Simple Ira Contribution Limits 2024 Over 50

Hey there, coffee buddy! So, we're talking about money, retirement, and all that grown-up stuff. Fun, right? Well, sort of. Let's dive into those IRA contribution limits for 2024, especially if you're rocking the "over 50" club. You know, the club where your back might crackle more than a bag of chips, but your brain is still sharp as a tack? Yeah, that one!

First off, don't panic. This isn't some secret handshake or a pop quiz. It's just about knowing how much you can squirrel away for your golden years. And honestly, the government isn't being totally stingy. They even give you a little "catch-up" bonus. How thoughtful!

The Basics, Without the Boring Bits

Okay, so for the year 2024, the standard IRA contribution limit for anyone under 50 is going to be $7,000. Yep, seven grand. That's like, a really nice vacation. Or, you know, a decent chunk towards not having to eat ramen forever. Your call!

But wait! The magic happens when you hit the big 5-0. Or, you know, the year you turn 50. This is where the "catch-up contribution" comes into play. Think of it as a little "thank you" for all those years you've been adulting. The government basically says, "You've been working hard, maybe you didn't start saving early enough, so here's a little extra wiggle room." Isn't that sweet?

The Sweet, Sweet Catch-Up

So, what is this magical catch-up contribution? For 2024, if you are age 50 or older, you get to add an extra $1,000 on top of the standard limit. That brings your total potential contribution to a cool $8,000. Eight thousand! That's more than one nice vacation. Maybe two, if you're thrifty!

This is HUGE, people! Why? Because time is a funny thing. For those of us who might be a little "later to the party" in terms of retirement savings, this catch-up is a lifesaver. It’s like getting a cheat code in a video game, but for your financial future. Who doesn't love a cheat code?

Traditional vs. Roth: Does It Even Matter for the Limit?

Now, you might be wondering, "Does this limit apply to both my Traditional IRA and my Roth IRA?" And the answer is, for the total contribution limit, yes, it does. The $7,000 (or $8,000 if you're 50+) is the combined maximum you can put into all of your IRAs. So, you can't put $7,000 in a Traditional and then another $7,000 in a Roth. That would be too easy, wouldn't it?

Think of your IRA limit like a pie. You can slice that pie up and put some in your Traditional and some in your Roth, but the whole pie can only be so big. The IRS is the baker, and they've decided the maximum pie size for 2024. For those over 50, they've just added a little extra crust!

The difference between Traditional and Roth is more about when you get the tax break, not how much you can contribute. With a Traditional IRA, your contributions might be tax-deductible now, and you pay taxes when you withdraw in retirement. With a Roth IRA, you contribute with money you've already paid taxes on, and then qualified withdrawals in retirement are tax-free. Pretty sweet deal, right?

But for hitting that contribution limit, they both play by the same rules. So, decide which one tickles your financial fancy more, and then start filling it up, up to that generous limit.

Why Bother with the Catch-Up?

Seriously, why? Because retirement is a marathon, not a sprint. And for many of us, we might have started the race a bit later. Or maybe life threw some curveballs, and saving took a backseat for a while. Kids, mortgages, unexpected trips to the vet for your beloved, but expensive, pug. You know the drill.

The catch-up contribution is a gift. It's a chance to make up for lost time without feeling like you're sacrificing your entire social life. Because, let's be honest, we still want to go out for that coffee, right? We don't want to be the person who only eats rice cakes and watches paint dry in retirement.

Imagine this: You're 50, and you've got a good chunk of change already saved. Now, thanks to this catch-up, you can boost that even faster. That means potentially retiring a little earlier, or having a more comfortable retirement, or being able to afford those fancy avocado toast brunches without guilt. The possibilities are endless!

What About Other Retirement Accounts?

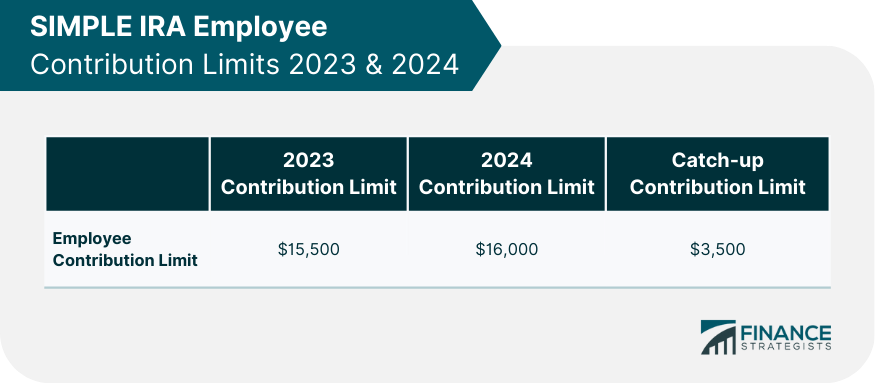

Now, this is just about IRAs. If you're lucky enough to have a 401(k) or a similar employer-sponsored plan, those have their own, usually much higher, contribution limits. And guess what? They often have their own catch-up contributions too! So, don't forget to look into those as well. It's a whole smorgasbord of retirement savings opportunities out there!

The key is to maximize every opportunity. If you can contribute to both an IRA and a 401(k), and you're over 50, you're looking at some serious savings power. It's like having a superpower for your future self. And who doesn't want superpowers?

Important Caveats (Because There Always Are)

Before you go off and deposit your entire paycheck into your IRA, a couple of quick but important notes. First, these limits are for contributions. If you have an existing IRA, you can't just magically turn last year's savings into this year's contribution. This is about putting new money in.

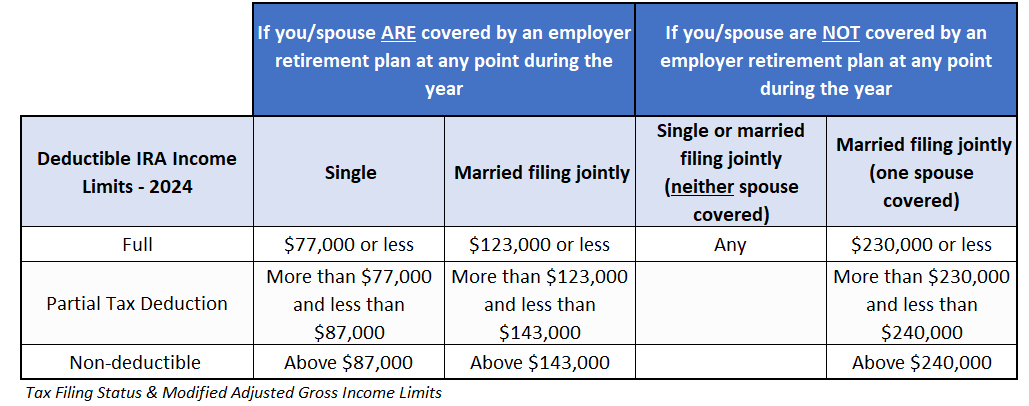

Second, there are income limitations, especially for Roth IRAs and deductibility of Traditional IRA contributions. So, while the limit is $8,000 (for over 50), you might not be able to contribute the full amount if your income is too high. It’s always a good idea to check the IRS website or chat with a financial advisor if you're unsure about your specific situation. They're the wizards of the tax code!

And, of course, these are limits for individual contributions. If you're married, your spouse has their own separate IRA limit and catch-up contribution. Double the savings potential! It’s like a team effort for your financial future. High fives all around!

Making it Happen: Practical Tips

So, how do you actually do this? It's easier than you think. Most brokerage firms and banks make it super simple to set up an IRA. You can usually do it online in a matter of minutes.

Consider setting up automatic contributions. Treat it like any other bill you have to pay. Set it and forget it! You can have a certain amount automatically transferred from your checking account to your IRA each month. This way, you're consistently saving without even having to think about it. Out of sight, out of mind, but definitely in your retirement account!

Another thing: review your budget. Are there small expenses you can cut back on? That daily fancy latte? That subscription service you never use? Those little bits can add up quickly and make a big difference in your ability to hit that IRA limit. Think of it as reallocating funds from "fun now" to "fun later, but much more fun!"

The Power of Compound Interest

And let's not forget the magic of compound interest. The earlier your money starts working for you, the more it grows. That $8,000 you contribute today could be worth a whole lot more down the road, thanks to the magic of earning interest on your interest. It's like a snowball rolling down a hill, getting bigger and bigger.

The catch-up contribution gives you that extra push to get that snowball rolling even faster. It’s a powerful tool for those of us who might need a little extra boost to reach our retirement goals. So, embrace the catch-up! Your future self will thank you with a knowing wink and maybe a very comfortable armchair.

Don't Wait!

Honestly, the biggest takeaway here is: don't procrastinate. The sooner you start contributing, and the more you contribute, the better off you'll be. Those limits are there for a reason, and for those of us over 50, that catch-up is a golden ticket.

So, grab another cup of coffee, think about your dreams for retirement – whether it's traveling the world, mastering a new hobby, or just having the peace of mind of financial security – and then make a plan to hit that 2024 IRA contribution limit. You've got this!

And remember, if you're feeling overwhelmed, a quick chat with a financial advisor can be incredibly helpful. They can help you navigate the rules and make a plan tailored just for you. You're not alone in this!

So, cheers to saving for the future, and here's to making the most of that sweet, sweet catch-up contribution. Now, go forth and contribute wisely!