What Is Take Home Pay On 50000? Explained Simply

Ever wondered what magic happens between your paycheck amount and the money you actually get to spend? It’s like a secret recipe! Today, we’re pulling back the curtain on a salary that many people dream of: $50,000 a year. But the real question is, what’s your take-home pay on that? Let's dive in, and trust us, it's more interesting than it sounds!

Think of your gross pay – that’s the big number, $50,000 – as the whole pizza. Your take-home pay is the slice you actually get to eat. And oh boy, there are a few toppings that get taken off before it reaches your plate!

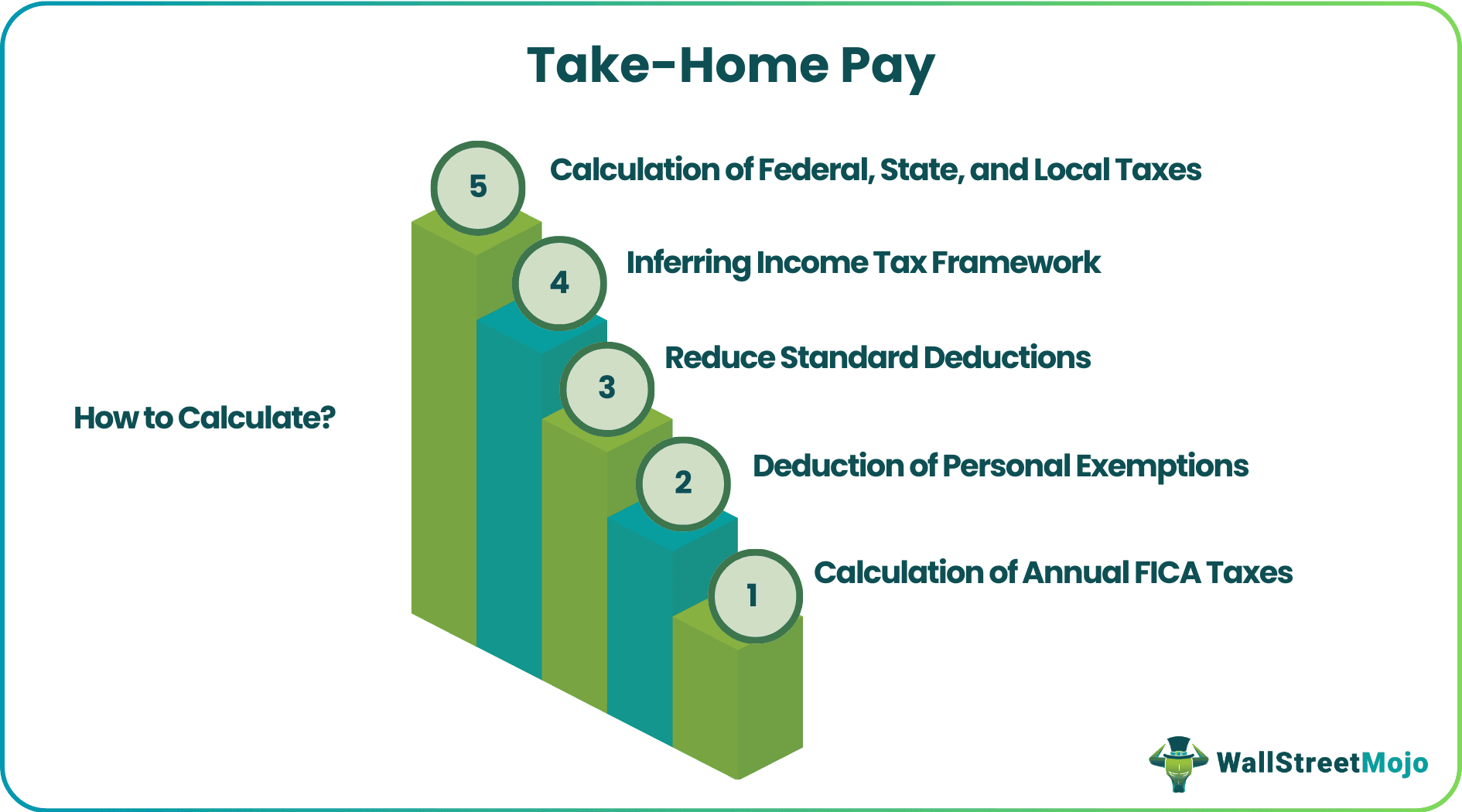

The biggest players in this game are taxes. Yep, Uncle Sam and your state government like a little slice of that pizza. We’re talking about federal income tax and state income tax. The amount you pay depends on a few things, like where you live and how many deductions you claim. It’s a bit like trying to guess how many olives are on your pizza – it can vary!

Then there are other deductions. These are the things that often get taken out of your pay automatically, before you even see it. Things like your health insurance premiums if your employer offers it. It’s a super important benefit, but it does chip away at that $50,000. Think of it as the delicious crust that’s part of the pizza, but you might not always notice it’s gone until you’re finished.

Another common one is contributions to a retirement account, like a 401(k). This is your future self giving you a high-five! Putting money aside for later is a smart move, but it means that money isn't in your pocket right now. It’s like saving a few slices of that pizza for a midnight snack – totally worth it!

So, what’s the actual number? Well, it's not a single, fixed figure. But we can give you a really good idea! For someone earning $50,000 a year, after all those deductions – taxes, health insurance, maybe a little bit for retirement – their take-home pay could realistically fall somewhere between $35,000 and $42,000 per year. That breaks down to roughly $2,900 to $3,500 per month. See? It’s a range, and that’s what makes it a little puzzle!

Why is this so cool to know? Because it’s about being in the know about your money! Understanding your take-home pay isn't just about numbers; it's about financial empowerment. It’s knowing exactly what you have to work with for rent, groceries, fun stuff, and those little treats that make life sweet. It’s like having a secret cheat code for your budget!

Imagine this: you’ve got that $50,000 goal in mind. You’re working hard, and you’re excited about what that means. But then, when you see your paystub, you might get a little surprise. Knowing your take-home pay before it happens takes away the guesswork. You can plan ahead, save smarter, and feel more in control. It’s like having a treasure map with the X clearly marked!

And let’s talk about the feeling of it all. When you finally crunch the numbers and see what’s truly yours, there’s a sense of accomplishment. You’ve navigated the system, you understand the deductions, and you’ve got a clear picture of your spending power. That’s a win! It’s like finally solving a tricky crossword puzzle and feeling super smart about it.

The variations are what make it intriguing. Your take-home pay on $50,000 could be a bit higher if you live in a state with no income tax, or if you opt out of expensive health insurance plans (if that’s an option, of course!). It could be a bit lower if you contribute a larger chunk to your 401(k) or if your health insurance is pricey. It’s a personalized financial journey, and that’s what’s special!

So, next time you hear about someone earning $50,000, you’ll know the real story. It’s not just about the big number; it’s about the magic that happens behind the scenes. It’s about understanding your net pay, the money that truly fuels your dreams and your daily life. It’s a little bit of financial detective work, and the reward is clarity and confidence.

This isn't about feeling cheated; it’s about being informed. It’s about appreciating the benefits that come with your salary, like health insurance and retirement plans, even if they reduce your immediate cash. It’s a trade-off that often sets you up for a more secure future. Think of it as investing in your future self, who will thank you later with a comfortable retirement and good health. That’s a pretty amazing deal, right?

The real fun is when you start to play with the numbers yourself. There are tons of online paycheck calculators out there. These are your secret weapons! You can plug in your salary, your state, and your estimated deductions, and poof – you get a personalized estimate of your take-home pay. It’s like having a personal financial wizard at your fingertips!

So, if you’re curious, or if $50,000 is a salary you’re aiming for, take a peek! See what that number might actually mean in your pocket. It’s a fascinating peek into the world of personal finance, and honestly, it’s a lot more engaging than you might think. Go on, discover the magic of your potential take-home pay!