Us Citizen Working In Puerto Rico Taxes

Hey there, fellow adventurer! So, you're eyeing up a gig in the absolutely stunning, sun-drenched paradise of Puerto Rico, huh? That’s awesome! Imagine swapping your daily commute for a stroll on the beach, your bland office view for lush rainforests, and your worries for the sweet sound of salsa music. Sounds like a dream, right? But as much as we’d all love to just pack our bags and embrace the piña colada lifestyle, there’s this little thing called… taxes. Don’t let that word send shivers down your spine! We’re going to break down how being a U.S. citizen working in Puerto Rico affects your tax situation in a way that’s as easy to digest as a plate of mofongo.

Let’s get one thing straight from the get-go: you are still a U.S. citizen. This is huge! It means you don't need a special visa or anything to work there. You’re basically a resident of a U.S. territory, which comes with its own set of cool tax perks. Think of Puerto Rico like a U.S. state, but with way better weather and a lot more palm trees. And just like some U.S. states, it has its own tax system.

Now, here’s where things get interesting, and a little bit… taxing (pun intended, you’re welcome). For the most part, if you’re a U.S. citizen living and working in Puerto Rico, you are exempt from paying federal income taxes on your Puerto Rico-sourced income. Yes, you read that right. No federal income tax! It’s like finding an extra guayaba in your grocery bag – a delightful surprise!

This glorious exemption comes courtesy of a little something called Section 933 of the Internal Revenue Code. It’s basically the U.S. government saying, "Hey, go enjoy yourself in Puerto Rico, and we’ll give you a break on your federal taxes there." Now, this isn't some secret loophole for the super-rich or anything; it's designed to encourage people to live and work in the island.

But hold your horses, it’s not all sunshine and margaritas when it comes to federal taxes. There are a few caveats, and we need to chat about them. First off, this exemption applies to your Puerto Rico-sourced income. What does that mean? It means the money you earn from a job or business conducted within Puerto Rico. If you’re a remote worker for a company based in, say, California, and you’re just chilling on the beach in Vieques while you work, things can get a bit more complicated. That income might be considered U.S.-sourced, and therefore, taxable at the federal level. So, make sure you know where your paycheck is truly originating from!

Secondly, the exemption is for income tax only. We’re talking about the tax on your earnings. Other federal taxes, like Social Security and Medicare taxes, are still very much on the table. You’ll likely still be paying these, just like you would if you were living on the mainland. Think of it as your contribution to the national retirement fund and healthcare system – essential, even in paradise.

Now, let’s talk about Puerto Rico income taxes. Because Puerto Rico has its own government and its own tax system, you will have to file a tax return with the Puerto Rico Department of Treasury (Hacienda). Yep, you’ll be dealing with a whole new set of tax forms and deadlines. It's like learning a new dance routine – a little practice, and you’ll be grooving to the beat.

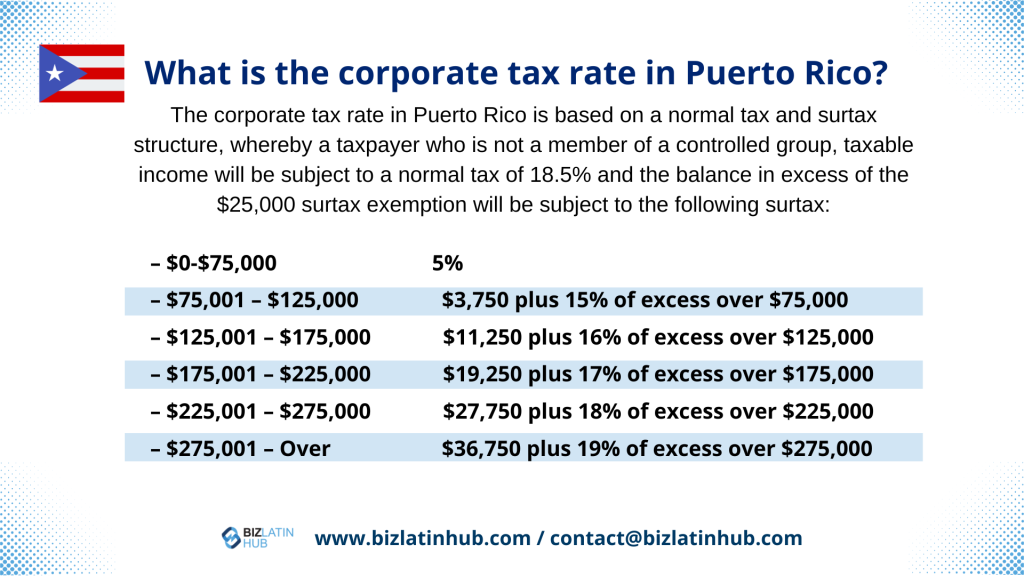

The tax rates in Puerto Rico can vary. They have their own progressive tax system, and depending on your income level, you'll be looking at different percentages. It’s a good idea to get familiar with their tax brackets and deductions. They might have deductions or credits that are specific to living in Puerto Rico, like for homeowners or for expenses related to earning income there.

One of the really cool things that might apply to you is the Tax Incentives Act of 1996 (Act 60), formerly known as Act 20 and Act 22. This is where things get really exciting for entrepreneurs and investors. If you’re starting a business in Puerto Rico or have certain types of investment income, Act 60 can offer some incredible tax benefits. We’re talking about significantly reduced or even 0% tax rates on certain business income and capital gains. How’s that for a motivation to set up shop?

However, Act 60 isn't a free-for-all. It has specific requirements. You typically need to become a bona fide resident of Puerto Rico, meaning you have to spend a certain amount of time on the island and establish your primary home there. You also need to have a qualifying business or investment that generates income within Puerto Rico. It’s not as simple as just saying, “I’m here for the tax breaks!” but for those who qualify, it can be a game-changer.

What about when you file your U.S. federal taxes? Even though you’re exempt from federal income tax on your Puerto Rico earnings, you still might need to file a federal return. This is especially true if you have other U.S.-sourced income that doesn’t qualify for the exemption, like that remote work for a mainland company we mentioned earlier, or maybe some rental income from a property you own back in the States. You’ll use Form 1040, and you’ll likely need to report your Puerto Rico income and claim the exemption using Schedule P (Form 1040), Notice of Taxpayer’s Election to Be Treated as Resident of Puerto Rico, or by reporting it on the appropriate lines to show it’s excluded. It can feel like a bit of a puzzle, but it’s all about showing the IRS, "Hey, I’m living the island life and my main income is tax-free at the federal level, per Section 933!"

Now, let's talk about residency. To truly benefit from the Section 933 exemption, you generally need to establish yourself as a bona fide resident of Puerto Rico. This means you’re not just on vacation with a work laptop. You need to show intent to reside there. This involves things like:

- Spending at least 183 days of the tax year in Puerto Rico.

- Not having a "tax home" outside of Puerto Rico.

- Not having closer connections to more than one place outside of Puerto Rico.

Basically, Puerto Rico needs to be your real home, not just a really nice Airbnb. This distinction is crucial for claiming those federal tax exemptions.

So, what happens if you’re a U.S. citizen living and working in Puerto Rico, but you also have income from the other 49 states? That income is generally taxable by the U.S. federal government. The exemption only applies to income earned in Puerto Rico. So, if you’re earning passive income from stocks you own in a U.S. brokerage account, or if you have a side hustle that’s entirely based in the mainland, you’ll likely owe federal taxes on that. It’s like having two different sets of rules for your income – one for island earnings and one for mainland earnings.

It’s also worth noting that Puerto Rico has its own self-employment taxes. If you’re working as an independent contractor or running your own business, you’ll be paying into the Puerto Rico system. Again, this is separate from what you might be used to on the mainland, but it's all part of contributing to the local economy.

And what about filing your Puerto Rico taxes? This is where you'll be interacting with the Departamento de Hacienda. You'll likely need to file an annual income tax return. The forms and deadlines are specific to Puerto Rico, so it's a good idea to consult their official website or a local tax professional. They might have different filing requirements, such as estimated tax payments throughout the year.

For those of you who are thinking about setting up a business there, remember that Puerto Rico has made significant efforts to attract businesses with incentives like Act 60. If you’re an entrepreneur looking for a more favorable tax environment, it’s definitely worth exploring. Just make sure you understand the requirements and commitments involved.

One of the most common questions is: "Do I have to pay taxes in both Puerto Rico and the U.S.?" Generally, no, not on the same income. If you’re a bona fide resident of Puerto Rico and your income is sourced from Puerto Rico, you’re usually exempt from federal income tax. However, you will pay Puerto Rico income tax. So, it’s not double taxation on your primary income, but rather a shift from federal taxes to local (Puerto Rico) taxes on that income. It’s a crucial distinction!

Think of it this way: The U.S. federal government gives you a pass on your island earnings, and Puerto Rico says, "Welcome! Here's how you contribute to our island’s development." It’s a partnership!

Now, for the nitty-gritty. The rules and regulations can change, and the specifics can get quite complex depending on your individual circumstances. Are you an employee? An independent contractor? Do you have investments? Do you own property on the mainland? All these factors can influence your tax obligations. This is where seeking professional advice becomes not just recommended, but highly recommended. A tax advisor who specializes in U.S. expatriate or territorial tax law can be your best friend. They can help you navigate the forms, ensure you’re claiming all the benefits you’re entitled to, and keep you out of hot water with both the IRS and Hacienda. Think of them as your personal tax sherpas, guiding you through the mountain of paperwork.

It's also a good idea to keep excellent records. Save all your income statements, receipts for business expenses, and any documentation that proves your residency in Puerto Rico. This will make tax filing much smoother and provide backup if any questions arise. Good record-keeping is like having a well-organized recipe box – you can whip up a delicious tax return without a fuss!

Finally, let's wrap this up with a smile. Moving to Puerto Rico and working there as a U.S. citizen is an incredible opportunity. Yes, taxes are a part of life, but the tax structure for U.S. citizens working in Puerto Rico is designed to be advantageous. By understanding the rules, doing your due diligence, and perhaps enlisting a little professional help, you can navigate the tax landscape with confidence. Imagine yourself, tax obligations understood, with a clear mind and a warm breeze on your face, ready to embrace all the beauty and vibrance that Puerto Rico has to offer. It’s not just about earning a living; it’s about living a life. So go ahead, chase that sunshine, and enjoy every moment! You've earned it!