Vesting In Pension Plan What Does That Mean

Ah, the glorious pension plan. It’s like a magical money tree your employer plants for you. But there’s a little secret about this money tree: it doesn’t give you all its fruit at once. This is where the fun, or maybe slightly confusing, concept of vesting comes in.

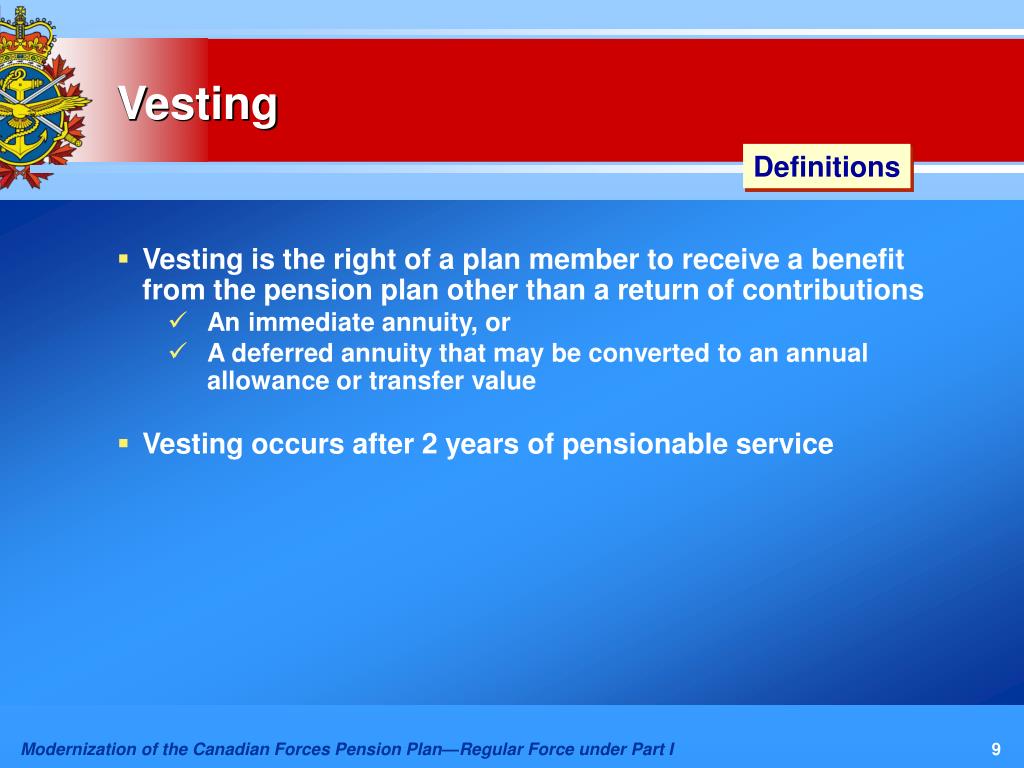

Think of vesting as earning your stripes. It's the process of becoming officially entitled to the money your employer puts into your pension. It's like when you were a kid and had to do chores before you got your allowance. Except, with vesting, it's about time, not scrubbing the toilet.

So, what does vesting in a pension plan really mean? It means you’ve reached a certain milestone with your company. You’ve stuck around long enough to say, “Hey, this money is actually mine!” It's not like a free-for-all upfront where you grab all the cookies. Nope. You have to prove your loyalty.

Imagine your pension is a pie. When your employer contributes to it, it’s like they’re adding delicious slices to that pie. But those slices are initially on a leash. They’re not fully yours until you’ve fulfilled the vesting requirements. It's a bit like a puppy graduating from basic obedience.

There are a few ways this vesting magic happens. The most common is called "cliff vesting." This is where you have to wait a specific, unbroken period of time before you own any of the employer's contributions. Think of it as a cliff you have to climb. Once you reach the top, boom! All the employer's money is yours.

Let’s say your company has a “one-year cliff vesting” policy. That means you have to work for them continuously for a whole year. No taking extended sabbaticals to find yourself in Peru. If you leave before that year is up, the employer's contributions might just vanish back into the corporate ether. Poof!

It's a little dramatic, isn't it? Like a spy thriller where the prize is… your own retirement money. You've got to be patient, or as I like to call it, strategically patient. This isn't about impulse buying; it's about long-term investment. And by "long-term," I mean potentially years.

Then there’s "graded vesting." This is a bit gentler, like a slow-cooked stew instead of a sudden microwave meal. With graded vesting, you gradually earn ownership over a period of time. For example, you might own 20% of your employer’s contributions after one year, 40% after two years, and so on, until you’re 100% vested.

This is the kind of vesting that makes you feel like you're steadily progressing. It’s like collecting trading cards, but instead of cool superheroes, you're collecting retirement funds. Each year, you unlock another layer of ownership. It’s less of a cliff and more of a gentle slope.

Some companies might even offer immediate vesting. Now, that’s a party! This means you own all the employer's contributions from day one. It’s like finding out your birthday is tomorrow and you get double presents. But honestly, immediate vesting is rarer than finding a unicorn riding a unicycle.

So, when you start a new job and they mention a pension plan, your brain should immediately go to: "What's the vesting schedule?" This is the golden question. It’s the secret handshake to understanding your future financial freedom. Don't be shy; ask your HR department. They're the keepers of this vital knowledge.

It’s also super important to know the difference between your contributions and your employer’s contributions. Generally, any money you put into your pension is always 100% yours. It's like the candy you bought with your own allowance. No vesting needed for that!

But the employer's chunk? That's the part subject to the vesting rules. It’s the bonus treats they’re offering as a thank you for your service. They want to make sure you're sticking around for a good stretch before they hand over the really good stuff.

Why do companies do this, you ask? Well, it’s a smart strategy for them. It encourages employee retention. They're essentially saying, "Stay with us, and you'll be rewarded handsomely for your loyalty." It's a way to build a stable, dedicated workforce.

:max_bytes(150000):strip_icc()/vesting.asp-final-7ce6b3f836d841c2b4f66b81909872f6.png)

It’s also a bit of a gamble for them. If you leave early, they get to keep some of the money they put aside. It’s like a subtle, long-term insurance policy against high turnover. So, while you’re earning your stripes, they're also hedging their bets.

Now, here's my unpopular opinion: sometimes, pension plans and their vesting schedules feel a bit like a game of "keep away." You're playing catch with your future self, and the employer holds the ball for a while. It can be frustrating, especially if you have to change jobs before you're fully vested.

Imagine hitting that perfect four-year mark, only to realize you’re about to be 100% vested, and then… life happens. You get a fantastic opportunity elsewhere, or maybe you need to move for family. And you have to walk away from that accumulated employer money. It stings, doesn't it?

It’s like being in line for a delicious cake, only to have the line suddenly move very, very slowly, and you might not get a slice. It tests your patience and your commitment. And let's be honest, sometimes life throws curveballs that make sticking around for that elusive vesting date impossible.

But, here's the silver lining: once you are vested, that money is yours to keep, even if you leave the company. It might sit in the pension plan until you retire, or you might have options to move it to a new employer's plan or an IRA. The important thing is, it’s no longer on a leash. It's your retirement gold.

So, the next time someone mentions their pension and the mysterious word "vesting," you'll know exactly what they're talking about. It's the waiting game, the earning of your rightful share, the slow and steady climb towards a more secure future. And while it might not be as exciting as instant riches, it's a crucial part of the retirement puzzle.

Embrace the vesting process, understand its rules, and know that your future self will thank you for your patience. Think of it as planting seeds. You don't see the full harvest the next day, but with consistent care, you'll eventually reap a bountiful reward. And that, my friends, is the magic of vesting in your pension plan. It’s a long game, but a rewarding one.

So, don't get discouraged by the waiting game. It's a sign that your employer values your commitment. And as you navigate your career, always keep an eye on your vesting status. It’s your personal retirement progress bar. Keep earning those points!