Proof Of Funds To Buy A House: Complete Guide & Key Details

Dreaming of your own place, that cozy corner to call yours, or that spacious backyard for epic BBQs? Buying a house is a massive, exciting milestone! And while the vision of moving day might be a kaleidoscope of unpacked boxes and new beginnings, there's a crucial, though perhaps less glamorous, step involved: proving you’ve got the dough. Think of Proof of Funds (POF) as your golden ticket to the real estate party. It’s not just a formality; it’s a fundamental piece of the puzzle that gets you from dreaming to dwelling.

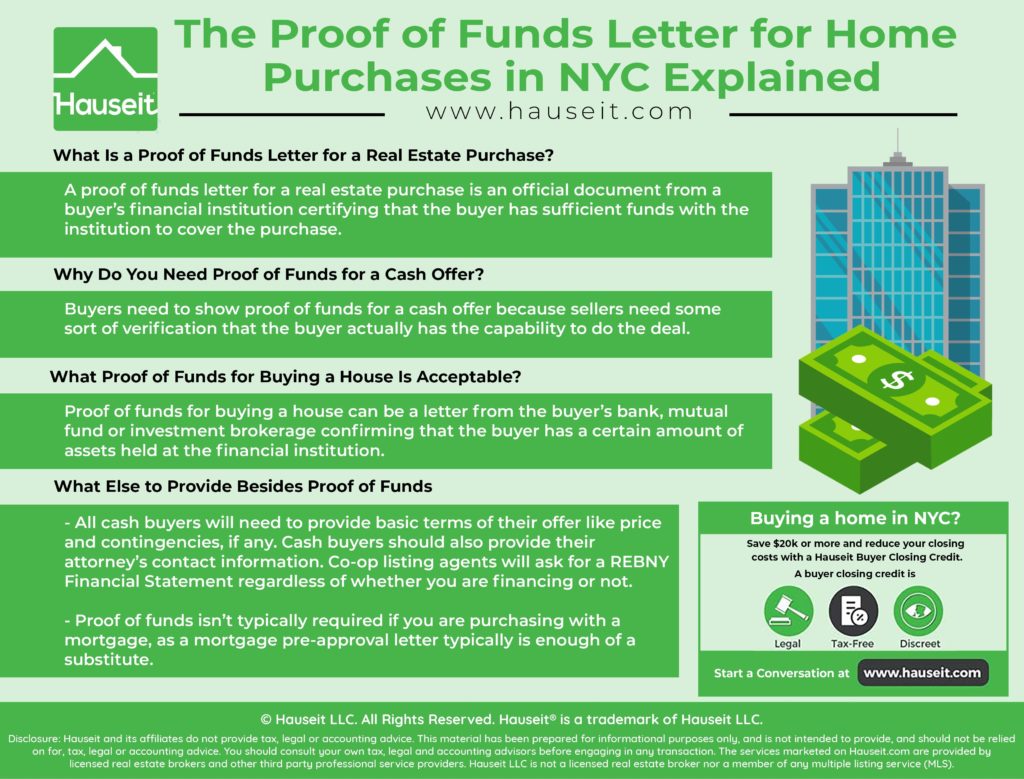

Why is Proof of Funds Such a Big Deal?

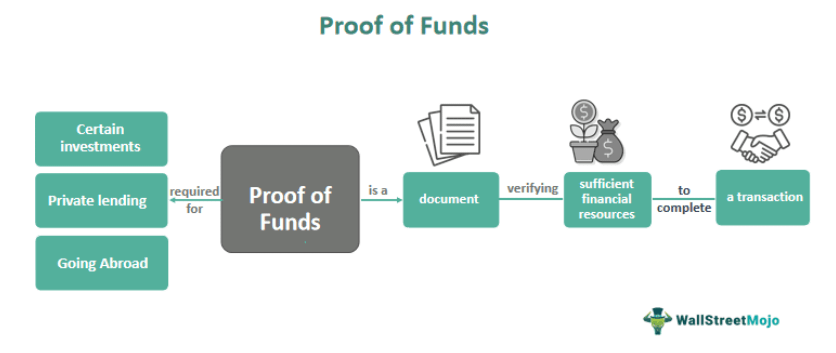

Imagine walking into your favorite bakery and asking for a dozen of their most exquisite pastries, but then telling the baker, "Oh, I'll pay you... sometime." Not exactly a recipe for success, right? The same principle applies to buying a home. Sellers and lenders need to know that you have the financial muscle to complete the transaction. Proof of Funds is essentially your financial handshake, assuring them that you're a serious buyer with the actual cash or readily available assets to back up your offer.

This isn't about boasting about your bank balance; it's about building trust and confidence in the buying process. Without it, your offer might get tossed aside like yesterday's newspaper, no matter how charming your personality or how perfect the house is for you. It’s a vital step that ensures everyone involved, from the seller to the mortgage lender, feels secure about the sale moving forward.

The Purpose: It's All About Confidence and Credibility

The primary purpose of a Proof of Funds statement is to demonstrate to the seller and the lender that you have sufficient liquid assets to cover the down payment, closing costs, and any other expenses associated with purchasing the property. This usually means showing you have the cash readily accessible in accounts like:

- Checking Accounts

- Savings Accounts

- Money Market Accounts

- Certificates of Deposit (CDs)

- Stocks and Bonds (though these may need to be liquidated first)

- Retirement Accounts (like 401(k)s or IRAs – lenders have specific rules about using these for down payments)

Lenders, in particular, are keen on POF. They are essentially lending you a significant amount of money, and they need to be confident that you have skin in the game and can handle your financial obligations. A solid POF statement reassures them that you’re not overextending yourself and that the loan is a sound investment for them.

The Benefits: More Than Just Getting the House

Beyond the obvious benefit of actually being able to buy your dream home, a strong POF offers several advantages:

- Stronger Offers: When you can present a clear and comprehensive POF, your offer becomes significantly more attractive to sellers. It signals that you are a serious, well-prepared buyer, which can give you an edge over other potential buyers, especially in competitive markets. You might even be able to negotiate better terms because the seller feels more confident.

- Smoother Mortgage Process: For lenders, POF is a critical piece of your mortgage application. Having it ready and organized can expedite the underwriting process, meaning you could get approved for your loan faster. This reduces stress and keeps your home-buying journey on track.

- Reduced Risk of Offer Withdrawal: If you can't sufficiently prove your funds, your offer could be rejected, or worse, if you get far into the process and suddenly can't produce the funds, your contract could be terminated. This is a massive disappointment and can sometimes lead to forfeiture of earnest money deposits.

- Peace of Mind: Knowing you have your finances in order provides immense peace of mind throughout the entire home-buying process. You can focus on the exciting parts, like picking out paint colors or planning your housewarming party, without the nagging worry of whether you can actually afford it.

Essentially, Proof of Funds transforms you from a hopeful browser to a credible contender. It's about showing you've done your homework, you're financially prepared, and you're ready to make a significant commitment. So, while it might seem like a bureaucratic hoop to jump through, understanding and preparing your POF is an empowering step towards unlocking the door to your new home. It’s the financial foundation upon which your homeownership dreams are built, making the whole process more secure, more efficient, and ultimately, more successful.

Think of it as your financial report card for homeownership. A good grade here means smoother sailing!

Let’s dive into the nitty-gritty of what you’ll need and how to get it all sorted. It’s not as daunting as it sounds, and a little preparation goes a long way!