Irs Head Of Household Qualifying Person

Ah, taxes. That word alone can make even the most cheerful person sigh. And then there’s the whole Head of Household filing status. It sounds so… official. Like you’ve just been promoted to captain of your own financial ship. But for many of us, it’s more like navigating a slightly leaky dinghy in a sea of paperwork. And at the heart of this particular tax adventure is the mythical creature known as the Qualifying Person.

Now, you might be thinking, "Qualifying Person? Is that like a VIP pass to tax breaks?" Well, sort of. But it’s also way less glamorous. Think less red carpet, more… checking a box on a form. And the rules for this "qualifying" business can feel a bit like a riddle wrapped in an enigma, dipped in IRS jargon.

Let’s be honest, the IRS has a way of making simple things sound complicated. They throw around terms like "dependency exemption" and "gross income threshold" like confetti at a parade we didn't even know we were invited to. And the Qualifying Person? They’re the key ingredient. Without them, your Head of Household dreams are just… dreams. Like that unused gym membership gathering dust.

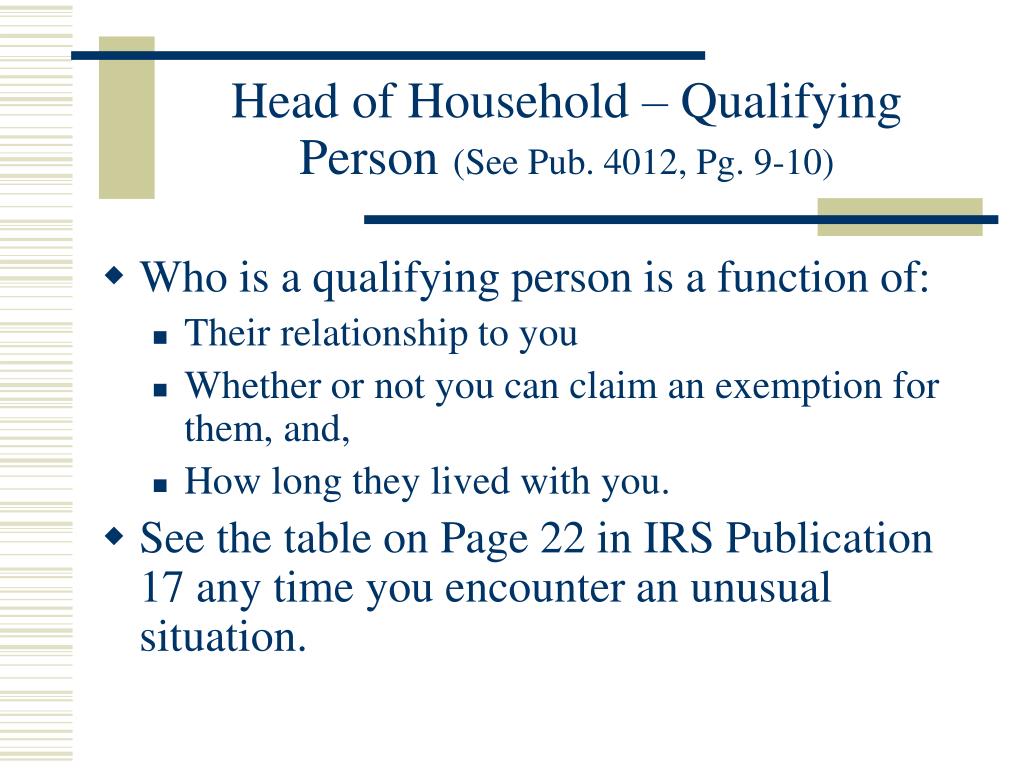

So, who is this coveted Qualifying Person? Usually, it’s a child. A little human you’re responsible for. Someone who eats your snacks, leaves toys everywhere, and generally adds a delightful chaos to your life. But it’s not just any child. Oh no. The IRS likes specifics. They have to live with you for more than half the year. That’s right, more than half! So, if your kid spends summer vacation at Grandma’s, you might need to do some serious mental math to see if they still qualify. It’s a good thing we all loved math in school, right?

And here’s a little secret, a kind of an "unpopular opinion" from my tax-weary brain: sometimes, the real qualifying person isn't the one on the tax form. Sometimes, it’s the person who does all the qualifying. You know, the one who wrangles the kids, makes the lunches, remembers the dentist appointments, and somehow also files the taxes. That person is definitely qualifying something. Maybe it’s the qualifying person of the year in the Domestic Operations Award category. They deserve a trophy. And maybe a nap.

But back to the IRS definition. It’s not just about the kids. Sometimes, it can be a parent. Yes, your own mom or dad. If they live with you and meet certain financial requirements, they can be your Qualifying Person. This is where things get even more interesting. Suddenly, you’re not just a taxpayer; you’re a… financial guardian? A benevolent landlord of sorts? It’s a role reversal that can be both heartwarming and slightly terrifying when you realize how much their bills now factor into your budget.

And then there are the rules about being "related." The IRS has a whole list. If they aren’t related in the way they expect, they might not qualify. It’s like a family tree of tax eligibility. Sometimes, I swear, they’ve got people in cubicles with magnifying glasses looking at ancestry.com. "Hmm, second cousin, twice removed, born in a leap year? Does that count?"

The best part? This Qualifying Person needs to be your Qualifying Person. You can't just borrow one from your neighbor, no matter how helpful they are with their kids. It’s a personal relationship, like a best friend, but with tax implications. You can’t claim your friend’s kid, even if you bake them cookies more often than their own parents do. That’s a tough pill to swallow for some of us cookie-baking superheroes.

My neighbor's kid is incredibly well-behaved. Perhaps I can just list him as a dependent? For… moral support?

Definition Head Of Household Irs at Marilyn Sylvester blog

And don't forget the age limit. If your child is a full-fledged adult who has their own job and is paying their own way, they might no longer be your Qualifying Person. It's a bittersweet milestone. The day your child "qualifies" for their own life, and you might "de-qualify" as their primary tax support. It's a cosmic joke, I tell you.

The truth is, understanding who qualifies can feel like decoding an ancient scroll. You read the instructions, you reread the instructions, you stare blankly at the screen, and then you just hope for the best. It’s a leap of faith, a prayer to the tax gods, and a quiet nod to the very real, very actual Qualifying Person who makes your household, well, a household.

So, next time you’re filling out those forms and staring at the box for "Head of Household," give a little nod of appreciation to your Qualifying Person. They might be a tiny human who demands snacks, a parent you cherish, or a furry friend who simply brightens your days (though, sadly, Fido probably won't qualify). They are the reason you might get to file that status. And in the grand scheme of taxes, that’s a pretty big deal. They’re not just a name on a form; they’re the real MVP of your tax return. The silent, often sticky-fingered, hero of the Head of Household club. And for that, they deserve more than just a tax break. They deserve a parade. A small, quiet parade, of course, so as not to disrupt their nap schedule.