What Is The Death Cross In The Stock Market

Hey there, folks! Ever heard of a "death cross" in the stock market and thought, "Uh oh, that sounds a bit grim!"? Well, you're not wrong. It definitely has a dramatic name, but let's break it down in a way that's as easy-going as your Sunday morning coffee. No fancy jargon, just good old common sense, with a sprinkle of everyday life comparisons.

Imagine you're planning a road trip. You've got your trusty, older map (let's call this your long-term trend) and a more up-to-the-minute GPS (your short-term trend). The GPS is showing you the quickest way to get to your destination right now, maybe taking you on some twisty backroads to avoid traffic. The old map, though, gives you the big picture – the main highways, the general direction, the reliable, well-trodden path.

Now, what if your GPS suddenly shows you a sharp turn that veers off completely from the main highway on your old map? That's kind of what a death cross is in the stock market. It's not a literal death, of course! It's a technical signal that some investors look at to gauge the mood of the market.

Here's the simple scoop: we're talking about moving averages. Think of these as smoothed-out versions of stock prices over time. They help us see the general direction without getting bogged down by every single little fluctuation. It’s like looking at your average speed over the last hour versus your speed at this exact second. Both are useful, but they tell different stories.

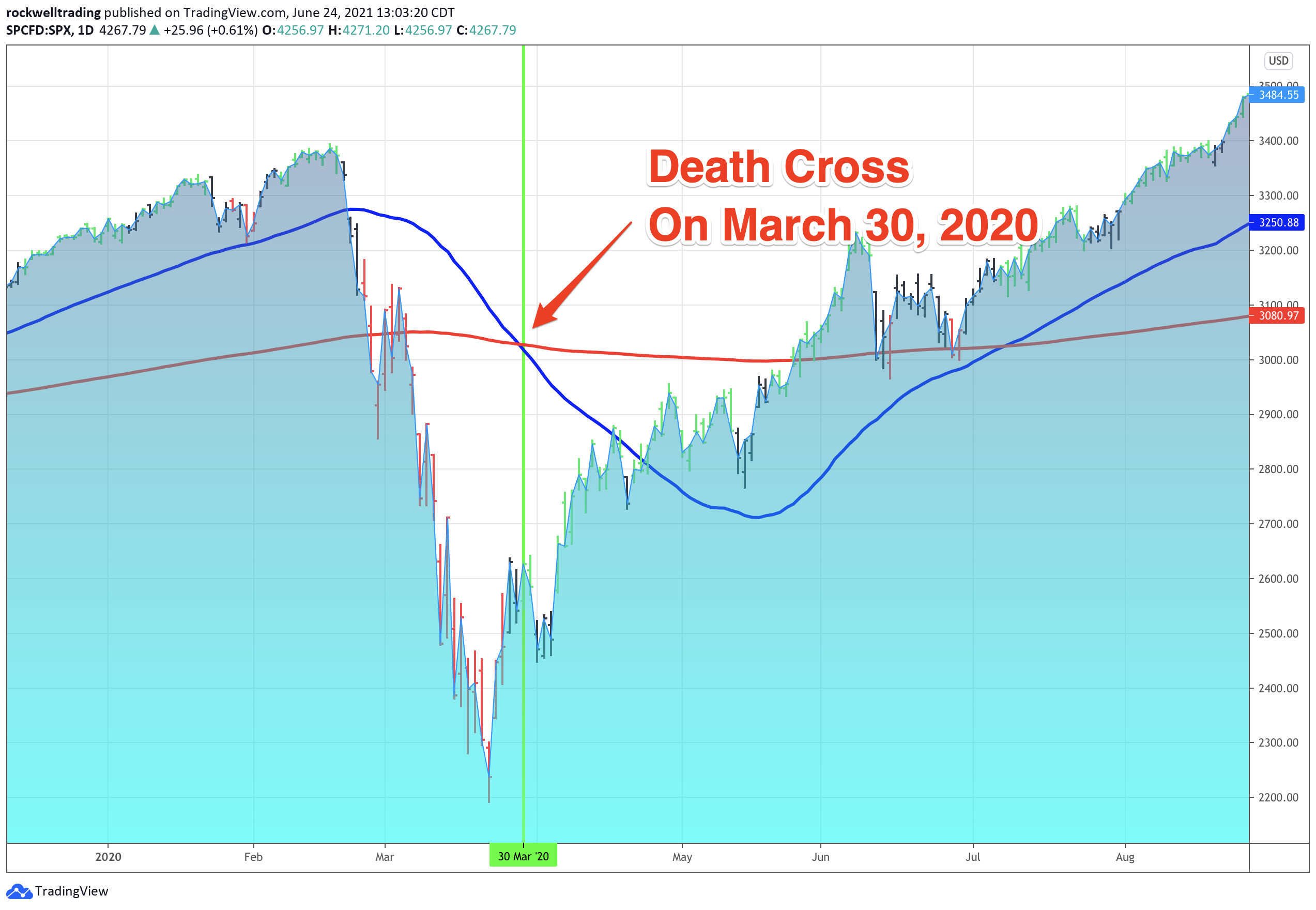

We usually talk about two specific moving averages when we mention a death cross: the 50-day moving average and the 200-day moving average. The 50-day is like our speedy GPS – it’s more sensitive to recent price changes. The 200-day is our reliable old map – it’s a much broader view, looking at the past several months.

So, when does this "death cross" happen? It happens when the shorter-term moving average (the 50-day) crosses below the longer-term moving average (the 200-day). Picture it like this: our speedy GPS, which was showing us a generally upward trend (above the old map's highway), suddenly starts pointing us down a different, lower path than the main highway. The shorter-term optimism is giving way to a longer-term downtrend.

Think about it like a popular ice cream shop. For a while, everyone's been going there, and the trend of sales is happily heading upwards (the 50-day and 200-day are both pointing up, and the 50-day is above the 200-day). But then, maybe a new, trendier froyo place opens across the street. Suddenly, fewer people are lining up for ice cream. The daily sales (short-term) start to dip. If this dip continues and the average daily sales over the last few weeks become lower than the average sales over the last several months, that's your death cross for the ice cream shop's popularity! The immediate enthusiasm has cooled off and is now below the longer-term, established popularity.

Now, why should you, the everyday person, even care about this slightly spooky-sounding term? Well, it's not about panicking or selling everything you own in a frenzy. It's more like a warning sign, a heads-up that the market might be shifting gears. It's like seeing dark clouds rolling in on a picnic day. You don't necessarily pack up immediately, but you start paying a bit more attention to the sky.

Many investors, especially those who like to follow trends, see a death cross as a signal that bearish sentiment (that’s just a fancy way of saying people are feeling a bit pessimistic or worried about the market) is gaining traction. They might interpret it as a sign that stock prices could continue to fall for a while.

It's like when your car's "check engine" light comes on. You don't have to pull over and abandon your car, but it’s a pretty good indicator that something might need a look. Ignoring it could lead to bigger problems down the road. A death cross is similar; it’s a signal to maybe pay attention, reassess, and think about your investment strategy.

But here’s the really important part: a death cross is not a perfect prediction. It's a signal, and like all signals, it can sometimes be wrong. Think about our road trip analogy again. What if your GPS took you on a detour that ended up being much faster because it avoided a massive accident on the main highway? Sometimes, the market does something unexpected after a death cross, and prices might actually start to rebound. It’s not a crystal ball!

Sometimes, the market might even have a "fake death cross," where the averages cross, but then quickly cross back. It’s like the ice cream shop's sales dipping, but then a sudden influx of tourists saves the day and sales shoot back up. These are less common, but they happen!

So, why do people pay attention at all? Because trends matter. When the longer-term trend starts to look shaky, it can influence investor confidence. And when investor confidence dips, it can lead to less buying and more selling, which can, in turn, push prices down. It’s a bit of a psychological domino effect.

:max_bytes(150000):strip_icc()/2018-12-14-DeathCross-5c13eaf0c9e77c00013499e4.png)

For the average investor, who isn't day-trading or trying to time the market perfectly, understanding the death cross can be helpful for long-term planning. It’s not a reason to panic-sell your retirement fund. Instead, it might prompt you to:

- Review your portfolio: Are your investments aligned with your goals?

- Consider diversification: Are you spread out enough so that one market downturn doesn't wipe you out?

- Stay informed: Understand the general sentiment and what might be influencing it.

Think of it like preparing for a rainy season. You don't need to build an ark for every single cloud, but if the meteorologist (the technical analyst!) is forecasting a long period of rain, it might be a good time to check your gutters and make sure your umbrella is in good repair. It's about being proactive, not reactive with fear.

So, the next time you hear about a death cross, remember: it's a technical signal where the 50-day moving average dips below the 200-day moving average. It's a sign that shorter-term trends might be turning bearish and that longer-term downtrends could be forming. It's not a death sentence for your investments, but it is a good reminder to keep your eyes open, stay informed, and make sure your investment strategy is as sturdy as your favorite pair of walking shoes. Happy investing, and stay curious!