Td Bank Minimum Balance For Savings Account

Let's talk about savings accounts. Specifically, let's chat about TD Bank. You know, that friendly green place where you can stash your hard-earned cash. We all have one, right? Or at least, we should. It’s like a piggy bank, but fancier. And with slightly less chance of you finding ancient pennies in it.

Now, here’s where things get… interesting. When it comes to a TD Bank savings account, there's often talk of a minimum balance. The dreaded, the mysterious, the sometimes elusive minimum balance. It’s like a secret handshake, but instead of cool knuckles, you're dealing with dollars and cents.

My unpopular opinion? Sometimes, these minimum balances feel like a gentle nudge. Or maybe a not-so-gentle shove. It’s like your bank is saying, "Hey there, friend. We appreciate your business. But can you maybe, just maybe, keep a little more green with us? Pretty please?"

And for the longest time, I just accepted it. "Oh, a minimum balance," I'd nod sagely, as if I understood the cosmic implications of keeping a specific number of dollars in my account. It felt like a rule set by folks who definitely have enough spare change to buy a small island. And I was just over here, counting the lint in my pockets and hoping for a stray quarter.

But then I started thinking. Is this minimum balance thing really necessary? Like, for my savings account? I'm trying to save, right? That's the whole point. I'm not trying to run a hedge fund from my kitchen table. I'm just trying to build up a little cushion. Maybe for a rainy day. Or for that really nice coffee machine I’ve been eyeing.

You see, the idea of a minimum balance can sometimes feel a bit like a hurdle. It's like, "Okay, you want to save? Great! Now, can you also keep this amount here at all times, or we'll have to… well, let's not even go there." And suddenly, your humble savings goal feels a little more complicated. It’s like trying to get a driver's license, but the road test involves juggling flaming torches while reciting Shakespeare backwards.

I’m pretty sure that when most of us open a savings account, we’re not thinking, “Ah, yes, I shall now meticulously manage a specific dollar threshold to avoid any… inconveniences.” We’re thinking, “Let’s put this money somewhere safe. Somewhere it can grow, even if it’s at the speed of a particularly determined snail.”

And here's the thing about TD Bank. They're usually pretty straightforward. They have friendly tellers, convenient ATMs, and a generally pleasant banking experience. But then this minimum balance thing pops up, and it’s like, "Wait a minute. Am I being punished for trying to be responsible?" It’s a confusing message, if you ask me.

I sometimes envision the bank executives in a room, stroking their chins, saying, "We need to incentivize… activity. Yes, activity. But not too much activity. Just the right kind of activity. The kind that keeps a certain number of zeroes in our vaults." It’s a delicate balance, I’m sure.

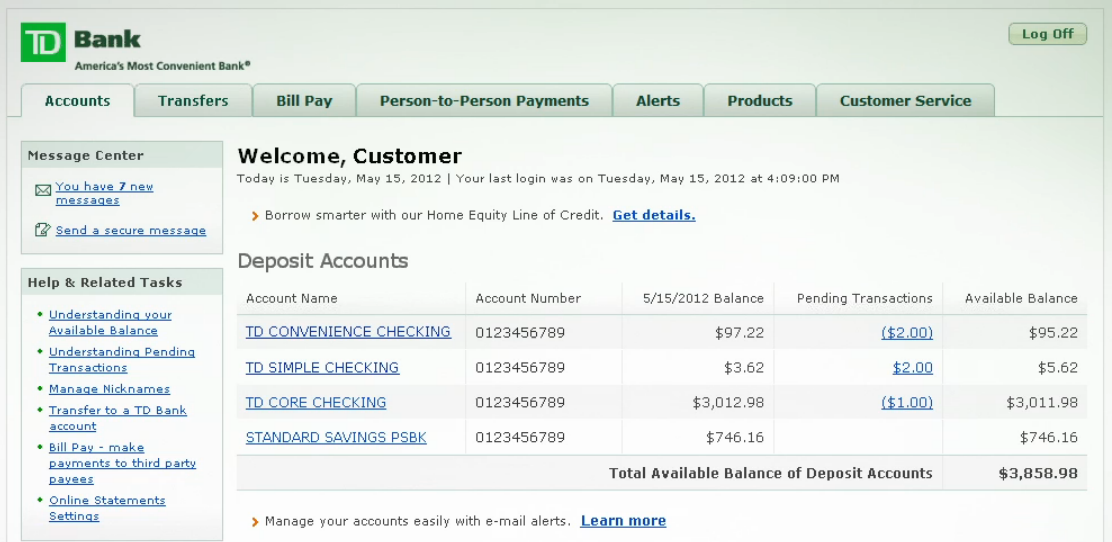

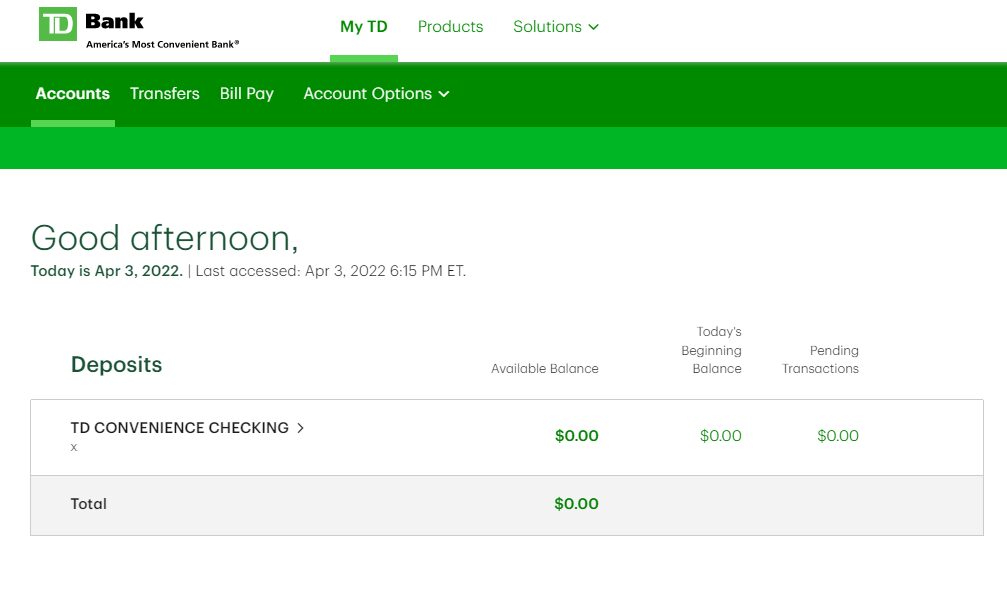

So, what’s the actual number? For a TD Bank savings account, it can vary. Sometimes it's a few hundred dollars. Sometimes it's a bit more. And for some accounts, there might not even be a minimum balance! It’s enough to make your head spin a little, like you've just stepped off a merry-go-round. You’re looking for solid ground, and instead, you find a revolving door of numbers.

"The minimum balance. Is it a suggestion? A threat? A cosmic test of your financial fortitude?"

And let’s be honest, for many of us, that minimum balance amount can feel like a significant chunk of our savings. It’s like your bank is asking you to put a down payment on your own money. "Here's your savings, but first, prove you have a commitment to having savings." It's a bit of a paradox, don't you think?

I’ve often wondered if the people setting these minimum balances have ever actually tried to save from scratch. Like, starting from zero, with just a dream and a slightly ripped wallet. If they had, they might understand that every dollar counts. Every single one. And sometimes, the goal is just to get to that first hundred, not to worry about keeping a hundred and then some in there perpetually.

Perhaps, and this is just me, a radical thought, I know, but perhaps the best incentive for saving is… well, the ability to actually save. Without the feeling that you're constantly on the brink of some invisible financial penalty. It’s like trying to encourage someone to run a marathon, but telling them they have to sprint the first mile at a sub-four-minute pace. It’s a bit discouraging.

So, next time you’re checking your TD Bank savings account, and you see that little notification about a minimum balance, just give it a wink. A knowing, slightly amused wink. Because we’re all just trying to do our best with our money. And sometimes, the best thing a bank can do is just let us save. Without making us feel like we're auditioning for a role in the "Financial Fortress" movie. It's enough to make you chuckle, isn't it? Just a little bit.