What Does A Negative Statement Balance Mean

Ever found yourself staring at a bank statement, or maybe a credit card bill, and a certain phrase pops out: "Negative Statement Balance"? It sounds a bit dramatic, doesn't it? Like your finances just took a unexpected detour into the Twilight Zone. But fear not, fellow humans navigating the delightful chaos of adulting! It’s not as scary as it sounds, and once you decode it, it’s actually… well, pretty darn good news.

Think of it like this: you’re chilling, maybe scrolling through your Instagram feed, and you see a post that’s just chef’s kiss. It's aesthetically pleasing, the caption is witty, and overall, it just makes you feel good. A negative statement balance is kind of the financial equivalent of that perfect post. It's your money behaving itself, and then some!

Let’s break down what this magical phrase actually means, without the jargon that makes your eyes glaze over faster than a burnt pop-tart. It’s all about the flow of money, a dance between what’s coming in and what’s going out. And when the numbers do a little shuffle in your favor, you get this lovely outcome.

The Lowdown on the Low Numbers

At its core, a statement balance is a snapshot of your financial activity over a specific period, usually a month. It’s the sum of all your transactions: deposits, withdrawals, payments, purchases. Now, when we talk about a negative balance, it typically refers to a few different scenarios, and they’re usually the ones you’re secretly hoping for.

Imagine your bank account. You deposit your paycheck (positive!). You buy your morning latte (negative!). You pay your rent (negative!). The statement balance is the final tally. If this tally is a negative number on a credit card statement, that's a whole different story, and we'll get to that in a moment. But for a checking or savings account, a negative balance on the statement itself is a rare bird, and often a sign of something quite pleasant.

For example, some banks or financial institutions might display your closing balance, and if it's a positive number that means you have money. If it's a negative number, it implies you owe them. However, this is usually not the case for a checking account statement itself, as banks will usually inform you if you've overdrafted. The more common scenario where you’ll see a negative balance, and where it’s generally a positive sign, is often when referring to how a credit card payment has been applied.

Credit Where Credit is Due (Literally!)

Okay, so let's dive into the world of credit cards. This is where the "negative statement balance" can really shine. When you pay your credit card bill, you’re sending money to the credit card company. The goal is to reduce the amount you owe, right?

So, if you’ve made a payment that’s more than your current balance, or even if you’ve paid your full balance and then made a small purchase right before the statement closes, you might end up with a negative balance on your credit card statement. This is fantastic news! It means you’ve effectively overpaid or put yourself in a position where you have a credit with the credit card company.

Think of it like this: You went to your favorite vintage store, spotted the most amazing, sequined jacket for $50. You hand over a $100 bill. The cashier gives you $50 in change. That $50 in change? That’s your credit. The credit card company owes you that money. So, a negative balance on a credit card statement is essentially saying, "Hey, you've got a little credit with us!"

What Does This Mean for Your Wallet?

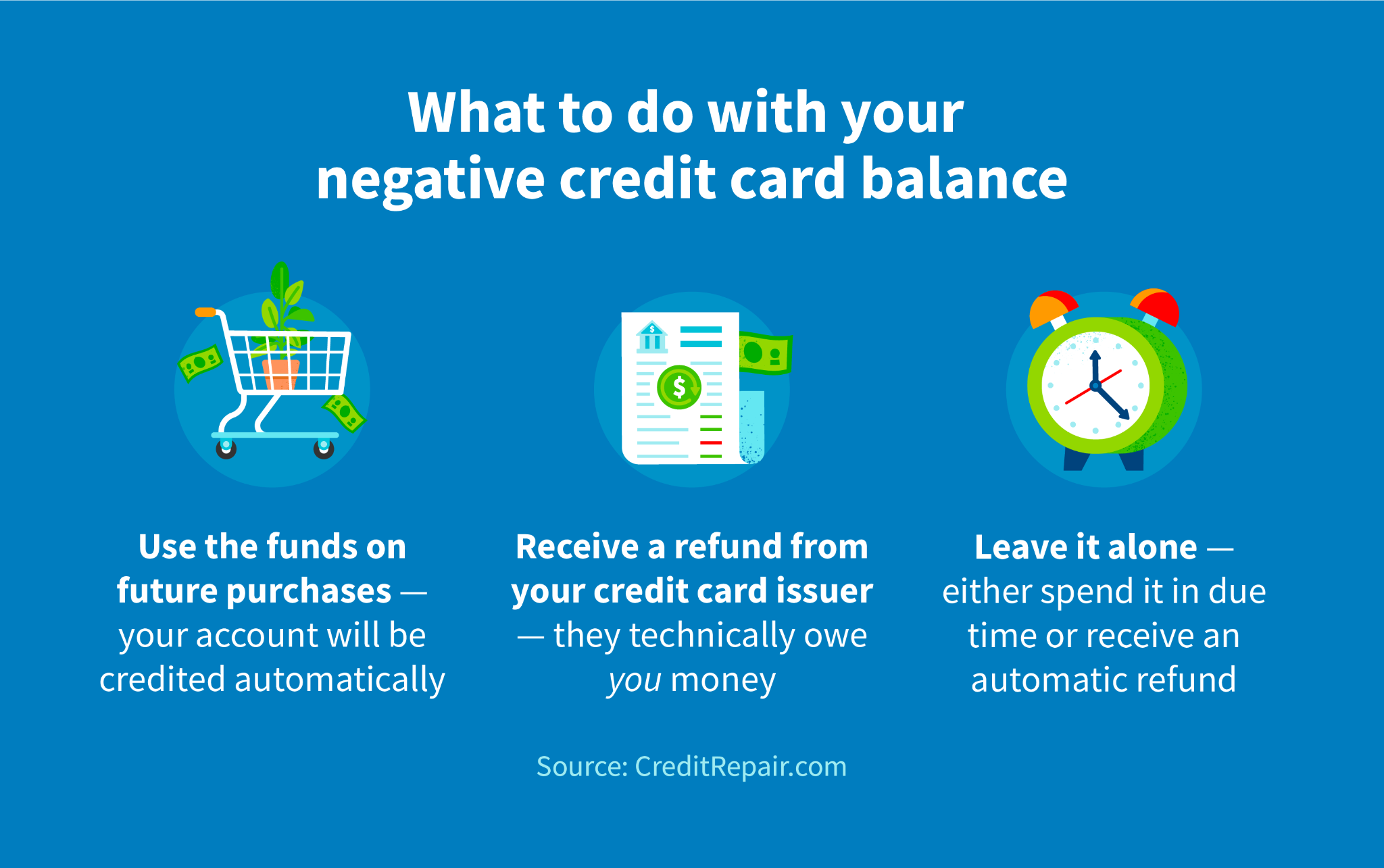

This is where the practical magic happens. If your credit card statement shows a negative balance, you have a few options, all of which are pretty sweet:

- Let it ride: The credit card company will simply hold onto that extra money and apply it to your future purchases. So, the next time you swipe that card, that negative balance will automatically reduce what you owe. It's like getting a discount before you even buy anything!

- Request a refund: If the negative balance is substantial, you can usually contact your credit card company and request a direct refund. This means they'll send you a check or direct deposit for the excess amount. Hello, extra spending money! Just imagine that unexpected bonus showing up in your account – perfect for that weekend getaway or that new gadget you've been eyeing.

- Use it as a buffer: Even if you don't opt for a refund, that credit can act as a handy buffer. If you're a little short on cash for a small purchase later in the month, that negative balance can cover it without you needing to dip into your checking account. It’s like a tiny financial safety net.

It’s a bit like when you return an item to a store and they give you store credit. You haven't lost anything; you just have the flexibility to use that value later. The difference here is, it's cash you’re due, not just a credit for that specific store.

Beyond the Credit Card: Other Scenarios

While credit cards are the most common place to encounter a beneficial "negative balance," it's worth noting other less frequent but still positive interpretations:

- Merchant Refunds: Sometimes, a merchant might issue a refund that exceeds the original purchase price, or a refund might be processed after a statement has already been generated. This can sometimes lead to a negative balance on a linked account or statement.

- System Glitches (Rare!): Very rarely, a financial system might experience a glitch that incorrectly shows a negative balance. If this happens and you haven't made an overpayment, it's crucial to contact your financial institution immediately to clarify. But in most cases, this is not the reason for the specific phrase we're discussing.

The key takeaway is that in the context of consumer finance, when we talk about a negative balance that you have created through your actions (like overpaying a bill), it’s generally a sign of good financial health and management.

Cultural Tidbits and Fun Facts

Did you know that the concept of credit itself dates back thousands of years? Ancient Mesopotamians used clay tablets to record loans and debts. Imagine the complexity of managing those records compared to our sleek apps today! And the credit card as we know it? That’s a relatively recent invention, really taking off in the mid-20th century.

The idea of a "balance" is also a fascinating one. It's rooted in the concept of scales, aiming for equilibrium. In finance, a negative balance on a credit card is like tipping the scales in your favor – you have a surplus. It’s a positive outcome disguised in a negative number, a bit like how a really great plot twist in a movie can feel negative at first but ultimately enhances the story.

Consider the modern obsession with "hustle culture" and maximizing every dollar. While that’s important, sometimes the most financially savvy moves aren't about working harder, but about managing smarter. A negative statement balance is a prime example of this – it's the result of having your money work for you, rather than you constantly chasing it.

Think about the joy of finding a forgotten $20 bill in an old coat pocket. A negative statement balance, especially from an overpayment, feels a bit like that, but on a potentially larger scale and with more intentionality. It’s that little financial win that makes you feel a bit smug (in a good way, of course!).

Navigating the Statement with Confidence

So, how do you ensure you're always aiming for these positive "negative balances" when it comes to your credit cards?

- Pay on time, every time: This is non-negotiable for good credit.

- Consider paying more than the minimum: If your budget allows, paying more than the minimum balance can help reduce your overall debt faster and might even lead to that coveted negative balance.

- Automate your payments: Set up automatic payments for at least the minimum due. This prevents missed payments and late fees, keeping your financial life smoother.

- Review your statements: Don't just glance at the total. Take a moment to understand what's going on. Look for the payment applications and your current balance.

- Set up alerts: Many credit card companies offer alerts for payment due dates, high balances, or even when a payment has been processed.

It’s about being proactive and informed. Your financial statements aren't just numbers; they're a narrative of your financial journey. And a negative balance on your credit card statement is a chapter that reads: "Smart Moves Made Here!"

A Little Reflection

In a world that often emphasizes constant striving and the fear of falling behind, it's refreshing to encounter a financial concept where a "negative" outcome is actually a positive indicator. It reminds us that sometimes, the best financial strategies aren't about aggressively earning more, but about prudently managing what we have. It’s the quiet satisfaction of a well-balanced ledger, or in this case, a well-managed credit card account. So, the next time you see that phrase, don't let the word "negative" throw you off. Instead, give yourself a little nod of approval. You've earned it, and your money, in a way, has too.