How To Read A Balance Sheet Uk (step-by-step Guide)

Right then, my fellow humans, gather 'round! Let's dive headfirst into the thrilling, albeit sometimes slightly daunting, world of a balance sheet. Think of it as a financial snapshot of a company, like a super-powered Instagram pic, but instead of avocado toast and holidays, it shows you what a business owns, what it owes, and how much it's worth to its owners. We're talking UK style, so buckle up for a friendly, no-nonsense guide that'll have you feeling like a financial whiz in no time. No complex jargon, no stuffy suits, just pure, unadulterated clarity. Ready to unlock the secrets?

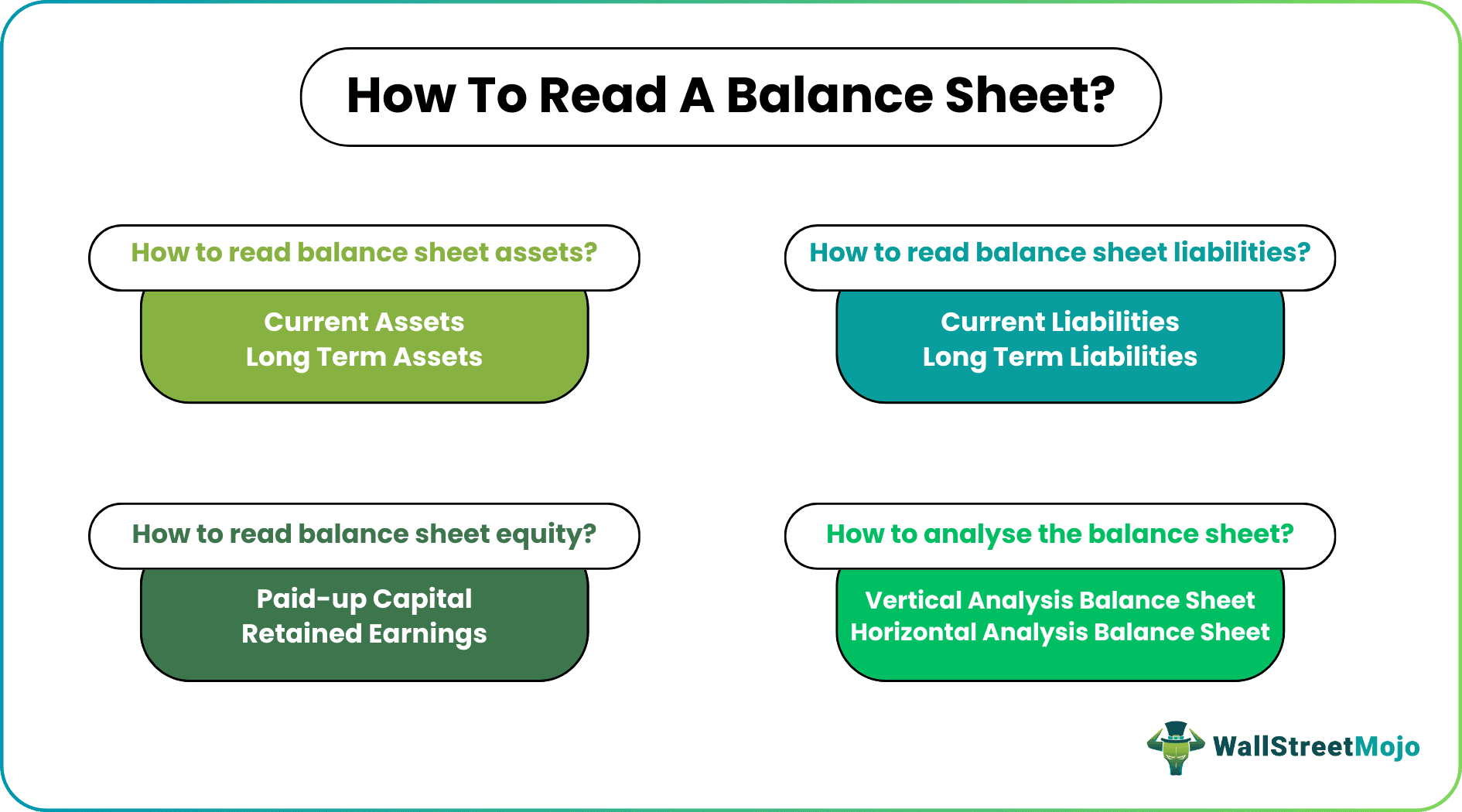

So, first things first, you've got your balance sheet in front of you. It's usually split into three main sections, like a delicious three-course meal for your brain. We've got Assets, Liabilities, and Equity. The golden rule, the absolute unshakeable truth, the mantra you must repeat until it's etched into your very soul is: Assets = Liabilities + Equity. Got it? No? Repeat after me: What a company HAS equals what it OWES to others PLUS what it OWES to its owners. It’s the financial universe's way of saying everything balances out, like a perfectly stacked Jenga tower.

Assets: The Shiny Stuff and the Useful Stuff

Let's kick off with Assets. These are all the good things a company possesses that have value. Think of it as the company's toy box, filled with all sorts of goodies. We split these into two main categories: Current Assets and Non-Current Assets.

Current Assets are the quickies, the things that can be turned into cash or used up within a year. Imagine your own wallet: that's your current asset! For a business, this includes things like:

- Cash and Cash Equivalents: The actual money in the bank, or very easily accessible funds. This is the company's pocket money, ready to be spent.

- Debtors (or Accounts Receivable): This is the money owed to the company by its customers. So, if you've bought something on credit, you're a debtor! The company's eagerly awaiting your payment, like a kid waiting for their birthday money.

- Inventory: This is all the stuff the company has to sell – think t-shirts for a clothing store, ingredients for a bakery, or widgets for a gadget maker. It's all their potential future cash.

Then we have Non-Current Assets, also known as Fixed Assets. These are the big players, the long-term investments that the company expects to use for more than a year. These are the company's grown-up toys, the ones that help it make money. Examples include:

- Property, Plant, and Equipment (PPE): This is the physical stuff. The buildings the company operates from, the machinery that churns out products, the vehicles that deliver them. It's the backbone of the business!

- Intangible Assets: These are trickier! They don't have a physical form, but they're super valuable. Think of things like patents (the secret recipe for success!), trademarks (the cool logo that everyone recognises), or goodwill (that brilliant reputation the company has built up). It’s like owning the best ideas in the playground.

Liabilities: The Bills to Pay

Now, let's talk about Liabilities. This is the flip side of the coin, the money the company owes to others. It’s like a very long to-do list of bills that need to be settled. Just like assets, we split these into Current Liabilities and Non-Current Liabilities.

Current Liabilities are the short-term debts, the ones due within a year. These are the immediate bills, the things that need paying pronto. Think of your credit card bill or your rent. For a business, these can be:

- Creditors (or Accounts Payable): This is the money the company owes to its suppliers. If a company buys raw materials on credit, it's a creditor. The company is saying, "Thanks for the stuff, I'll pay you back soon!"

- Short-Term Loans: Borrowing a bit of cash for a quick fix.

- Accrued Expenses: These are costs that have been incurred but not yet paid, like salaries due to staff at the end of the month.

Non-Current Liabilities, also known as Long-Term Liabilities, are the big, hefty debts that are due in more than a year. These are the mortgages on the office building or the long-term bank loans. These are the commitments that keep the business ticking over for the long haul.

Equity: The Owner's Slice of the Pie

Finally, we arrive at Equity. This is the bit that truly belongs to the owners of the company – the shareholders, the investors, the people who took a leap of faith. It’s the residual value left over after all the liabilities have been paid off. It's the company's net worth, what's truly left for the owners.

The main components of equity are:

- Share Capital: This is the money the owners originally put into the company when they bought shares. It's their initial investment, their stake in the game.

- Retained Earnings: This is where the magic happens! It's the profit the company has made over the years that hasn't been paid out as dividends to the owners. Instead, it’s been reinvested back into the business to fuel further growth. It's like a piggy bank that keeps getting fuller!

So, there you have it! You've just taken your first glorious steps into the world of balance sheets. Remember that golden rule: Assets = Liabilities + Equity. It’s the cosmic financial equation that keeps everything in perfect harmony. Don't be shy, grab a few balance sheets from your favourite companies (you can usually find them on their websites!) and start playing detective. You'll be surprised at how much you can understand. Happy balancing!