What Is An Index Fund Simple Definition

Ever feel like the world of investing is a giant, confusing puzzle with pieces you can't quite grasp? You're not alone! Many people hear about investing and immediately think of complicated charts, Wall Street jargon, and the need for a crystal ball. But what if I told you there's a surprisingly simple and popular way to dip your toes into the investment waters, a way that takes a lot of the guesswork out of the equation? Enter the world of index funds! Think of them as your friendly, accessible entry point into the stock market, designed to be both easy to understand and incredibly beneficial.

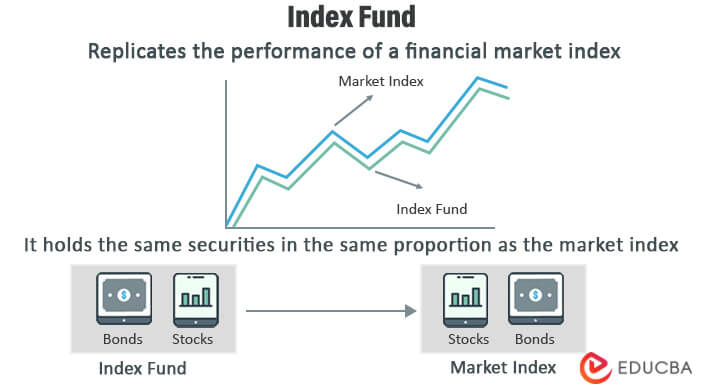

So, what exactly is an index fund? In its simplest form, an index fund is a type of investment fund that aims to mirror the performance of a specific market index. What’s a market index, you ask? Imagine a curated list of popular stocks or bonds that represents a segment of the market. The most famous one you've probably heard of is the S&P 500, which tracks the performance of 500 of the largest publicly traded companies in the United States. Other popular indexes include the Dow Jones Industrial Average (which follows 30 prominent companies) or the Nasdaq Composite (known for its tech-heavy focus).

Instead of a smart investor picking individual stocks and trying to "beat the market" (a notoriously difficult feat!), an index fund simply buys all, or a representative sample of, the stocks or bonds that make up that particular index. It's like deciding to buy a slice of almost every pizza at a popular pizzeria, rather than trying to guess which single slice will be the tastiest. You get a little bit of everything the pizzeria offers, and your success is tied to how well the pizzeria as a whole does. It's a strategy that embraces diversification and aims for average market returns, rather than trying to chase above-average, and often elusive, results.

Why is this approach so popular and useful? Well, it boils down to a few key advantages that make it a favorite for both seasoned investors and beginners alike. First and foremost is the concept of diversification. When you invest in an index fund, you're not putting all your eggs in one basket. Instead, you're spreading your investment across dozens, hundreds, or even thousands of different companies. If one company in the index stumbles, the impact on your overall investment is significantly softened because many other companies are still performing well. This significantly reduces the risk associated with individual stock volatility.

Another huge perk of index funds is their incredibly low cost. Because they are passively managed (meaning they don't require a team of high-paid analysts constantly buying and selling individual stocks), their operating expenses, known as expense ratios, are typically much lower than those of actively managed funds. These low fees are a big deal over the long term. Think of them as small, consistent leaks in your investment bucket. The smaller the leaks, the more your investment can grow! Over decades, these tiny differences in fees can add up to a significant amount of money that stays in your pocket, rather than going to fund managers.

Then there's the aspect of simplicity. You don't need to spend hours researching individual companies, tracking their earnings reports, or trying to predict market trends. By choosing an index fund that aligns with your investment goals (like a broad U.S. stock market index fund, or a bond index fund), you're essentially outsourcing the heavy lifting. The fund manager's job is simply to ensure the fund accurately tracks its designated index. This makes it an ideal option for busy individuals who want to invest wisely without becoming full-time market analysts. It’s an accessible way to participate in the growth of the economy without needing an advanced degree in finance.

The historical performance of broad market indexes is also a compelling reason for their popularity. While past performance is never a guarantee of future results, over long periods, the stock market has historically trended upwards. By investing in an index fund that mirrors a major market index, you're essentially betting on the long-term growth of the economy. This approach is often referred to as "passive investing" because you're not actively trying to pick winners or time the market; you're simply letting the market's growth work for you. It's a strategy that has proven to be remarkably effective for many people building wealth over time.

:max_bytes(150000):strip_icc()/Investopedia-terms-indexfund-f7a1af966bd34da5b77ca1627607e41b.png)

In essence, an index fund offers a straightforward, low-cost, and diversified way to invest. It democratizes investing, making it approachable for almost everyone. Instead of trying to outsmart the market, you aim to simply be a part of it, reaping the rewards of its overall growth. It’s a strategy built on patience, discipline, and the power of compounding. So, the next time you hear about investing, remember that it doesn't have to be complicated. The humble index fund might just be the most straightforward and rewarding step you can take!