What Is The Mortgage Rate Today For 15 Year

Hey there, you! Glad you could grab a virtual coffee with me. So, we're chatting about mortgages today, huh? Specifically, those 15-year fixed-rate beauties. You know, the ones that make you feel all responsible and grown-up, but also, like, "Is this it? Is this my life now?"

Let's be real, talking about mortgage rates can feel about as exciting as watching paint dry. Or maybe even more exciting? Who knows! But it's important, right? It's the big one, the elephant in the room, the… well, you get it. It’s the number that can totally make or break your homeownership dreams. Or at least, make them a lot more or a lot less painful. Ouch.

So, you’re wondering, "What’s the mortgage rate today for a 15-year?" It’s the million-dollar question, literally! Or, well, the several-hundred-thousand-dollar question, depending on your neck of the woods. And let me tell you, it's not like there's one magic number that applies to everyone. Nope, life is rarely that simple, is it? If only! Imagine a world where we all just had the same rate. Bliss!

Think of it like asking, "What's the price of a car today?" It depends, right? Are we talking a sleek sports car, a sensible minivan, or a beat-up old pickup truck that sounds like it’s coughing up a lung? Same goes for mortgages. A 15-year fixed rate, while specific in its term, still has a whole lot of variables attached. It’s like a personalized pizza – you pick your toppings, and the price changes. But instead of pepperoni, it's your credit score and down payment.

First off, let's talk about the 15-year fixed rate itself. What even is that? Well, it means your interest rate is locked in for the entire 15 years you're paying off your loan. No surprises! Your principal and interest payment stays the same from the first payment to the last. It’s like a steadyEddy, a reliable friend. Unlike those variable rates that can go up and down like a roller coaster at Six Flags. Wheeee! Or, you know, not so wheeee if it goes up. Predictability is the name of the game here. You know exactly what you owe, month after month. It brings a certain peace of mind, doesn't it? Like a warm hug on a chilly day.

Now, why a 15-year? It’s shorter than the traditional 30-year mortgage. That means you'll pay off your house way faster. Boom! Done. And because you're paying it off faster, you'll generally pay less interest over the life of the loan. Cha-ching! So, while your monthly payments might be a smidge higher than a 30-year (because, you know, you're cramming more payments into less time), in the long run, you're saving a boatload of cash. Think of all the extra avocado toast you could buy with that saved interest! Or maybe a down payment on a vacation home? Just saying.

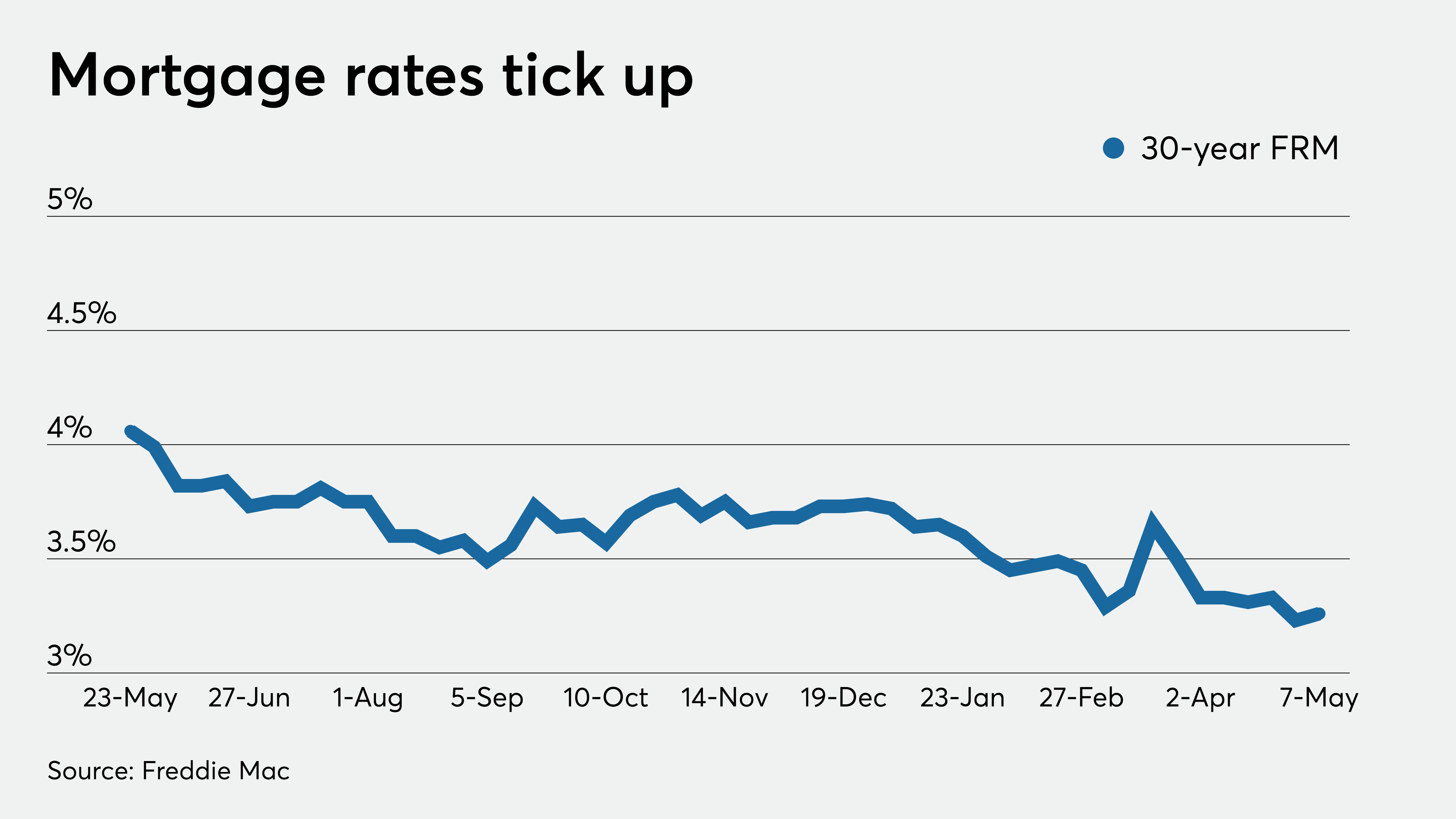

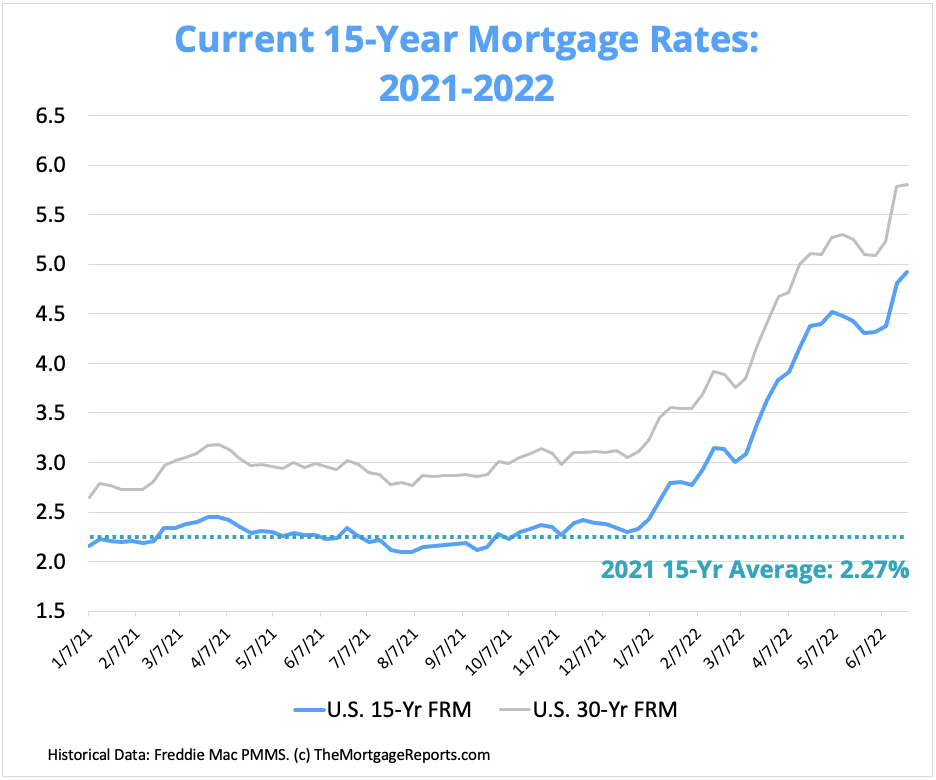

So, what’s the actual rate today? This is where it gets a little… fluid. Mortgage rates are like the weather – they change. Constantly. They’re influenced by a gazillion things. The economy, inflation, what the Federal Reserve is doing (those guys are important!), even how many people are buying houses right now. It’s a whole ecosystem of financial forces at play. It’s basically a giant, invisible market constantly adjusting. Makes your head spin, doesn’t it?

Generally speaking, 15-year fixed rates are usually lower than 30-year fixed rates. Why? Because lenders see them as less risky. They’re getting their money back sooner. It’s like lending your friend $20. If they promise to pay you back tomorrow, you’re probably more confident than if they say, “Uh, maybe next year?” The shorter the loan, the less time for things to go sideways. So, that’s a win for us borrowers!

But again, “lower” is a relative term. We’re talking about a percentage point or two, maybe more, depending on the market conditions. And over 15 years, that difference can add up to a serious chunk of change. It’s the difference between that fancy new Tesla and… well, maybe a slightly used but still cool Tesla. Small victories, people!

To get the most accurate rate for you today, you really need to shop around. It’s not a passive activity, unfortunately. You can’t just sit back and expect the perfect rate to land in your inbox. You gotta do a little digging. Think of yourself as a financial detective, on the hunt for the best deal. Sherlock Holmes, but for mortgages. "Elementary, my dear homeowner!"

Where do you look? Well, there are tons of online lenders, banks, and credit unions. Each one will have its own set of rates and fees. And trust me, those fees can add up too. It’s not just about the advertised interest rate; it’s the Annual Percentage Rate (APR) that tells the whole story. That includes all the fees rolled into the loan. So, always compare the APRs, not just the interest rates. It’s the hidden details that matter!

Your personal situation plays a huge role. Let’s break down the big players. Your credit score is probably the most critical factor. If you've been a financial saint, diligently paying bills on time, and keeping your credit utilization low, you're likely to get a better rate. Lenders see you as a low-risk borrower. It’s like getting a gold star in your financial report card. On the flip side, if your credit score is a little… shall we say, "creative," you might see higher rates. It’s their way of saying, "We’re taking a bigger gamble here, so we need more compensation." Ouch, again.

Then there’s your down payment. A bigger down payment generally means a lower interest rate. Why? Because you're borrowing less money, and you have more "skin in the game." Lenders feel more secure when you’ve put down a substantial amount of your own cash. It’s like showing them you’re serious about this whole homeownership thing. A 20% down payment is often the sweet spot to avoid private mortgage insurance (PMI), which is an extra monthly cost you definitely don’t want. So, that extra cash upfront can save you money in the long run, both on the interest rate and by ditching PMI.

Your debt-to-income ratio (DTI) is another big one. This is basically a comparison of how much you owe each month in debt payments (student loans, car payments, credit cards, etc.) versus how much you earn each month. Lenders want to see that you can comfortably afford your mortgage payments on top of your other debts. If your DTI is too high, they might see you as a higher risk. They want to make sure you’re not going to be living on ramen noodles every night just to make your mortgage payment. Nobody wants that!

And let's not forget the loan amount. The size of the loan can sometimes influence the rate. Larger loans might sometimes have slightly different rate structures, although for a 15-year fixed, it’s usually more about the other factors. But it’s worth keeping in mind. It’s all about the lender’s risk assessment. The bigger the number, the bigger the potential headache for them if things go south.

Now, for a rough idea of what the rates might look like right now? This is where it gets tricky, and I have to preface this with a huge disclaimer: This is not financial advice! I’m just your friendly neighborhood coffee-guzzling conversationalist. For the most up-to-date information, you’ve got to check with actual lenders. But, as of my last chat with the mortgage gods (okay, more like scrolling through financial news), 15-year fixed rates have been hovering in a certain range. We’re talking, and this is a generalization, anywhere from the high 5% to the mid-6% range. Maybe even a little lower if you’ve got a pristine financial record and a hefty down payment. Or maybe a smidge higher if the market is feeling a bit spicy. It’s a moving target, my friend.

Imagine you’re buying a $400,000 house with a 20% down payment ($80,000), so you’re financing $320,000 on a 15-year fixed. If the rate is, say, 6%, your principal and interest payment would be around $2,280 per month. Now, if that rate creeps up to 7%, your payment jumps to about $2,450. That’s an extra $170 a month, or $2,040 a year, just in interest. Over 15 years, that’s over $30,000 more! See why it matters? It’s like leaving money on the table. Or, even worse, like having to skip that extra vacation. The horror!

So, what’s the best course of action? First, check your credit score. Know where you stand. If it needs a little sprucing up, start working on that now. Second, figure out your budget and down payment. How much can you realistically afford each month, and how much cash do you have saved up? Third, get pre-approved. This is a crucial step! A pre-approval from a lender will give you a much clearer picture of what rate you might qualify for. It’s like getting a personalized quote before you even start shopping.

And don’t be afraid to shop around and compare offers. Talk to at least three different lenders. See what they offer you. Don’t just go with the first one you talk to, unless they’re offering you an unbelievably sweet deal. And even then, maybe get a second opinion. It's your money, after all! You want to make sure you’re getting the best bang for your buck. Or, you know, the best mortgage for your buck.

Think about the overall picture. A 15-year fixed-rate mortgage offers security and long-term savings. You'll be mortgage-free faster, building equity quicker, and paying less interest overall. It’s a fantastic option if your budget can handle the slightly higher monthly payments. It’s for the folks who want to be debt-free sooner rather than later. They’re the marathon runners of the mortgage world. The 30-year is more like a brisk walk. Both get you there, but the pace is a little different. And the cost can be too.

So, to sum it up, the mortgage rate today for a 15-year fixed is not a single number. It’s a spectrum, influenced by your financial health, your down payment, and the ever-changing market. It’s a personalized deal. You gotta do your homework, talk to lenders, and compare, compare, compare! That’s how you find the rate that’s just right for you. It’s a quest, an adventure, a… well, it’s a mortgage. But a mortgage you can feel good about!

Don't stress too much, though. The world of mortgages can feel overwhelming, but with a little effort and a good cup of coffee (or tea, no judgment here!), you can navigate it. You've got this! Now, go forth and conquer those mortgage rates! And maybe treat yourself to some of that avocado toast you saved on. You earned it!