How To Transfer Money From My Bank To Venmo

Alright, let's talk about something that’s become as commonplace as arguing over the last slice of pizza: moving money around. Specifically, we're diving into the surprisingly chill world of getting your hard-earned cash from your trusty bank account into your slick Venmo wallet. Think of it like this: your bank is your comfy, well-worn armchair, and Venmo is that trendy new coffee shop where all your friends are hanging out. You gotta get yourself from the armchair to the coffee shop, right?

You might be staring at your Venmo app, craving that instant gratification of sending your buddy back for that concert ticket, or maybe you’re just prepping for a spontaneous taco run. But alas, your Venmo balance is looking as empty as a politician’s promise. No sweat! This isn’t some complicated, suit-and-tie affair. It’s more like finding the right key for your apartment door – once you know it, it’s a breeze.

The "How-To" Without the Hoo-Ha

First things first, you need to link your bank account to Venmo. This is basically the digital handshake that says, "Hey Venmo, this bank account is cool and I give it permission to send me money." If you haven't done this yet, it's like trying to use your TV remote without putting batteries in it – you're just not gonna get very far.

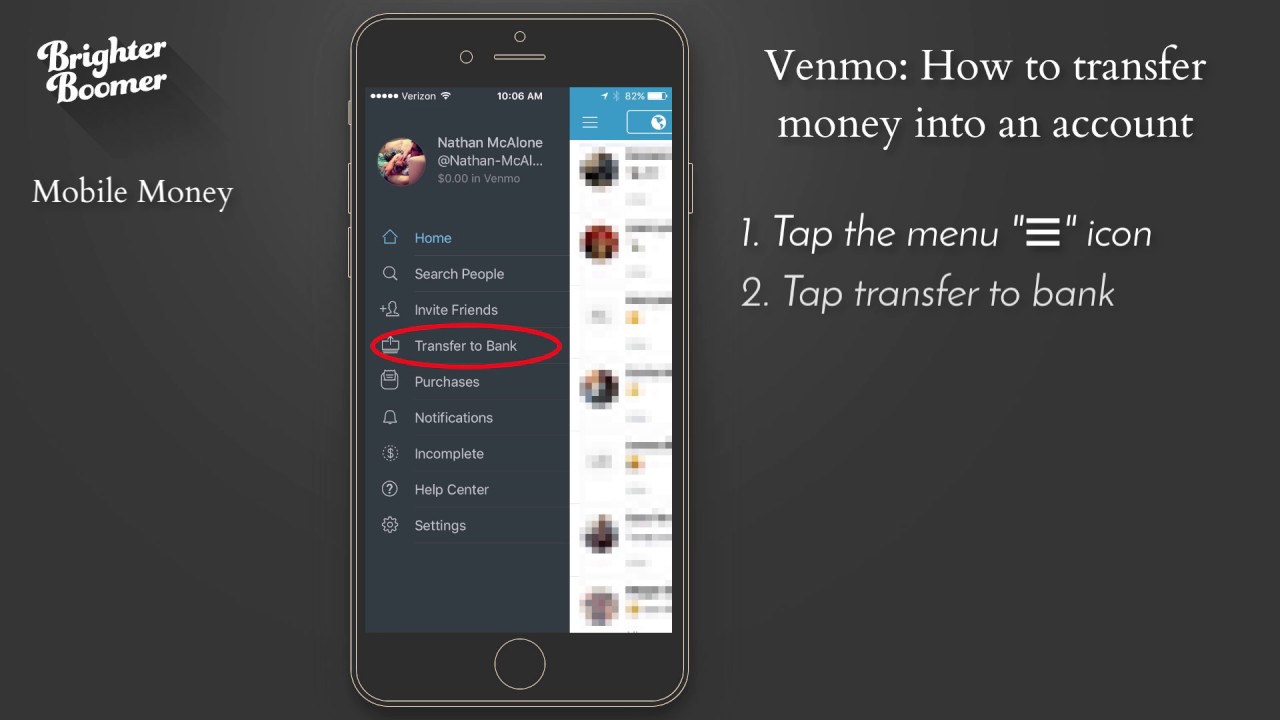

To do this, you’ll usually head to the "Settings" or "Profile" section in your Venmo app. Then, look for something like "Linked Accounts" or "Payment Methods." It’s usually pretty obvious, like finding the "on" button on your toaster. Once you tap that, you'll see an option to "Add Bank."

This is where things get a tad… interactive. Venmo wants to make sure it's your bank account and not, say, your neighbor Brenda's (even if Brenda is super cool and might lend you money). They'll ask you to log in to your bank account directly through Venmo. Don't freak out! This is a secure process, kind of like showing your ID at the airport. They use encryption and all that fancy tech jargon to keep your information safe. Think of it as a digital bouncer making sure only authorized people get in.

You'll probably need your bank's login ID and password. The same ones you use to check your balance while you're pretending to work or, let's be honest, stalking your own spending habits. If you've forgotten them, well, that's a whole other adventure, isn't it? Time for the "Forgot Password" rabbit hole, which is usually as fun as assembling IKEA furniture on a Sunday afternoon.

The "Instant" vs. The "Wait a Sec"

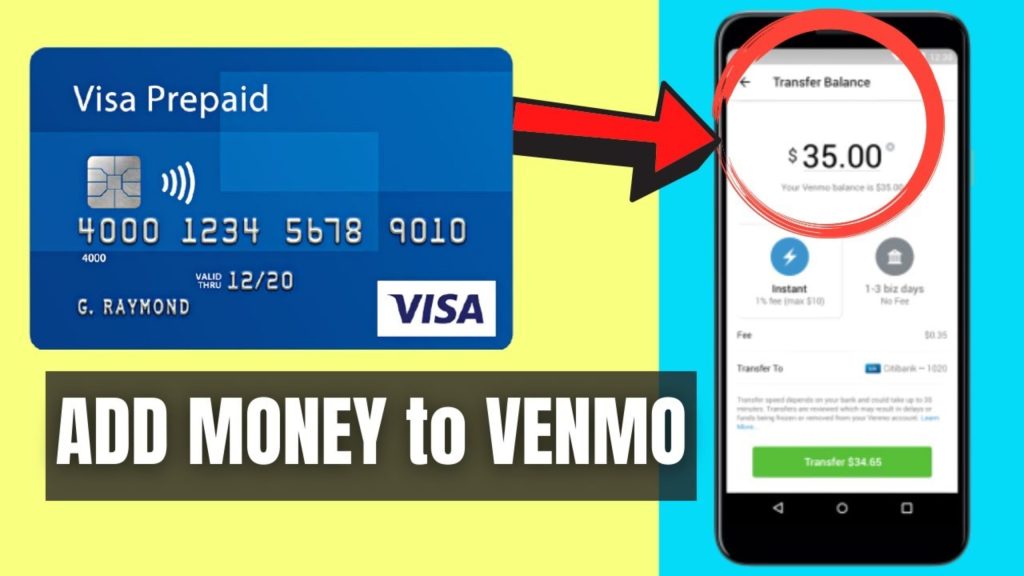

Once your bank is linked, you’ve unlocked the magic! Now you can actually add money to your Venmo balance. Navigate back to your main Venmo screen. You’ll see your current balance. Usually, there's a big, friendly button that says "Add Money" or "Add Cash." Click that, and a menu of options will pop up.

Here's where you have to make a crucial decision, like choosing between pizza or tacos for dinner. You'll typically see two main ways to get money in:

- Instant Transfer: This is the superhero of the Venmo world. You select this, pick the amount, and poof! The money is in your Venmo account faster than you can say "Send it!" It’s like those express checkout lanes at the grocery store – no waiting, no fuss. However, there's usually a small fee for this. Think of it as a convenience tax. It's a few cents, nothing to write home about, but it's there. Worth it if you're in a pinch and need those funds yesterday.

- Standard Transfer (or just "Add Money"): This is the chill, take-your-time approach. You select this option, choose your amount, and then you wait. It’s like waiting for your favorite song to come on the radio – sometimes it feels like forever, but it’ll get there. This usually takes 1-3 business days to show up in your Venmo balance. The best part? No fee! This is your go-to if you're planning ahead and don't need the cash immediately. It’s the digital equivalent of packing your lunch the night before.

So, when you hit that "Add Money" button, you'll be prompted to enter the amount you want to transfer. This is where you might do some mental gymnastics. "Do I have enough for that impulse buy? Should I transfer $20 or $50?" It's like standing in front of the vending machine, agonizing over the perfect snack. Then, you'll choose your linked bank account as the source of funds.

After confirming the amount and the transfer method (instant or standard), you’ll likely hit a "Confirm" or "Add Money" button. And that's pretty much it! You've successfully navigated the interbank money highway. Now your Venmo wallet is ready for action, whether it's for a quick "thanks for lunch!" or a more substantial loan to your best friend who swears they’ll pay you back next week.

A Little Chat About Fees (Because, You Know, Money)

Let's be real, nothing in life is truly free, except maybe a good laugh at a bad pun. Venmo is no different. While adding money from your bank account to your Venmo balance using the standard transfer method is free, the instant transfer comes with a small fee. It's usually a percentage of the amount, plus a small flat fee, but it's capped at a reasonable amount. Think of it as paying for express shipping on a package – you get it faster, but it costs a little extra.

This fee is what allows Venmo to operate and, more importantly, to offer you that instant gratification. If you're not in a rush, the standard transfer is your best friend. It’s like choosing to walk instead of taking a cab – you save money, even if it takes a bit longer to get there.

Troubleshooting: When Things Get a Bit Wiggly

Now, like any technology, sometimes things don't go perfectly. You might try to link your bank account, and it just… won't. Or maybe you transferred money, and it's been three business days, and your Venmo balance is still looking a little sad. Don't panic!

If you're having trouble linking your bank, first, double-check those login credentials. Are you sure that’s the right password? Did you accidentally type in your dog’s name instead of your bank’s? It happens! Sometimes, your bank might have extra security measures that can interfere. In those cases, you might need to contact your bank directly to see if there are any blocks or if they have specific instructions for linking with third-party apps like Venmo.

If your transfer seems to be stuck, again, check the timeframe. Business days don't include weekends or holidays, so that "1-3 business days" can sometimes stretch a bit. If it's genuinely past the expected timeframe, the next step is to reach out to Venmo's customer support. They’re usually pretty good at sorting things out. Think of them as the friendly mechanics of the money world – they can often diagnose and fix the problem.

The key is to be patient and persistent. Most issues are solvable, and with a little troubleshooting, you’ll be back to smoothly transferring money like a pro.

Why Bother Transferring Money to Venmo Anyway?

So, why go through the effort of moving money from your bank to Venmo? For starters, it’s the gateway to all the fun stuff! Need to pay your roommate back for the artisanal cheese you devoured? Venmo. Splitting the bill at that dimly lit jazz club with friends? Venmo. Sending your niece a birthday present because you’re too far away to give it in person? You guessed it, Venmo!

Having a Venmo balance is like having a little digital pocket full of cash, ready for immediate use. It eliminates that awkward moment of "Can you Venmo me?" when you’re already at the checkout counter. Plus, Venmo has some pretty neat features, like splitting bills automatically and even earning a little cash back sometimes with special promotions. It’s all about making those everyday transactions just a little bit smoother and a lot more social. It's like having a digital wallet that's always ready to party.

Ultimately, transferring money from your bank to Venmo is a pretty straightforward process once you’ve done it once. It’s about connecting your traditional finances to the modern, on-the-go world of digital payments. So, go ahead, link that bank account, add some cash, and get ready to Venmo your way through life!