Marcus Goldman Sachs Certificate Of Deposit

Life’s too short for overly complicated financial jargon, right? We’re all about that smooth sailing, the effortless flow, the kinda vibe where your money works for you, not the other way around. Think of it like finding that perfect playlist that just gets you, or discovering a hidden gem of a coffee shop that feels like your own personal sanctuary. It’s about making smart choices that don’t feel like a chore, and that’s exactly where something like a Marcus by Goldman Sachs Certificate of Deposit (CD) can sneak into your easy-going life and make a surprisingly big splash.

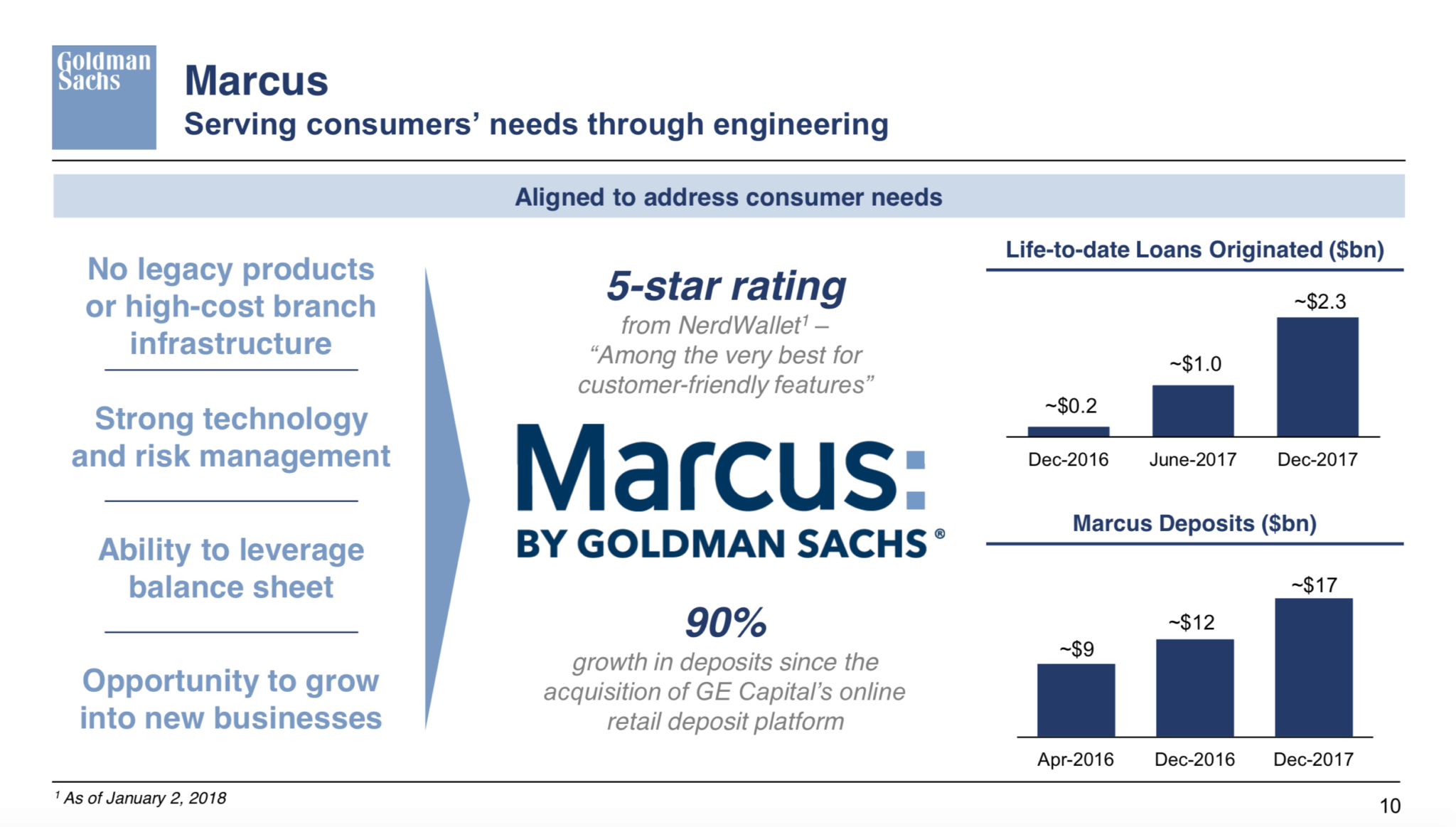

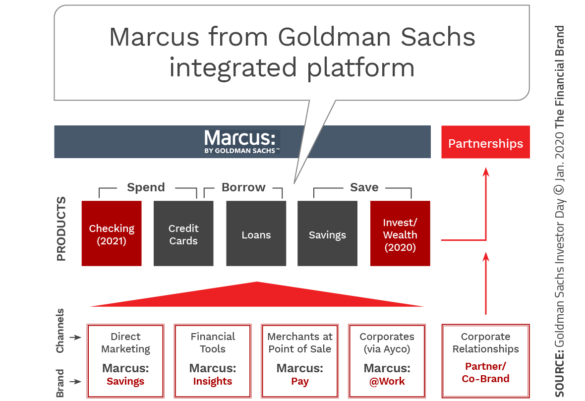

Now, before your eyes glaze over at the mention of "Certificate of Deposit," let’s ditch the stuffy bank teller image. Imagine Goldman Sachs, a name that often conjures up images of high-stakes trading floors and Wall Street wizards, but with a decidedly chill personal banking arm. That’s Marcus. They’re basically the cool cousin of the traditional banking world, bringing a fresh, no-nonsense approach to your savings. And their CDs? They're like a reliable, yet surprisingly appealing, addition to your financial toolkit.

The Zen of the CD: What’s the Big Deal?

So, what exactly is a Marcus CD? In a nutshell, it’s a savings product where you agree to keep your money in a specific account for a set period – think of it as a commitment to your future self. In return, you get a fixed interest rate that’s usually higher than a regular savings account. It’s like putting your money on a mini-vacation where it just chills and earns, no drama involved.

Why is this good for an easy-going lifestyle? Because it’s predictable. You know exactly how much your money is going to grow. No market fluctuations, no sudden dips. It’s the financial equivalent of a perfectly brewed cup of tea – consistently satisfying. Plus, your deposits are FDIC-insured up to the maximum amount allowed by law, which is like having a comfy safety net. So, you can sleep soundly knowing your hard-earned cash is protected.

Think of it like this: you’re planning a summer road trip. You need to know how much money you’ll have for gas, snacks, and maybe that kitschy souvenir. A Marcus CD offers that kind of certainty. You lock in a rate, and for the duration of your CD term, that rate is your jam. It’s a beautiful thing in a world that often feels a bit… unpredictable.

Choosing Your Term: Finding Your Financial Rhythm

Marcus offers a variety of CD terms, from a few months to several years. This is where you get to play conductor of your financial orchestra. Do you have a specific goal coming up, like a down payment for a new apartment or a dream vacation in, say, Tuscany (sipping that Chianti, of course)? A shorter-term CD might be your perfect match.

Or perhaps you’re more of a long-term player, someone who likes to let things marinate. In that case, a longer-term CD could be your financial soulmate. The longer you commit, the generally higher the interest rate you can snag. It’s like aging a fine wine – the longer it rests, the richer the flavor.

Pro Tip: Don’t just pick a term at random. Think about your cash flow. Do you need this money in the next six months? If the answer is yes, a CD might not be the best fit. But if it’s money you can comfortably set aside, then you’re in prime CD territory. It’s all about finding that sweet spot where your savings goals align with your spending habits.

Consider your life stage, too. If you’re a recent grad building your financial foundation, a series of shorter-term CDs could be a smart way to get a feel for how they work. If you’re further along, perhaps planning for retirement or a major life event, longer terms might offer more attractive returns. It’s about tailoring your financial strategy to your personal narrative, like choosing the perfect soundtrack for your life’s movie.

The Marcus Difference: Beyond the Buzzwords

What sets Marcus apart? For starters, their user-friendly online platform. No more navigating labyrinthine bank websites or dealing with confusing apps. Marcus is designed to be intuitive and straightforward. It’s like switching from a flip phone to a sleek smartphone – a definite upgrade.

They pride themselves on transparency. What you see is what you get. No hidden fees, no confusing fine print that makes you need a magnifying glass and a law degree. Their website clearly outlines the interest rates, terms, and conditions. It’s refreshing, to say the least.

And the interest rates? Marcus is often a strong contender in the CD market, offering competitive rates that can give your savings a serious boost. They understand that you want your money to work hard, and they’re here to help make that happen. It’s like finding out your favorite band just dropped a surprise album – a delightful and profitable surprise!

Making it Work for You: Beyond Just Stashing Cash

A Marcus CD isn’t just about letting your money sit there. It’s about building a foundation of financial security and growth that supports your lifestyle. Think of it as your financial anchor, providing stability while you navigate the exciting currents of life.

Fun Fact: The concept of a certificate of deposit has roots going back centuries, with early forms appearing in medieval Italy! While the digital age has certainly revolutionized how we interact with them, the core idea of earning interest on a committed deposit remains a timeless financial strategy.

Here are a few ways to integrate Marcus CDs into your easy-going financial flow:

- The "Future Fun Fund" CD: Got a birthday coming up in six months? Or maybe you want to treat yourself to a new set of noise-canceling headphones to truly immerse yourself in your music? Open a 6-month CD and earmark the funds for that specific indulgence. By the time the CD matures, you'll have not only saved the principal but also earned a little extra for your treat. It’s like finding money in your old jacket pocket, but you planned it!

- The "Emergency Cushion" CD: While you should always have a readily accessible emergency fund, a slightly longer-term CD can be a great place to store additional funds for unexpected events. The slightly higher interest rate can help your cushion grow, and if a true emergency arises, you can withdraw the funds (though you might incur a penalty, so this is for truly unforeseen circumstances). Think of it as a fortified savings account.

- The "Goal Getter" CD Ladder: This is for the strategic thinkers among us. Imagine opening several CDs with staggered maturity dates. For example, you might open a 1-year, a 2-year, and a 3-year CD. As each one matures, you can reinvest it into a new 3-year CD, or decide to use the funds for a larger goal. This strategy provides regular access to some of your funds while still benefiting from potentially higher long-term rates. It’s like having multiple streams feeding into a larger river of savings.

Cultural Cue: Think of the classic "set it and forget it" mantra, but for your money. It’s akin to putting your favorite album on repeat – you know you’re going to enjoy it, and it requires minimal effort. It’s about building passive income without the passive stress.

A Little Sprinkle of Financial Wisdom

When considering a Marcus CD, or any CD for that matter, remember these simple truths:

- Understand the Early Withdrawal Penalty: This is crucial. If you break the CD term before maturity, you'll likely pay a penalty. So, be honest with yourself about your liquidity needs.

- Compare Rates: While Marcus is often competitive, it never hurts to do a quick comparison of current CD rates across different institutions. Knowledge is power, and in this case, it’s also potential profit.

- Automate Your Contributions: If possible, set up automatic transfers from your checking account to your Marcus CD. This takes the guesswork out of saving and ensures your money is consistently working for you. It’s like having a personal savings assistant.

The digital age has made financial management so much more accessible. Gone are the days of needing to physically go to a bank to open an account. With Marcus, the entire process can be done from your couch, perhaps with a good book or while binging your latest Netflix obsession. It’s financial convenience at its finest.

The Bigger Picture: Money as a Tool, Not a Tyrant

Ultimately, the goal of having products like Marcus CDs in your financial life is to make money work for you, not the other way around. It’s about freeing up your mental energy to focus on what truly matters: spending time with loved ones, pursuing your passions, and simply enjoying the ride.

In a world that often bombards us with financial pressures, the simplicity and security of a well-chosen CD can be a breath of fresh air. It’s a quiet, steady contributor to your overall financial well-being, allowing you to live your life with a little more ease and a lot more confidence.

So, the next time you’re sipping your morning coffee, scrolling through social media, or planning your next weekend adventure, consider how a Marcus by Goldman Sachs CD could subtly, yet powerfully, enhance your easy-going lifestyle. It’s not about get-rich-quick schemes; it’s about smart, steady growth that supports the life you’re building. And in the grand tapestry of life, isn't that a beautiful thing?

Reflection: This week, I realized how much mental real estate I give up worrying about my finances. It’s like having a nagging thought in the back of your mind. By taking small, intentional steps, like understanding how a simple CD can offer stability, I feel a little lighter. It's not about becoming a Wall Street guru; it's about finding those pockets of financial peace that allow me to be more present in my everyday moments, whether that's enjoying a quiet evening at home or planning a spontaneous outing with friends.