What Is The 401k Contribution Limit For 2024

Ah, the 401(k)! For many, the mere mention of it sparks a warm, fuzzy feeling, like finding an extra twenty-dollar bill in your old jeans or finally conquering that particularly tricky level in your favorite video game. It’s not exactly a thrill ride, but it’s got that satisfying hum of responsibility and the sweet promise of future comfort. Think of it as your personal financial superhero cape, ready to swoop in and save the day when those golden years finally arrive.

So, what exactly is this magical 401(k), and why should you care? At its heart, a 401(k) is a retirement savings plan offered by many employers. It’s your gateway to tax-advantaged savings, meaning the money you put in often reduces your taxable income now, and your investments grow without being taxed year after year. This is a huge deal! Imagine your money working overtime, compounding and growing, all while the taxman takes a little siesta. The primary purpose? To build a nest egg substantial enough to fund your retirement dreams, whether that involves traveling the world, finally mastering the art of sourdough, or simply enjoying a well-deserved, stress-free existence.

How does it work in the wild? It's pretty straightforward. You, the intrepid saver, decide how much of your paycheck you want to contribute. This money is then typically deducted automatically from your salary before taxes are calculated. Your employer might even throw in a little something extra – a matching contribution – which is essentially free money! It’s like getting a bonus just for being responsible. Common examples include a percentage of your salary, like 3% or 5%, which your employer then matches dollar-for-dollar or at a reduced rate. Some plans even offer a profit-sharing component, adding to your savings when the company does well. These contributions are then invested in a variety of funds you get to choose, often ranging from conservative bonds to more aggressive stocks.

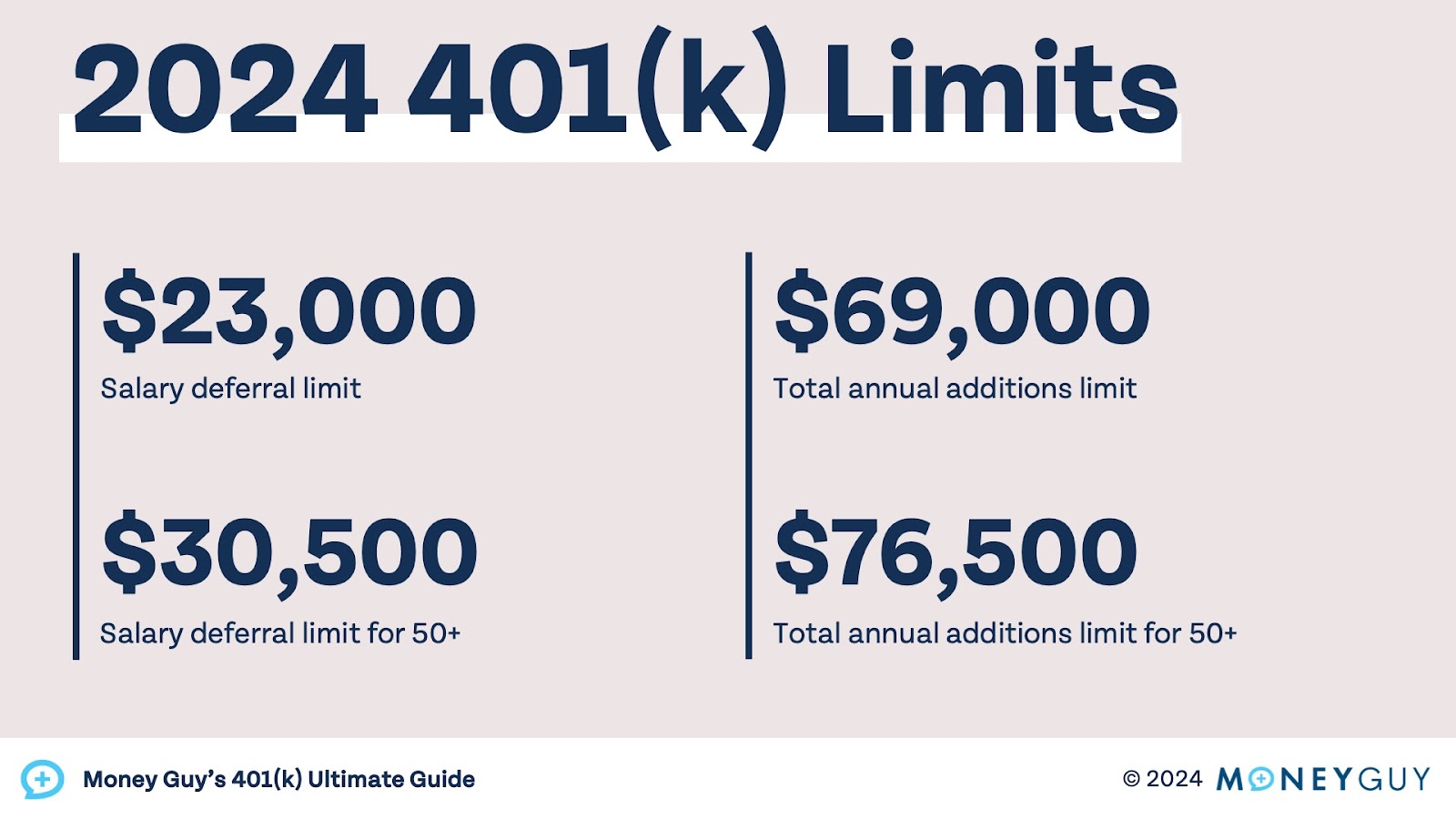

Now, let’s talk about the nitty-gritty: the 401(k) contribution limit for 2024. This is the maximum amount you can sock away into your 401(k) for the year, tax-free. For 2024, the standard employee contribution limit is $23,000. If you're feeling particularly ambitious and are 50 or older, you can make an additional catch-up contribution of $7,500, bringing your total to a whopping $30,500! It’s crucial to be aware of these limits to maximize your savings potential.

To truly enjoy your 401(k) journey, here are a few practical tips. First, start early! The earlier you begin contributing, the more time your money has to grow. Even small, consistent contributions can snowball into a substantial sum over decades. Second, take advantage of employer matches. Don’t leave free money on the table! Contribute at least enough to get the full match. Third, understand your investment options. Don’t just blindly pick funds. Do a little research, consider your risk tolerance, and choose investments that align with your long-term goals. Finally, review your contributions annually. As your income increases, consider increasing your contribution percentage. The 401(k) is a marathon, not a sprint, and with a little planning and consistency, it can be one of the most rewarding financial endeavors you embark on.