Should I Invest In Dow Jones Or S&p 500

Alright folks, gather 'round! Let's talk about something that sounds a bit like a secret handshake at a fancy club: investing in the Dow Jones or the S&P 500. Now, before your eyes glaze over like a donut fresh out of the fryer, stick with me. We're going to demystify this whole thing, and I promise, it'll be more fun than trying to assemble IKEA furniture with just the picture instructions.

Imagine you're at a huge, bustling farmers' market. You've got all sorts of goodies: juicy tomatoes, crusty bread, artisan cheese. Now, let's say you want to get a general "feel" for how well the market is doing. Are people buying a lot? Is business booming? You could try to track every single vendor, but that sounds like a lot of work, right? You'd need a super spreadsheet and probably a third cup of coffee.

This is where our two heroes, the Dow Jones Industrial Average (let's just call it the Dow for short, because who has time for "Industrial Average"?) and the S&P 500, come in. Think of them as your market cheerleaders. They're not selling you anything directly, but they're giving you a pulse check on the overall health of the biggest companies out there.

The Dow is like the "greatest hits" album of American business. It's been around for a while, a real veteran. It's made up of 30 of the biggest, most well-known companies in the country. Think of them as the rock stars of the business world. We’re talking about companies whose names you probably hear every day, companies that make the stuff you use, wear, and maybe even eat. It's a curated list, like a VIP section of the stock market.

It's like picking your all-time favorite superheroes to represent the entire comic book universe. You've got the big names, the ones with the iconic logos!

Dow Jones vs Nasdaq vs S&P 500: Structure and Key Differences

Now, the S&P 500, on the other hand, is more like the entire top-40 radio station. It's a much bigger club, made up of 500 of the largest publicly traded companies in the United States. This means it's a broader snapshot. It includes not just the rock stars, but also the talented musicians who might not be topping the charts yet but are definitely part of the vibrant music scene. It gives you a more diverse mix.

So, if the Dow is your curated playlist of legends, the S&P 500 is your entire streaming service library. It's got more variety, more different kinds of music (or, in this case, businesses).

Now, the big question: which one should you be listening to? Or, more importantly, which one should you be investing in? It's like choosing between that perfectly aged, slightly pricey bottle of wine (the Dow) and a really good, well-rounded case of assorted craft beers (the S&P 500).

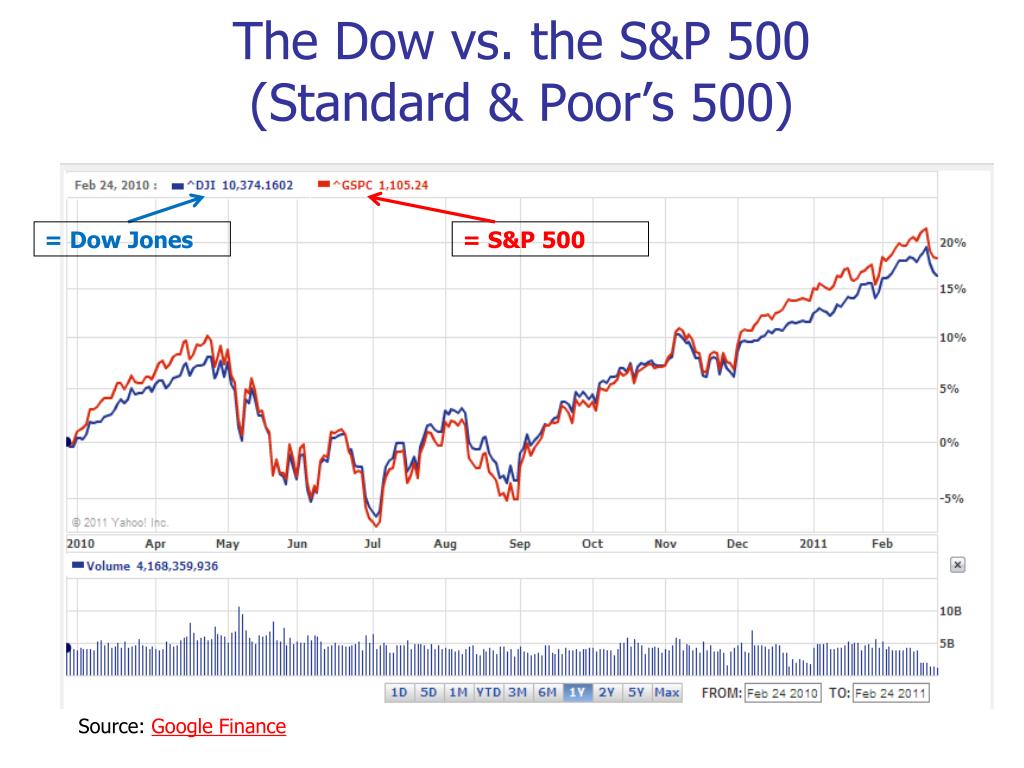

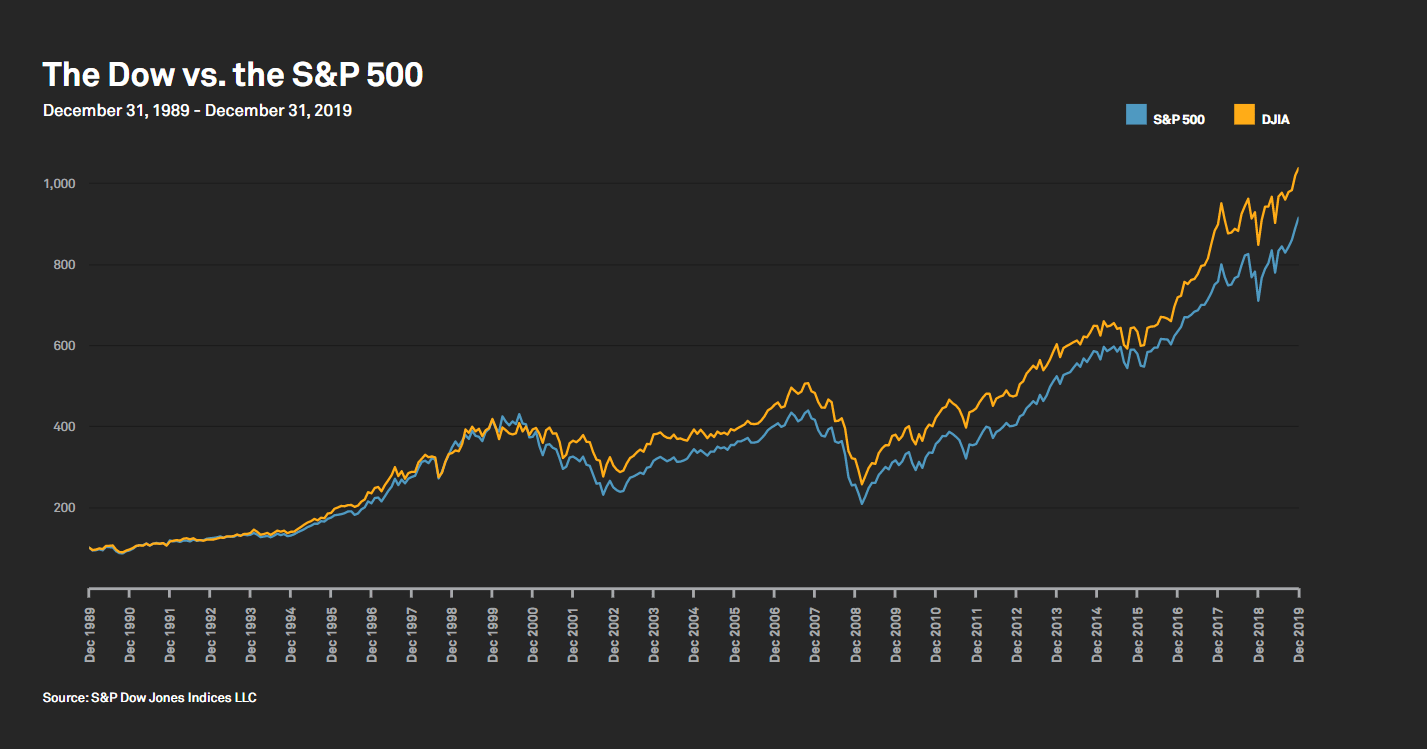

Historically, both have done a pretty good job of making money over the long haul. Think of them as two trusty steeds, carrying your investment dreams forward. But here's where it gets a little interesting. Because the S&P 500 includes so many more companies, it’s often seen as a more complete picture of the U.S. stock market. It's like trying to understand the weather by looking at 500 different weather stations versus just 30.

The Dow, with its smaller, more select group, can sometimes be a bit more… dramatic. Imagine if one of your 30 rock stars had a really bad concert. It could shake things up a bit more than if one musician out of 500 had a slightly off note. This doesn't mean it's bad, just that its movements can sometimes be a bit more pronounced because it's less diversified.

The S&P 500, with its larger cast of characters, tends to be a bit smoother. It's like a well-rehearsed orchestra. If one instrument falters, the others can often pick up the slack, leading to a more consistent overall sound (or stock market performance).

It’s the difference between a star quarterback having a slightly off day versus your entire league of skilled players navigating the field.

For most people dipping their toes into investing, the S&P 500 is often the go-to. Why? Because it’s simple, it’s broad, and it generally mirrors the overall growth of the U.S. economy. You’re essentially investing in a massive chunk of American success. It's like buying a tiny piece of a really, really big pie.

The Dow is still a fantastic benchmark, and many people love it because it represents those iconic American brands. It’s got a certain nostalgic appeal, like a classic car. But when it comes to sheer breadth and diversification, the S&P 500 usually takes the cake.

So, should you invest in the Dow or the S&P 500? Think about it this way: do you want to bet on your favorite 30 rock stars to keep hitting home runs, or do you want to invest in the entire music industry, from the legends to the rising stars? For most folks, that broader investment in the whole industry, the S&P 500, is a pretty solid, and often less stressful, choice.

Ultimately, both are fantastic ways to get your money working for you. They’re like two wise old friends who have seen a lot and know how to weather a storm. Choose the one that makes you feel most comfortable, like picking your favorite cozy sweater. And remember, the real magic happens when you let them do their thing over time. Happy investing!