The Classical Dichotomy Argues That Changes In The Money Supply

Hey there, curious minds! Ever wonder what makes the prices of stuff go up or down? Like, why did that avocado toast suddenly cost a dollar more last week? Or why did my grandma’s favorite antique teacup seem like a steal a few years back? Well, buckle up, because we’re about to dive into a pretty neat idea from the world of economics called the Classical Dichotomy. Sounds fancy, right? But don't worry, it's actually a super chill concept that tries to explain some big picture stuff about how our economies tick.

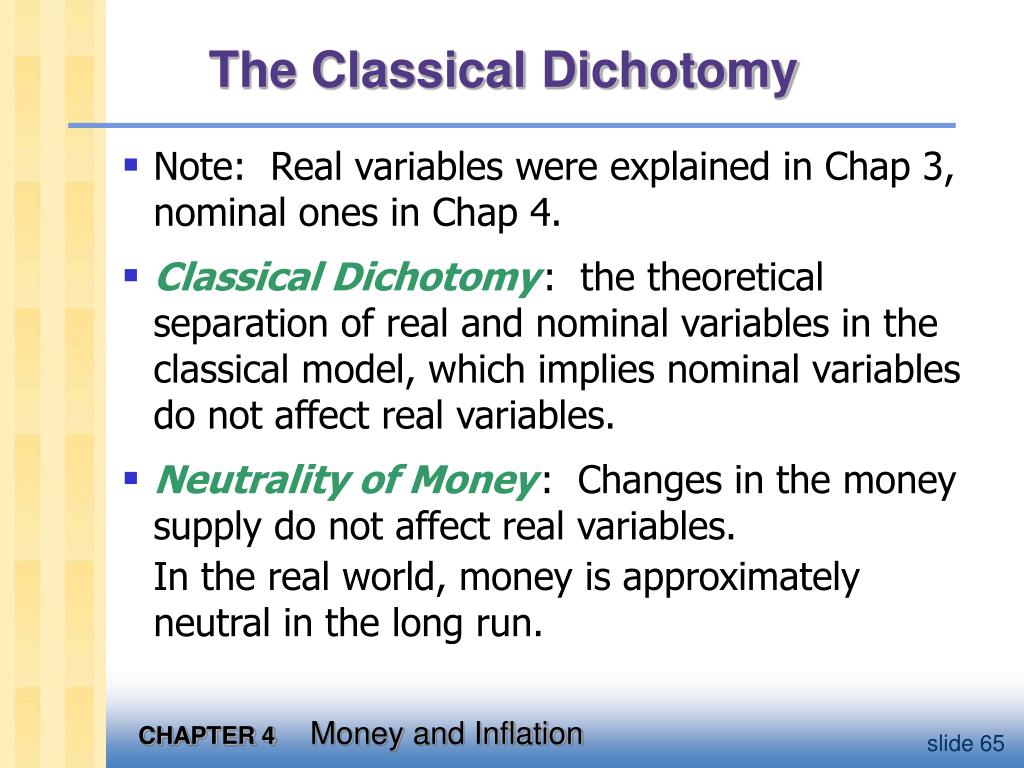

So, what exactly is this Classical Dichotomy thing? Imagine you have two totally different worlds, like a kitchen and a workshop. The Classical Dichotomy basically says that in an economy, we can, in a way, think about things happening in two separate spheres: the real world and the money world.

Let’s break it down. The real world is all about the actual stuff we make, buy, and sell. Think about it: the number of cars being produced, the amount of wheat farmers are growing, the number of houses being built, the skills of a carpenter, or even how much time you spend playing video games. These are all real things, right? They affect our actual lives and what we can do. It’s like the tangible output of our efforts.

And then there’s the money world. This is all about the numbers, the prices, the wages – you know, the stuff we use to measure the value of everything in the real world. If you get paid in dollars, those dollars are in the money world. If a loaf of bread costs 3 dollars, that’s also a part of the money world. It's the language we use to trade goods and services.

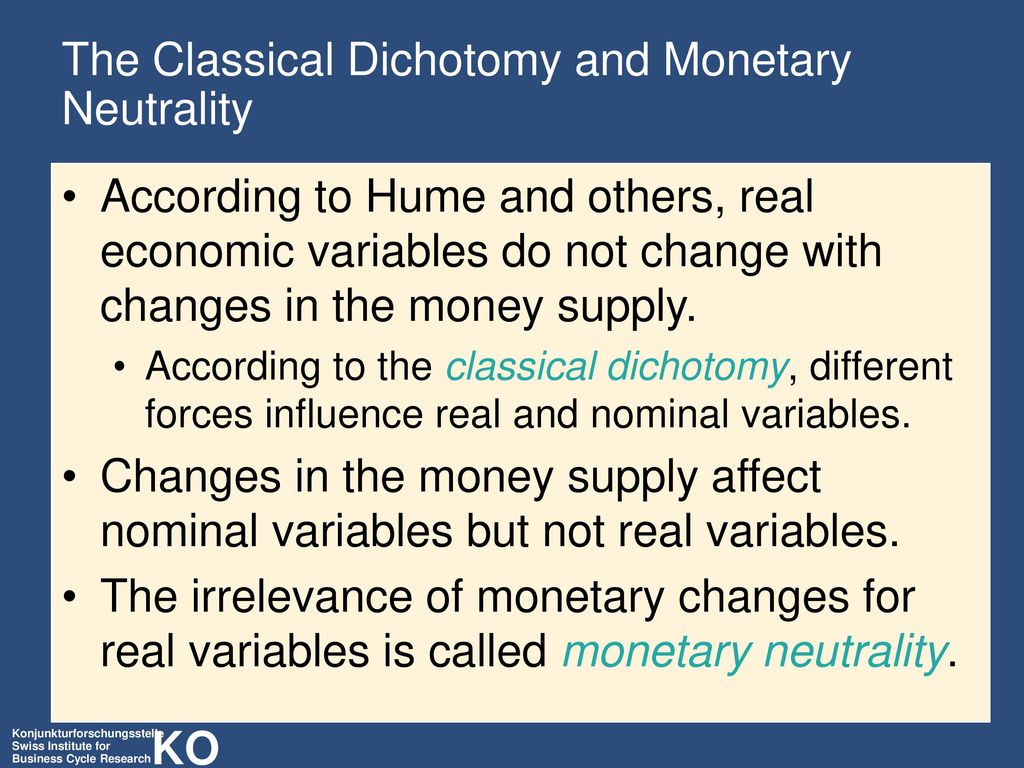

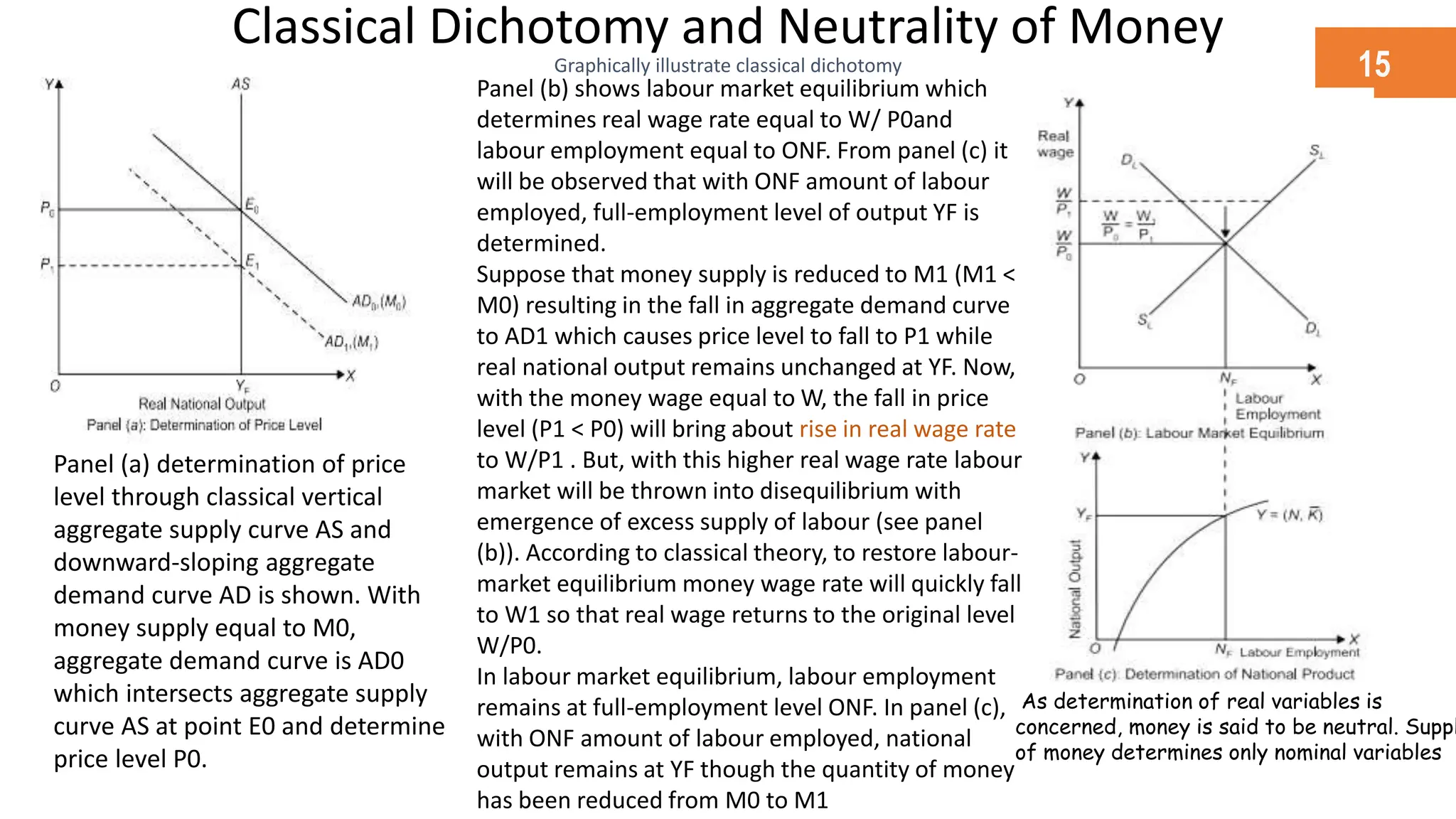

Now, here’s where the cool part of the Classical Dichotomy comes in. It suggests that, over the long haul, changes in the amount of money floating around in our economy – what economists call the money supply – mostly affect the money world, and have little to no effect on the real world. Mind blown, right?

Think of it like this: Imagine you have a pizza-making business. The real things are the ingredients (flour, tomatoes, cheese), the ovens, the skill of your pizza maker, and the number of pizzas you can actually bake in an hour. The money things are the price of a slice of pizza and how much you pay your pizza maker per hour.

Now, what happens if suddenly everyone in town gets an extra $100 in their pocket? Let’s say the central bank, the folks who control the money, prints a bunch of extra money and distributes it. This is a change in the money supply. According to the Classical Dichotomy, what’s likely to happen? Well, people might have more money to spend on pizza, so they’re willing to pay a bit more for it. The price of your pizza slices might go up from $3 to $3.50. You might also have to pay your pizza maker a bit more per hour to keep them happy.

But here’s the kicker: did the number of pizzas you can actually make change? Did you suddenly get more ovens? Did your pizza maker’s skill magically improve? Probably not! The ability to produce pizzas, the number of pizza ovens, the quality of the ingredients – those are all in the real world. They haven't fundamentally changed just because there's more money zipping around.

So, what’s the big deal?

It’s interesting because it tells us something fundamental about how economies adjust. If you pump more money into the system, it’s like adding more labels to the same pile of toys. The labels (prices) get bigger, but the number of toys (real goods and services) stays the same.

This idea is super old, dating back to thinkers like David Hume and John Stuart Mill. They were trying to figure out the relationship between money and the actual economy. And honestly, it’s a pretty powerful insight, even today.

Think of it as a giant scale. On one side, you have all the stuff being produced (real goods and services). On the other side, you have all the money available to buy that stuff (money supply). If you suddenly make the money side heavier, without changing the stuff side, what happens? The value of each unit of money goes down, which means the price of everything goes up. It’s like if you have one apple and ten people who want it. The apple is going to be expensive! But if you have ten apples and ten people, the price per apple will be much lower.

Why is this important?

Well, it helps us understand things like inflation. When the money supply grows much faster than the production of goods and services, you get inflation – that general rise in prices we all experience. The Classical Dichotomy suggests that this inflation is primarily a monetary phenomenon, not necessarily a sign that we're suddenly better at producing things or that people are suddenly lazier.

It also implies that policies aimed at boosting the economy should focus on the real side, like investing in education, infrastructure, or technology. If you just flood the economy with money, according to this view, you might just end up with higher prices and not much more actual wealth.

It’s like telling a chef: if you want more delicious meals, you can either get more high-quality ingredients and better cooking tools (investing in the real economy), or you can just put fancier price tags on the same old meals (just increasing the money supply). Which one do you think leads to actual culinary satisfaction?

Of course, economics is a messy, real-world thing. And there are a lot of smart people who debate how strictly this dichotomy holds. In the short term, changes in the money supply can affect real things. Think about it: if interest rates drop because of more money, businesses might borrow more and invest in new factories, which does affect the real economy. So, the Classical Dichotomy is more of a long-run tendency than an ironclad rule for every single moment.

But as a general principle, this idea that the money world and the real world are somewhat separate is pretty fascinating. It helps us untangle complex economic puzzles and think more clearly about what drives prosperity. It’s a reminder that while money is super important for how we trade and value things, the true engine of our well-being is our ability to actually produce and create real goods and services. Pretty cool, huh? Keeps you thinking, doesn't it?