What Should Be Included In A Financial Plan

I remember my Uncle Barry. Bless his heart, he was a bit of a… well, let's just say he was a very enthusiastic collector. His garage wasn't just a garage; it was a shrine to forgotten hobbies. One week it was artisanal pickle-making supplies, the next it was a bewildering array of vintage lava lamps. He’d spend hours, days even, researching the perfect fermenting crock or the most authentically groovy lava lamp. He had these beautiful, elaborate plans in his head for his future pickle empire or his retro-themed lounge.

The problem? Uncle Barry never actually did much with these plans. He had the tools, he had the passion, he had the idea. But when it came to the nitty-gritty – figuring out how much those jars of brine were actually costing him, or how much he’d need to charge for a glowing orb to make a profit – his eyes would glaze over. He’d wave his hands and say, "Oh, that's all just numbers. The vision is what matters!"

And that, my friends, is where we all, myself included at times, can fall into a bit of an Uncle Barry trap. We have these grand dreams for our lives – a cozy retirement, that dream vacation, or maybe just enough breathing room to not break out in a cold sweat every time the utility bill arrives. We have the vision. But without a solid financial plan, that vision can end up like Uncle Barry’s lava lamps: gathering dust and looking a bit… underwhelmed.

So, what exactly is this magical thing called a financial plan, and what should be lurking inside its digital or paper pages? Let’s dive in, shall we? No need for a business suit here; think of this as a friendly chat over coffee, or maybe a virtual high-five. We’re talking about making your money work for you, not the other way around.

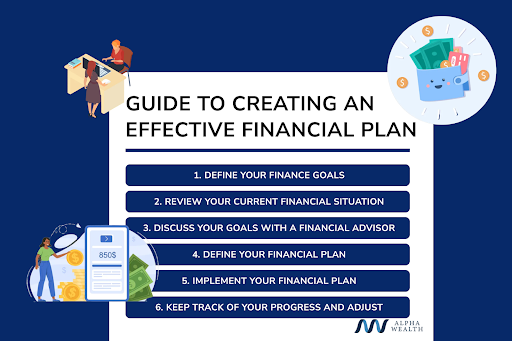

The "Why": Your Goals, Big and Small

Before we get lost in spreadsheets (don't worry, we'll keep those friendly), the absolute, numero uno, most crucial thing to include in your financial plan is your goals. Seriously, this is the engine of the whole operation. Without knowing where you’re going, how can you possibly plan the route?

And I’m not just talking about generic "be rich" goals. We need specifics. Think of it like this: if you’re planning a road trip, you don’t just say, "I want to drive somewhere fun." You say, "I want to drive to the Grand Canyon, see the sunset, and get back by Tuesday."

So, let’s break down those goals. We’ve got the short-term goals (think: within the next year or two). This could be building up a decent emergency fund (more on that!), saving for a new appliance, or even a fabulous weekend getaway. These are the immediate wins that keep you motivated.

Then we have the medium-term goals (say, 3-10 years). This is where things like saving for a down payment on a house, a significant car purchase, or maybe funding a big renovation start to come into play. These require a bit more strategic planning and consistent saving.

And, of course, the big kahuna: long-term goals (10+ years). This is primarily your retirement, but it could also include funding your children's education or leaving a legacy. These are the mountain peaks you’re aiming for, and they require a sustained, often compound-driven, approach.

![Free Printable Financial Plan Templates [Excel, PDF, Word] Business Plan](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Plan-1200x675.jpg)

When you’re listing these, be as detailed as possible. Instead of "save for retirement," try "retire at age 65 with enough income to maintain my current lifestyle, allowing for travel and hobbies." And then, the scary but necessary part: put a number on it. How much will that lifestyle cost annually in retirement? This is where the magic (and the math) starts to happen. Don’t shy away from the numbers! They’re not the enemy; they're your roadmap.

The "How Much": Your Income and Expenses

Alright, now that we know why we’re doing this, let's get down to the brass tacks of how. This is where your income and expenses strut their stuff. Think of this as a really honest, no-holds-barred conversation with yourself about where your money is coming from and, more importantly, where it's going.

First up: your income. This seems obvious, right? But are you accounting for all of it? We’re talking your regular paychecks, of course, but also any side hustles, freelance gigs, rental income, or even the occasional birthday cash from your favourite aunt. Be thorough. Every little bit counts. Knowing your net income (that’s the money you actually get to keep after taxes and deductions) is crucial.

Next, the often-feared expense tracking. I know, I know. It can feel like a cosmic judgment on your spending habits. But trust me, this is where you uncover the hidden treasures (or perhaps, the hidden drains) in your budget. You can use apps, spreadsheets, or even a good old-fashioned notebook. The key is consistency. Track everything, from your mortgage or rent down to that daily latte or impulse online purchase.

Categorize your expenses: fixed expenses (like rent/mortgage, loan payments, insurance premiums – the things that are pretty much the same each month) and variable expenses (like groceries, utilities, entertainment, dining out – the things that fluctuate).

The goal here isn’t to starve yourself or become a hermit (unless that’s your specific goal, no judgment!). It's about understanding your spending patterns so you can make conscious decisions. Are you spending $300 a month on subscriptions you never use? Gasp! Could that daily takeout be swapped for a delicious home-cooked meal a few times a week? These are the little adjustments that can free up significant cash for your goals. It's about intentionality, not deprivation.

The "What If": Your Safety Net (aka Emergency Fund)

Let’s talk about the financial equivalent of a life raft. No one wants to think about getting into trouble, but life, as we all know, is a beautifully messy and unpredictable affair. That’s where your emergency fund comes in. This is non-negotiable, people. Seriously. It’s the financial superhero that swoops in when the unexpected happens.

What kind of "unexpected"? Think job loss, a major medical bill, or a sudden, costly home repair (your roof deciding to go rogue in a thunderstorm, perhaps?). These are the events that can derail even the most carefully crafted plans if you don't have a buffer.

How much should be in this magical fund? The general consensus is 3 to 6 months of your essential living expenses. This means the money you absolutely need to cover your rent/mortgage, utilities, food, and basic transportation. If you have a less stable income or more dependents, you might aim for a bit more, say 6-12 months. It’s about peace of mind, not just a number.

And where should this fund live? In a separate, easily accessible savings account. You don’t want it tied up in investments where you might have to sell at a loss in an emergency. The point is quick access. Think of it as your financial deep breath.

The "Growth": Your Investments

Once your emergency fund is looking plump and happy, it's time to talk about making your money work harder for you. This is where investing comes in. Uncle Barry probably thought of his pickle money as "invested" in cucumbers, but we're talking about a slightly more sophisticated approach here.

Investing is how you grow your wealth over the long term, outpacing inflation and making your money work for you through the magic of compounding. Compound interest is basically your money having babies, and then those babies having babies! It’s powerful stuff.

What kind of investments? This is a whole world in itself, and it depends on your goals, risk tolerance, and time horizon. For most people, a diversified portfolio is key. This could include:

- Stocks: Owning a piece of companies. They can be volatile, but historically offer good growth potential.

- Bonds: Loaning money to governments or corporations. Generally less risky than stocks, but with lower potential returns.

- Mutual Funds and ETFs: These are like baskets of stocks or bonds, offering instant diversification and professional management. This is often a great starting point for beginners.

- Real Estate: Owning property can provide rental income and potential appreciation.

It’s crucial to understand your risk tolerance. Are you okay with some ups and downs for the potential of higher returns, or do you prefer a more stable, less volatile approach? Your financial plan should outline your investment strategy, including how much you’re willing to invest and what types of investments you’re considering. Don't just pick things at random!

And don’t forget about your retirement accounts! Things like 401(k)s, IRAs (both Roth and Traditional), and other employer-sponsored plans are designed specifically for long-term growth and often come with tax advantages. If your employer offers a match on your 401(k), that's literally free money. You’d be crazy not to take it!

The "Protection": Insurance

This is another one of those "I hope I never need it, but I'm so glad I have it" categories. Insurance is all about protecting yourself and your assets from catastrophic financial loss. It’s like wearing a helmet when you’re cycling – you might never crash, but it’s a smart precaution.

What kinds of insurance are we talking about?

- Health Insurance: Absolutely essential. Medical emergencies can bankrupt you without it.

- Life Insurance: If you have dependents who rely on your income, life insurance is crucial to ensure they're taken care of if something happens to you.

- Disability Insurance: This replaces a portion of your income if you become unable to work due to illness or injury. Often overlooked, but incredibly important for income protection.

- Homeowner's/Renter's Insurance: Protects your dwelling and belongings from damage or theft.

- Auto Insurance: Legally required and protects you in case of an accident.

Your financial plan should include a review of your current insurance coverage. Are you adequately protected? Are you paying too much? It's worth reviewing periodically.

The "Taxes": Making Them Work for You

Ah, taxes. The one thing in life that’s almost as certain as death. Your financial plan needs to acknowledge them and, where possible, strategize to minimize your tax burden. No one likes paying more taxes than they have to, right?

This can involve things like:

- Maximizing contributions to tax-advantaged retirement accounts (like those IRAs and 401(k)s we mentioned!).

- Understanding deductions and credits you might be eligible for.

- Strategizing with investments to take advantage of capital gains tax rules.

This is an area where consulting a tax professional can be incredibly valuable. They can help you navigate the complex world of tax laws and ensure you're not leaving any money on the table. Don't be afraid to seek expert advice here.

The "Review and Adjust": Keeping It Alive

This is arguably the most critical step, and the one most often forgotten. Your financial plan is not a static document that you create once and then frame on your wall. It's a living, breathing document. Life happens, your goals change, your income fluctuates, and the market goes up and down.

Therefore, you need to regularly review and adjust your financial plan. I recommend doing a significant review at least once a year. What went well? What didn't? Are you still on track for your goals? Have any of your goals changed?

For example, maybe that dream vacation to Fiji is now a priority over renovating the kitchen. Or perhaps you've received a significant promotion, and it's time to re-evaluate your savings and investment strategy. Life's a marathon, not a sprint, and your plan needs to adapt.

Don't be discouraged if you're not hitting every single target perfectly. The act of planning and tracking is already a huge win. It's about progress, not perfection.

Putting It All Together

So, there you have it. A financial plan is more than just a budget or a list of savings goals. It’s a comprehensive roadmap that integrates your aspirations, your current reality, and a strategy to bridge the gap. It's about taking control of your financial future, not just letting it happen to you.

Think of it as building your financial house. You need a solid foundation (your goals and emergency fund), sturdy walls (your income and expenses managed), a protective roof (insurance), and a way to heat and cool it efficiently (investments and tax strategies). And, of course, you need to keep an eye on it, making repairs and renovations as needed (the regular reviews).

Don’t let your financial future be like Uncle Barry’s artisanal pickle-making kit – full of potential but ultimately unused. Start building your plan today. Even small steps make a huge difference. Your future self will thank you, probably with a very sophisticated, financially secure cup of artisanal coffee. Cheers to that!