What Happens If I Ignore A Ccj: Complete Guide & Key Details

Alright, settle in with your cuppa, because we're about to dive into a topic that’s about as exciting as watching paint dry, but with way more potential for your wallet to get a wedgie. We’re talking about ignoring a CCJ. That’s right, a County Court Judgment. It sounds fancy, like something a Victorian lord would utter before demanding more scones, but it’s actually a serious bit of business when it lands on your doorstep.

Imagine you’ve been a bit… let’s say, relaxed about your financial obligations. Maybe you forgot that credit card bill, or that loan payment slipped your mind like a greased watermelon. Then, bam! A letter arrives. Not a nice, cheerful one, but one that looks like it’s been written by a disgruntled badger in a grey suit. That, my friends, is the harbinger of doom. It’s the official notification that someone is taking you to court because you owe them money.

Now, the natural instinct for many of us, when faced with something unpleasant, is to… well, ignore it. We shove it under a pile of junk mail, hope it spontaneously combusts, or perhaps leave it for a passing gust of wind to whisk away to a more responsible universe. But here’s the kicker: ignoring a CCJ is about as effective as trying to hold back a tidal wave with a sieve. It’s not going to work, and you’re going to get very, very wet. And by ‘wet’, I mean ‘financially sodden’.

So, what exactly is this mythical CCJ? Think of it as a formal declaration from a judge saying, "Yep, you owe this person/company money, and you gotta pay up." It’s like a really, really official IO U, but with the added thrill of potential legal repercussions. And once it’s in place, it doesn't just magically disappear like that questionable takeaway from last Tuesday. It sticks around, like a bad smell or that one song you can’t get out of your head.

The "Ooh, That's Awkward" Stage: When the CCJ is Issued

First things first, you’ve got to receive the actual judgment. This usually happens after the creditor (the person or company you owe money to) has gone through the court process. You’d have received letters before this, telling you they were planning on taking action. If you ignored those, well, this is the point where the badger in the grey suit makes its grand entrance.

A CCJ typically lasts for six years. Six! That’s longer than most celebrity marriages. And during that time, it sits there, on your credit record, like a particularly embarrassing tattoo you can’t afford to get lasered off. It’s not just a little footnote; it’s a giant, flashing neon sign that screams, "This person isn't the most reliable with their cash!"

The Unseen Consequences: How it Stalks Your Credit File

Your credit file is like your financial report card. It’s what lenders, landlords, and even some employers peek at to see if you’re a good bet. And a CCJ? It’s like getting a big, red 'F' in the 'Responsibility' section. This means that for the next six years, getting credit will be about as easy as convincing a cat to enjoy a bath.

Want a mortgage? Good luck, sunshine. Need a new phone on contract? You might have to buy it outright, like a peasant from the Middle Ages. Thinking about renting that swanky apartment? The landlord might have nightmares about you. It’s not just about loans; it affects things like getting a mobile phone contract, or even sometimes getting certain jobs, especially if they involve handling money. So, that quick fix of ignoring the problem? It’s creating a whole heap of future problems.

The "Uh Oh, They're Serious" Stage: What Happens Next

Ignoring the CCJ doesn’t make it go away. Instead, it opens the door for the creditor to start taking more active steps to get their money. This is where things can get a bit more dramatic, and a lot less funny. Think of it as the plot of a B-movie where the antagonist finally catches up with the protagonist.

Bailiffs: The Debt Collectors with Badges (and Possibly Big Boots)

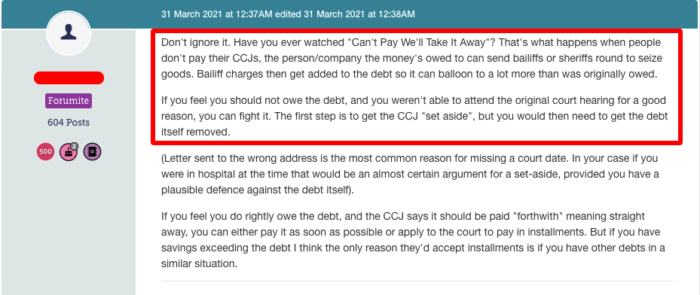

If you don't pay, the creditor can apply for a Warrant of Control. This is basically a court order allowing bailiffs (sometimes called 'enforcement agents') to come to your home and collect what you owe. And I’m not talking about them politely knocking and asking for a cheque.

These folks have powers. They can, under certain circumstances, enter your home and seize your belongings. We’re talking about your TV, your car (if it’s not specifically protected), your furniture – anything that can be sold to cover the debt. It’s like a very unwelcome decluttering service, but instead of Marie Kondo, you’ve got someone who looks like they wrestle bears for fun.

Now, there are rules. They can’t take essential items like your fridge, washing machine, or tools of your trade. But don’t underestimate them. They’re not there to admire your knick-knacks; they’re there to collect. And the longer you leave it, the more fees and interest pile up. So that £500 debt could balloon into something truly terrifying.

Attachment of Earnings: Your Paycheck Gets a Side Hustle

Another delightful option for the creditor is to get an Attachment of Earnings Order. This is where the court orders your employer to deduct money directly from your salary before you even see it. It’s like your paycheck is being intercepted by a secret agent on its way to your bank account.

Your employer has to comply with this, and it can be pretty embarrassing. Imagine your boss calling you in and saying, "So, about that CCJ… and your missing pay this week." It’s not exactly a career booster. This order is designed to ensure you pay a fixed amount each month until the debt is cleared. It's a bit like a forced savings plan, but with the distinct lack of ‘savings’ and a surplus of ‘forced’.

Charging Orders: When Your Home Becomes Collateral

If you own property, things can get even more serious. A creditor can apply for a Charging Order. This basically puts a legal charge on your home, meaning you can't sell it or remortgage it without paying off the debt first. It’s like your house is holding its breath, waiting for you to sort out your financial mess.

In some extreme cases, if you still don’t pay, the creditor can even force the sale of your home to recover the money. Yes, you read that right. Your casa could be on the market because you decided to play ostrich with a CCJ. It’s a stark reminder that debts have real-world consequences, and sometimes those consequences are about as comfortable as wearing a suit of armour in July.

The "Okay, I Messed Up" Stage: What Can You Do NOW?

So, you’ve ignored it, and now the walls are closing in. Don’t despair! While ignoring it is the worst strategy, it doesn't mean all hope is lost. It’s never too late to try and fix things, although it will be a bit harder now. Here’s the game plan:

1. Don't Panic (Easier Said Than Done, I Know)

Take a deep breath. Freaking out won't solve anything, although it might make you feel slightly more alive for a few minutes. The first step is acknowledging the problem.

2. Contact the Court and the Creditor IMMEDIATELY

Once you know a CCJ has been issued, you need to act fast. Contact the court to find out the exact details. Then, call the creditor. Yes, that person/company you’ve been avoiding like a tax audit. Explain your situation. They might be willing to negotiate a payment plan.

3. Apply to Vary the Judgment

If you can prove to the court that you cannot afford to pay the original amount, you can apply to vary the judgment. This means asking for the payment amount to be reduced or for a longer payment period. You'll need to provide evidence of your income and outgoings. The judge will look at your financial situation and decide if a new payment plan is fair.

4. Consider an 'Application to Set Aside'

This is a long shot, but if you have a really good reason for not responding to the original court documents (e.g., you genuinely didn't receive them due to an address error, or you were seriously ill), you can apply to set aside the judgment. This basically means asking the court to cancel the CCJ. You’ll need strong evidence, and it’s usually only granted if you can show you had a valid defence or a good reason for not attending the hearing.

5. Seek Professional Advice

Honestly, if you’re in this situation, it’s probably a good idea to chat with a debt charity or a debt advisor. They’re like financial superheroes who can help you understand your options, negotiate with creditors, and navigate the confusing world of court orders. Places like Citizens Advice, StepChange, and National Debtline offer free, impartial advice. Think of them as your financial pit crew.

Ignoring a CCJ is like playing Russian roulette with your financial future. It’s a gamble that rarely pays off. The best approach is always to face your financial obligations head-on, even when it’s scary. Because trust me, dealing with bailiffs at your door is a lot scarier than opening a letter.