Price Of Silver Per Ounce History Graph

Ever found yourself staring at a graph, mesmerized by the ebb and flow of numbers? For many, exploring the price of silver per ounce history graph is more than just a data dive; it's a fascinating journey through time and economics. It’s like watching a silent movie of global events unfold, played out in the fluctuations of this lustrous metal. Whether you're a seasoned investor, a curious hobbyist, or just someone who appreciates a good story told through charts, this visual chronicle of silver's value offers a unique and often surprising perspective.

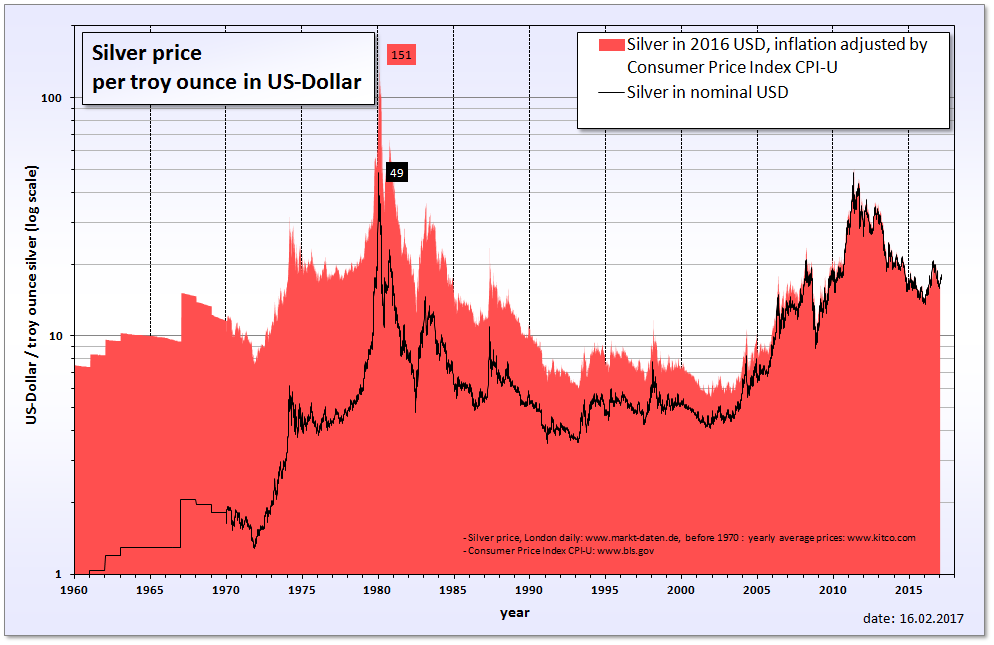

But why should you care about a silver price graph in your everyday life? It’s more than just a tool for speculators. Understanding the historical price of silver can offer valuable insights into economic trends and the overall health of the global marketplace. Silver, much like gold, is often seen as a safe haven asset. This means that during times of economic uncertainty or inflation, its price tends to rise as investors flock to it for security. Conversely, in periods of strong economic growth and stability, its demand for industrial uses might increase, but its 'safe haven' premium might decrease. So, by looking at this graph, you can get a visual clue about past periods of economic stress or prosperity. It can also serve as a hedge against inflation, protecting the purchasing power of your savings over the long term.

You might encounter the impact of silver's price history in more ways than you realize. Think about the electronics you use every day – silver is a crucial component in many of them, from smartphones to solar panels. Changes in its price can subtly influence the cost of these technologies. For jewelry enthusiasts, understanding historical price trends can help in making smarter purchasing decisions, ensuring they are getting fair value for their treasured silver pieces. Furthermore, for those who collect silver coins or bars, the graph is an indispensable tool for assessing the potential appreciation of their holdings.

So, how can you get the most out of exploring the price of silver per ounce history graph? Firstly, don't just look at the most recent data. Take the time to zoom out and observe the long-term trends – think decades, not just months. This will give you a much better understanding of the cycles and patterns. Secondly, try to correlate significant price jumps or drops with major historical events. Did a global conflict coincide with a spike? Did a technological boom lead to a dip? Connecting the dots makes the history much more engaging. Many reputable financial websites offer interactive graphs where you can hover over specific dates to see the exact price and often have accompanying articles explaining market drivers. Finally, remember that historical data is a guide, not a crystal ball. The future price of silver will be influenced by a complex interplay of factors. Enjoy the journey of discovery, and let the graph tell its story!