Nerdwallet Credit Cards For Fair Credit

Okay, let’s talk credit cards. You know, those little plastic rectangles that hold the power to buy that amazing thing you suddenly can’t live without, or maybe just help you get that dream apartment. But what if your credit score is looking a little…well, like it’s had a rough week? Don’t worry, because even if your credit is just okay – let’s call it “fair” credit, like a participation trophy in the financial Olympics – there are still some shiny, happy options out there. And guess who’s been doing the detective work to find them? Yep, our friends at NerdWallet!

Imagine you’re at a buffet, and you’re eyeing all the delicious food. Some options are for the five-star connoisseurs, and some are for those who are just starting their culinary journey. Well, credit cards can feel a bit like that too. Cards for people with excellent credit are the caviar and champagne – fancy, exclusive, and maybe a little intimidating.

But the cards we’re talking about today are more like the perfectly grilled cheese sandwich with a side of tomato soup. They’re accessible, comforting, and incredibly useful. They’re designed to help you get your financial footing, and they do it without making you feel like you’ve messed up.

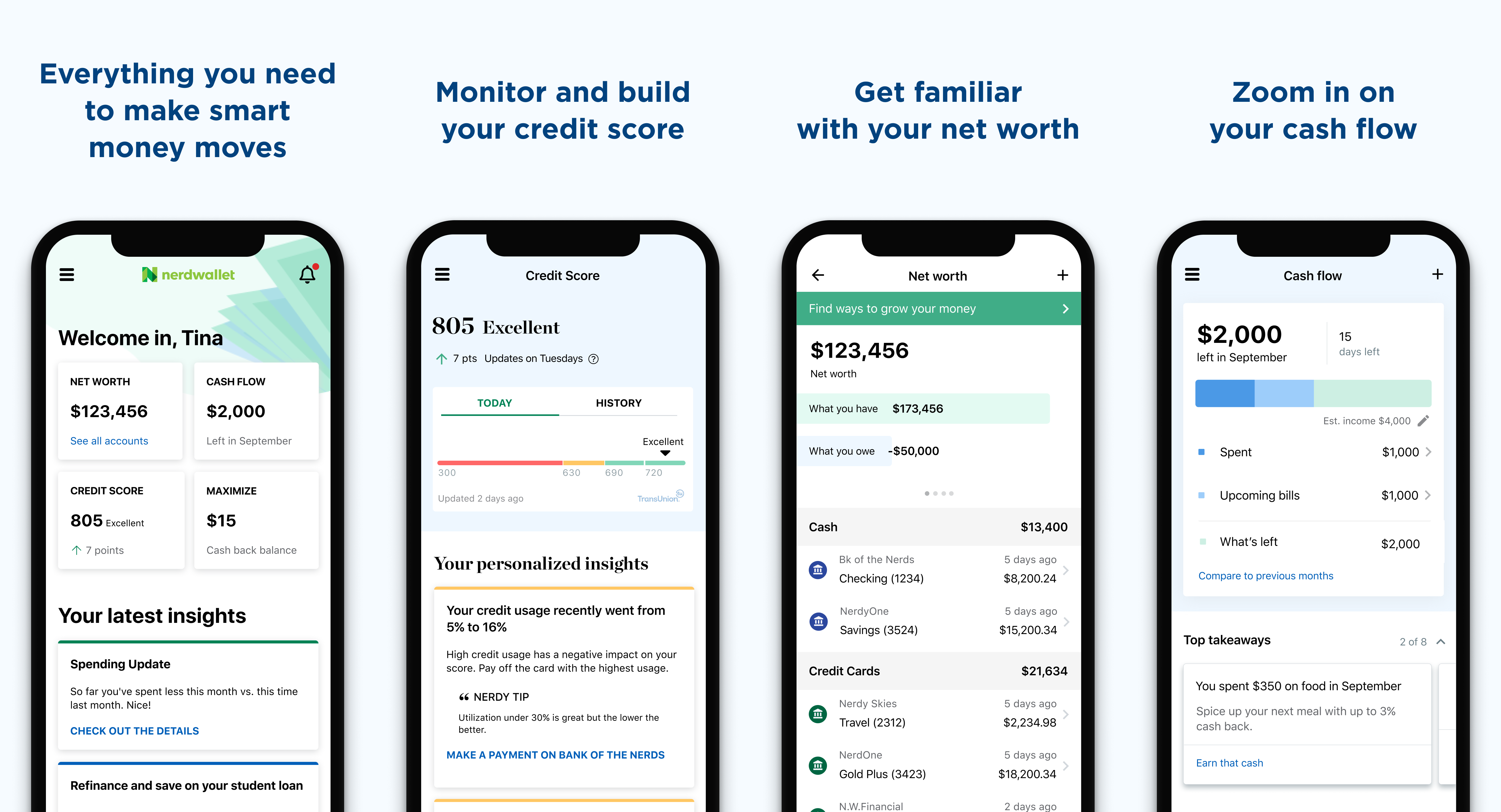

NerdWallet has a knack for breaking down these confusing financial topics into bite-sized, understandable pieces. They’re like your super-smart, slightly quirky friend who’s really good at explaining how the stock market works using analogies involving pizza. And when it comes to credit cards for fair credit, they’ve done their homework, digging through the fine print so you don’t have to.

So, what’s the big deal about fair credit? Think of your credit score as a report card for how well you’ve handled borrowed money. If you’ve had a few late payments, or maybe some unexpected expenses that put a dent in your ability to pay things off on time, your score might be in the “fair” range. It’s not the worst score possible, but it’s not exactly stellar either. It’s like getting a C+ on that big history essay – you passed, but you know you could have done better.

The good news is that a fair credit score doesn’t mean you’re locked out of the credit card world. It just means you need to be a little more strategic about which cards you apply for. And that’s where the magic of a good guide, like NerdWallet, comes in handy.

They highlight cards that are specifically designed for people in your situation. These aren’t the flashy rewards cards that give you points for every latte you buy. Instead, they’re often focused on the building blocks: helping you establish a positive payment history. It’s all about progress, not perfection.

One of the most common types of cards you’ll see for fair credit are secured credit cards. Now, this might sound a little…scary. “Secured”? Like, they’re going to come and take your prized beanie baby collection if you’re late? Not at all! A secured card is actually pretty straightforward and surprisingly helpful.

Here’s the fun part: with a secured card, you give the credit card company a cash deposit. This deposit essentially becomes your credit limit. So, if you put down $300, your credit limit will be $300. It’s like putting down a security deposit for an apartment, but instead of a roof over your head, it’s a credit line to build your financial future.

This deposit acts as a safety net for the credit card company. Because they have your money on hand, they’re more willing to give someone with fair credit a chance. And by using this card responsibly – making small purchases and paying them off on time – you’re essentially proving to them (and the rest of the financial world) that you’re a trustworthy borrower.

NerdWallet makes it super clear which secured cards are good options. They’ll tell you about any annual fees (try to find one with no annual fee if you can!), what kind of deposit you’ll need, and most importantly, if the card reports your activity to the major credit bureaus. This last part is crucial! Without that reporting, your responsible spending won’t actually help your credit score improve.

Another type of card you might come across is a student credit card. Even if you’re well past your college days, some of these cards are accessible to individuals with limited or fair credit. They’re designed for younger people who are just starting out, so they’re often more forgiving. It’s like borrowing your older sibling’s favorite jacket – it’s a bit worn, but it gets the job done and helps you look good.

The beauty of these cards, whether secured or student-focused, is that they’re stepping stones. You use them consistently, build up a good payment history, and watch that credit score start to creep up. It’s a process, like training for a marathon. You start with short jogs, and gradually build up to longer distances.

NerdWallet also dives into the world of credit builder loans. These aren’t exactly credit cards, but they serve a similar purpose: to help you build credit. You make regular payments on a loan, but the money you pay is held in a savings account until you’ve paid off the loan in full. It’s like a piggy bank that magically helps your credit score grow!

The humor in all of this is that we’re often talking about small amounts of money and small steps, but the impact can be huge. It’s the financial equivalent of eating your vegetables – not always the most exciting, but essential for good health.

What’s heartwarming about NerdWallet’s approach is their genuine desire to empower people. They’re not just listing products; they’re offering guidance. They understand that navigating the financial world can be overwhelming, especially when you’re feeling a little insecure about your credit.

They’ll point out the cards that have a low introductory APR, which means the interest rate you pay on purchases is really low for a set period. This can be a lifesaver if you need to carry a balance for a short time, though the ultimate goal is always to pay your balance in full.

They also highlight cards that offer cash back or rewards, even for fair credit. While these might not be the super-generous, travel-hacking rewards of premium cards, any little bit of cash back is a win! It’s like finding a forgotten dollar bill in your jeans – a pleasant surprise.

The key takeaway from NerdWallet’s guidance is that having fair credit is not a dead end. It’s a detour, a learning curve, an opportunity to get smarter about your money. These cards are tools, and when used correctly, they can unlock doors.

Think about it: a better credit score can mean lower interest rates on car loans, easier approval for apartments, and even better insurance premiums. It’s like leveling up in a video game, unlocking new abilities and opportunities.

So, if your credit score is currently in the “fair” zone, don’t despair. Take a deep breath, grab a cup of your favorite beverage, and dive into the resources NerdWallet provides. They’ll help you find a card that’s right for you, a card that will help you build a stronger financial future, one responsible swipe at a time. It’s a journey, and you’ve got a great guide to help you along the way!