Top Rated Credit Card Debt Relief Companies

Hey there, fellow humans! Are you juggling credit card bills like a circus performer trying to keep a dozen flaming torches in the air? Does the thought of your credit card statements make you want to hide under your duvet with a giant tub of ice cream? We've all been there, my friends. But what if I told you there's a secret society, a league of superheroes, ready to swoop in and save your financial sanity? Yep, I’m talking about the Top-Rated Credit Card Debt Relief Companies!

Imagine this: your credit card debt is like a pesky fly buzzing around your head, constantly annoying and hard to swat away. These companies are like the super-powered fly swatters you never knew you needed. They’re here to help you conquer that debt mountain and get back to living your best life. Think of them as your personal financial ninjas, silently and skillfully taking down your debt one by one.

Now, navigating the world of debt relief can sound as confusing as assembling IKEA furniture without instructions. But fear not! We've done the digging, the research, and the (imaginary) superhero costume fitting, all to bring you the crème de la crème of debt relief services. These are the companies that are consistently praised, the ones with stellar reputations and success stories longer than a CVS receipt.

Let's dive into some of the heavy hitters, the titans of debt transformation. First up, we have National Debt Relief. These guys are like the wise old wizards of the debt world. They’ve been around the block, they know all the spells, and they’re incredibly good at conjuring up solutions.

People rave about their transparency and the genuinely helpful advice they offer. They don't just wave a magic wand; they work with you, explaining every step of the process. It's like having a super-smart financial best friend who actually knows what they're talking about and has your back.

Then there's Debt.com. Now, these folks aren't a direct debt relief company themselves, but think of them as the ultimate matchmaker for debt solutions. They connect you with the right companies for your specific situation. It’s like a dating app for your debt – they help you find your perfect financial soulmate!

They’ve got a wealth of information, tools, and resources to help you understand your options. It’s a fantastic starting point if you’re feeling a bit lost in the financial wilderness. They’re like the helpful park ranger pointing you towards the right trail.

Moving on, let's give a massive shout-out to Credit Associates. These guys are like the meticulous architects of your debt-free future. They are known for their personalized approach, which is super important because let’s face it, your debt situation is as unique as your fingerprint (or your questionable taste in karaoke songs).

They take the time to understand your story, your budget, and your goals. Then, they craft a plan that’s tailor-made for you. It’s not a one-size-fits-all situation; it’s a bespoke suit for your financial well-being.

Another star player in this debt-busting league is Freedom Debt Relief. The name says it all, doesn't it? They aim to set you free from the shackles of high-interest credit card debt. They’re like the brave knights charging in to rescue you from the dragon of debt!

Their clients often highlight their professional and compassionate service. They understand that dealing with debt can be stressful, and they offer a supportive hand every step of the way. Imagine a calming spa day for your finances – that’s the vibe they often bring.

And we can't forget about Accredited Debt Relief. These guys are all about integrity and achieving results. Think of them as the no-nonsense, highly effective trainers who get you into the best financial shape of your life.

They’re known for their straightforward communication and their commitment to helping clients successfully navigate their debt relief journey. They’re the kind of people you want in your corner when you’re facing a tough financial battle. They’re your seasoned generals planning the ultimate debt victory!

Now, what makes these companies "top-rated"? It's not just about them making your debt disappear like a magician pulling a rabbit out of a hat (though that would be pretty cool!). It’s about their dedication to helping you achieve sustainable financial freedom.

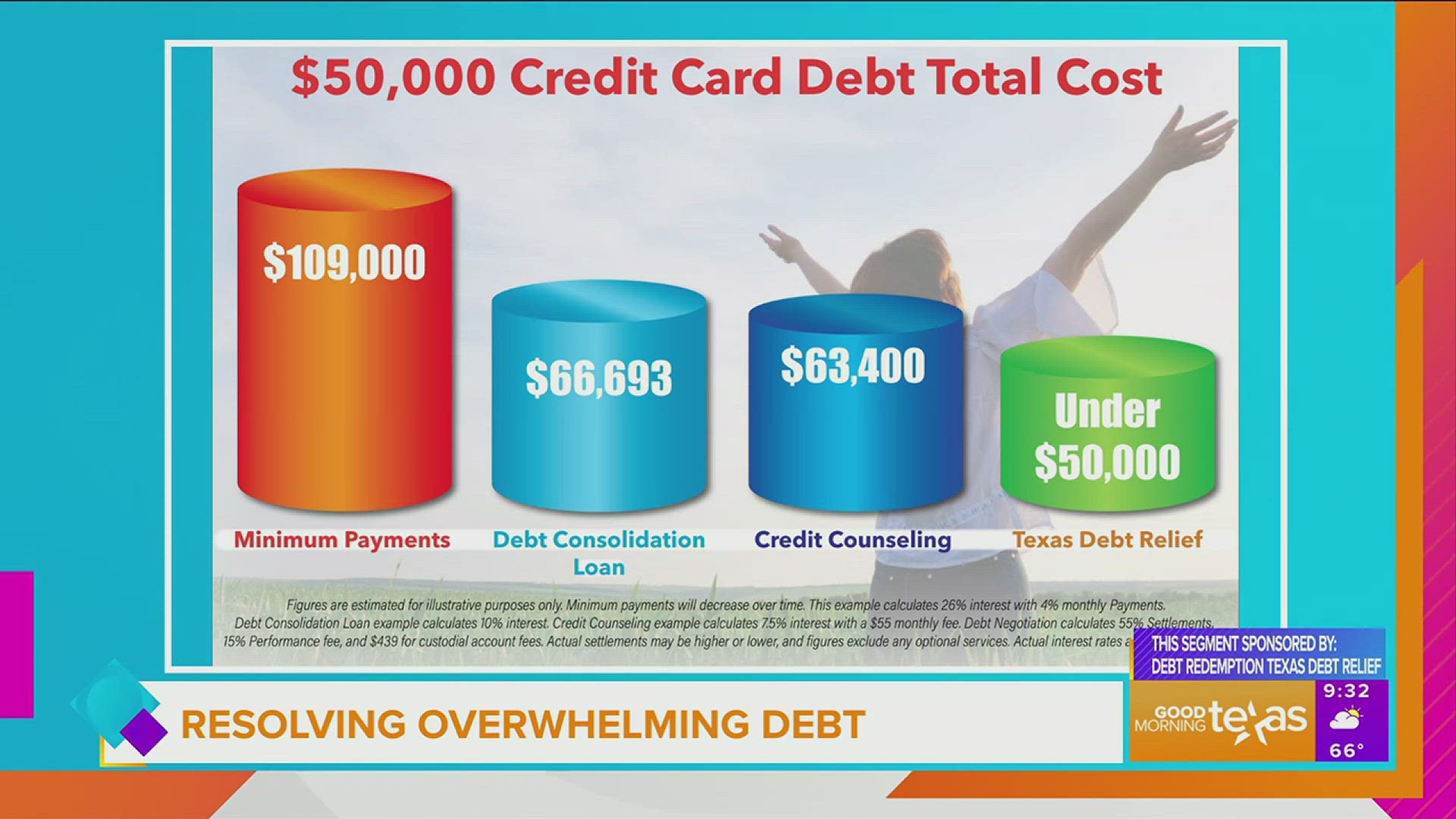

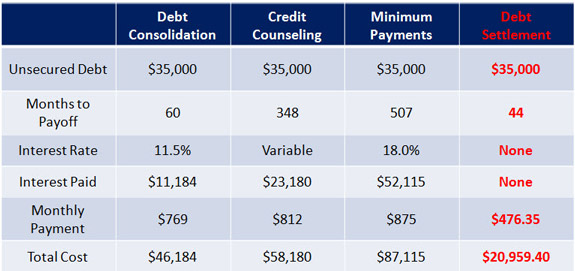

They often negotiate with your creditors to lower your interest rates, reduce your monthly payments, and sometimes even settle your debts for less than you owe. This can save you a boatload of cash and significantly shorten the time it takes to become debt-free. It's like finding a secret shortcut on a ridiculously long road trip!

These companies typically have a few different ways they can help. One common method is debt management, where they consolidate your payments into one manageable monthly sum, often with a lower interest rate. This is like tidying up your chaotic sock drawer into perfectly folded pairs.

Another approach is debt settlement. This is where they negotiate with your creditors to accept a lump sum payment that's less than the total amount you owe. It’s like getting a killer deal at a final clearance sale – you pay less and walk away with your financial freedom!

What you'll notice with these top-tier companies is their commitment to education. They don't want you to just get out of debt; they want you to stay out of debt. They'll often provide resources and advice on budgeting, saving, and smart spending habits.

It’s like learning to ride a bike – they help you get going, but they also teach you how to balance, steer, and avoid those pesky potholes. They’re equipping you with the skills for long-term financial success. They’re your financial senseis!

When you're looking at these companies, keep an eye out for a few key things. First, do they have accreditation from reputable organizations? This is like having a badge of honor that shows they're trustworthy and operate ethically. Think of it as a superhero's official emblem.

Second, read reviews and testimonials. What are actual people saying about their experiences? Are they singing the praises of these companies? It’s like checking out the Yelp reviews before trying a new restaurant – you want to know if it’s a hidden gem or a total disaster.

Third, understand their fee structure. Top-rated companies are usually upfront and transparent about their costs. You shouldn’t be surprised by hidden fees lurking in the fine print. It’s like knowing the price of everything before you commit to buying.

Finally, consider their customer service. Do they make you feel heard and understood? Are they responsive to your questions and concerns? You want a team that’s supportive and patient, not one that makes you feel like just another number.

So, if your credit card debt is making your life feel like a never-ending episode of "Who's Line Is It Anyway?" where all the points are made up and the prizes don't matter, it's time to call in the cavalry. These top-rated debt relief companies are ready to help you rewrite your financial story.

They’re not a magic bullet, and it takes effort on your part too. But with their expertise and your determination, you can absolutely achieve the sweet, sweet freedom of a debt-free life. Imagine finally being able to breathe easy when that credit card bill arrives, or even better, not receiving one at all!

So, go forth, my friends! Explore these fantastic companies, and take that crucial first step towards a brighter, less debt-filled financial future. Your future, debt-free self will thank you. Now go out there and conquer those credit cards like the financial warrior you are!