The Arithmetic Average Rate Of Return Measures The ____.

Ever feel like your brain does a little somersault when someone whips out terms like "arithmetic average rate of return"? Don't worry, you're not alone! It sounds super fancy, like something only rocket scientists or Wall Street wizards would understand. But guess what? It's actually a pretty down-to-earth concept, and understanding it can totally spice up your financial life and make you feel like a smarty-pants in the best possible way.

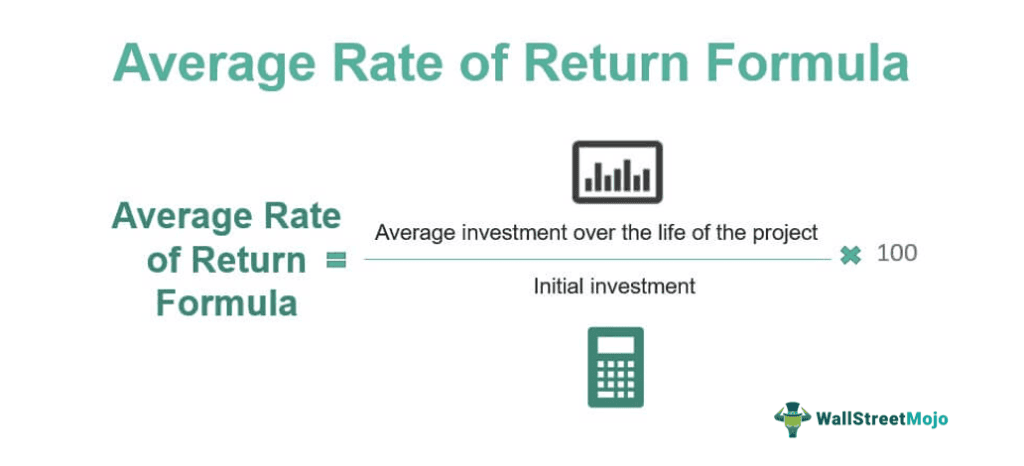

So, what exactly does this mysterious phrase measure? Drumroll, please... 🥁 The arithmetic average rate of return measures the average performance of an investment over a specific period. Think of it as your investment's report card, but instead of letters, you get cool percentage points!

Unpacking the "Arithmetic Average" Mystery

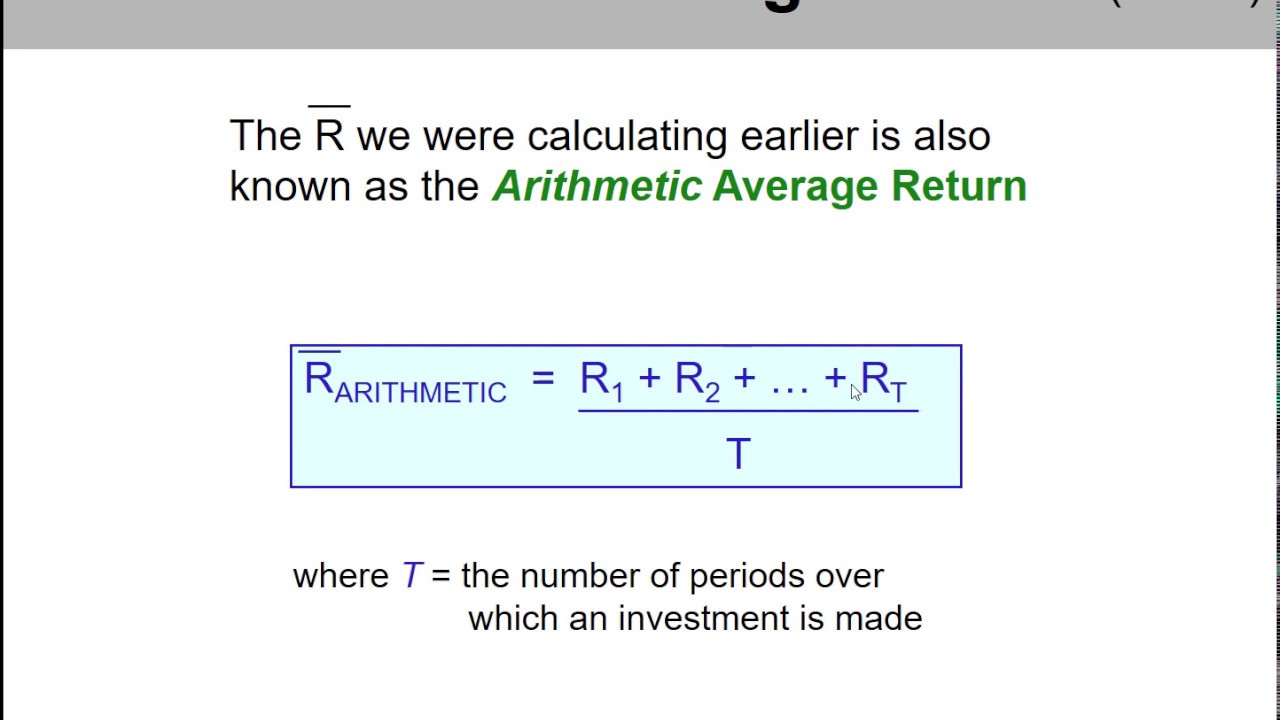

Let's break it down. "Arithmetic" is just a fancy word for the kind of averaging you probably learned back in school. Remember adding up all your test scores and dividing by the number of tests? Yep, it's that simple! We're taking all the individual rates of return for each year (or period) and then finding their average. Easy peasy, right?

And "Rate of Return"? That's just a way of saying how much your investment grew (or shrunk, but let's focus on the good stuff!) in percentage terms over a particular time frame. So, if you invested $100 and it grew to $110, your rate of return for that period was 10%.

When we combine them, the arithmetic average rate of return gives us a single, easy-to-digest number that tells us, on average, how well your investment has been doing. It’s like getting a summary of your investment’s highlights reel!

Why This Little Number Can Be Your Financial Buddy

Now, you might be thinking, "Okay, that's nice, but how does knowing this make my life more fun?" Oh, my friend, prepare to be enlightened! This isn't just about numbers; it's about making smarter, more confident financial decisions.

Imagine you're looking at two investment options. One has a higher arithmetic average rate of return than the other. That immediately gives you a clear signal, a starting point for your decision-making. It's like having a superpower that helps you spot potentially better opportunities!

It allows you to compare different investments side-by-side. Are you thinking about putting your hard-earned cash into stocks, bonds, or maybe a groovy real estate venture? The arithmetic average rate of return can be your trusty compass, guiding you through the often-bewildering world of investments.

It also helps you set realistic expectations. If you see that historical investments in a certain area have averaged, say, 8% per year, you know that aiming for 50% in a year might be a bit… optimistic. And managing expectations is a HUGE part of avoiding stress and enjoying the journey!

Plus, understanding this helps you celebrate your wins! Did your investment strategy pay off? Seeing that positive arithmetic average return is like a little pat on the back from the universe, acknowledging your smart choices. High five yourself!

It's Not Just About the Destination, It's About the Journey (and the Averages!)

Now, a tiny little caveat (but a friendly one!). The arithmetic average is fantastic for understanding past performance and getting a general idea. However, it doesn't tell you the whole story of risk. An investment that had some wild swings – big gains one year, big losses the next – could have the same arithmetic average as a super steady, slow-and-steady Eddie investment. Both might end up with the same average return, but the feeling of riding those waves is very different, right?

Think of it like this: If you drive to work and sometimes hit traffic and sometimes fly down the road, your average commute time might be 30 minutes. But that doesn't tell you about the days you were stuck for an hour! The arithmetic average gives you a good snapshot, but it smooths out the bumps and the exhilaration.

But don't let that stop you! It's still a super useful tool in your financial toolbox. It’s a stepping stone to understanding more complex concepts, and honestly, just demystifying these terms can be incredibly empowering.

Making Investing Less Scary and More Exciting!

When you understand what the arithmetic average rate of return is, you’re no longer intimidated by financial jargon. You can actually engage in conversations about money with more confidence. You can ask informed questions. You become an active participant, not just a spectator.

And that, my friends, is where the fun truly begins! Investing shouldn't feel like a chore; it should feel like an adventure. It’s about making your money work for you, so you can live the life you dream of. And understanding basic metrics like the arithmetic average rate of return is a key part of that exciting journey.

It’s about building a brighter future, one smart decision at a time. It’s about the satisfaction of seeing your wealth grow, steadily or with a little bit of excitement. It’s about the peace of mind that comes from understanding where your money is going and how it’s performing.

So, next time you hear "arithmetic average rate of return," don't glaze over. Smile! You know it's measuring the average performance of an investment. It's a simple yet powerful piece of information that can help you navigate the financial world with a little more clarity and a lot more joy. Go forth and be financially savvy, you magnificent human!