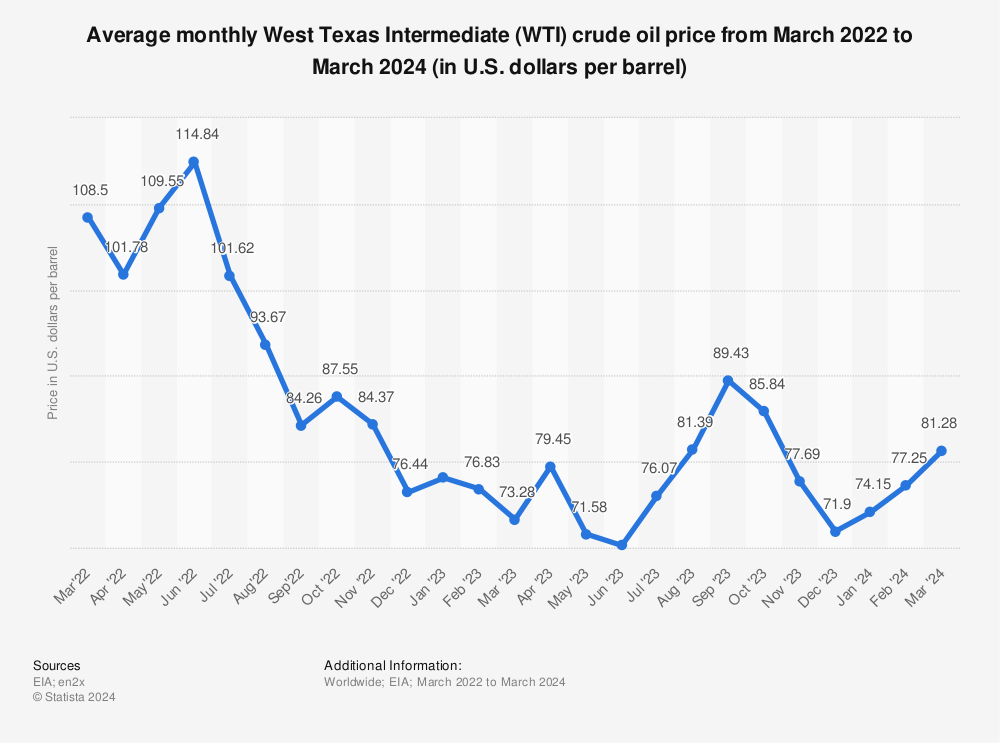

West Texas Intermediate Oil Price Chart

Alright folks, let's talk about something that might sound a bit… dry, but trust me, it's actually quite fascinating and surprisingly relevant to your everyday life: the West Texas Intermediate (WTI) oil price chart. Now, before you picture dusty textbooks and complicated graphs, think of it more like a global mood ring for the economy. People who follow it, whether they're seasoned traders or just curious observers, find a certain thrill in deciphering its movements. It's like a puzzle, where every tick and tock tells a story about what's happening around the world, from geopolitical shifts to the latest technological advancements.

So, why should you, the average Joe or Jane, care about this seemingly niche market indicator? Well, the WTI price chart is a powerful barometer for the health of our planet's economy. Oil is the lifeblood of so much of what we do. From the gasoline in your car to the plastic in your phone, to the materials used to build your home – oil is intricately woven into the fabric of modern society. When WTI prices go up, it often means higher costs for transportation, manufacturing, and ultimately, for the goods and services you use daily. Conversely, a dip in prices can signal a potential slowdown in global demand, which might lead to cheaper gas at the pump, but could also hint at underlying economic challenges.

You encounter the impact of WTI prices far more often than you might realize. Think about your last trip to the gas station – that price per gallon is directly influenced by crude oil markets. Planning a vacation? Airfare prices are also sensitive to jet fuel costs, which are tied to crude. Even the price of the clothes you wear, the food on your table (think about agricultural machinery and transportation), and the electronics you use are all indirectly affected. It’s a constant, underlying hum in the background of our financial lives.

Now, how can you get a better handle on this, or even find some enjoyment in it? First off, don't feel like you need to become a Wall Street wizard overnight. Start small. There are plenty of user-friendly financial news websites that display WTI charts in an accessible way. Look for trends: Is the price generally rising, falling, or staying relatively stable? Read the accompanying news; journalists often explain why the price is moving. Is it due to a natural disaster in an oil-producing region? A new trade agreement? A surge in demand for a particular product? Understanding the ‘why’ makes the ‘what’ much more engaging. Another tip: try following it for a month. Notice how your own expenses, particularly for fuel, might fluctuate. It's a great way to connect abstract numbers to your tangible reality. Finally, don't be afraid to discuss it! Chatting with friends or family about what you've learned can solidify your understanding and make it a more social, and thus enjoyable, pursuit. So, next time you hear about WTI, remember it's not just about oil – it's about the pulse of our interconnected world.