What Is A Stop Loss In Trading? Explained Simply

Imagine you're at a really fun party. You've got your snacks, you're chatting with friends, and maybe even busting out some questionable dance moves. Everything is going great! Then, suddenly, someone spills a whole pitcher of brightly colored punch right onto your brand new, pristine white sneakers. Ruuuuuin!

A stop loss in trading is kind of like having a little, invisible bouncer at the party for your money. You tell this bouncer, "Okay, if things get really messy, like my account balance starts looking like that punch-stained sneaker, please politely escort me out of this situation before it gets any worse."

It’s a pre-set instruction you give to your online broker. You say, "If the price of this stock I bought (let’s call it 'Awesome Widgets Inc.') drops down to, say, $10 per share, then sell it immediately. No questions asked. Just get me out of there."

Think of it as your financial "get out of jail free" card. Except, instead of Monopoly money, it's your actual, hard-earned cash we're talking about. And instead of landing on "Go to Jail," you're landing on "Let's not lose all my money."

Now, some people might say, "But what if it bounces back up after hitting $10?" And to them, I say, "Well, bless your optimistic heart." Because while that can happen, it can also not happen. And if it doesn't, you're just standing there, watching your investment bleed out like a character in a particularly dramatic movie.

The stop loss is your friendly reminder that nobody, not even the most seasoned trader in a tweed jacket, can predict the future with 100% certainty. Markets are, shall we say, a bit like a toddler after too much sugar: unpredictable and prone to sudden tantrums.

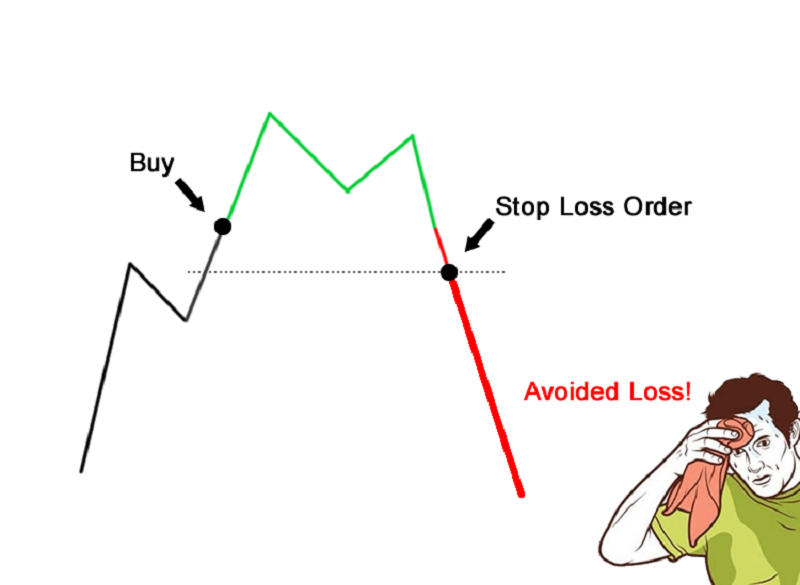

Let's say you buy 100 shares of Awesome Widgets Inc. at $12 per share. Your total investment is $1200. You're feeling pretty good. You see yourself on a yacht, sipping something fizzy. Then, you decide, "Okay, if this thing dips below $10, I'm out. That's my limit." So, you place a stop loss order at $10.

If the price of Awesome Widgets Inc. tumbles and hits $10, your stop loss kicks in. Poof! Your shares are sold. You might have taken a small hit, maybe lost $200 in this scenario. It stings, no doubt. It’s like realizing you’ve forgotten your wallet at the grocery store after you’ve already loaded all the bags into the car.

But here's the unpopular opinion: it's way better than the alternative. The alternative is watching those shares keep dropping. Maybe to $9. Then $8. Then $5. Suddenly, your $1200 investment is worth a sad, lonely $300. And you’re staring at your screen with that wide-eyed, slightly panicked look of someone who just saw their favorite show get canceled after a cliffhanger.

Your stop loss acts as a pain limiter. It's like saying, "I'm willing to endure this much discomfort, but no more!" It’s your personal financial boundary. Think of it as a tiny, digital guardian angel whispering, "It’s okay to cut your losses. We’ll find another party to go to."

It’s important to remember that a stop loss isn't a magic wand that guarantees you'll never lose money. Oh, if only! But it is a crucial tool in your trading toolbox. It’s the difference between a controlled exit and a chaotic freefall.

Some traders set their stop losses very tight, wanting to minimize any potential loss. Others set them wider, giving their trades more room to breathe and hoping to avoid being "stopped out" by minor market jitters. It's a personal choice, like deciding how much hot sauce is "too much" on your tacos. Everyone has a different tolerance level.

There's also something called a "trailing stop loss". This is like a stop loss that chases your profits. If Awesome Widgets Inc. goes up to $15, your trailing stop might automatically adjust upwards, say to $12. If it then dips to $12, it sells. It's like having a security guard who not only stops you from falling down a hole but also helps you climb a bit higher before you might consider coming down.

So, in a nutshell, a stop loss is your pre-determined exit strategy. It’s your "Oops, this isn't working out as planned, time to bail" button. It’s your way of saying, "I’m not married to this trade. If it goes south, I’m prepared to move on." And in the wild, sometimes wacky world of trading, being prepared to move on is half the battle.

It’s a bit like knowing when to leave a party. You don't want to be the last one standing when the lights come on and the DJ has packed up. A stop loss helps you make a graceful exit, preserving your energy (and your funds) for the next, hopefully, much more successful, party.

So, the next time you hear about a stop loss, don't let it sound like some scary, complicated jargon. It's simply your financial safety net. Your "nope, not today, market" declaration. And honestly, in the grand scheme of things, having a little bit of control when things go sideways? That’s not just smart trading; that’s just good sense.