What Is Mark Walter's Net Worth In 2026?

Hey there, fellow humans! Let’s chat about something that’s a little bit like that ridiculously fancy coffee you see advertised, the one with gold flakes and unicorn tears. You know, the one you’d never actually buy, but it’s fun to imagine? Today, we’re peering into the crystal ball (or, you know, a fancy financial projection) to talk about Mark Walter's net worth in 2026. Sounds a bit like a secret agent’s code name, doesn’t it? Mark Walter, 2026. Mission: Figure out the moolah!

Now, before your eyes glaze over thinking about spreadsheets and stock markets, let’s make this as comfy as your favorite armchair. Think of net worth like this: if you sold everything you own – your car (even that clunker you secretly love), your comic book collection, that slightly-too-small sweater you keep “just in case” – and then paid off all your debts, the money left over is your net worth. For folks like Mark Walter, well, let’s just say their “everything” is a tad more extensive than ours.

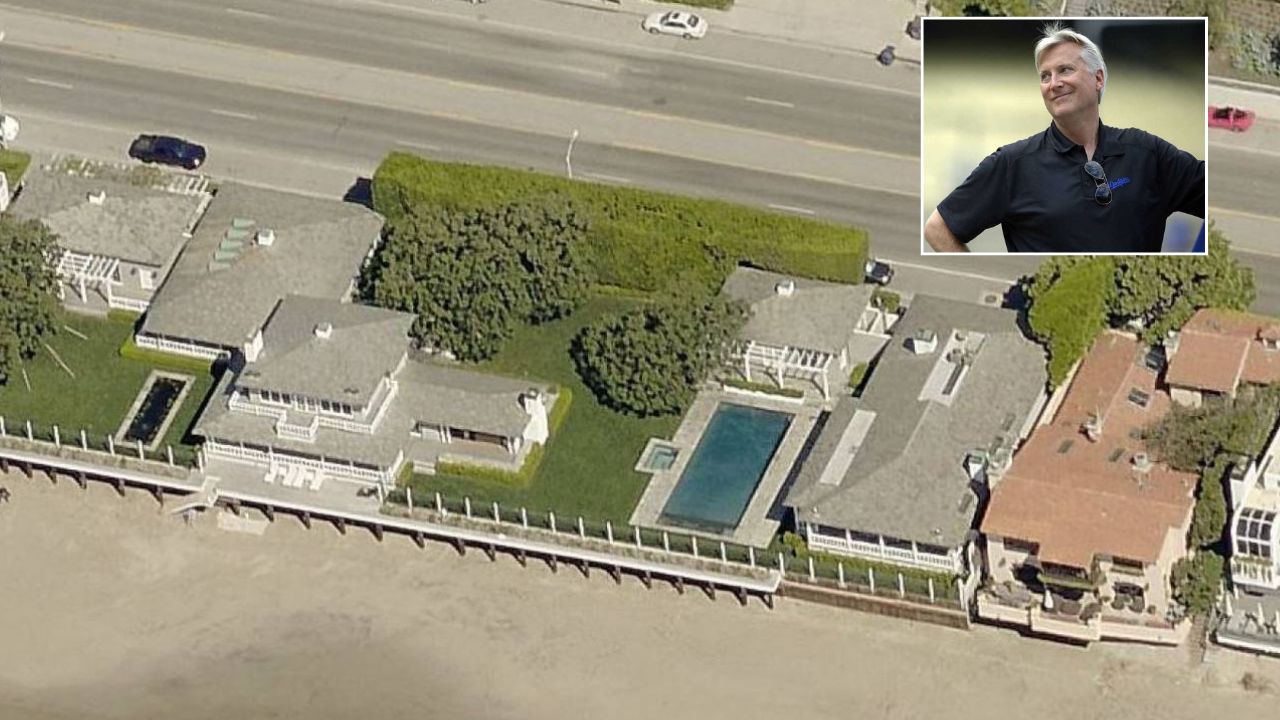

So, who is this Mark Walter, anyway? He’s a pretty big deal in the world of finance. Think of him as the captain of a giant financial ship, steering it through the choppy seas of investments. He’s the CEO of Guggenheim Partners, and if that name sounds familiar, it’s probably because they’re involved in a whole bunch of things – from managing money for super-rich folks and big companies, to owning sports teams. Yep, like the Los Angeles Dodgers! Imagine owning a baseball team. It’s like owning the ultimate, most expensive baseball card collection you could ever dream of.

Why should you care about Mark Walter’s net worth in 2026? Honestly, for most of us, it’s not going to directly impact whether we can afford that extra scoop of ice cream. But here’s the fun part: it’s a fascinating peek into a world most of us only see in movies. It’s like watching a documentary about penguins in Antarctica – you’re not going to start waddling, but it’s pretty cool to see how they live!

Plus, understanding how fortunes are built and grow can be, dare I say, educational. It’s like learning a new recipe. You might not become a Michelin-star chef overnight, but knowing how to whip up a decent omelet is a good start, right? And who knows, maybe some of his strategies will inspire you to finally start that side hustle you’ve been dreaming about!

Now, let’s talk about the crystal ball part. Predicting net worth in the future is a bit like predicting the weather next Tuesday. We can make educated guesses, look at trends, and consider all sorts of factors, but there’s always a chance of a surprise thunderstorm (or a sudden market crash, yikes!).

However, based on what we know about Guggenheim Partners and the general trajectory of successful investment firms, the outlook for Mark Walter’s net worth in 2026 is looking… well, sunny. Experts are projecting that his net worth could see a significant jump. We’re talking numbers that make your head spin a little, like a carousel on fast-forward. Estimates are floating around the ballpark of $5 billion to $7 billion. Yes, that’s with a ‘b’ for ‘billions’! That’s enough to buy… well, a lot of things. Imagine buying all the ice cream in the world. You could do that. (Though, I suspect the logistics would be a nightmare).

What’s driving this potential growth?

It’s a combination of things, really. Guggenheim Partners is a powerhouse. They’re skilled at making smart investments, growing their clients' money, and then, of course, benefiting from that success themselves. Think of it like a well-oiled machine. Every part works together to keep things running smoothly and efficiently.

One of the key drivers is likely the continued success of their various investment funds. These are like tiny financial farms where money is planted and hopefully grows. They’ve been doing a fantastic job cultivating these farms. Also, Guggenheim is involved in a lot of different areas, from real estate to infrastructure projects. These are like planting different kinds of crops – you don’t put all your eggs in one basket, you diversify!

And let’s not forget those sports teams, like the Dodgers. Owning a successful sports franchise can be a huge money-maker. Think of all the ticket sales, merchandise, and broadcasting rights. It’s like owning a popular theme park – there’s always a queue of people wanting to experience the magic (and open their wallets).

So, when we look at 2026, these different streams of income and investment growth are expected to really add up. It’s like a river getting wider and deeper as more tributaries join it. Each successful venture adds to the overall flow of wealth.

Why does it matter to you and me?

Besides the sheer fascination of it all, understanding the scale of wealth can offer some perspective. When you hear about a net worth in the billions, it’s easy to feel a little insignificant, right? Like a tiny ant at a giant picnic. But it’s more about recognizing the mechanisms at play.

It highlights the power of smart financial planning, strategic investment, and the creation of valuable businesses. It’s about understanding how capital works, how it can be leveraged, and how it can generate more capital. It’s like watching a master chess player make their moves. You might not be playing the game at that level, but you can learn a lot by observing.

Also, and this is a bit more whimsical, think about what that kind of wealth enables. People with immense resources can make big impacts. Guggenheim Partners, under Walter’s leadership, has been involved in philanthropic efforts. They’ve supported arts, education, and community initiatives. It’s like having a giant lever that can move mountains, and sometimes, those mountains are poverty or lack of opportunity. It’s a reminder that significant wealth can, and often does, come with significant responsibility and the potential for immense good.

So, while you might not be checking Mark Walter’s financial statements before deciding on your next vacation destination, understanding his projected net worth in 2026 offers a fascinating glimpse into the world of high finance, the power of strategic business, and the potential for large-scale impact. It’s a story of growth, investment, and, for many, a source of inspiration and a touch of wonder. It’s like looking up at the stars – you’re not going to touch them, but their sheer brilliance is undeniably captivating.

And hey, if all this talk of billions has you feeling a little inspired, maybe it’s time to dust off that savings account or finally research that business idea. Who knows? Maybe in 2026, you’ll be doing your own fascinating financial projections! Until then, let’s keep dreaming big and enjoying the journey, one comfortable armchair at a time.