What Is A Limit Price When Buying Stock

Hey there! So, you're dipping your toes into the wild, wonderful world of stock trading, huh? Awesome! It can feel a bit like learning a new language, right? All those fancy terms! Today, let's chat about something super common, yet totally essential: a limit price when you're buying stock. Think of it like this: we're grabbing a coffee, and I'm just breaking it down for you, no jargon overload, I promise!

Imagine you've got your eye on a stock. Let's call it "AwesomeWidgets Inc." (because who doesn't want to own AwesomeWidgets, right?). You've done your homework, you're feeling good about it, and you're ready to hit that "buy" button. But wait! You don't just want to buy it at any price, do you? Nah, that would be a bit like walking into a bakery and saying, "Just give me a croissant at whatever price you feel like today!" Wild, right?

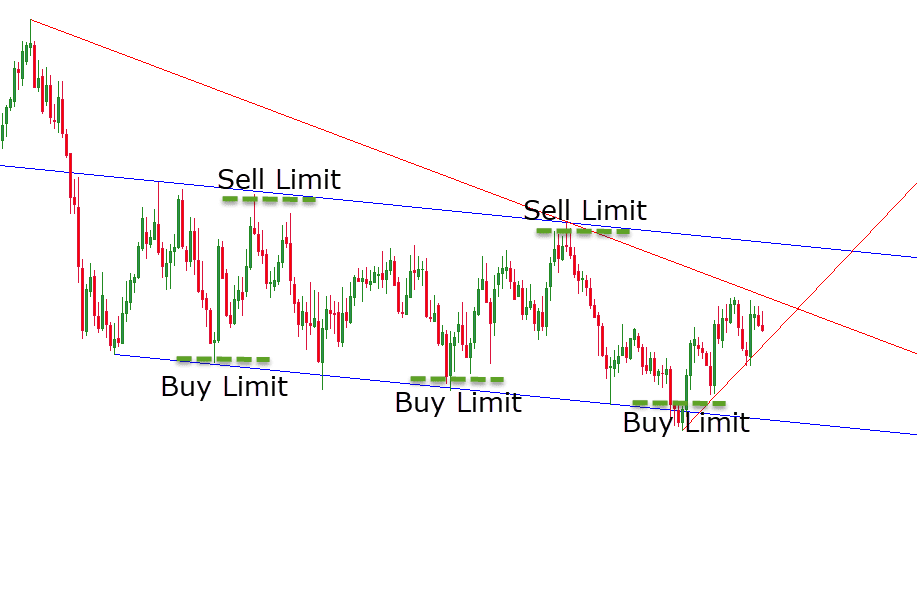

This is where our hero, the limit price, swoops in to save the day. So, what exactly is it? In plain English, it's the maximum price you're willing to pay for a stock. Yep, you set a ceiling. You're basically telling the stock market, "Hey, I want to buy AwesomeWidgets, but only if I can get it for $50 or less." See? Simple as that!

Why would you even bother with this? Well, think about it. Stock prices are constantly doing a little dance, up and down, sometimes by the minute! If you just place a regular "market order" (we'll touch on that later, maybe!), you're essentially saying, "Buy it NOW, whatever the current going rate is!" That can be great if the price is moving in your favor, but what if it suddenly jumps just as you're clicking?

Suddenly, that $50 stock you wanted is now $52. Ouch. That's an extra $2 per share you weren't planning on spending. Multiply that by, say, 100 shares, and bam! You've spent an extra $200. Not the best start to your investment journey, is it? This is where a limit order is your best friend. It’s your financial bodyguard, protecting you from unexpected price spikes.

So, let's say you've decided you're happy to buy AwesomeWidgets at $50 a share, but no higher. You place a buy limit order. You tell your brokerage (that's the company you use to buy and sell stocks, like Fidelity, Robinhood, Schwab – you know the drill) your order: "Buy 100 shares of AwesomeWidgets at a limit price of $50."

Now, here's the cool part. Your order doesn't just execute immediately. It sits there, patiently waiting. It's like a polite guest at a party, waiting for the right moment. The market will keep ticking along, showing you the current price of AwesomeWidgets. As long as the price is at $50 or lower, your order is ready to go! If it hits $50, or even drops to $49.50, your order will likely be filled at that better price. Hooray for saving money!

But what happens if the price of AwesomeWidgets decides to go on a rocket ship and zooms up to $55, $60, or even higher? Well, your limit order simply waits. It won't be executed at $55 or $60 because you clearly said, "$50 or less, please!" Your order just sits there, like a stubborn mule, refusing to budge on your price. This is a good thing! It means you're sticking to your plan and not overpaying.

So, to recap, a buy limit order gives you control. It's your way of saying, "This is the absolute most I am willing to shell out for this stock." You're not at the mercy of a sudden market surge. You're in the driver's seat, setting the terms of engagement!

When Does This Magic Happen?

Okay, so when is this limit price thing actually useful? It's super handy in a few situations. Picture this:

1. You've Done Your Research and Have a Target Price

Let's say you've analyzed AwesomeWidgets and you've determined, with scientific precision (or maybe just a really gut feeling!), that the stock is a great buy at $50. You're not sure if it's worth more than that right now. So, you set your limit at $50. If the market price dips to $50 or below, you snag it. If it stays above $50, you're perfectly happy to wait. You're not chasing a potentially overvalued stock.

2. You Want to Avoid "Slippage"

Ah, "slippage." Sounds a bit like something you'd slip on, right? In the trading world, it refers to the difference between the price you expected to get and the price you actually get. This can happen with market orders, especially in fast-moving markets or for less-traded stocks. A limit order helps you avoid this unwelcome surprise. It guarantees your execution price, or guarantees no execution at all if your price isn't met.

3. You're Not in a Hurry

If you're not thinking, "OMG, I need these AwesomeWidgets shares right this second!", then a limit order is perfect. You have the luxury of waiting for the price to come to you. It's like waiting for your favorite song to come on the radio instead of listening to whatever they're playing now. Patience, my friend, is a virtue, especially in investing!

4. You're Trading Less Liquid Stocks

What's "liquid"? Think of water. It flows easily, right? A liquid stock is one that's traded a lot, so it's easy to buy and sell without massively affecting the price. A "less liquid" stock is like trying to push a boulder – it moves slower, and your actions can have a bigger impact. For these stocks, a market order can be a bit risky, as even a small buy order could push the price up significantly before your order is fully filled. A limit order helps you control that impact.

It’s like wanting to buy a rare comic book. If you just say, "I'll pay whatever!" the seller might jack up the price knowing you're desperate. But if you say, "I'll pay $100 for this specific issue," you’re setting your boundary. Much smarter!

So, What's the Alternative? The Market Order!

We've talked a lot about limit orders, but it's good to know the other main type: the market order. When you place a market order, you're saying, "Get me these shares ASAP, at whatever the current market price is!" It’s the impulsive, "let's do this now!" option.

Market orders are great when you're absolutely sure you want the stock, the price is stable, and you want to get in quickly. For super popular stocks like Apple or Google, where there are tons of buyers and sellers, a market order is usually fine. The price you get will be very close to what you saw a second ago.

But, as we discussed, in volatile markets or for less popular stocks, that "current market price" can be a bit of a moving target. That's when the market order can lead to that dreaded slippage. It's like ordering a pizza and the price goes up by $2 while you're still on the phone. Annoying!

Think of it like this: Market order is like taking the first available taxi. Limit order is like calling your favorite cab company and saying, "I need a ride, but I won't pay more than $20." You might have to wait a few extra minutes, but you'll save money!

A Little Warning (Because There's Always One!)

Now, while limit orders are fantastic for controlling your purchase price, there's a small catch. If the stock price never drops to your limit price, your order will never be filled. Yep, you might miss out on buying the stock entirely. It's the price you pay for price protection!

Imagine you set a limit price of $50 for AwesomeWidgets, but the stock just keeps climbing and never dips back down. You'll be sitting there, watching it go up and up, and your order will just sit there, unfulfilled. You might be kicking yourself later, thinking, "I should have just paid $52!" But remember, that’s a trade-off you make for certainty on your maximum cost.

So, it's a bit of a balancing act. Do you want guaranteed execution at the current (potentially higher) price, or do you want to set a maximum price and risk missing out if the market moves against you? This is where your investment strategy comes into play!

Putting It All Together: Your Limit Order Checklist

So, before you hit that buy button, here’s a quick mental checklist for using a limit price:

- What's your absolute max? Decide the highest price you're willing to pay per share. Be realistic!

- How liquid is it? If it's a super popular stock, a market order might be fine. For anything less, or if you're worried, a limit order is your pal.

- Are you in a rush? If you can wait, a limit order gives you more control.

- What's your goal? Are you trying to get in at a specific entry point, or just get shares as quickly as possible?

Using limit orders is a smart move for beginner investors and seasoned pros alike. It's one of those little tricks that can really help you manage your risk and make sure you're getting the best possible deal for your hard-earned cash. It's about being a savvy shopper in the stock market!

So next time you're looking to buy some stock, don't just hit "buy." Take a moment, think about your limit price, and place an order that works for you. It’s a small step, but it can make a big difference in your trading journey. Happy investing, and may your limit orders always be filled at a price you love! Now, who needs a refill on that coffee?