List Of Debt Collection Agencies In Usa

Ever have that feeling, right before your birthday, where you know something is coming, but you're not entirely sure if it's cake or a stern talking-to about that overdue gym membership from 2017? Well, sometimes life throws you a curveball, and those pesky little things we owe money for can suddenly get a bit more… vocal. And when they do, they often hand off the microphone to a whole cast of characters we call debt collection agencies. Think of them as the helpful folks who remind you that your wallet isn't just for carrying pictures of your dog; it's also for, you know, paying bills.

Now, before you start picturing shadowy figures in trench coats lurking outside your local coffee shop (though, let's be honest, some of their phone calls can feel that dramatic), the reality is a lot less Hollywood and a lot more… paperwork. These agencies are essentially businesses that buy up outstanding debts from original creditors – think credit card companies, medical providers, or even that streaming service you forgot to cancel before you moved. It’s like when your favorite band sells their old demo tapes to a collector; except, well, with more interest.

So, why should you care about this whole list of debt collection agencies? Well, knowledge is power, right? It's like knowing the best route to avoid rush hour traffic. If you do find yourself in a situation where a collection agency is on your case, understanding who they are and what their deal is can make the whole experience feel a lot less like wrestling a greased pig and more like a polite, albeit firm, negotiation. It's about knowing your rights, and frankly, knowing who's calling you at 8 AM on a Saturday. Because, let's face it, nobody needs that kind of wake-up call unless it's an actual fire alarm.

The United States has a whole ecosystem of these agencies, ranging from the massive, corporate giants to smaller, more specialized outfits. They operate under the watchful eye of regulations like the Fair Debt Collection Practices Act (FDCPA). This is your superhero cape, folks! It’s there to make sure they don't go all Bill O'Reilly on you, threatening to send the repo man for your favorite armchair. They can’t harass you, they can’t lie, and they definitely can’t call you at work if your employer doesn’t allow it. Think of the FDCPA as the rulebook for the debt collection game. Without it, it’d be like a soccer match with no referee – pure chaos, and probably a lot of red cards.

Now, finding a definitive, universally updated "list of all debt collection agencies in the USA" is a bit like trying to count all the grains of sand on a beach. They’re out there, they come and go, and some operate under different names or specialize in specific types of debt. However, there are resources that can give you a good lay of the land. Think of it as looking at a map before embarking on a road trip. You might not know every single diner along the way, but you know the major highways and the big cities.

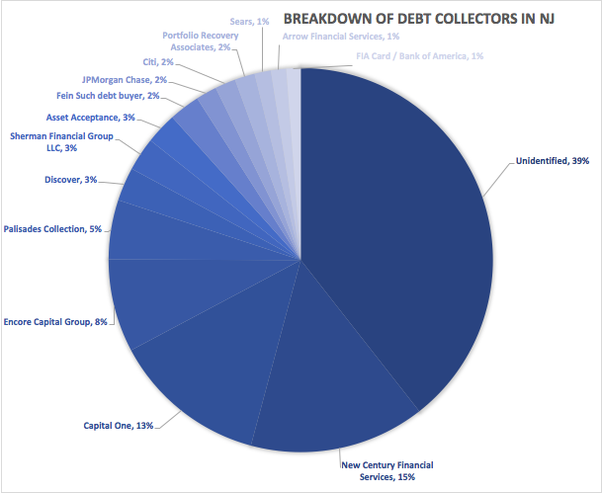

The Big Players in the Debt Collection Arena

When you're talking about debt collection, some names pop up more often than a bad penny. These are the behemoths, the ones that have been around the block a few times and have the paperwork to prove it. They handle a ton of debt, so if you're getting a call about something that feels like it's from way back when, chances are it might be one of these guys.

Nationwide Credit Inc. (NCI)

These folks are a pretty significant player. They've been in the business for a while, and they tend to work with a wide range of creditors. Imagine them as the experienced captain of a large ship, navigating the sometimes choppy waters of collections. They're known for their professional approach, which, in the world of debt collection, can sometimes feel like a breath of fresh air. They’re not usually the ones you see in the sensationalized news stories; they’re more about the methodical process.

Portfolio Recovery Associates (PRA)

PRA is another name you might encounter. They’re known for purchasing portfolios of charged-off debt, meaning debts that the original creditor has written off as unlikely to be repaid. So, if you have an older debt that you thought had faded into the mist like a forgotten New Year's resolution, PRA might be the one to bring it back to life. They’re like the archaeologists of the debt world, digging up those forgotten accounts. They’re a big company, and they operate on a large scale, so their presence is definitely felt.

CRI Solutions (Collection Resource, Inc.)

CRI is another well-established agency that handles a variety of consumer debts. They often work with healthcare providers, which is a common source of outstanding bills. You know, those hospital visits that come with a side of unexpected expenses? Yeah, those. CRI is one of the agencies that might be reaching out to help settle those. They’re a solid, reputable company in the industry, and they’ve been around for a good chunk of time, so they understand the ins and outs of collections.

Midland Funding, LLC

Midland Funding is part of a larger group called Encore Capital Group. They are very active in the debt buying market. This means they often acquire debts that have been through the collection process with the original creditor and are now being sold off. It’s a bit like buying a house that’s had a few tenants already; the history is there, and the new owner wants to make it their own. They are a large entity, and their name often appears on statements and communications related to purchased debt. They are known for being quite diligent in their collection efforts.

Unifund Corp.

Unifund is another significant player that acquires and collects on various types of debt. They've been in the game for a while, and they have a broad reach. Think of them as a general contractor for debt. They can handle a lot of different types of projects, or in this case, debts. Their longevity in the industry suggests they have a pretty good grasp of how to navigate the complexities of debt collection. They aim to provide resolution for both consumers and their clients.

Why You Might Encounter Them

So, how does your name end up on one of these agencies' calling lists? It’s usually not because you’ve been secretly hoarding unpaid library books. The most common reasons involve:

- Unpaid Credit Card Bills: This is probably the biggest one. Life happens, a card gets maxed out, and sometimes, things fall through the cracks.

- Medical Bills: Ah, healthcare. Sometimes the bills can feel as serious as the ailment itself. Co-pays, deductibles, procedures you didn't even know you needed – it all adds up.

- Student Loans: For many, student loans are a rite of passage. And sometimes, that passage involves a few bumps in the road with repayment.

- Auto Loans: That car is your trusty steed, but if the payments stop, the steed might find itself looking for a new stable.

- Personal Loans: Sometimes you borrow from a friend, sometimes you borrow from a financial institution. Either way, it needs to be paid back.

- Utility Bills: Yes, even that electricity bill can eventually find its way to a collection agency if left unattended for too long. Don't want to live in the dark, do we?

Essentially, any debt that you owe to a company can, if it goes unpaid for a significant period, be sold to a debt collection agency. The original creditor might decide it's more cost-effective to sell the debt for a fraction of its value than to continue trying to collect it themselves. It's like selling a slightly dented but still functional toaster at a garage sale instead of trying to get top dollar at a fancy appliance store.

Navigating the Maze: What to Do If You Get a Call

Okay, so the phone rings, and it’s an unfamiliar number. You answer, and it’s someone asking about a debt you might have forgotten about, or maybe one you didn't even know existed. Deep breaths. Remember that superhero cape – the FDCPA. Here’s a simplified game plan:

1. Don't Panic!

Seriously. Panicking is like trying to swat a fly with a sledgehammer. Ineffective and messy. These agencies are businesses, and you have rights. They want to resolve the debt, and you want to resolve the debt. It’s a problem to be solved, not a personal attack.

2. Verify the Debt

This is crucial. Before you agree to pay anything, ask the agency to validate the debt. This means they need to send you proof that you owe the debt and that they have the legal right to collect it. This should include the amount, the original creditor, and their right to collect. Think of it like asking for the receipt before you hand over your hard-earned cash. If they can't validate it, you don't owe them anything, and they can't continue collecting. Boom!

3. Know Your Rights

As mentioned, the FDCPA is your best friend. They can’t call you at odd hours, they can’t threaten you, and they can’t reveal your debt to others. If they violate the FDCPA, you might have grounds to take legal action. It's like knowing the rules of the game before you step onto the field.

4. Communicate in Writing

Once the debt is validated, it’s usually best to communicate in writing, especially when discussing payment arrangements or disputes. This creates a paper trail. Email is your friend here, or certified mail. It's like keeping a diary of your financial conversations – solid proof!

5. Consider Negotiation

Many collection agencies are willing to negotiate. They bought the debt for less than its face value, so they're often willing to accept less than the full amount owed. Don’t be afraid to make a reasonable offer, especially if you can pay it off in a lump sum. It’s like haggling at a flea market, but with slightly higher stakes.

6. Seek Professional Help if Needed

If the debt is substantial, you’re unsure of your rights, or the agency is being particularly aggressive, consider consulting with a consumer protection attorney or a non-profit credit counseling agency. They can provide expert guidance and help you navigate the situation. Think of them as your financial pit crew.

Finding More Information

While there isn't one single, comprehensive directory that lists every single debt collection agency in the US, you can find valuable information through several avenues:

- Better Business Bureau (BBB): Many collection agencies are accredited by the BBB, and you can check their ratings and any filed complaints.

- Consumer Financial Protection Bureau (CFPB): The CFPB is a government agency that collects complaints about financial products and services, including debt collection. Their website is a treasure trove of information and resources.

- Online Search Engines: A simple Google search for "debt collection agencies" will yield results, but always be critical of what you find. Look for agencies with official websites and reputable reviews.

- Industry Associations: Organizations like ACA International (the Association of Credit and Collections Professionals) represent many debt collection agencies. Their websites may offer directories or resources.

It’s important to remember that the goal isn't to avoid your responsibilities, but to approach them with clarity and confidence. Knowing who might be calling and understanding your rights can transform a potentially stressful situation into a manageable one. So, the next time your phone rings with an unfamiliar number, take a breath, remember your superhero cape, and approach it like the financially savvy individual you are! After all, we’ve all had those moments where a forgotten bill suddenly reappears, right? It’s just part of the grand, sometimes chaotic, tapestry of adulting.