What Is The Interest Rate On Grad Plus Loans

Ah, higher education! That magical time of late-night study sessions fueled by questionable coffee, the thrill of learning, and… the looming question of how to pay for it all. For many ambitious students and their families, the Grad PLUS loan is a familiar, albeit sometimes intimidating, friend on this journey. It’s not exactly the most glamorous topic, but let’s face it, for many, it’s the key that unlocks doors to advanced degrees and fulfilling careers. Think of it as your personal rocket fuel for academic aspirations!

The primary benefit of the Grad PLUS loan is its accessibility. Unlike some other forms of financing, it’s designed to help graduate and professional students cover the difference between the cost of attendance and other financial aid they've already received. This means it can be used for tuition, fees, living expenses, books, and even equipment needed for your studies. Essentially, it’s designed to ensure that financial barriers don't stand in the way of your pursuit of knowledge and specialized skills. It’s an investment in your future, empowering you to become doctors, lawyers, researchers, artists, and so much more!

You'll commonly see Grad PLUS loans used to finance Master's degrees, Doctoral programs, and various professional degrees like law or medicine. For example, a budding cardiologist might use a Grad PLUS loan to cover the significant costs associated with medical school, while a future astrophysicist might rely on one to fund their PhD research. It’s also a lifeline for students pursuing graduate programs at private institutions, where costs can be particularly high.

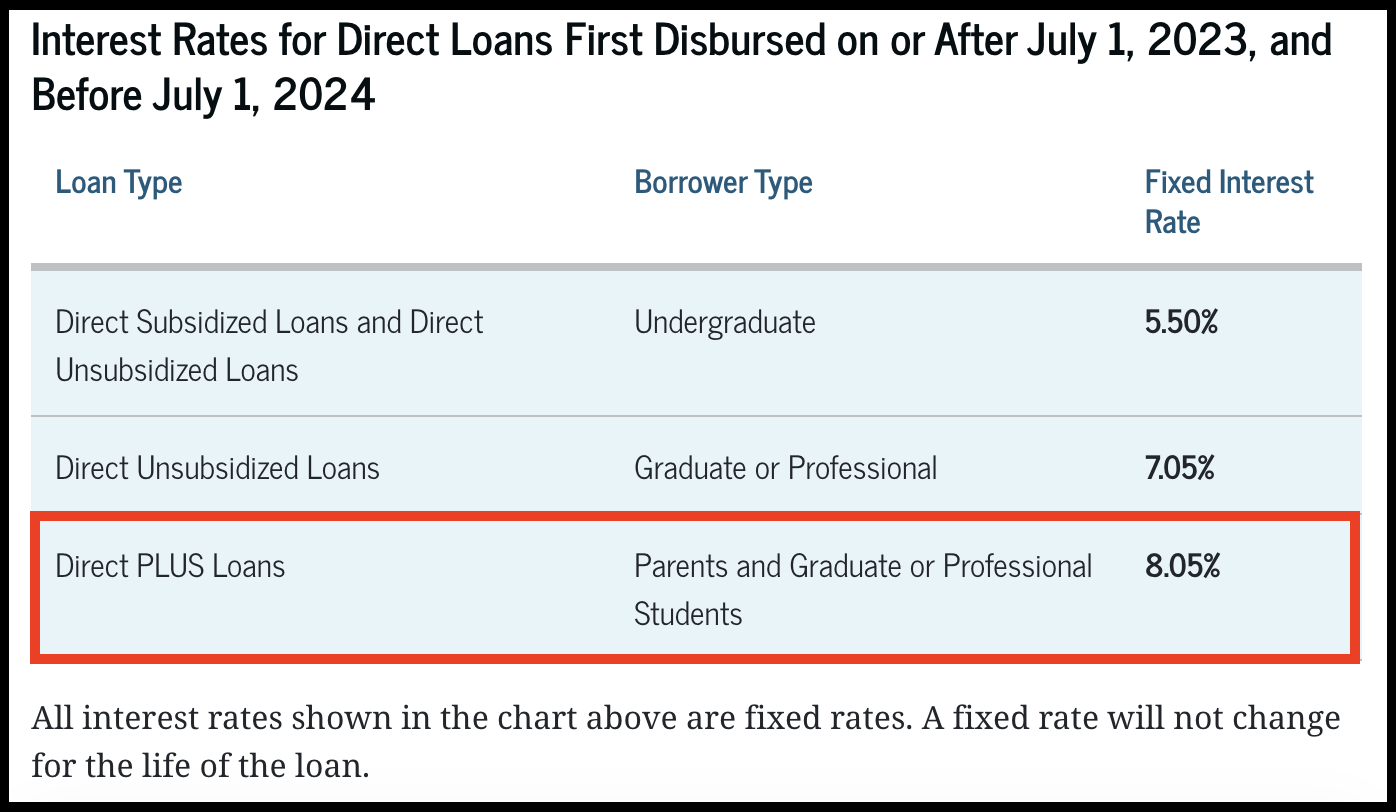

Now, let's get to the nitty-gritty: what is the interest rate on Grad PLUS loans? This is where things get a bit more fluid. Unlike fixed-rate options, the Grad PLUS loan interest rate is a variable rate. This means it can change each year. It's tied to the yield on U.S. Treasury Notes auctioned in May of each year, plus a fixed add-on. As of my last update, for the 2023-2024 academic year, the rate was around 8.06%. It's crucial to check the official Federal Student Aid website for the most current rate applicable to your loan period. This rate is higher than some undergraduate loans, reflecting the increased risk associated with graduate-level borrowing.

To make the most of your Grad PLUS loan experience and to enjoy the fruits of your education without excessive financial strain down the road, consider these practical tips. Firstly, borrow only what you absolutely need. Resist the temptation to max out your loan for wants; focus on essential educational and living costs. Secondly, understand the repayment options. Grad PLUS loans are eligible for income-driven repayment plans, which can significantly lower your monthly payments based on your income after graduation. This can be a real game-changer! Finally, start researching repayment strategies early. Even while you're in school, having a plan for how you'll tackle those loans post-graduation can alleviate a lot of stress and help you manage your finances more effectively. Remember, this loan is a tool to achieve your dreams, so use it wisely and strategically!