How To Reduce Tax In Salary Uk (step-by-step Guide)

Right, let's talk money. Specifically, that slice of your salary that vanishes before it even reaches your bank account. Yes, we're talking taxes. It's a bit like a magic trick, but instead of a rabbit, a chunk of your hard-earned cash disappears.

Now, some people just accept this. They shrug their shoulders and think, "Well, that's just how it is." But is it? What if there are ways to be a bit… smarter about it?

We're not talking about anything dodgy or complicated. Just some simple, legal nudges to keep a little more of what you earn. Think of it as a friendly chat with HMRC, where you politely suggest they might not need quite so much of your money.

Step 1: Embrace the Humble Pension

This is the golden ticket, folks. If your employer offers a workplace pension, jump on it like it's the last biscuit in the tin. It's a no-brainer, really.

When you contribute to a pension, you get tax relief. This means the government essentially tops up your pension pot with money that would have otherwise gone to them. Pretty neat, right?

So, that £100 you put into your pension? It might only feel like £80 coming out of your pay, but the government adds the extra £20. Over time, that really adds up. It's like a secret bonus, just for saving for your future.

Some employers even match your contributions. Imagine putting in £100 and your employer adding another £100. That's double the money for your future self. Your future, retired self will be giving you a standing ovation.

Even if they don't match, the tax relief alone is fantastic. It’s a direct reduction in your taxable income. Less taxable income means less tax paid. Simple maths, really.

Don't overthink it. Just sign up. You're essentially getting a discount on your future. And who doesn't love a discount? Especially a discount on not having to work forever.

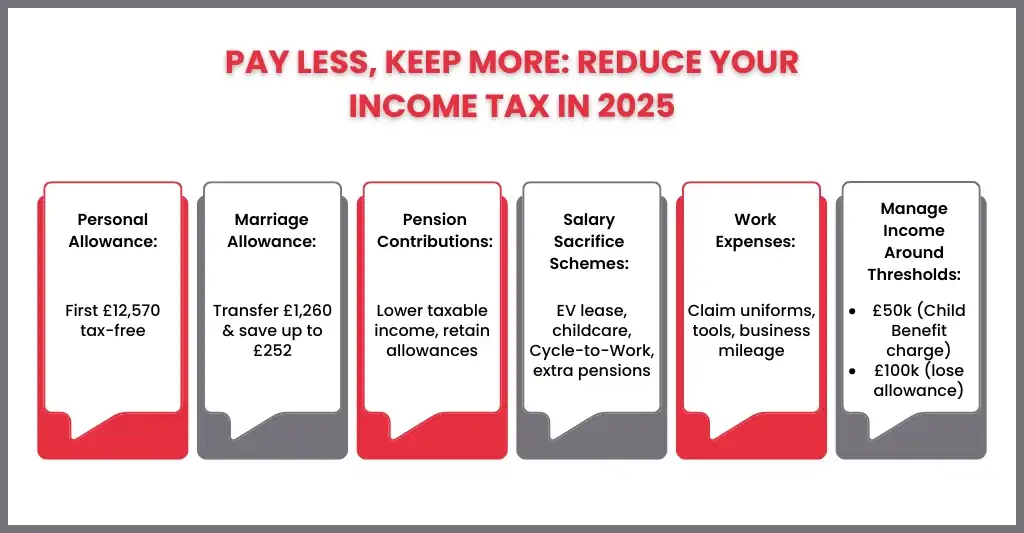

Step 2: The Wonderful World of Salary Sacrifice

This often goes hand-in-hand with pensions. Salary sacrifice is a clever arrangement where you agree to give up a portion of your salary in return for a non-cash benefit.

The most common non-cash benefit is, you guessed it, your pension. So, instead of getting your full salary and then contributing, you have a lower salary that already has your pension contribution taken out.

Because your salary is now technically lower, you pay less Income Tax and less National Insurance. It’s like a stealth tax reduction. You don't even notice it happening, but your take-home pay for immediate expenses might be slightly less, but your overall tax bill is definitely lower.

Think of it as trading a bit of today's cash for a bigger chunk of future security and a smaller tax bill right now. It’s a win-win, or at least a win-win-ish.

Other things can be done through salary sacrifice too, like childcare vouchers or cycle-to-work schemes. These are also taxed more favourably, or even tax-free, depending on the scheme.

It’s worth having a chat with your HR department to see what salary sacrifice options are available. They’re the gatekeepers of these tax-saving treasures.

It might sound complicated, but it’s really just an agreement. You agree to a small change in how your pay is structured, and in return, you get tax benefits. It’s the adult equivalent of a clever shortcut.

Step 3: Childcare Vouchers (If Applicable)

Got little ones? Then this could be your golden ticket. Childcare vouchers, or more accurately, the Childcare Service Scheme, can save you a pretty penny.

If you use approved childcare, you can get tax relief on certain amounts. This is usually done through salary sacrifice. So, you sacrifice part of your salary, and that money goes towards your childcare costs, tax-free.

It's a brilliant way to reduce your taxable income while getting help with those eye-wateringly expensive nursery fees. Seriously, are they made of gold?

The amount you can save depends on your income and the amount you spend on childcare. But even a small saving is a saving, right?

Make sure you’re using an approved childcare provider. The government likes things to be official, you see. So, no dodgy nan-at-home arrangements, unfortunately.

This scheme can make a real difference to families struggling with the cost of raising children. It’s a little bit of government support disguised as a clever financial move.

It’s worth investigating if this applies to you. Your children get looked after, and you get to keep more of your money. It’s a beautiful synergy.

Step 4: The Cycle to Work Scheme

Fancy a bit of exercise and a tax break? The Cycle to Work scheme is your friend. It’s designed to encourage people to cycle to work.

You can get a new bike and cycling equipment through your employer. And, you guessed it, it’s usually done via salary sacrifice. This means you save money on tax and National Insurance.

It’s like getting a discount on your commute and your taxes all at once. Plus, you get healthier. It’s the triple threat of good decisions.

The bike and equipment are yours to keep at the end of the scheme, often for a nominal fee. So, you get a new bike and save money. What’s not to love?

Again, check with your employer. Not all companies offer this, but if yours does, it's a fantastic perk. It’s a win for your wallet and a win for your waistline.

It’s a simple concept: you save money on tax by agreeing to a small salary sacrifice to pay for your bike. The government sees it as promoting healthy living, and you see it as a clever way to get a new bike and pay less tax. We all have our priorities.

Step 5: Expenses and Allowances (The Niche Stuff)

Now, this gets a bit more specific. If your job requires you to travel, buy specific equipment, or incur other necessary expenses, you might be able to claim tax relief on them.

This is usually done through something called an 'expenses and benefits' claim, or sometimes through an 'allowance' your employer provides.

For example, if you have to use your own car for work and your employer doesn't pay you a mileage allowance, you might be able to claim tax relief on those miles. It's a small thing, but it can add up.

Some professions have specific allowances, like nurses or engineers, where certain tools or professional memberships are tax-deductible. It's worth looking into if your job has any specific requirements.

The key here is that the expenses must be wholly, exclusively, and necessarily incurred for your job. This is HMRC's favourite phrase. They like things to be very clear.

You'll likely need to keep records and receipts to prove your claims. So, that shoebox full of crumpled receipts might actually come in handy. Who knew?

This isn’t for everyone, but if you have job-related expenses that aren’t reimbursed, it’s worth exploring. It’s about ensuring you’re not out of pocket for doing your job.

A Final Thought (Or Two)

Look, nobody enjoys paying taxes. It’s a necessary evil, like going to the dentist. But there are ways to make that evil a little less evil.

The main takeaway? Pensions and salary sacrifice are your best friends. They’re the heavy hitters in the tax-saving game.

Don't be afraid to ask your employer about these schemes. They’re there for a reason, and often, people just don’t bother to find out. It’s like leaving money on the table.

And remember, these are all perfectly legal ways to reduce your tax bill. We’re not advocating for anything that would make HMRC send you a sternly worded letter. Just clever planning.

So, go forth and be a little bit tax-smart. Your future self (and your current bank account) will thank you. And who knows, maybe you can use that extra cash to buy a really nice biscuit. You’ve earned it.