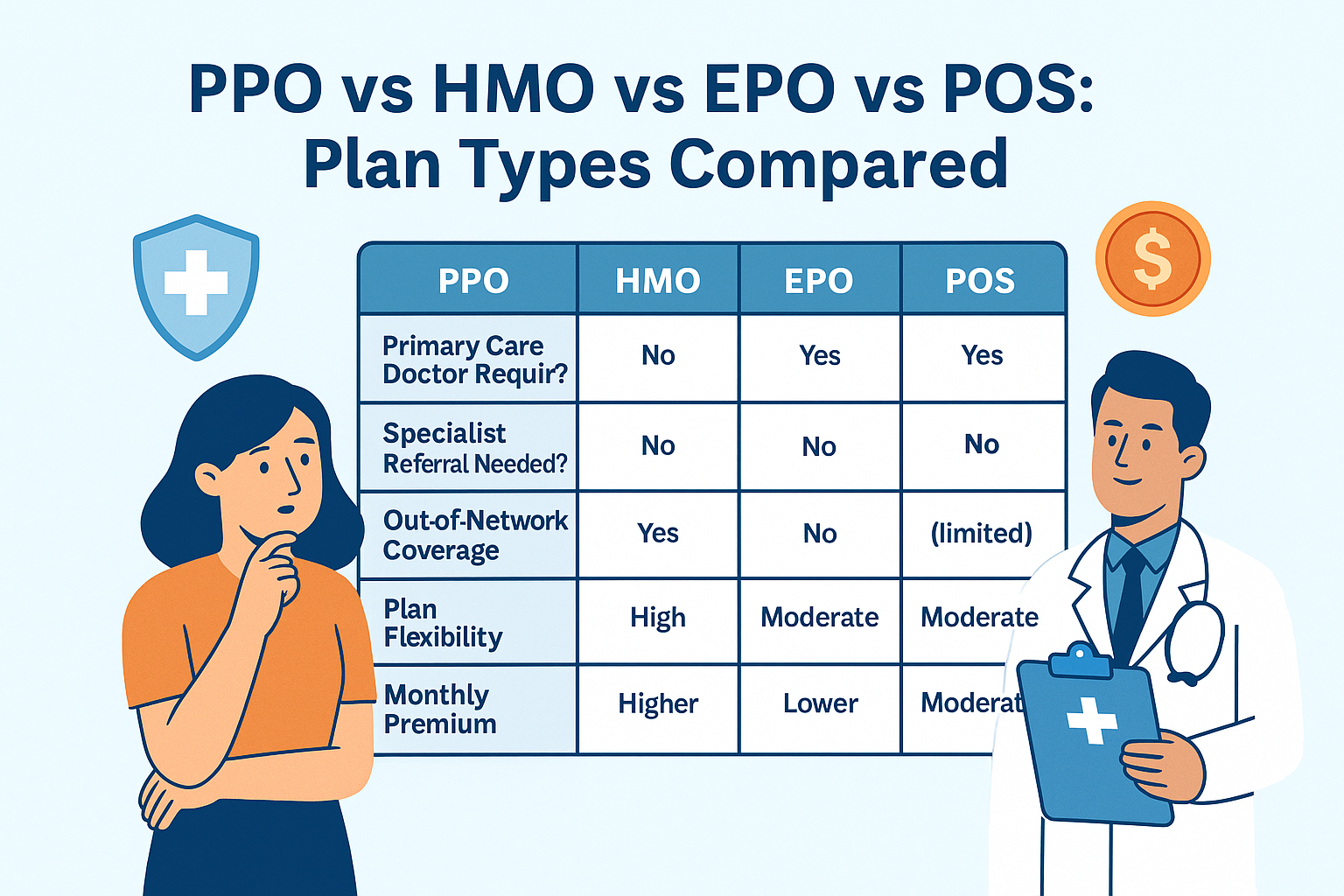

Navigating the world of health insurance can feel like deciphering a secret code, but understanding the differences between EPO, PPO, and HMO plans is actually a superpower that can save you time, money, and a whole lot of stress. Think of it as your personal cheat sheet for staying healthy and happy without breaking the bank. Knowing these acronyms isn't just about picking a plan; it's about empowering yourself to make informed decisions about your healthcare. It's a popular topic because, let's face it, we all need healthcare at some point, and understanding your options means getting the best bang for your buck when it comes to your well-being.

The Big Picture: What's the Goal?

At its core, every health insurance plan, whether it's an EPO, PPO, or HMO, has the same fundamental purpose: to help you manage your healthcare costs and ensure you have access to medical services when you need them. They are designed to spread the financial risk of healthcare across a large group of people, making it more affordable for individuals. These plans act as a financial safety net, covering a significant portion of your medical expenses, from routine check-ups and doctor visits to more serious illnesses and hospital stays. The main benefit for you, the insured, is predictable costs and access to care without facing overwhelming bills.

Let's Break It Down: The Acronyms Unpacked

Now, let's dive into the nitty-gritty of what makes each of these plan types unique. It all boils down to how they manage their network of doctors and hospitals, and how much freedom you have in choosing your providers.

HMO: The Gatekeeper with a Primary Care Physician

HMO stands for Health Maintenance Organization. Think of an HMO as a tightly knit community. To use your HMO plan, you'll need to choose a Primary Care Physician, or PCP. This PCP is your main doctor, your go-to person for all your healthcare needs. They act as your gatekeeper. If you need to see a specialist, like a cardiologist or a dermatologist, your PCP must give you a referral first. This referral system is key to how HMOs operate. One of the biggest benefits of an HMO is often lower monthly premiums and lower out-of-pocket costs, like copays and deductibles, because the network of providers is generally more cost-controlled. However, the trade-off is less flexibility. You generally can't see doctors or hospitals outside the HMO's network, except in emergencies, and without that referral, your care might not be covered.

PPO: The Flexible Friend

PPO stands for Preferred Provider Organization. If you like having choices and the freedom to see a variety of doctors, a PPO might be your best bet. With a PPO, you don't typically need to choose a PCP, and you don't need referrals to see specialists. You can see doctors and visit hospitals both in and out of the plan's network. The "preferred" part comes in because you'll pay less if you use providers within the PPO's network. Seeing an out-of-network provider will cost you more, but it's usually still covered to some extent, which offers a significant advantage in flexibility. PPOs often come with higher monthly premiums compared to HMOs, but this is the price you pay for that greater freedom and wider choice of providers. If you're someone who likes to have a wide array of healthcare options readily available, a PPO can be a great fit.

HMO vs EPO vs PPO Explained - Medicoverage.com

EPO: The Best of Both Worlds (Kind Of!)

EPO stands for Exclusive Provider Organization. This plan tries to strike a balance between the cost-effectiveness of an HMO and the flexibility of a PPO, but with a crucial distinction. With an EPO, you generally do not need a referral from a PCP to see a specialist. This is a big win for convenience! However, the "exclusive" in EPO means you are limited to seeing doctors and hospitals that are within the plan's network. If you go outside the network for non-emergency care, you'll likely have to pay the full cost yourself. So, while you get direct access to specialists without a referral, your network choices are just as restricted as an HMO. EPOs can offer a middle ground in terms of premiums and out-of-pocket costs, making them an appealing option for those who want some of the conveniences of a PPO without the higher costs, but are comfortable staying within a defined network.

Making the Smart Choice for You

So, how do you choose? It really depends on your personal healthcare needs and preferences. If you're generally healthy, don't need to see specialists frequently, and are looking for the most affordable option, an HMO might be perfect. If you value flexibility, see multiple specialists, or travel often, a PPO could be the better choice, even with its higher costs. And if you want direct access to specialists without referrals but are comfortable staying within a specific network, an EPO offers a compelling option. Remember to always check the specific details of any plan you're considering, including the network of providers, coverage details, and out-of-pocket costs. Understanding these differences is your first step to confidently managing your health and your budget.