What Is The Starting Credit Score At 18

So, you've hit the big 1-8! Congrats! This is a pretty awesome milestone, right? You're officially an adult, ready to conquer the world... or at least figure out how to get your own Netflix password. But have you ever stopped to think about what else comes with this newfound freedom? Like, what's the deal with that mysterious thing called a "credit score"? And more importantly, what's your starting point? Let's dive in and unpack this, no panic required!

You might be picturing a wizard in a tower somewhere, meticulously assigning scores to every person who blows out their 18th birthday candle. While that's a fun image, the reality is a bit less magical and a lot more… data-driven. The truth is, most 18-year-olds don't actually have a credit score when they turn 18. Shocking, I know!

Think of it like learning to ride a bike. You can't just have the skill; you've gotta practice, wobble a bit, maybe fall off a few times (metaphorically speaking, hopefully!), and eventually, you get your balance. Your credit score is kind of the same. It's built over time, based on how you handle borrowed money. If you haven't borrowed any money yet, well, there's no history to score!

So, if you're 18 and you check your credit report, chances are it's going to be pretty blank. Like a fresh notebook, ready for your brilliant ideas. This isn't a bad thing, by the way! It's just the starting line. It means you have a clean slate, which is actually a pretty neat advantage. You get to build your credit history from the ground up, making smart choices from the get-go.

Why Does This Even Matter?

Okay, so you don't have a score yet. Why should you even care about this credit score thing? Well, imagine you want to rent your first apartment, get a car loan, or even just get a cell phone plan without paying a massive deposit. All of these things often rely on a credit check. A good credit score shows lenders and landlords that you're responsible with money, making you a lower risk to lend to.

Think of your credit score as your financial report card. A good score is like getting straight A's – it opens doors and makes things easier. A low score? Well, that might mean more hoops to jump through, higher interest rates, or even being denied altogether. It's not the end of the world, but it's definitely something you want to have in your favor!

The Big Question: What's the Starting Score?

As we touched on, the most common "starting score" for an 18-year-old is… non-existent. Zip. Nada. Zilch. It's like being at the starting gate of a race before the gun has even fired. You're there, you're ready, but your race time hasn't begun yet.

However, there are a few ways you can start building a credit history right around that age, and if you do, you'll start to see a score emerge. For example, if your parents add you as an authorized user on one of their credit cards, or if you get your own secured credit card (we'll get to that!), you'll begin to build that history.

The "Authorized User" Advantage

Being added as an authorized user is like getting a co-pilot on your first flight. Your parents, assuming they have a good credit history themselves, can add you to their credit card. This means you get a card with your name on it, and their responsible credit usage (making payments on time, keeping balances low) can start reflecting positively on your credit report.

It's crucial that your parents are responsible with their credit if they do this. If they miss payments or have high balances, it can actually hurt your budding credit history. So, it's a bit like borrowing their amazing secret recipe – you want to make sure they're actually good cooks first!

Secured Credit Cards: Your First Real Step

Another common way to get your credit score rolling is by getting a secured credit card. This is like a gym membership for your credit. You put down a deposit, say $300, and that becomes your credit limit. You use the card for small purchases, and as long as you pay it back on time, you're showing the credit bureaus that you can handle credit responsibly.

The deposit acts as collateral, making it much less risky for the credit card company to give you a card. It’s a fantastic way to build a positive credit history from scratch. Think of it as training wheels for your credit. You learn how to balance, steer, and stop, all in a controlled environment.

So, When Do I Get My First Real Score?

Once you've opened a credit account (like a secured card or by being an authorized user) and made at least one payment, a credit bureau will likely start creating a credit report for you. It usually takes a few months of activity for a numerical credit score to be generated.

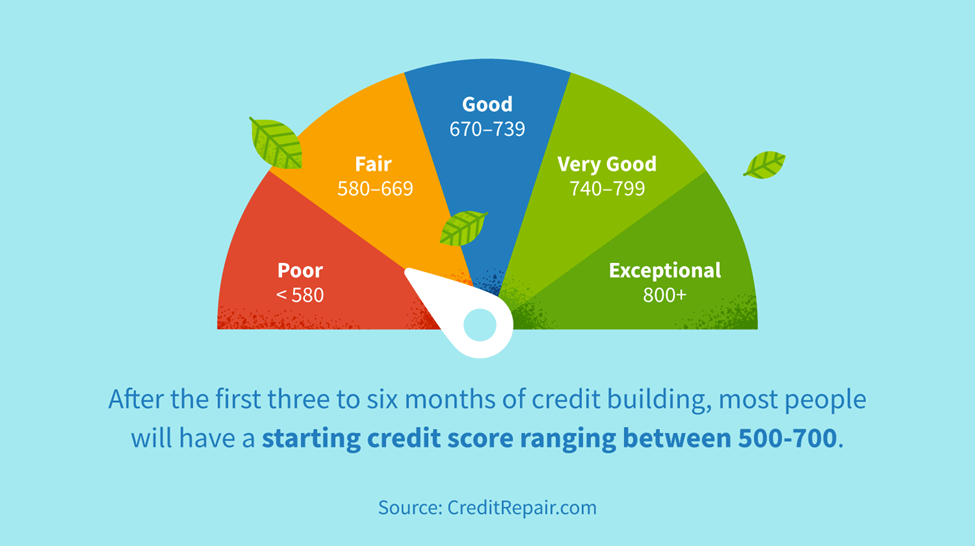

The initial scores can vary wildly, but generally, if you've been responsible with those early credit activities, you might see a score somewhere in the mid-600s. This isn't a "perfect" score by any means, but it's a solid starting point. It shows you've begun the journey and are on the right track.

If you haven't done anything to build credit, then you'll continue to have no score. And that's okay! You just need to start somewhere. It’s like starting a new video game; you're at level one, and you've got a whole world to explore and conquer.

The Power of a Good Score (Even When It's New)

Building good credit early is like planting a money tree when you're young. The longer it grows, the more fruit it bears! A good credit score can save you a ton of money over your lifetime through lower interest rates on loans and credit cards. It can also make everyday life just… smoother.

Imagine needing a car to get to that dream job. A good credit score can mean a lower monthly payment on your car loan, freeing up cash for other important things, like, you know, actual fun. Or think about getting your first apartment without needing a guarantor or a huge security deposit. That's freedom!

Tips for Starting Strong

So, what's the takeaway? If you're 18 and just starting out, don't stress about not having a score. Instead, focus on these:

- Be Responsible: If you get a credit card, always pay your bills on time. This is the golden rule of credit.

- Keep Balances Low: Don't max out your credit cards. Aim to use less than 30% of your available credit.

- Check Your Reports: Once you have a score, it's a good idea to check your credit reports annually for errors. You can get free reports from the major credit bureaus.

- Educate Yourself: The more you understand about credit, the better you can manage it.

Building credit at 18 isn't about having a sky-high score right away. It's about understanding the system and making smart, consistent choices. It’s a marathon, not a sprint, and you’ve just received your official starting pistol. So, go forth, be responsible, and watch your financial future bloom!