What Is Difference Between Apr And Interest

Ever found yourself staring at a price tag, wondering about the little numbers tacked on, or heard folks talking about "APR" and "interest" like they're the same thing? Well, get ready to unlock a bit of financial fun! Understanding the difference between APR and interest isn't just for math whizzes; it's like having a secret decoder ring for making smarter money moves, whether you're saving up for that dream vacation or just trying to understand your credit card statement. It’s a popular topic because it touches on how we manage our money every single day, and knowing the scoop can save you a surprising amount of cash!

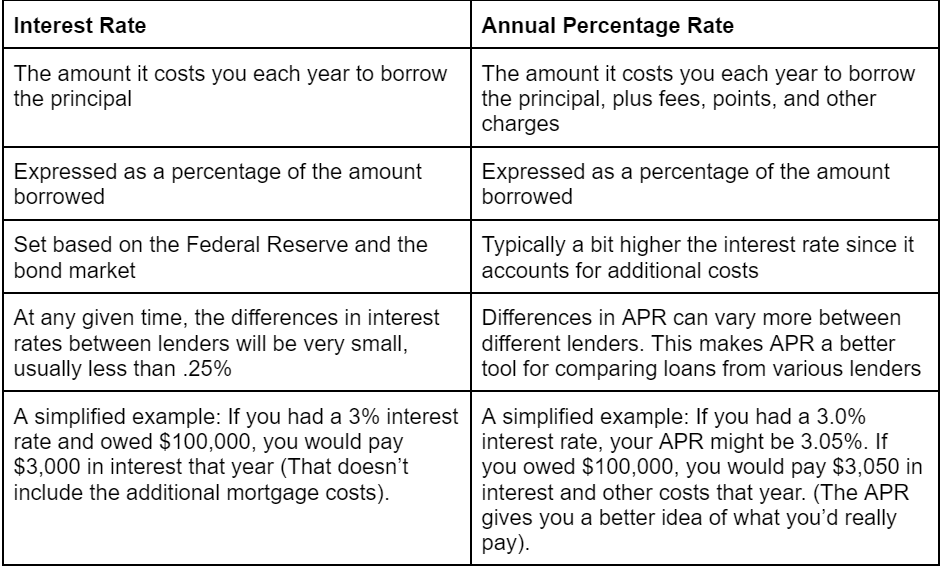

So, what’s the big deal? Think of interest as the basic fee you pay for borrowing money, or the reward you get for lending it out. If you take out a loan, the interest is the extra bit you pay back on top of the original amount. If you have a savings account, interest is what the bank pays you for letting them hold your money. It’s pretty straightforward, right?

Now, APR, which stands for Annual Percentage Rate, is a bit more of a superhero. It takes that basic interest rate and throws in all the other mandatory charges associated with a loan or credit card. Imagine it as the total cost of borrowing, presented as a yearly rate. This could include things like origination fees, processing fees, or even monthly service charges. For beginners, understanding APR is crucial because it gives you a clearer picture of the true cost of a loan. Families might find it super useful when comparing mortgages or car loans, ensuring they’re not surprised by hidden fees. And for hobbyists looking to finance a big purchase for their passion, like a new camera or a woodworking tool, knowing the APR helps them budget effectively and avoid overspending.

Let’s say you’re looking at a credit card with a 15% interest rate. That sounds okay, but if its APR is 18%, it means there are other fees bundled in that make it more expensive. Or, consider a personal loan with a 5% interest rate. If the APR is 7%, those extra 2% likely cover things like an application fee or a loan processing fee. It’s always smarter to compare APRs when you're shopping for credit.

Getting started is easier than you think! First, always look for the APR on loan applications and credit card offers. Don't just focus on the advertised interest rate. Second, read the fine print. This is where you'll often find details about what’s included in the APR. Third, use online comparison tools. Many websites allow you to input loan amounts and APRs to see how different options stack up. It’s a simple way to get a quick overview.

So, there you have it! While interest is the basic cost of money, APR gives you the full story. It's a small distinction, but a powerful one that can lead to more informed decisions and ultimately, a healthier financial future. Happy saving and spending wisely!