The Business Cycle Illustrates The Long-run Fluctuations Of Brainly

Hey there! Grab your coffee, let's chat about something kinda cool, even if it sounds a little bit like homework. We're gonna talk about the business cycle. Yeah, I know, sounds dry, right? But stick with me, because it’s actually a pretty neat way to understand why things in the world feel like they're on this constant rollercoaster. And guess what? It totally illustrates those long-run fluctuations you might see on Brainly. Pretty wild, huh?

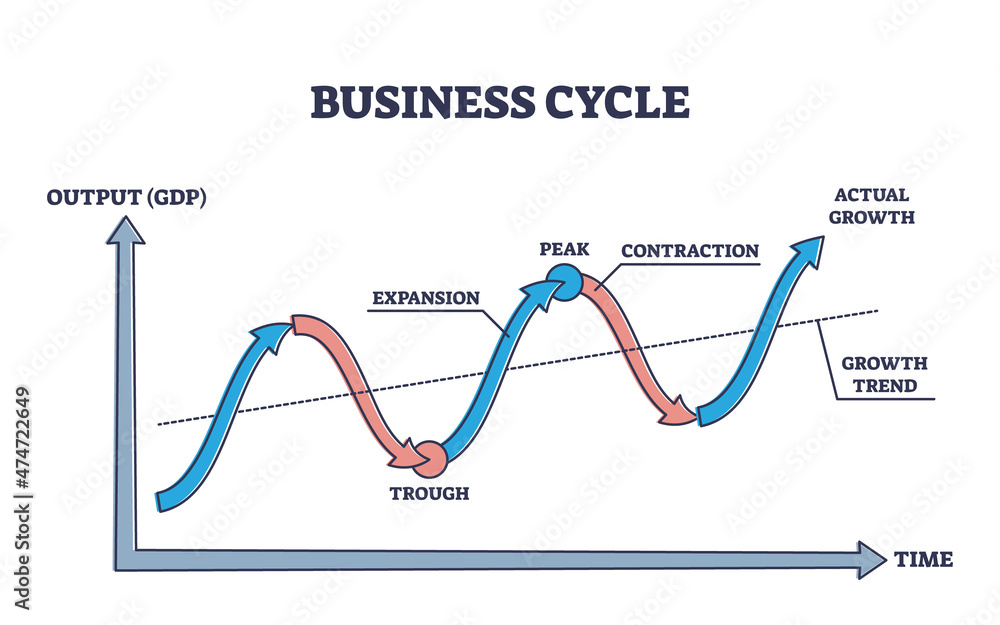

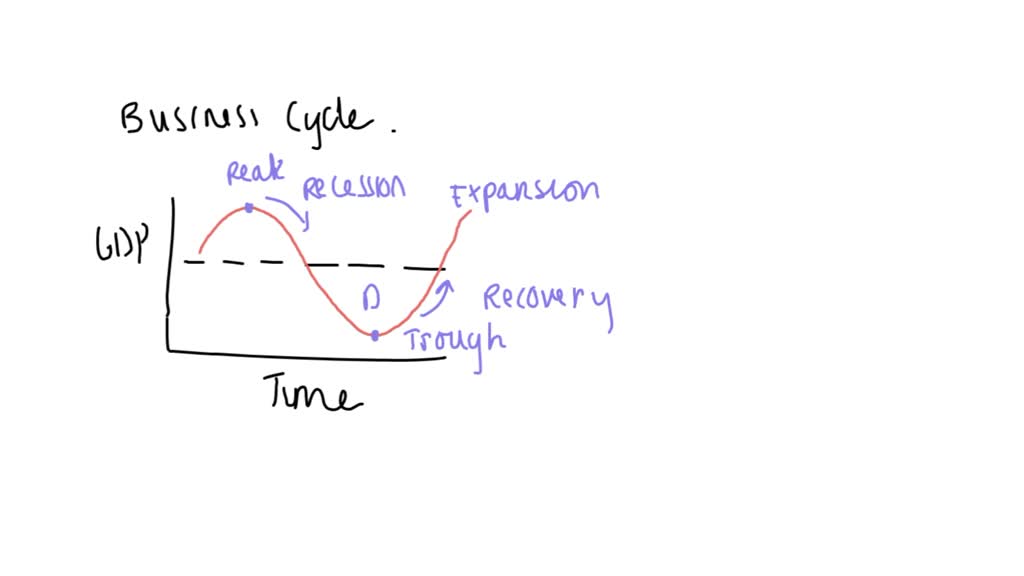

So, what IS this business cycle thing, anyway? Think of it like this: the economy isn't just a straight line going up, up, up. Nope. It’s more like a series of bumps and dips. Sometimes things are booming, everyone's spending money, jobs are plentiful – it’s like a big, happy party! And then, sometimes… well, things cool down. People get a little more cautious, maybe jobs get a bit harder to find. It’s the ebb and flow, baby.

Imagine you’re at a concert. There are those awesome moments where the crowd is going wild, singing along at the top of their lungs. That’s your expansion phase. Everyone’s hyped, the energy is high, and it feels like the good times will never end. Businesses are selling tons of stuff, making a mint. It’s the peak of the performance, you know?

But then, even the best concerts have to wind down, right? The music might get a little slower, the crowd starts to thin out a bit. That’s kinda like the peak of the business cycle. Things have been great for a while, but maybe they can't get much better. It's like reaching the summit of a mountain – the view is amazing, but you can't go any higher. For a little while, at least!

And what comes after the peak? The descent, my friends. This is where things start to slow down. Maybe people aren't buying as many new gadgets, or that restaurant you love is suddenly a little less packed. This is the contraction, or recession, phase. It’s not the end of the world, but it’s definitely a shift in gear. Think of it as the slow ballad after the rock anthem.

Now, if this contraction goes on for a while, and it gets pretty noticeable, we call it a recession. It’s like the concert is over, and everyone's shuffling out. Businesses might have to make some tough choices, and unemployment might tick up. It’s a bummer, no doubt about it. But here’s the kicker: recessions are usually temporary.

Eventually, things hit rock bottom. This is the trough. It’s the deepest part of the dip, the quietest moment of the concert. It feels like the music has stopped completely, and everyone’s a bit down. But, and this is a big BUT, it’s also the point where things can start to turn around. It's like the quiet before the encore!

And just like that, the music starts again! Slowly at first, maybe a few people start tapping their feet. Then, the energy picks up, and we’re back into another expansion. See? It's a cycle! Up, peak, down, trough, and then up again. It’s like the economy is doing its own little dance.

Now, you might be thinking, "Okay, I get the ups and downs, but what does this have to do with Brainly and 'long-run fluctuations'?" Ah, great question! Think about those ups and downs as the short-term movements within the economy. They're like the individual songs in our concert analogy.

But the business cycle, when you look at it over a really long time, shows us something bigger. It shows us the long-run trend. Even with all the little bumps and dips, the economy, over decades and decades, generally tends to grow. It’s like, even if our concert has some slow songs and some loud ones, the overall vibe and energy of attending concerts, in general, might be increasing over time. More people are going, the venues are bigger, you know?

So, when you see a question on Brainly about how the business cycle illustrates long-run fluctuations, they're not just asking about one little recession or one big boom. They're asking about how those individual ups and downs, when you zoom out and look at them over many, many years, paint a picture of overall economic growth. It’s the forest, not just the trees.

Imagine plotting the path of the economy on a graph over 50 years. You'd see all those jagged lines going up and down, up and down. Those are your business cycles. But if you were to draw a smooth line through all of it, a line that kind of averages out all those bumps, what would that line do? For most developed economies, that line would be sloping upwards. That’s your long-run growth!

The business cycle is like the noise and excitement of a crowd at a sporting event. There are cheers, groans, moments of intense focus, and periods of relative calm. But if you watch that stadium over many seasons, the overall attendance might be increasing, the team might be getting better, and the sport itself might be gaining popularity. The fluctuations are the individual games; the long-run trend is the sport's growth.

Brainly questions often test your understanding of this very concept. They want to know if you can see that beneath the day-to-day drama of economic news, there’s a larger story unfolding. The business cycle is the mechanism by which these fluctuations happen, and these fluctuations, over time, demonstrate the overarching trend.

Think about technological advancements. They often drive expansions. New innovations lead to new products, new industries, more jobs, and more spending. That’s a huge boost! But sometimes, the excitement around a new technology can lead to over-investment, or older technologies become obsolete, contributing to a contraction. It’s a constant churn, a reshuffling of the economic deck.

And what about government policy? Governments try to smooth out these cycles. They might lower interest rates during a contraction to encourage borrowing and spending, or raise them during an expansion to prevent the economy from overheating and causing inflation. It's like they're trying to be the DJ, mixing the music to keep the party going at a steady pace, without too many jarring transitions.

Sometimes, these cycles can feel pretty intense. A deep recession can be really tough on people, leading to job losses and financial hardship. It's in those moments that the "long-run" part can feel pretty far away. It's like being stuck in a really slow song, and you just want the next upbeat track to start!

But history shows us that economies are remarkably resilient. Even after major downturns, they tend to bounce back and continue on their upward trajectory. That's the magic of long-run growth. It's fueled by things like increased productivity, a growing labor force, and the relentless pursuit of innovation. These are the powerful forces that, over time, pull the economy upwards, even through the inevitable bumps in the road.

So, when you’re looking at Brainly, and you see a question about the business cycle and long-run fluctuations, remember our concert analogy. The business cycle is the setlist, the ups and downs of individual songs. But the long-run fluctuation, that’s the overall popularity and growth of live music over decades. One is the immediate experience, the other is the broader historical narrative.

It's like looking at a single wave on the ocean versus looking at the tide. A single wave can crash and recede, but the tide is a much larger, slower movement that dictates the overall sea level. The business cycle is the wave; the long-run fluctuation is the tide.

And this concept is super important for understanding how the world works. It helps us explain why some periods are good for starting businesses and others are better for being cautious. It helps us understand why governments intervene in the economy. And it gives us a sense of perspective when we see news about economic downturns – they are part of a larger pattern, not necessarily a permanent state of affairs.

The beauty of the business cycle is that it’s a continuous process. There’s no final peak or ultimate trough. It’s just a perpetual dance of expansion and contraction, always moving, always evolving. And superimposed on all these movements is that steady, underlying force of long-run growth.

So next time you’re on Brainly and you see that question, don't just stare at it blankly. Think about the concert, the stadium, the ocean tide. Think about how those individual ups and downs, those exciting highs and those challenging lows, are all part of a much bigger, longer story of economic progress. It’s a story that, despite the occasional dramatic plot twists, generally keeps moving forward. Pretty neat, huh? Now, go get a refill!