West Texas Intermediate Crude Oil Price

Hey there, oil enthusiast! Or, you know, just someone who vaguely remembers hearing about gas prices. Let's talk about something super cool, surprisingly dramatic, and undeniably important: West Texas Intermediate crude oil. Yeah, I know, "crude oil" sounds a bit… dirty. But trust me, WTI, as the cool kids call it, is way more fascinating than it lets on.

So, what even is WTI? Think of it as the gold standard of North American oil. It's a specific type of light, sweet crude. "Light" means it's got fewer heavy molecules, making it easier to refine into stuff we actually use, like gasoline. "Sweet" means it has a low sulfur content. Less sulfur, less headache for refineries. Easy peasy.

But here's the really fun part: WTI is a benchmark price. This means its price isn't just its price. It's like the official scorekeeper for a whole bunch of other oil. When WTI goes up, a lot of other oil prices tend to follow suit. It’s the swaggering big brother of the oil world, setting the trend for everyone else.

And where does this mighty WTI come from? You guessed it: West Texas! The name isn't exactly subtle, is it? Imagine vast, dusty plains under a sky so big it feels like it could swallow you whole. That's the WTI birthplace. It's pumped from the Permian Basin, which is this enormous underground treasure trove of oil and natural gas.

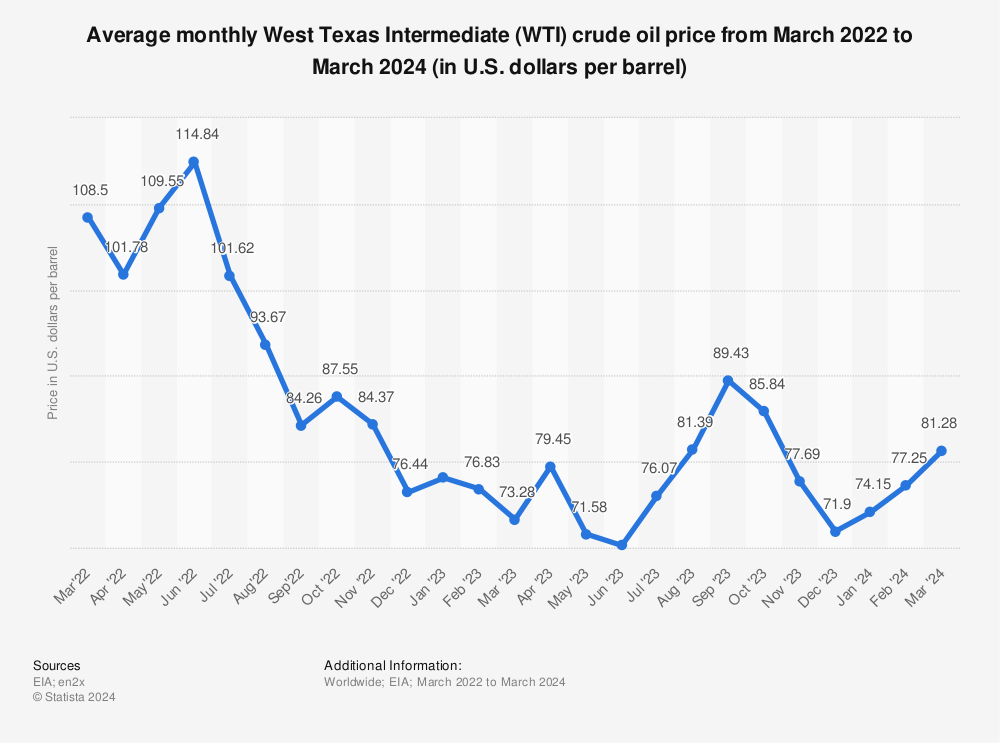

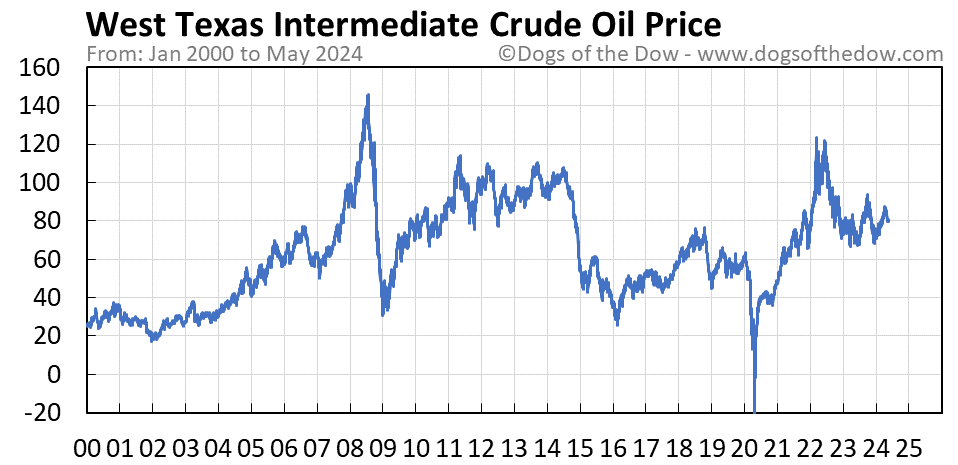

Now, the price of WTI is like a rollercoaster. Seriously. One day it's soaring, making everyone in the oil industry do a happy dance. The next, it's plummeting, and the mood gets a bit… somber. Why the drama? Oh, so many reasons!

Think about it: supply and demand. It’s the oldest trick in the book, but it’s so true for oil. If there's a ton of WTI flowing out of the ground, and not enough people needing it, prices drop. But if something happens to disrupt that flow – say, a hurricane in the Gulf of Mexico messes with pipelines, or a major oil-producing nation decides to… slow down production – then suddenly, everyone’s scrambling for what’s left. And prices? They go through the roof!

And it’s not just physical supply. Geopolitics plays a huge role. Imagine the world stage as a giant chessboard. Countries producing oil are like powerful queens. If one queen makes a move – like cutting production or facing internal instability – the whole board can shift. Suddenly, WTI prices react. It's like a giant, invisible hand is constantly fiddling with the market. Pretty wild, huh?

Here’s a quirky little detail: WTI is priced at the Cushing, Oklahoma, hub. Why Cushing? It’s a massive storage and pipeline nexus. Think of it as the central station for WTI. This is where a lot of the physical trading happens, and it gives the price a tangible location, even though oil is a global commodity.

The price you see for WTI is usually for a barrel. A barrel of oil is 42 US gallons. That's a lot of liquid! Imagine filling up 42 gallon jugs. And for that amount, the price can swing wildly. It’s enough to make your head spin, but also, kind of… exciting?

Have you ever noticed that sometimes gas prices go up even when the price of crude seems stable? That's because crude oil is just one ingredient in gasoline. There are refining costs, transportation costs, taxes… it’s a whole pizza of expenses. But the WTI price is the biggest slice, and it tends to influence the others.

Speaking of influences, the weather can be a surprising player. Extreme cold snaps can increase demand for heating oil (which is related to crude), while hot summers mean more people driving and thus more demand for gasoline. So, next time you're checking the WTI price, maybe also glance at the weather forecast! It’s all connected.

And the trading! Oh, the trading. WTI is traded on exchanges like the New York Mercantile Exchange (NYMEX). People are buying and selling contracts for future delivery of oil. It's a high-stakes game where fortunes can be made and lost in a heartbeat. It’s like a thrilling, global economic casino, but with much higher stakes than your average slot machine.

One of the things that makes WTI so interesting is its role in the US economy. When WTI prices are high, it can mean more revenue for US oil producers. This can lead to job creation, investment in new drilling technologies, and a boost to certain regions. It’s a powerful economic engine.

Conversely, low WTI prices can be a mixed bag. For consumers, it often means cheaper gas at the pump, which is great! But for the oil industry, it can mean layoffs, reduced investment, and a slowdown in production. It’s a delicate dance of competing interests.

Think about the sheer scale of it. We're talking about millions of barrels of oil being produced and traded every single day. The decisions made in boardrooms, at oil fields, and in geopolitical summits have a ripple effect that reaches your local gas station and influences global markets. It’s a humbling and awe-inspiring thought.

And the language! We talk about "barrels," "hedging," "futures," "spot prices." It's a whole specialized lingo. It can sound intimidating, but once you get the hang of it, it's like learning the secret code to a global conversation. It’s a fun puzzle to try and unravel.

So, why should you care about WTI? Well, beyond the obvious impact on your wallet at the gas pump, it’s a window into the complex workings of our modern world. It’s a story of innovation, of resource management, of global interconnectedness, and sometimes, of sheer, unadulterated market drama.

It's a topic that’s always buzzing, always changing. You can read a headline today, and by tomorrow, the entire narrative might have shifted. It keeps you on your toes, and honestly, that’s part of the fun. It’s never boring. Never. So next time you see the WTI price mentioned, don’t just skim past it. Give it a little nod. It’s the heartbeat of a massive global industry, and its rhythm is pretty darn fascinating.

Remember, it's not just about the black liquid itself. It's about the complex web of factors that influence its price, the people who produce it, the markets that trade it, and the way it shapes our everyday lives. It’s a story that’s constantly being written, one barrel at a time.