What Does Federal Income Tax Liability Mean

Hey there! So, you've probably heard the term "federal income tax liability" thrown around, maybe when you're doing your taxes or catching up on the news. It sounds super serious, right? Like something that requires a secret handshake and a decoder ring. But honestly, it's not as complicated as it seems! Think of me as your friendly neighborhood tax whisperer, here to break it all down so you can nod confidently next time it comes up. No more feeling like you're drowning in a sea of IRS jargon!

Let's start with the basics. Federal income tax is the money we, as individuals or businesses, pay to the U.S. government based on the money we earn. It's how the government funds all sorts of cool stuff, like building roads (yay for smoother commutes!), national parks (hello, majestic selfies!), and even keeping our country safe. So, it's not just money disappearing into a black hole; it’s (mostly!) going towards things that benefit us all.

Now, what about that "liability" part? In plain English, tax liability is simply the amount of tax you owe to the government. It's your responsibility to pay it. Think of it like this: if you go to a fancy restaurant and order the lobster thermidor (living the dream, right?), your bill at the end of the night is your "liability" to the restaurant. Federal income tax liability is your bill to Uncle Sam.

So, why does this "liability" change from year to year? Well, a few things come into play, and they’re usually tied to how much dough you've made. Your income is the big kahuna here. The more you earn, generally, the more tax you'll owe. It's like a sliding scale, but instead of free ice cream, it's taxes. Shocking, I know!

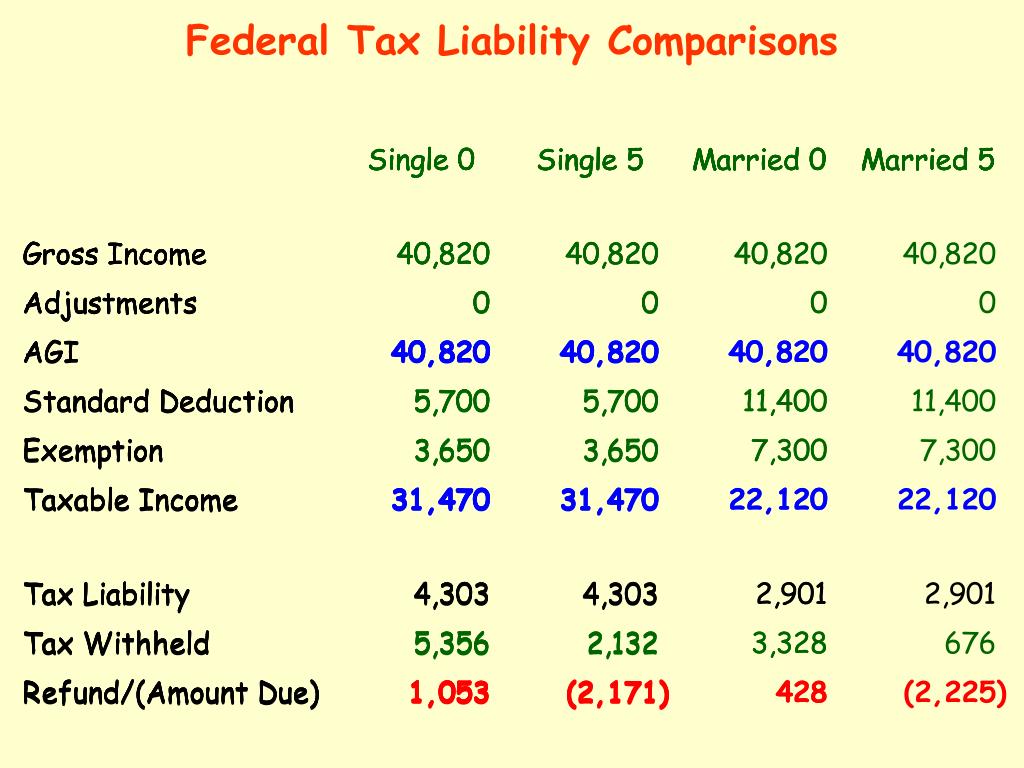

But it’s not just about your salary or wages. Taxable income is what we're really talking about. This is your gross income (that's all the money you earned before anything is taken out) minus certain deductions and exemptions. Ah, deductions and exemptions – these are your tax-saving superheroes! They're like little gifts from the tax gods that can lower the amount of income the government can tax.

Diving Deeper into Deductions and Exemptions

Let's break down these tax-saving heroes a bit more. Deductions are expenses that you can subtract from your income. For example, if you're self-employed, you might be able to deduct business expenses like office supplies, internet service, or even a portion of your home if you have a home office. Think of it as saying, "Hey IRS, I had to spend money to make money, so you can't tax that part!" Pretty neat, huh?

There are two main flavors of deductions: the standard deduction and itemized deductions. The standard deduction is a fixed amount that the IRS lets you subtract from your income. It’s super easy – you just claim it, and you’re done. No need to keep every single receipt for a pack of gum (phew!).

Itemized deductions, on the other hand, involve tracking specific expenses. This can include things like state and local taxes (SALT), mortgage interest, charitable donations, and medical expenses that exceed a certain percentage of your adjusted gross income. You’ll want to itemize if your total itemized deductions are more than the standard deduction. It’s like choosing between a pre-set meal and building your own gourmet plate – sometimes one is more satisfying (and cheaper!).

Now, for exemptions. These used to be a bigger deal, allowing you to reduce your taxable income for yourself and your dependents. However, for the sake of simplifying the tax code (a noble but perhaps impossible quest!), the Tax Cuts and Jobs Act of 2017 eliminated personal and dependent exemptions. So, while the concept of an exemption used to be key, it's not something we directly factor in anymore when calculating our federal income tax liability for individuals. Still good to know the history, though, right? Knowledge is power, even tax knowledge!

Tax Brackets: The Progressive Punisher (or Provider!)

Okay, so after you've figured out your taxable income, the government doesn't just slap a flat percentage on it. That would be too simple, wouldn't it? Instead, we have something called tax brackets. These are ranges of income, and each range is taxed at a different rate. This is known as a progressive tax system. In simpler terms, the more you earn, the higher the percentage of tax you pay on those higher earnings.

Think of it like this: imagine a fancy tiered cake. The bottom layer is taxed at a lower rate, the middle layer at a slightly higher rate, and the top layer (where the cherries and sprinkles are!) is taxed at the highest rate. You don't pay the highest rate on your entire income; you only pay that highest rate on the portion of your income that falls into that top bracket. So, if you’re in the 22% tax bracket, it doesn't mean you pay 22% on all your income. It means the last chunk of your income is taxed at 22%. It’s a subtle but important difference, and a common point of confusion. It's like thinking your whole pizza is pepperoni just because there's one slice with pepperoni on it. Nope!

The government publishes these tax brackets every year, and they change based on inflation. So, what might be a certain income range today could be slightly different next year. It’s like the tax code is always on the move, doing a little jig. Staying updated is key, though most tax software and accountants do this heavy lifting for us.

Credits: The Real VIPs of Tax Savings

While deductions lower your taxable income, tax credits are even better! Why? Because a tax credit directly reduces your tax liability, dollar for dollar. It’s like finding a $20 bill in your old jeans – pure, unadulterated joy! If you have a $1,000 tax liability and a $500 tax credit, your liability becomes $500. Boom! Instant savings.

There are tons of tax credits out there, designed to incentivize certain behaviors or help specific groups of people. You might have heard of the Child Tax Credit, which helps families with qualifying children. There are also credits for education expenses, retirement savings, energy-efficient home improvements, and even for adopting a child! It’s like the government saying, "Hey, you're doing a good thing here, have a little tax break!"

Some credits are refundable, meaning if the credit is more than the tax you owe, you can actually get the difference back as a refund. These are the unicorn credits, the stuff of tax legend! Most credits are nonrefundable, meaning they can only reduce your tax liability down to zero. Still great, but not quite as magical as getting money back.

Putting It All Together: The Tax Calculation Tango

So, how does it all come together to determine your federal income tax liability? It’s a bit of a dance, really!

- Figure out your Gross Income: This is all the money you earned from various sources (wages, interest, dividends, business income, etc.).

- Subtract Above-the-Line Deductions: These are deductions that you can take even if you don't itemize. Think student loan interest, IRA contributions, etc. This gives you your Adjusted Gross Income (AGI). Your AGI is a pretty important number; a lot of other tax rules and limitations are based on it.

- Subtract Your Standard or Itemized Deductions: Choose the one that gives you a bigger deduction!

- This gives you your Taxable Income: Ta-da! This is the number the government is going to apply its tax rates to.

- Calculate the Tax Based on Tax Brackets: Apply the progressive tax rates to your taxable income. This gives you your preliminary tax liability.

- Subtract Any Tax Credits: This is where you apply those dollar-for-dollar reductions.

- This is your Final Federal Income Tax Liability! Or, if you've already paid some tax through withholding from your paycheck, this is what you’ll compare to your payments to see if you owe more or get a refund.

It sounds like a lot, but remember, tax software and tax professionals are designed to guide you through this process smoothly. They're the expert choreographers for this tax calculation tango!

What About Self-Employment and Other Income?

If you're self-employed or have income from other sources like investments, your tax picture might be a little different. Self-employment tax, for instance, is a separate tax that covers Social Security and Medicare for individuals who work for themselves. This is in addition to federal income tax. It can feel like getting double-taxed, but it's essentially you covering both the employee and employer portions of these essential benefits. Oof!

When it comes to investments, things like capital gains (profits from selling assets like stocks) and dividends are also subject to federal income tax, often at different rates than ordinary income. Don't even get me started on passive income from rental properties – that’s a whole other ball game with its own unique set of rules and deductions! It's like exploring different wings of a vast tax museum, each with its own exhibits and artifacts.

The Importance of Staying Organized

Look, I know this can feel a bit overwhelming. The sheer volume of information can make you want to hide under a blanket with a good book. But here's the secret sauce: organization! Keeping good records of your income and expenses throughout the year makes tax time infinitely less stressful. Think of it as a treasure hunt where the treasure is a lower tax bill or a nice fat refund.

When tax season rolls around, you'll be so glad you have those receipts, W-2s, 1099s, and bank statements neatly organized. It prevents those frantic last-minute searches and the inevitable "Where did I put that?!" panic. A little bit of proactive effort can save you a lot of headaches. It's like watering your plants regularly – you don't wait until they're crispy brown to give them a drink!

Don't Forget About State Taxes!

One last little tidbit: remember that federal income tax liability is just for the U.S. government. Many states also have their own income taxes, which are calculated and paid separately. So, if you live in a state that taxes income, your total tax burden will include both federal and state obligations. It’s like ordering a combo meal – you get the main dish, and then there are the sides!

The Uplifting Conclusion

So, there you have it! Federal income tax liability, demystified. It’s the amount of tax you owe to the U.S. government, determined by your income, deductions, credits, and the tax brackets. While it might seem like a complicated puzzle at first glance, it's essentially a system designed to fund the services we all rely on. And the good news? There are legitimate ways, through deductions and credits, to minimize that liability. You're not just blindly handing over your hard-earned cash; you're actively participating in a system, and understanding it empowers you to navigate it wisely.

The most important takeaway is this: you are not alone in this. Tax professionals, tax software, and a wealth of resources are available to help you understand your obligations and take advantage of all the benefits you're entitled to. So, take a deep breath. You’ve got this! By arming yourself with a little knowledge and staying organized, you can tackle your federal income tax liability with confidence and maybe, just maybe, even feel a little sense of accomplishment. Now go forth and conquer that tax form, knowing you’ve got the power of understanding on your side!