What Does Remainder Mean For Direct Deposit

Hey there, awesome humans! Let's talk about something that pops up in our financial lives but might sound a little… math-y? We're diving into the world of direct deposit and that curious little word: remainder. Now, before your eyes glaze over, stick with me! This isn't your dusty old algebra textbook. Think of it more like a fun little puzzle that explains why your paycheck might be just a tad different than you expected, or why that shared bill got split down to the penny.

So, what exactly is a remainder when it comes to direct deposit? Imagine you're splitting a pizza with your friends. Everyone gets a whole slice, right? But what if you have 7 slices and 5 friends? Four friends get one slice each, and you've got 3 slices left over. Those 3 slices are your remainder. In direct deposit terms, it's what's left over after you've divided an amount into whole, equal chunks. Pretty simple when you think about it like pizza, huh?

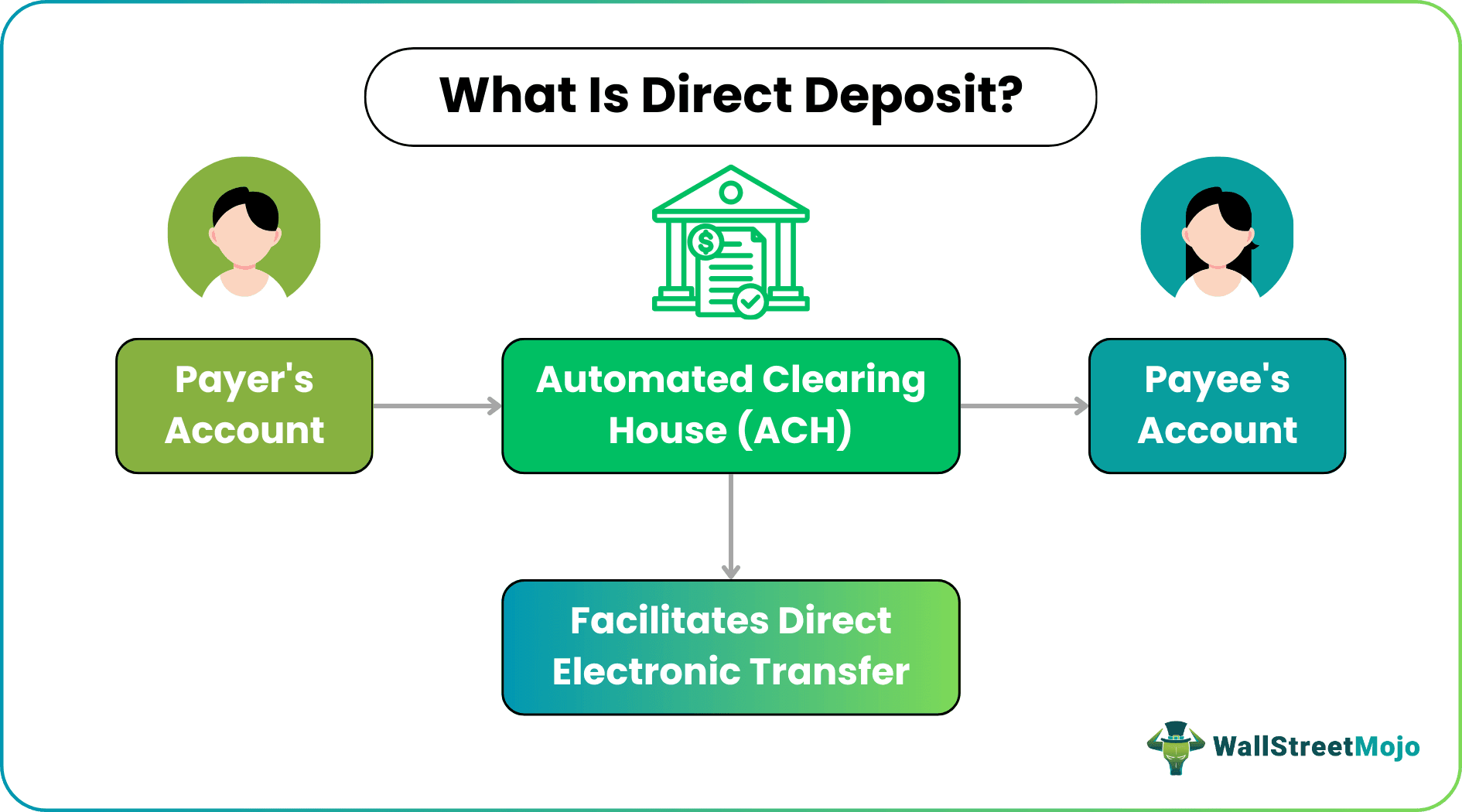

But why does this even matter for our hard-earned cash? Well, direct deposit is all about getting your money efficiently. Companies, payroll departments, they're all about smooth sailing. And sometimes, when they're sending out payments, especially to a large group of people, they need to divide up funds. This is where our pizza analogy comes back into play!

Think about a company trying to distribute bonuses. Let's say they have a total bonus pool of $10,000, and they have 3 employees they want to split it equally among. Easy peasy, right? $10,000 divided by 3 is $3,333.33. But wait! If they try to give exactly $3,333.33 to each person, they’d have a little bit left over. That little bit is the remainder. It's the tiny fraction of a cent that doesn't quite make a whole dollar or even a whole cent when you're dividing things up perfectly.

In our bonus example, $10,000 divided by 3 is actually 3333.3333... recurring. If the system rounds that down to $3,333.33 for each of the three employees, that’s a total of $9,999.99. See? There’s a remainder of $0.01 that’s left. It's not a huge amount, but it’s there!

So, how do companies handle these tiny remainders? They have a few smart tricks up their sleeves. Sometimes, they'll just add that tiny leftover to one person's account. It’s usually the first person in the list, or maybe the highest-paid employee, or sometimes it's just assigned randomly. It’s like when you’re splitting those pizza slices, and one friend ends up with the slightly bigger piece because it just worked out that way. No biggie, right?

Another common way to deal with the remainder is to have it go to a designated account. Maybe it goes to a company expense account, or a charity fund. This way, no one person is getting a seemingly random extra penny, and the money still gets accounted for. It’s like putting those leftover pizza crusts into a "future pizza experiment" container. Who knows what you'll do with them later!

Now, you might be thinking, "Is this going to mess up my budget? Am I going to be off by a penny every month?" Honestly, for most of us, the remainder is so tiny, it's practically invisible. Think of it like a microscopic dust bunny. You know it's there if you look really closely, but it doesn't really affect your day-to-day life. Your direct deposit is still going to show up pretty much exactly as you expect it.

However, understanding the concept can be surprisingly cool, especially if you’re someone who likes to track your finances down to the last cent, or if you’re involved in situations where money is being split amongst multiple people. Imagine you’re managing a club's finances, and you’re dividing up membership dues. The remainder concept helps you understand why the final split might have that odd penny.

It’s also interesting to consider how technology handles this. Modern accounting software is incredibly precise. When it comes to direct deposit, these systems are designed to perform these calculations flawlessly. They'll calculate the amount per person and then figure out what to do with any remaining cents. It’s a testament to how sophisticated our digital financial world has become. It’s like a super-smart pizza slicer that knows exactly how to divide things, and then has a little compartment for any leftover toppings.

So, next time you see your direct deposit hit your account, take a moment to appreciate the invisible magic happening behind the scenes. That tiny difference, or lack thereof, is often a result of these careful calculations, including the handling of any potential remainder. It’s a little peek into the organized, almost mathematical, way our money moves around.

It’s not about being ripped off or making a mistake. It’s about how systems, designed for efficiency and accuracy, handle the nitty-gritty details of dividing money. It’s like the universe making sure every single crumb is accounted for, even if that crumb is just a fraction of a cent!

Think about it this way: if a company has to send out thousands of paychecks, and each one has a potential remainder, those pennies could add up. By having a clear system for handling them, they avoid a lot of confusion and ensure everything balances out. It’s a very adult way of saying, "Let's make sure all the pizza slices, even the tiny bits, go somewhere useful!"

So, there you have it! The mysterious remainder in direct deposit. It’s not some scary financial jargon meant to confuse you. It’s just a simple concept that explains how money gets divided precisely, ensuring that every last cent is accounted for. It’s a little bit of financial wizardry that helps keep our paychecks on track, and honestly, it's kind of cool to know how it all works. Next time you’re sharing something, just remember the remainder – it’s the little bit that makes the whole picture complete!