Nedbank Interest Rate On Personal Loans

Ah, personal loans. The grown-up version of asking your parents for a little extra pocket money, but with slightly more paperwork and a lot more responsibility. And when we’re talking about Nedbank, it’s like your favorite aunt offering to help you out – there’s a certain warmth and trustworthiness involved, isn’t there?

Now, let’s talk about the bit that might make your eyes glaze over faster than a forgotten donut: the interest rate. It sounds so… official. So serious. But here’s the fun secret: it’s not as scary as it seems, especially when you’re looking at Nedbank. Think of it less as a stern lecturer and more as a friendly guide on your financial adventure.

Imagine you’ve got a dream. Maybe it’s a quirky vintage bicycle that just screams "you," or perhaps a surprise weekend getaway to finally see those penguins you’ve always adored. Sometimes, our dreams need a little nudge, a little financial spark. That's where a Nedbank personal loan can be your knight in shining armor, or at least your trusty steed.

And the interest rate? It’s the cost of that trusty steed, really. Nedbank aims to make that cost feel fair, like a reasonable rental fee for the vehicle that will get you to your dream destination. It’s not designed to trip you up, but rather to be a clear, understandable part of the journey.

The Magic of a Fixed Rate

One of the most comforting things about a Nedbank personal loan is the idea of a fixed interest rate. Picture this: you're driving your trusty steed, and the road ahead is a bit bumpy. You don't know if the speed bumps are going to get bigger or smaller. Sounds stressful, right?

A fixed rate is like having cruise control on that road. Your interest rate stays the same for the entire ride, from the moment you borrow the money until the last payment. This means you know exactly what your installments will be each month. No nasty surprises, no sudden jolts.

This predictability is pure gold. It lets you budget with confidence. You can plan that penguin trip down to the last detail, knowing your loan repayment won't suddenly decide to go on its own adventure. It’s a little piece of financial peace of mind, delivered with a friendly Nedbank smile.

“It's like knowing exactly how much you'll pay for your favorite coffee every morning. Reliable, comforting, and makes the start of your day a little brighter.”

What Influences Your Rate (The Not-So-Scary Bits)

Now, even with the fixed rate comfort, you might wonder what makes one person’s rate slightly different from another’s. Think of it like getting a custom-made suit versus an off-the-rack one. Both serve their purpose, but the custom one fits you perfectly, and that often comes with a different price tag.

Nedbank looks at a few things, and they do it with a spirit of fairness. Your credit score is a big one. This is like your financial report card. Have you been a good borrower in the past? Paid your bills on time? If so, your report card is looking good, and Nedbank sees you as a reliable borrower.

This reliability is key. When you have a good credit score, it tells Nedbank that you’re likely to repay the loan as agreed. It’s a sign of trust, and trust often comes with a more attractive interest rate. It’s their way of saying, "We trust you, and we’re happy to offer you a great deal."

The loan amount and the repayment period also play a role. Borrowing a smaller amount for a shorter time might have a different rate than a larger loan with more breathing room. It's like borrowing a cup of sugar versus a whole bag – the scale matters.

Nedbank works hard to find a balance that makes sense for both them and for you. They’re not trying to catch you out. They’re trying to build a relationship where you can achieve your goals, and they can be a part of that success story.

Beyond the Numbers: The Nedbank Difference

What truly makes Nedbank’s approach to personal loan interest rates feel so approachable is their focus on people. They understand that life throws curveballs, and sometimes those curveballs require a bit of financial support.

Imagine you need a loan for a family emergency. The last thing you need is to feel like you’re navigating a bureaucratic maze with a cold, unfeeling system. Nedbank aims to be different. Their consultants are there to help you understand your options, to explain the interest rate in plain English, and to guide you through the process with empathy.

It's the human touch that softens the edges of financial products. It's knowing that there's a real person on the other end of the line, someone who understands that behind every loan application is a real life, with real needs and real dreams.

Think about the times you've received genuinely helpful advice. It makes a difference, right? That’s the Nedbank vibe when it comes to their personal loans and interest rates. They want to empower you, not overwhelm you.

“They made me feel like they were genuinely invested in helping me sort things out, not just ticking boxes. That’s rare and really appreciated.”

Making it Work for You

So, how can you make sure you're getting the best possible interest rate from Nedbank? It all comes back to being prepared and being informed.

Firstly, know your credit score. You can get this information, and understanding where you stand is a powerful first step. If it’s not as strong as you’d like, there are steps you can take to improve it, like managing your existing credit responsibly.

Secondly, shop around (a little). While Nedbank aims for competitive rates, it’s always good practice to understand the market. This isn’t about finding the absolute lowest number at all costs, but about finding a rate that feels fair and a lender you trust.

Thirdly, talk to a Nedbank consultant. Seriously, they’re there for a reason! They can explain how their interest rates are determined, what factors might apply to your specific situation, and what options are available to you. Don't be shy about asking questions. The more you understand, the more confident you'll feel.

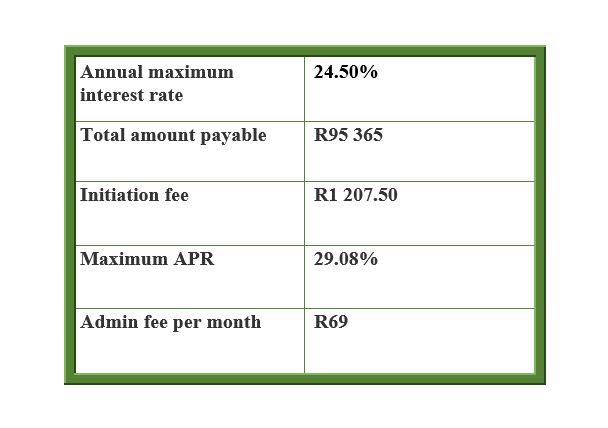

And finally, understand the total cost. The interest rate is a crucial piece of the puzzle, but it’s also important to look at the loan term and any potential fees. Nedbank is usually quite transparent about this, but it’s always good to have the full picture.

A Brighter Financial Future

In the grand tapestry of personal finance, the interest rate on a Nedbank personal loan isn't a dark, foreboding cloud. It’s more like a guiding star, helping you navigate towards your goals.

It's the soundtrack to your journey, a consistent rhythm that allows you to plan and to dream without constant financial anxiety. It’s Nedbank’s way of saying, "We believe in your dreams, and we're here to help you make them a reality, at a price that feels right."

So, the next time you think about a personal loan, or specifically a Nedbank personal loan, remember the friendly guide, the fixed-rate cruise control, and the human touch behind the numbers. It’s not just about borrowing money; it’s about unlocking possibilities, one manageable installment at a time.