Most State And Local Income Taxes Are Either

Alright folks, gather 'round! Let's talk about something that might make your eyes glaze over faster than a poorly made donut: state and local income taxes. Now, before you start imagining mountains of paperwork and a stern accountant with a calculator the size of a small child, let's get real. Most of the time, these taxes are basically two things, and honestly, they're not as scary as they seem. Think of them as the little guy, the understudy, the sidekick to Uncle Sam's grand, booming performance of "The National Tax Opera."

So, what are these two magical, mundane categories? Drumroll please... they are either flat or graduated. That's it! No secret handshake, no complex algorithms. Just two simple ways your hard-earned cash gets nudged a little bit towards your state or town's piggy bank. Let's break 'em down, shall we?

First up, we have the flat tax. Imagine this: you're at a buffet, and everyone, from the tiny toddler with a penchant for mashed potatoes to the seasoned seasoned pro who knows how to strategically pile on the prime rib, pays the same price for their plate. That's a flat tax! In most states that have this system, it means everyone, regardless of how much they earn – whether they're a rockstar selling out stadiums or a dedicated barista making your morning latte – pays the exact same percentage of their income in taxes. So, if the flat tax rate is, say, 5%, then if you make $30,000, you pay 5% of that. If you're raking in $300,000, you also pay 5% of that. It’s like a universal discount code for your income!

Now, this might sound a bit wild. "Wait a minute," you might say, "my neighbor who's rolling in dough pays the same rate as me?" Yep! The idea behind a flat tax is simplicity and, in theory, fairness across the board. It’s like everyone getting the same size slice of the tax pie, no matter how big their hunger is. It’s straightforward, and you don't need a detective’s magnifying glass to figure out your tax bill. Think of states like Illinois or Indiana – they’re rocking the flat tax vibe. They've decided that a single, steady rate is the way to go, keeping things nice and tidy.

Then we have the other big player: the graduated tax. This one’s a bit more like a tiered cake. You know, the kind with layers that get progressively fancier and, well, bigger? In a graduated tax system, the more money you make, the higher the percentage of your income you pay in taxes. It’s like a "pay-as-you-earn-more" kind of deal. This is often called a "progressive tax" because it’s designed to be progressive – meaning it asks for a bit more from those who have a bit more to give. Your first chunk of income might be taxed at a lower rate, and then as you climb the income ladder, those subsequent chunks get taxed at higher and higher rates. It's like a reward system for climbing the corporate Everest, but with taxes!

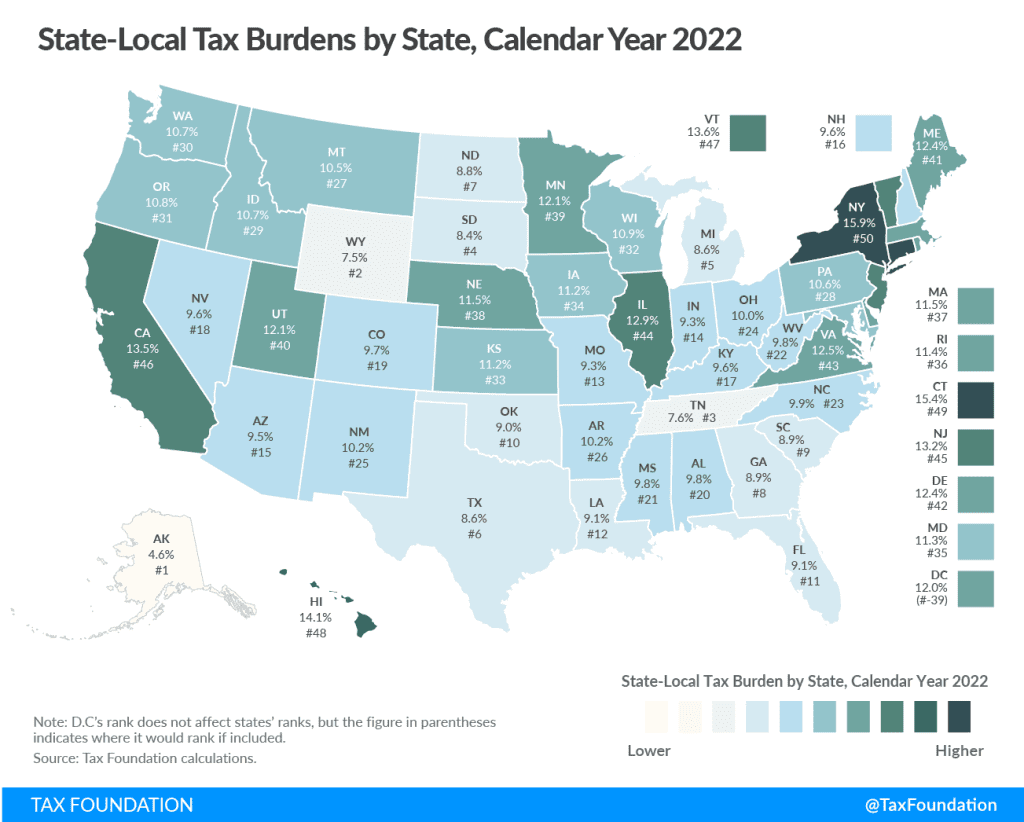

So, if you're just starting out and earning a modest amount, your tax rate might be quite low. But if you’re a CEO signing multi-million dollar deals, a larger chunk of that sky-high salary will be heading towards state coffers. States like New York or California are famous for their graduated tax systems. They believe that those who benefit most from the infrastructure and services provided by the state should contribute a bit more to keep it all running smoothly. It's about spreading the load, you see, like a friendly game of tug-of-war where the strongest team pulls a little harder.

Think of it this way: the graduated tax is like a dimmer switch for your tax rate. You can turn it up or down depending on your income level. The flat tax, on the other hand, is like a standard light bulb – it’s either on at a set brightness for everyone. Neither is inherently "better" or "worse" than the other. They're just different philosophies about how to collect taxes. It’s like choosing between a comfy pair of slippers and a fancy pair of dress shoes – both have their purpose and their fans!

The beauty of it is, most of us are only dealing with one of these two scenarios when it comes to our state and local income taxes. It's not a labyrinth of confusing percentages and special clauses. It's either a simple, single rate for everyone, or a series of steps that your tax rate climbs as your income grows. So next time you’re thinking about taxes, remember these two friendly characters: flat and graduated. They’re not here to cause you stress, just to ensure your state and local communities have the funds to keep the roads paved, the schools open, and the parks looking spiffy. And hey, a little bit of tax now and then means a lot more awesome stuff later, right? It's a win-win, and honestly, that's something to feel good about!