In 4 To 6 Sentences Explain The Savings-borrowing-investing Cycle

Ever feel like you're just treading water with your money? You work hard, get paid, and then... poof! It seems to vanish before you even have a chance to blink. We've all been there, staring at our bank balance and wondering where all those hard-earned dollars went. But what if I told you there’s a secret rhythm to how money works, a kind of cosmic dance that can actually help you build a little nest egg for yourself? It’s not some complicated jargon reserved for Wall Street wizards; it’s a simple cycle that’s actually quite relatable to our everyday lives.

Let’s break down this whole "savings-borrowing-investing" thing in a way that's as cozy as a warm hug on a chilly day. Think of it like this: you're tending to a little garden. You have your seeds (your money), you need to nurture them (save), sometimes you might need a little extra help to get things growing (borrow), and then, with a bit of patience and care, you watch your garden bloom and flourish (invest). It's a continuous process, a way to make your money work for you, rather than you constantly chasing after it.

The Saving Seed: Planting for Tomorrow

First up, we have saving. This is the bedrock, the very first step in our money garden. Imagine you’ve just harvested a basket of delicious apples from your own tree. You wouldn’t eat them all at once, right? You’d probably set aside a few to enjoy later, perhaps even save some seeds to plant new trees for the future. Saving money is exactly like that. It’s setting aside a portion of what you earn today so you have something for tomorrow.

It doesn’t have to be a grand gesture. Maybe it’s skipping that extra latte a few times a week and putting that money into a jar. Or perhaps it’s consciously deciding to put away a small percentage of your paycheck before you even get a chance to spend it. This is your "rainy day fund" – the money you’ll dip into if your car suddenly decides to throw a tantrum and needs an emergency vet visit (you know, the mechanic kind of vet!). It’s also the foundation for bigger dreams, like that down payment on a cozy little home or that epic vacation you've been pinning on Pinterest.

Think of your savings account as a little piggy bank that’s always getting a few coins tossed in. It might not seem like much at first, but over time, those little coins add up. It's the feeling of security, of knowing you've got a little buffer, that makes saving so incredibly important. It's like having a comfy blanket ready for when the weather turns unexpectedly cold.

The Borrowing Bridge: A Helping Hand

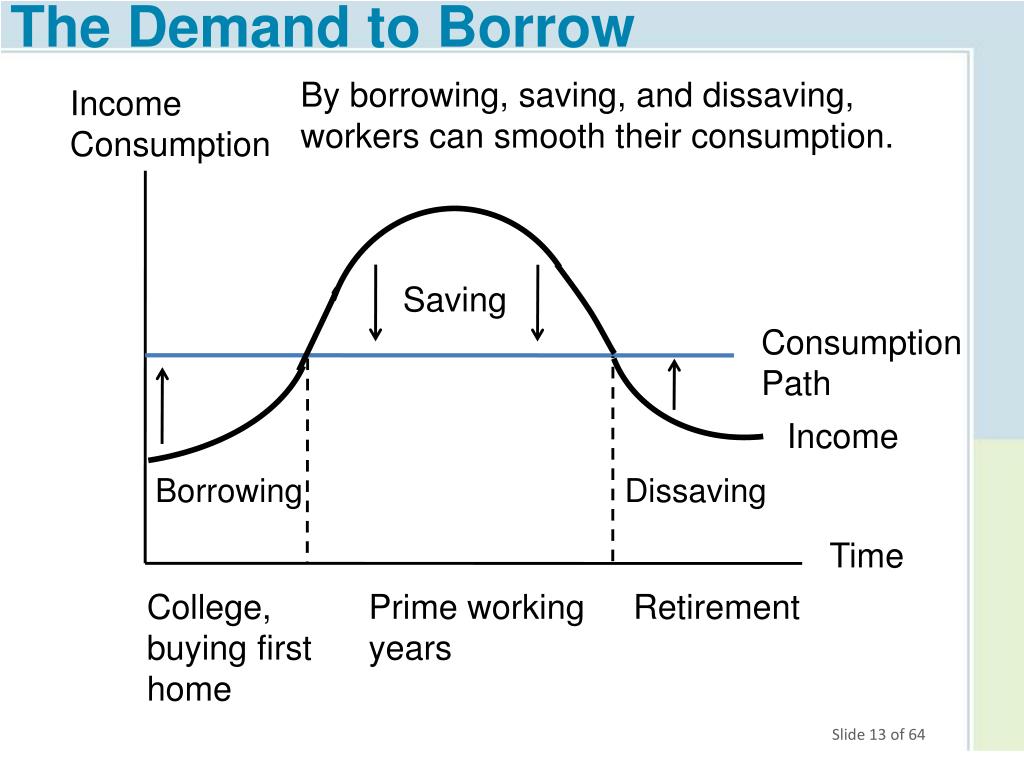

Now, sometimes life throws us curveballs, or perhaps an opportunity arises that requires a bit more than what we currently have saved. This is where borrowing comes into play. Think of it as building a sturdy bridge to cross a wider river. You can't jump it on your own, but a well-built bridge can get you to the other side, where exciting possibilities await.

Borrowing isn't inherently "bad"; it's a tool. Like a hammer, it can be used for construction or, if you're not careful, for a bit of accidental damage. When we borrow, we're essentially getting access to funds now that we promise to pay back later, usually with a little extra charge called interest. This could be for a mortgage to buy that dream home, a car loan to get you to work and adventures, or even student loans to help you gain valuable skills and knowledge.

The key to smart borrowing is understanding why you're borrowing and whether it’s a wise investment. Are you borrowing for something that will likely increase in value or provide a significant benefit, like a home or education? Or are you borrowing for something that will quickly depreciate, like a fancy gadget that will be outdated next year? It's like choosing between borrowing for a sturdy pair of hiking boots for your adventure or borrowing for a disposable party hat. One helps you reach your destination, the other is gone in a flash.

The trick is to borrow responsibly. This means understanding the terms of the loan, making sure you can comfortably afford the repayments, and not borrowing more than you absolutely need. A little bit of borrowing, used wisely, can be a powerful accelerator for your financial journey, opening doors that might otherwise remain shut.

The Investing Bloom: Watching Your Garden Grow

And then, we arrive at the most exciting part: investing! This is where our saved seeds, and perhaps the fruits of our responsible borrowing, get planted in fertile soil to grow and multiply. Imagine you’ve saved up enough to buy a small plot of land. Instead of letting it sit empty, you decide to plant a variety of wonderful things: some vegetables, some fruit trees, maybe even some beautiful flowers.

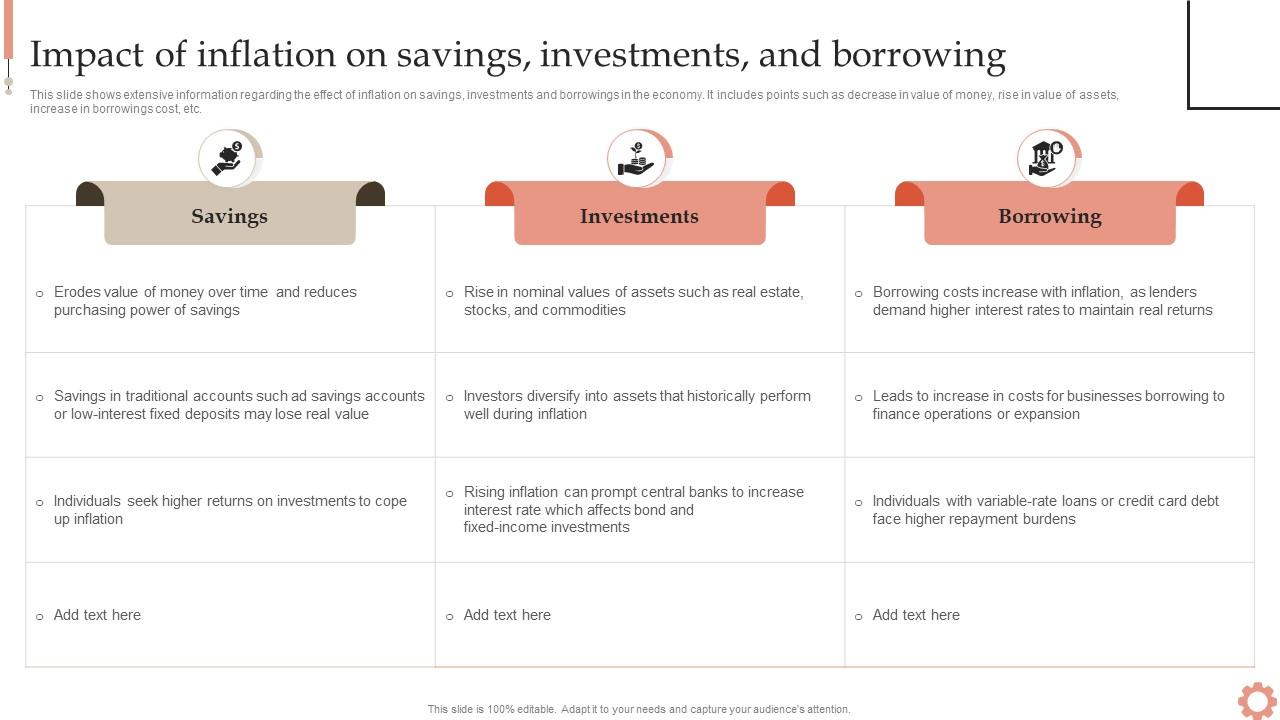

Investing is about putting your money to work so it can generate more money for you over time. Instead of just sitting in a savings account earning a tiny bit of interest (which is good, but often just keeps pace with inflation), investing aims to achieve higher returns. This could be by buying stocks in companies you believe in (essentially becoming a tiny owner!), investing in bonds (lending money to governments or corporations in exchange for interest), or even real estate.

Think of it like this: your savings are the water you give your plants. Your investments are the sunlight and the fertile soil that help them grow. The longer your money is invested, the more time it has to compound, which is like getting tiny little plant sprouts from your existing plants – a beautiful snowball effect!

The magic of investing is that it can help your money grow significantly over the long term. It’s not about getting rich quick; it’s about patient growth. It's about planting those apple seeds and knowing that in a few years, you’ll have a whole orchard. The key is diversification – not putting all your eggs in one basket, or in our garden analogy, not planting only one type of vegetable that might get wiped out by a sudden frost. Spreading your investments around helps reduce risk and increase the chances of healthy, consistent growth.

The Beautiful Cycle: A Self-Perpetuating Dream

So, how do these three pieces – saving, borrowing, and investing – fit together to create this magical cycle? It’s a beautiful, self-perpetuating dream! You start by saving diligently. This builds up your capital, your seed money. Then, you might strategically borrow for a significant purchase or opportunity that you know will ultimately benefit you financially, like investing in your education or a property that will appreciate in value.

That borrowed money, combined with your saved funds, allows you to invest more effectively. As your investments grow over time, they generate returns. These returns can then be used to pay back any loans you took out, with interest, and crucially, they also add to your savings! This increased savings then allows you to save even more, potentially borrow again for bigger and better opportunities, and invest even more aggressively.

It’s like a virtuous circle, a financial treadmill that actually propels you forward instead of just keeping you in place. Imagine you save up a down payment for a rental property. You then borrow the rest to buy it. You rent it out, and the rental income helps you pay off the loan and adds to your savings. With your increased savings, you can then buy another property, or invest in other assets, and the cycle continues. It's about building wealth not just through your hard work, but through the clever management and growth of the money you already have.

Why should you care? Because this cycle is the key to unlocking financial freedom. It’s the difference between just getting by and truly thriving. It’s about having the peace of mind to handle life’s uncertainties, the ability to pursue your passions, and the power to create a secure and comfortable future for yourself and your loved ones. It's about making your money work for you, so you can spend more time enjoying the fruits of your labor and less time worrying about where the next paycheck will come from. It's a journey, and by understanding and participating in this cycle, you're setting yourself on the path to a brighter, more prosperous tomorrow.