Wells Fargo Bank Account And Routing Number

Hey there, savvy money managers and future financial wizards! Let's talk about something that might not sound like a thrill-a-minute ride, but trust me, it's the secret sauce to making your money life flow smoother than a jazz solo: your Wells Fargo bank account and routing number. Think of it as your financial VIP pass, the keys to unlocking a world of convenient transactions and seamless money movement. It’s less about the glitz and glamour and more about the quiet, reliable hum of your financial engine working perfectly.

So, what's the big deal with these numbers? Your Wells Fargo account number is like your personal financial identifier. It's the unique code that tells your bank, "This money belongs to you!" It’s the foundation for everything from receiving your paycheck to sending money to your best friend for that concert ticket. The Wells Fargo routing number, on the other hand, is the address for your bank. It's like the postal code that ensures your money travels to the correct destination. Together, they form the dynamic duo that makes electronic money transfers possible. Without them, sending a payment or getting paid would involve a lot more carrier pigeons and considerably less caffeine.

The benefits are truly game-changing. Imagine this: getting paid electronically, directly into your account. No more waiting for checks to clear! You can set up automatic bill payments, meaning your rent, utilities, and even that Netflix subscription are handled without you lifting a finger. This is a lifesaver for avoiding late fees and those dreaded "Oops, I forgot!" moments. Need to send money to your kids at college? Direct deposit for your salary? Splitting the dinner bill with friends? All of these everyday scenarios rely on your trusty Wells Fargo account and routing numbers. They’re the unsung heroes of our digital economy, making life… well, easier.

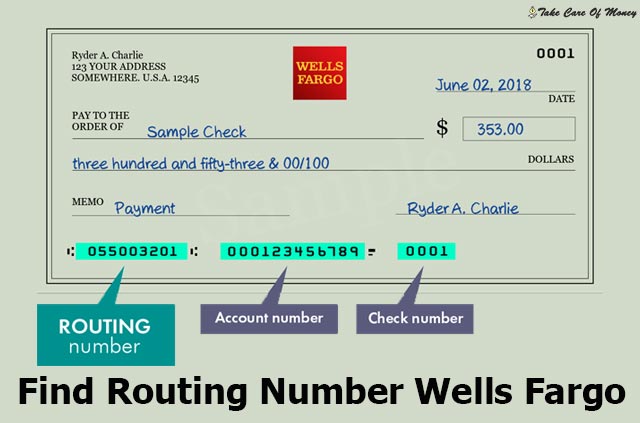

Let's dive into some common ways you'll use these numbers. You’ll find them on your Wells Fargo checks, usually at the bottom. They're also readily available on your online banking statement or by logging into your Wells Fargo mobile app. When you're setting up a new job and they ask for direct deposit information, you'll whip these out. When you’re signing up for a new service that requires automatic payments, guess what’s coming out? Yep, your account and routing number. Even if you're transferring money between your own accounts at different banks, these numbers are essential.

Now, how can you make the most of this financial tool? First and foremost, keep them secure! Treat your account and routing numbers like you would your credit card information. Don't share them unnecessarily, and be wary of suspicious requests. Secondly, familiarize yourself with where to find them. A quick check of your online banking dashboard or a physical check can save you time and hassle. Consider setting up auto-pay for recurring bills to maximize convenience and avoid missed payments. Finally, double-check them before entering them into any online form. A simple typo can lead to delays or, worse, money going to the wrong place. By understanding and utilizing your Wells Fargo account and routing number effectively, you’re not just managing money; you’re building a foundation for a more organized and stress-free financial life. Embrace the power of these numbers!