What Does It Mean When Stock Market Crashes

Hey there, ever heard folks talking about the stock market doing a big ol' "crash" and felt a little lost? It sounds dramatic, right? Like a movie scene where everything goes haywire. Well, let's break it down in a way that’s more fun than a roller coaster – and sometimes, just as thrilling!

Imagine the stock market as a giant, buzzing marketplace. Instead of fruits and veggies, people are buying and selling tiny pieces of companies. These pieces are called stocks. When you buy a stock, you own a little bit of that company. If the company does well, your stock might be worth more. If it stumbles, your stock might be worth less.

Now, most of the time, this marketplace is pretty calm. Prices go up a bit, down a bit, like gentle waves. But sometimes, things get a little… wild. A stock market crash is basically when a whole lot of people decide to sell their stocks, all at once. And when everyone wants to sell and not many people want to buy, the prices of those stocks go down. Really, really fast. Think of it like a sudden stampede at the market!

Why is this so fascinating, you ask? Well, it's all about human behavior on a massive scale. It’s a real-time experiment in fear and greed. When things are going up, up, up, people get excited. They feel like they can't lose! This is called "greed", and it can push prices even higher, sometimes beyond what a company is actually worth. It’s like everyone’s at a party, and the music is pumping, and nobody wants to leave.

But then, something happens. Maybe a big company announces bad news, or there’s a worry about the economy. Suddenly, the mood shifts. Fear creeps in. People start thinking, "Uh oh, maybe this party is ending!" And that fear can spread like wildfire. One person sells, then another, then ten, then a thousand. Everyone is rushing for the exit at the same time.

This is where it gets really interesting to watch. It’s like observing a huge, real-life social experiment. You see how quickly sentiment can change. One day everyone's optimistic, the next they're panicking. It’s a raw display of how our emotions, when amplified by thousands of people, can impact something as big as the global economy. It's not just numbers on a screen; it’s the collective pulse of the business world.

Watching a crash unfold can be a bit like watching a storm. It's powerful, a little scary, but also undeniably impressive. The sheer speed and scale of the price drops are breathtaking. Imagine a giant graph on a screen, and suddenly the line plunges downwards like a waterfall. It’s a visual spectacle of market dynamics at their most extreme.

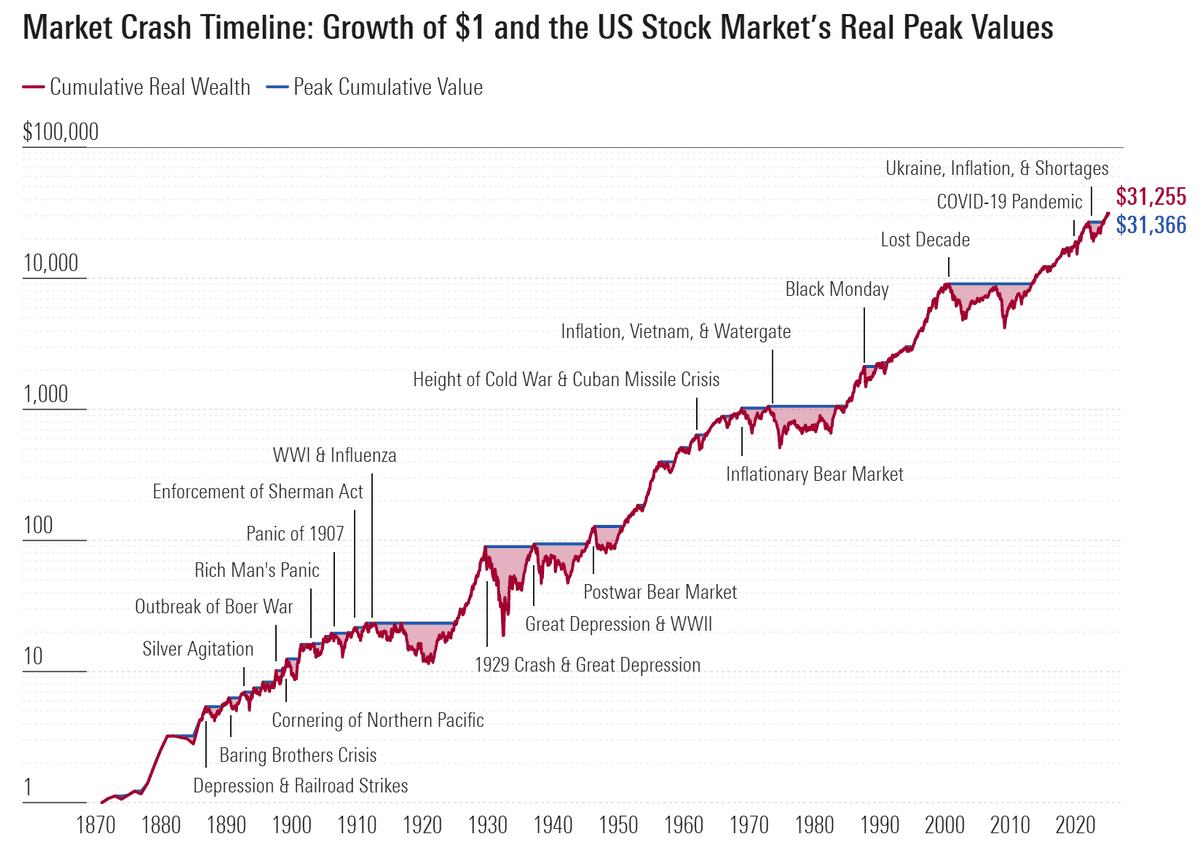

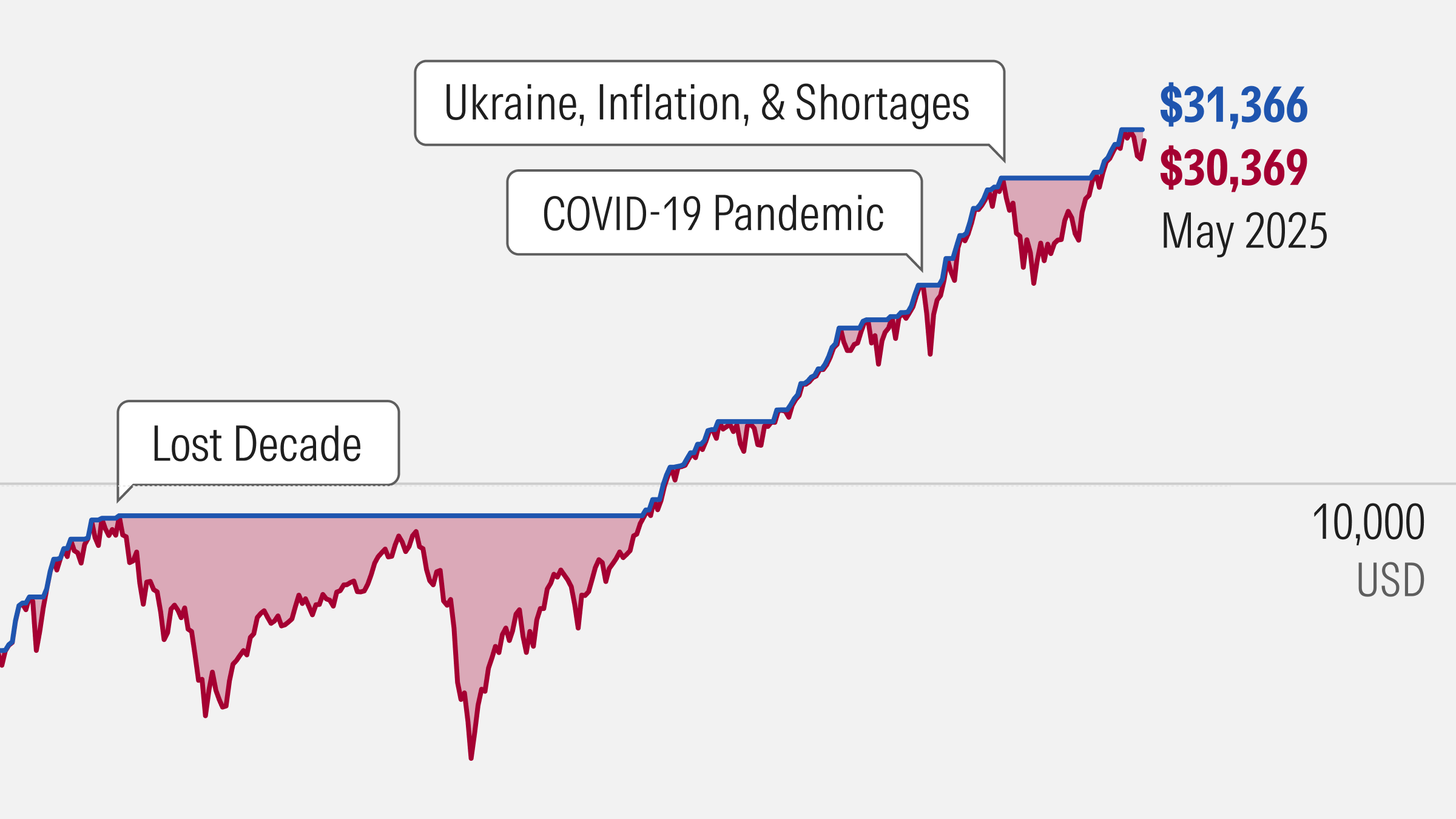

And what makes it even more special is that these crashes, while painful for many, often lead to comebacks. After the storm passes, the market usually starts to rebuild. Prices that have fallen can start to rise again. It’s this cycle of boom and bust, of fear and recovery, that makes the stock market a never-ending story. It's a testament to resilience and the fundamental belief that businesses, overall, tend to grow over time.

Think about the famous crashes. There was the one in 1929, which was a doozy. Then there was "Black Monday" in 1987, where the market dropped a huge amount in a single day. More recently, we've seen some pretty big dips, like in 2008 during the financial crisis, and the quick scare in 2020 at the start of the pandemic. Each one is a unique chapter in the history of how people and businesses interact.

These events are not just about losing money; they are about history, psychology, and the unpredictable nature of human confidence. They reveal the interconnectedness of the world. When one country's market stumbles, it can send ripples across the globe. It's a fascinating look at how our global village operates.

So, next time you hear about a stock market crash, don't just think of it as bad news. Think of it as a dramatic moment in a grand, ongoing play. It's a chance to see human nature laid bare, to witness the power of collective sentiment, and to understand that even in the face of widespread panic, there’s often a story of recovery waiting to unfold. It’s a spectacle that’s both educational and, dare we say, a little bit exciting to observe from a safe distance!

It's like watching a thrilling, fast-paced drama unfold in real-time, with fortunes made and lost, and the underlying currents of human emotion playing out on a global stage.

It's this raw, unpredictable energy that makes the stock market so captivating. It’s a constant reminder that the future is never guaranteed, and that sometimes, the most interesting stories are the ones where things get a little bumpy. So, why not tune in? You might be surprised at what you learn, and how much you find yourself drawn into the drama.